How easy is it to double your portfolio?

This article shows you how the growth of your investments, the amount you invest and how fast you grow your income have roles to play in increasing your net worth.

This article shows you how the growth of your investments, the amount you invest and how fast you grow your income have roles to play in increasing your net worth.

We will take the simplest possible way of thinking about this problem:

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 10.00 | 10.00 | 120.00 |

| 2 | 120.00 | 10.00 | 10.00 | 140.00 |

| 3 | 140.00 | 10.00 | 10.00 | 160.00 |

| 4 | 160.00 | 10.00 | 10.00 | 180.00 |

| 5 | 180.00 | 10.00 | 10.00 | 200.00 |

| Total | – | 50.00 | 50.00 | – |

In five years:

So, your money has now doubled. In real life, however, there are a few additional nuances:

So, three factors will make your portfolio double its value:

Of these, the last factor which is the return you get is not under your control. You can try to optimise it, by looking for the best investments, but you will end up with the return you get and not the one you want.

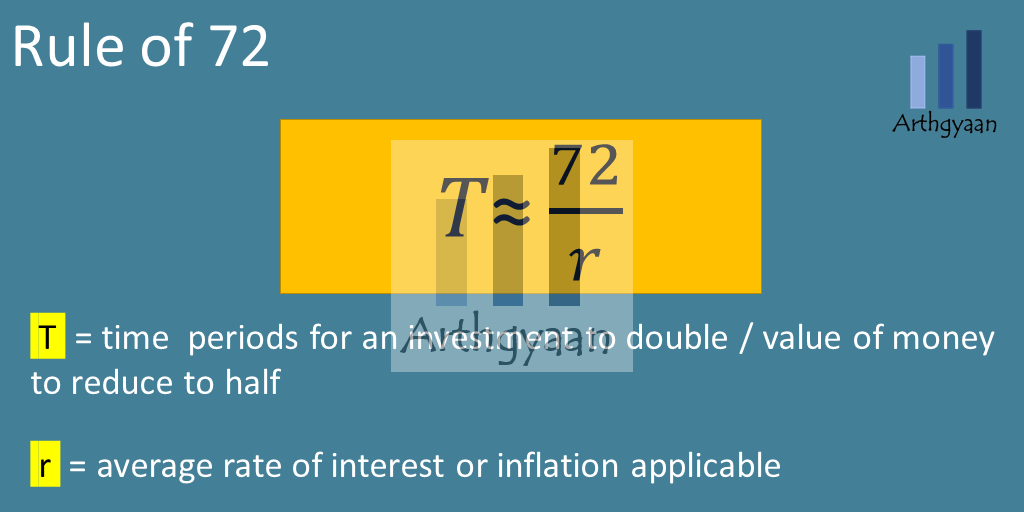

The rule of 72 says: Rate of doubling * Time in years = 72

Prudent readers should focus on the two factors they can control: investment rate and income growth rate (step-up rate) applying the compounding equation and the rule of 72.

Here we break down the rate of doubling into three components: investment as a percentage of the portfolio, step-up rate and the portfolio growth rate.

Investment amount growth = Salary growth - Lifestyle inflation growth

It is important to keep the above approximate relationship in mind when considering how the investment amount/year figure grows. This concept is that of the step-up SIP.

Income increases with time for most people while they are working and not yet retired. Their expenses also increase and not necessarily at the same rate.

| Year | Income (10% hike) | Expenses (8% inflation) | Surplus | SIP | Extra investment |

|---|---|---|---|---|---|

| 1 | 100.0 | 60.0 | 40.0 | 40.0 | 0.0 |

| 2 | 110.0 | 64.8 | 45.2 | 40.0 | 5.2 |

| 3 | 121.0 | 70.0 | 51.0 | 40.0 | 11.0 |

| 4 | 133.1 | 75.6 | 57.5 | 40.0 | 17.5 |

| 5 | 146.4 | 81.6 | 64.8 | 40.0 | 24.8 |

| 6 | 161.1 | 88.2 | 72.9 | 40.0 | 32.9 |

| 7 | 177.2 | 95.2 | 81.9 | 40.0 | 41.9 |

| 8 | 194.9 | 102.8 | 92.0 | 40.0 | 52.0 |

| 9 | 214.4 | 111.1 | 103.3 | 40.0 | 63.3 |

| 10 | 235.8 | 119.9 | 115.9 | 40.0 | 75.9 |

In this case, we can see that the investment amount is growing at 11% per year. We can invest this extra amount as a step-up SIP to create wealth in the examples below.

This example is best suited to those investors who are either early in their careers or are investing a very large amount per month relative to their portfolio value or both so that they can invest 15% of their portfolio value per year. They are also experiencing excellent investment growth (salary growth minus expense growth) of 15%/year (this is the step-up rate).

They are also fairly lucky with their investments getting an average of 11% XIRR.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 15.00 | 12.43 | 127.43 |

| 2 | 127.43 | 17.25 | 15.75 | 160.43 |

| 3 | 160.43 | 19.84 | 19.73 | 200.00 |

| Total | – | 52.09 | 47.91 | – |

Using these numbers (15% investment, 15% step-up rate and 11% portfolio return), the portfolio doubles in 3 years.

