When should you verify your Income Tax return as per the new rules effective from 1st April 2024?

This article explains the new rules regarding income tax return verification which are now in place for tax returns to be filed 1st April 2024 onwards.

This article explains the new rules regarding income tax return verification which are now in place for tax returns to be filed 1st April 2024 onwards.

As per Notification No. 2 of 2024, there are slight tweaks to the timelines applicable for income tax return verification.

As you know, the standard deadline for filing income tax returns for AY204-25 i.e. FY2023024 is 31st July 2024. Once the return is filed, there is a verification process that is required to be completed for the return to be processed. If this verification is not done typically within 30 days, the return will be rejected.

The new notification, dated 31-Mar-2024, tweaks these rules slightly regarding by when the verification must be done but created some confusion that we address below.

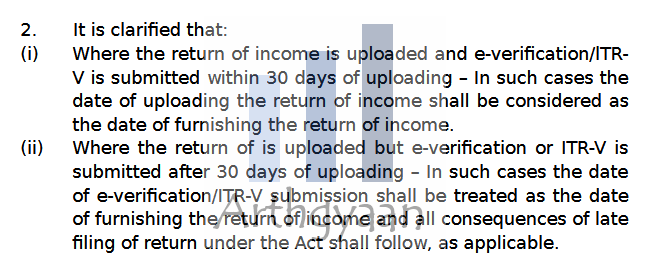

In the original notification, this text caused a bit of confusion:

since the following paragraph 5 said:

It is further clarified that where the return of income is not verified after uploading within the specified time lime as per paragraph 2 of this notification, such return shall be treated as invalid.

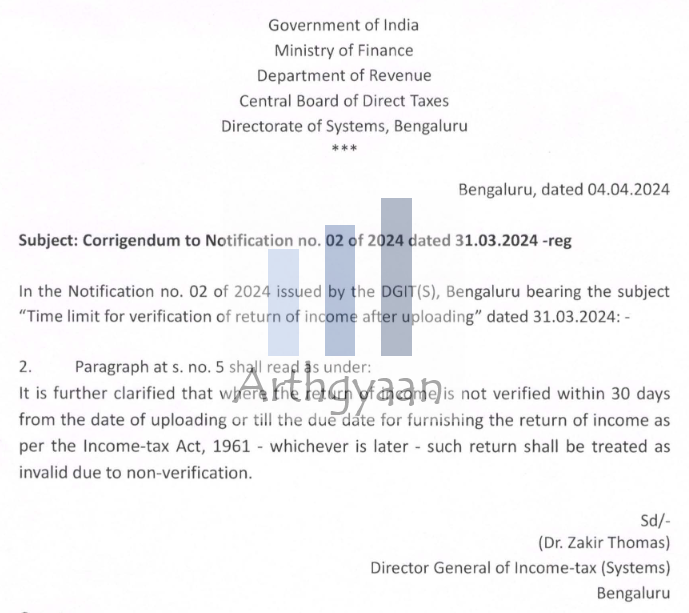

A corrigendum was later issued on 4-Apr-2024 to clarify this in simpler language which we breakdown further below.

You must verify within 30 days of filing or by 31st July whichever is later. Since you are filing within due date, the IT department gives you the grace period for verification.

To understand when to file your income tax return and then verify them correctly:

However, if you are filing at the last moment, or miss the deadline of 31st July, then you must verify within 30 days of filing.

This table will make this clear:

| Filing date | Verify by |

|---|---|

| on or before 29-Jun-24 | 31-Jul-24 |

| 30-Jun-24 | 31-Jul-24 |

| 01-Jul-24 | 31-Jul-24 |

| 02-Jul-24 | 01-Aug-24 |

| 03-Jul-24 | 02-Aug-24 |

| 04-Jul-24 | 03-Aug-24 |

| 05-Jul-24 | 04-Aug-24 |

| 06-Jul-24 | 05-Aug-24 |

| 07-Jul-24 | 06-Aug-24 |

| 08-Jul-24 | 07-Aug-24 |

| 09-Jul-24 | 08-Aug-24 |

| 10-Jul-24 | 09-Aug-24 |

| 11-Jul-24 | 10-Aug-24 |

| 12-Jul-24 | 11-Aug-24 |

| 13-Jul-24 | 12-Aug-24 |

| 14-Jul-24 | 13-Aug-24 |

| 15-Jul-24 | 14-Aug-24 |

| 16-Jul-24 | 15-Aug-24 |

| 17-Jul-24 | 16-Aug-24 |

| 18-Jul-24 | 17-Aug-24 |

| 19-Jul-24 | 18-Aug-24 |

| 20-Jul-24 | 19-Aug-24 |

| 21-Jul-24 | 20-Aug-24 |

| 22-Jul-24 | 21-Aug-24 |

| 23-Jul-24 | 22-Aug-24 |

| 24-Jul-24 | 23-Aug-24 |

| 25-Jul-24 | 24-Aug-24 |

| 26-Jul-24 | 25-Aug-24 |

| 27-Jul-24 | 26-Aug-24 |

| 28-Jul-24 | 27-Aug-24 |

| 29-Jul-24 | 28-Aug-24 |

| 30-Jul-24 | 29-Aug-24 |

| 31-Jul-24 | 30-Aug-24 |

| 01-Aug-24 | 31-Aug-24 |

| 02-Aug-24 | 01-Sep-24 |

| 03-Aug-24 | 02-Sep-24 |

| and so on | … |

You can always e-verify using Aadhaar OTP or automatically if you login via bank account into the IT site before filing your return. Or you can take the physical route of sending the ITRV to CPC Bangalore via post. For the CPC route, the date they receive the letter, not the date you posted it, is considered for verification.

You should always e-verify since it is easy and fast unless there is a valid reason not to.

Therefore you must verify, use the online route as soon as you complete the filing to complete the task in seconds. If you are sending the letter to CPC, do it immediately since CPC will get more and more letters for processing as 31st July comes close.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled When should you verify your Income Tax return as per the new rules effective from 1st April 2024? first appeared on 16 Apr 2024 at https://arthgyaan.com