Which stage of your career is most important for wealth creation?

This article looks at the various stages of your career from the perspective of maximum wealth creation.

This article looks at the various stages of your career from the perspective of maximum wealth creation.

Disclaimer: Life does not work like an Excel sheet (plans change) and stock markets (which go both up and down) do not behave like fixed deposits. This article should be used as an exercise in understanding relative concepts rather than absolute numbers.

This post builds on two previous articles:

The next article in this series is here: How easy is it to double your portfolio?

The essence of these two posts is that:

This formula is an example of an exponential curve where the current period growth happens on the entire corpus from the previous period. A good example is simple vs compound interest:

This interest-upon-interest feature is the reason compounding grows so fast and is the premise of this quote:

My life has been a product of compound interest” - Warren Buffett.

This article shows how much wealth is actually created over time in each decade of your career along with the interplay of the invested amount and the return you get.

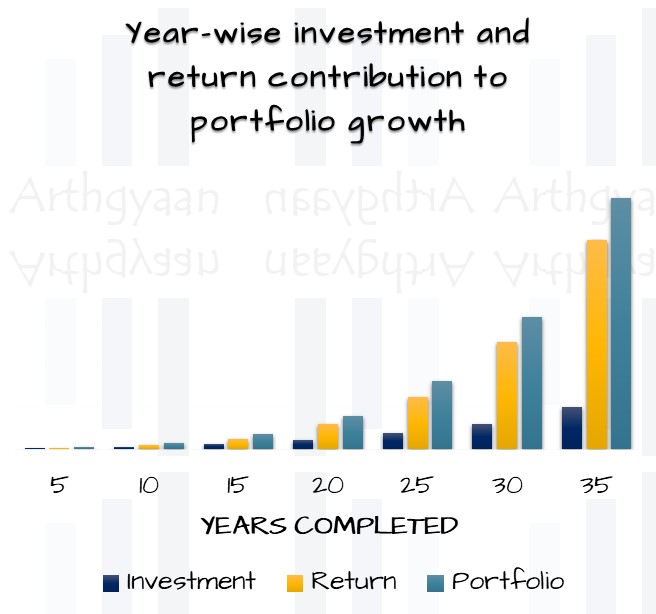

In the chart above, we have shown the impact of a 10% portfolio return created by a 10% step-up-sip. The first SIP is ₹25,000/month and the SIP amount is increased by 10% per year. So the amount invested in year 1 is ₹3 lakhs, in year 2 it is ₹3.3 lakhs and so on for 30 years. The investor starts investing in their late 20s.

| Decade | Investment (₹ lakhs) | Return (₹ lakhs) | Portfolio (₹ lakhs) | Change (₹ lakhs) |

|---|---|---|---|---|

| First 10 years | 47.8 | 28.3 | 76.1 | 76.1 |

| Next 10 years | 171.8 | 231.8 | 403.6 | 327.5 |

| Last 10 years | 493.5 | 1,111.4 | 1,604.9 | 1,277.4 |

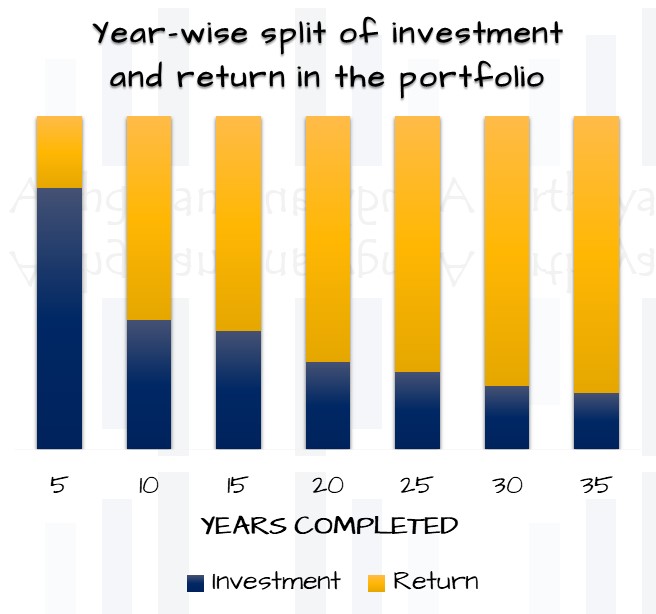

As the table shows, the first decade is the only period where the amount invested (47.8) is more than the return generated (28.3). This is because due to only 10 years having passed, there is no chance of the compounding effect to kick in.

The next decade is where things become more interesting:

The last decade is now clearly the most important for the portfolio. The amount invested (493.5) is itself higher than the total portfolio value (403.6) in the first two decades. The investment return (1,111.4) is more than double the amount invested (493.5).