Here we will take the example of a modest portfolio in terms of the amount invested (9%) and a decent annual step-up rate (10%). Here we need 10% portfolio growth to double the value in 4 years. Here we will focus more on the equity slice of the portfolio since the target growth amount is high at 10%.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 9.00 | 10.99 | 119.99 |

| 2 | 119.99 | 9.90 | 13.14 | 143.03 |

| 3 | 143.03 | 10.89 | 15.62 | 169.55 |

| 4 | 169.55 | 11.98 | 18.48 | 200.00 |

| Total | – | 41.77 | 58.23 | – |

Using these numbers (9% investment, 10% step-up rate and 10% portfolio return), the portfolio doubles in 4 years.

Here is the case of the late-career stage investor with a multi-crore portfolio. Here the amount invested is modest, due to the size of the portfolio, the step-up rate is decent at 10% and the portfolio is a mix of risky assets (like equity) and debt-type assets like Provident fund, debt mutual funds and investment real-estate.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 7.00 | 8.49 | 115.49 |

| 2 | 115.49 | 7.70 | 9.80 | 132.99 |

| 3 | 132.99 | 8.47 | 11.27 | 152.73 |

| 4 | 152.73 | 9.32 | 12.92 | 174.97 |

| 5 | 174.97 | 10.25 | 14.79 | 200.00 |

| Total | – | 42.74 | 57.27 | – |

Using these numbers (7% investment, 10% step-up rate and 8% portfolio return), the portfolio doubles in 5 years. Here it is important to note that only 8% portfolio growth, which does not require any fancy investment growth, is enough to double the portfolio in a decent amount of time.

A double-income family differs from single-income families in one critical aspect: their investment amount per year as a percentage of total portfolio value will be much higher compared to single-income families.

The example below uses these numbers:

Under these assumptions, the portfolio doubles in 3 years.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 20.00 | 8.76 | 128.76 |

| 2 | 128.76 | 22.00 | 11.15 | 161.91 |

| 3 | 161.91 | 24.20 | 13.89 | 200.00 |

| Total | – | 66.20 | 33.80 | – |

It is important to note here that the total investment (66.20 over 3 years) is the main driver of portfolio increase vs. the return that you get (33.80 over 3 years)

If we take the same assumptions of 10% step-up rate and 7.8% portfolio growth but change the family to single-income with around 12% investment per year as a percentage of the portfolio, then it takes 4 years to double the portfolio.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | 11.87 | 8.47 | 120.34 |

| 2 | 120.34 | 13.06 | 10.15 | 143.54 |

| 3 | 143.54 | 14.36 | 12.06 | 169.97 |

| 4 | 169.97 | 15.80 | 14.23 | 200.00 |

| Total | – | 55.10 | 44.90 | – |

Here the role of investment amount (55.10 over 4 years) is less important than before and the role of portfolio growth (44.90 over 4 years) is more than in the previous case.

Withdrawal during retirement changes the equation quite a bit. Assuming a 2.5% withdrawal rate and a 7% increase in the withdrawal amount per year, it will take an absurd 16%/year investment return to double the portfolio in 5 years.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | -2.50 | 17.03 | 114.53 |

| 2 | 114.53 | -2.68 | 19.52 | 131.38 |

| 3 | 131.38 | -2.86 | 22.41 | 150.92 |

| 4 | 150.92 | -3.06 | 25.76 | 173.62 |

| 5 | 173.62 | -3.28 | 29.65 | 200.00 |

| Total | – | -14.38 | 114.37 | – |

Using more realistic portfolio growth numbers of 9.4%, the portfolio doubles in 10 years. Even that is a bit on the higher side for a retirement portfolio.

| Year | Start | Investment | Growth | End |

|---|---|---|---|---|

| 1 | 100.00 | -2.50 | 9.68 | 107.18 |

| 2 | 107.18 | -2.68 | 10.37 | 114.87 |

| 3 | 114.87 | -2.87 | 11.12 | 123.11 |

| 4 | 123.11 | -3.08 | 11.91 | 131.95 |

| 5 | 131.95 | -3.30 | 12.77 | 141.42 |

| 6 | 141.42 | -3.54 | 13.69 | 151.57 |

| 7 | 151.57 | -3.79 | 14.67 | 162.45 |

| 8 | 162.45 | -4.06 | 15.72 | 174.11 |

| 9 | 174.11 | -4.35 | 16.85 | 186.61 |

| 10 | 186.61 | -4.67 | 18.06 | 200.00 |

| Total | – | -34.83 | 134.83 | – |

However, the purpose of a retirement portfolio is not to double it every N number of years. We have discussed how retirement portfolios behave in this article: Can you run a SWP from mutual funds when you are retired?

There is nothing special about doubling the portfolio. It is like driving your car fast to reach your office in half the time which is neither practical nor necessary.

However, if we study the compounding equation shown above, especially the rule of 72, there are other things to learn here:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How easy is it to double your portfolio? first appeared on 02 Jun 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.