What is a step-up SIP and how much more wealth does it create vs. a normal SIP?

This article explains the concept of a step-up SIP and allows you to calculate how much more returns can you get using a step-up SIP vs. a normal SIP.

This article explains the concept of a step-up SIP and allows you to calculate how much more returns can you get using a step-up SIP vs. a normal SIP.

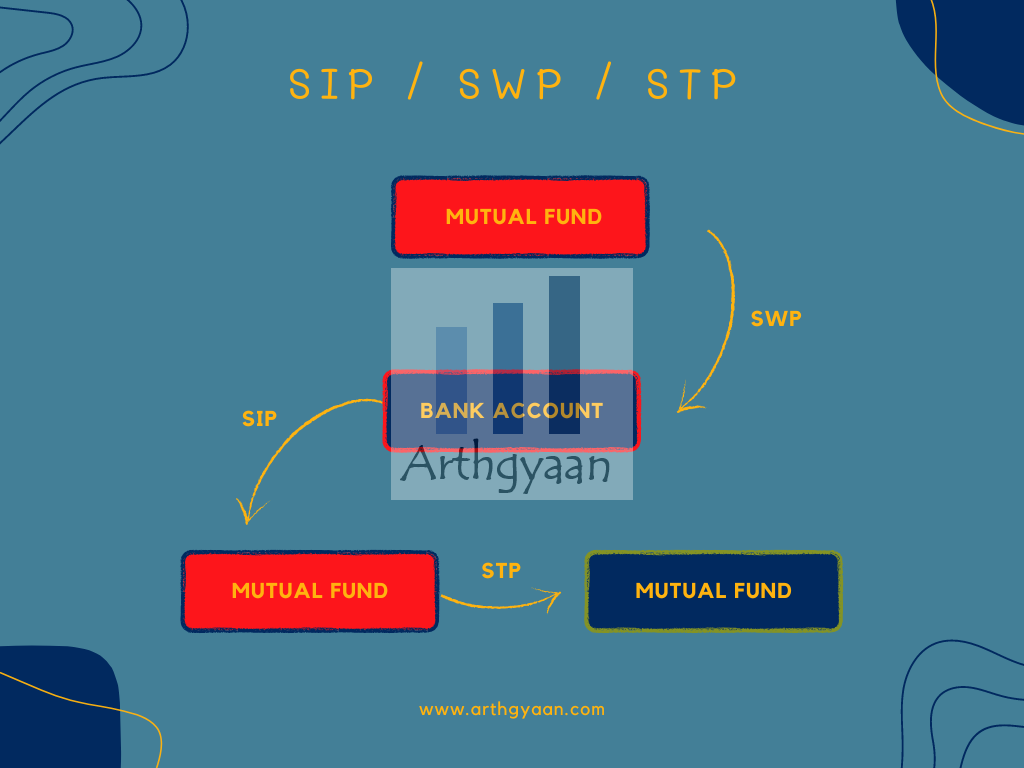

All of these are standing instructions that get executed as per a schedule you specify:

A SIP is an instruction to a mutual fund to deduct from your bank account, typically every month, to invest in a mutual fund. The amount invested stays the same every month.

A step-up SIP is one where you increase the monthly amount invested, say by 5% or 10%, every year. This way you make a lot more money vs. the normal fixed SIP.

You can see how the monthly amounts in a SIP and step-up SIP change like this:

| Year | SIP per month | 10% Step-up SIP per month |

|---|---|---|

| 1 | 1,000 | 1,000 |

| 2 | 1,000 | 1,100 |

| 3 | 1,000 | 1,210 |

| 4 | 1,000 | 1,331 |

| 5 | 1,000 | 1,464 |

| 6 | 1,000 | 1,611 |

| 7 | 1,000 | 1,772 |

| 8 | 1,000 | 1,949 |

| 9 | 1,000 | 2,144 |

| 10 | 1,000 | 2,358 |

Investible surplus = Income - Expenses

Income increases with time for most people while they are working and not yet retired. Their expenses also increase and not necessarily at the same rate.