We break down the table into 5-year chunks to show the effect more clearly.

| Years completed | Investment (₹ lakhs) | Return (₹ lakhs) | Portfolio (₹ lakhs) | Change (₹ lakhs) |

|---|---|---|---|---|

| 5 | 18.3 | 5.1 | 23.4 | 23.4 |

| 10 | 29.5 | 46.6 | 76.1 | 52.8 |

| 15 | 65.8 | 120.1 | 185.9 | 133.2 |

| 20 | 106.0 | 297.6 | 403.6 | 270.4 |

| 25 | 189.0 | 632.4 | 821.4 | 551.0 |

| 30 | 304.4 | 1,300.5 | 1,604.9 | 1,053.9 |

Splitting the portfolio table into 5-year chunks brings out another interesting observation.

| Years completed | Portfolio | Change in 5y |

|---|---|---|

| 5 | 23.4 | N.A |

| 10 | 76.1 | 3.26x |

| 15 | 185.9 | 2.44x |

| 20 | 403.6 | 2.17x |

| 25 | 821.4 | 2.04x |

| 30 | 1,604.9 | 1.95x |

We can see that every five years, the portfolio value doubles. We have seen a similar result in our previous article:

FIRE journey in India: what happens if you work just a bit longer

To understand how portfolio growth happens at various career stages:

As time passes, the amount of wealth created is driven more by the return on your capital than the invested amount.

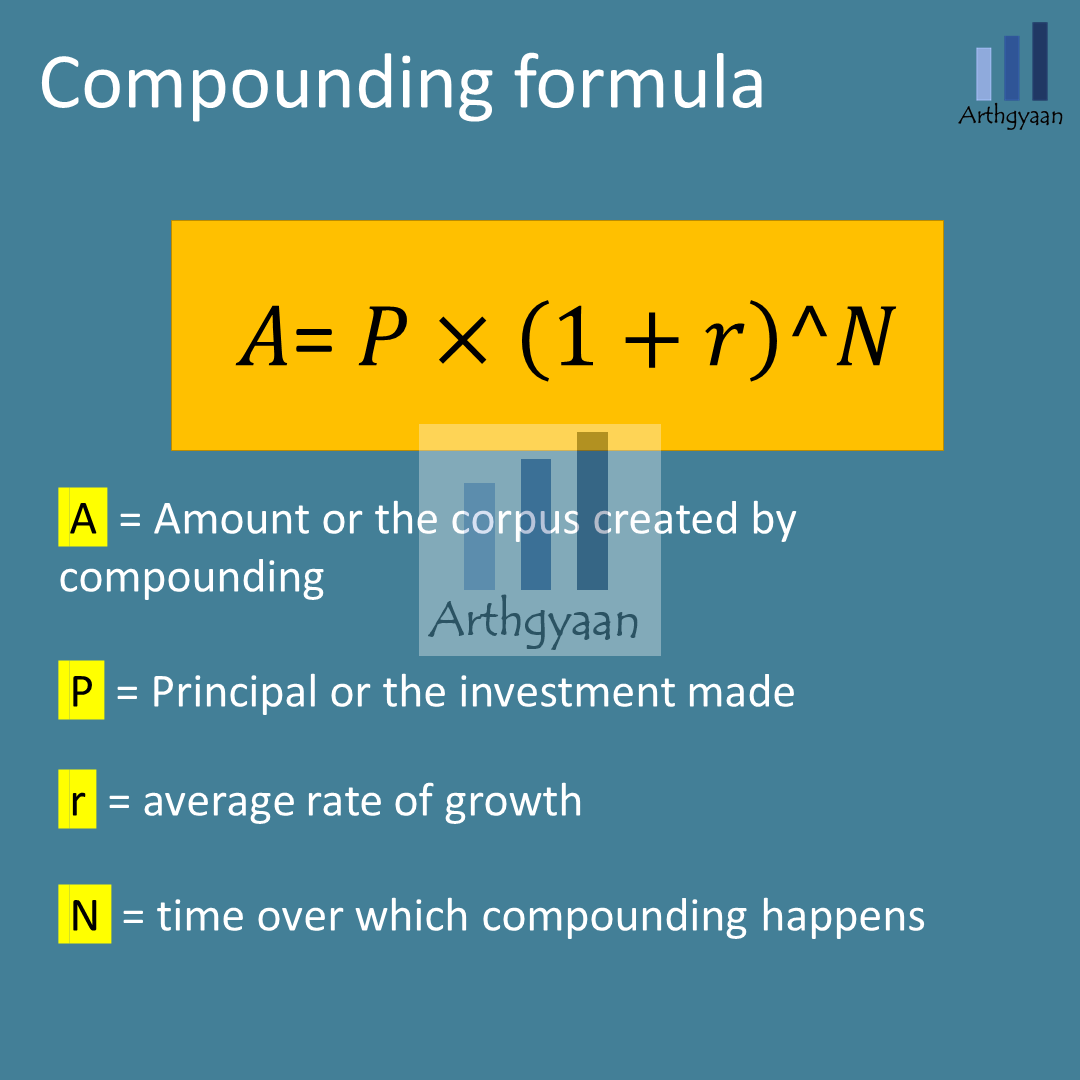

Compounding: Corpus = Base * (1 + return% ) ^ Time

This result is due to the increasing base effect in the compounding equation.

As we had discussed in our post titled FIRE journey in India: what happens if you work just a bit longer, the longer you can work, the higher your SWR is in FIRE.

If you are consciously cutting out years from your pre-retirement accumulation phase, you need to find a way to reach your FIRE goal faster: What is the quickest way to reach FIRE?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which stage of your career is most important for wealth creation? first appeared on 17 Apr 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.