| Year | Income (10% hike) | Expenses (8% inflation) | Surplus | SIP | Extra investment |

|---|---|---|---|---|---|

| 1 | 100.0 | 60.0 | 40.0 | 40.0 | 0.0 |

| 2 | 110.0 | 64.8 | 45.2 | 40.0 | 5.2 |

| 3 | 121.0 | 70.0 | 51.0 | 40.0 | 11.0 |

| 4 | 133.1 | 75.6 | 57.5 | 40.0 | 17.5 |

| 5 | 146.4 | 81.6 | 64.8 | 40.0 | 24.8 |

| 6 | 161.1 | 88.2 | 72.9 | 40.0 | 32.9 |

| 7 | 177.2 | 95.2 | 81.9 | 40.0 | 41.9 |

| 8 | 194.9 | 102.8 | 92.0 | 40.0 | 52.0 |

| 9 | 214.4 | 111.1 | 103.3 | 40.0 | 63.3 |

| 10 | 235.8 | 119.9 | 115.9 | 40.0 | 75.9 |

In this case, we can see that the investment amount is growing at 11% per year. We can invest this extra amount as a step-up SIP to create extra wealth. The rest of this article shows you how much extra wealth you create with a step-up SIP.

You can use this calculator:

Total Investment (₹):

Total Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

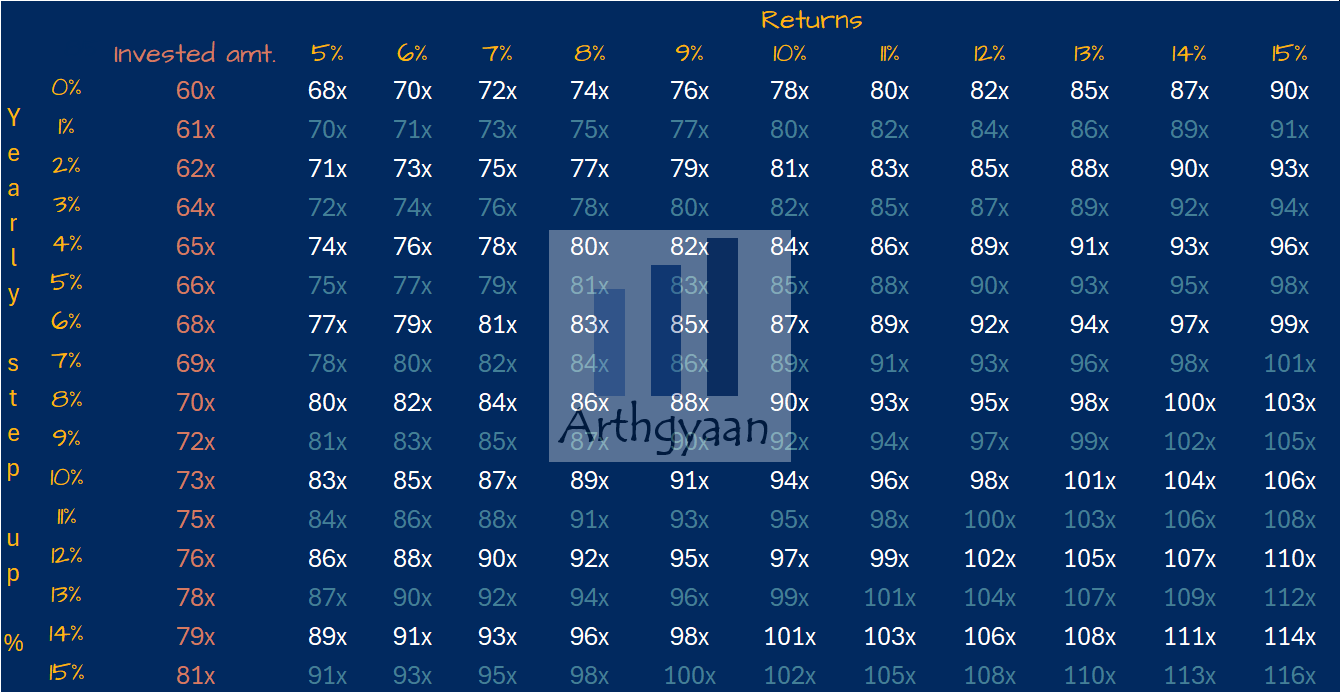

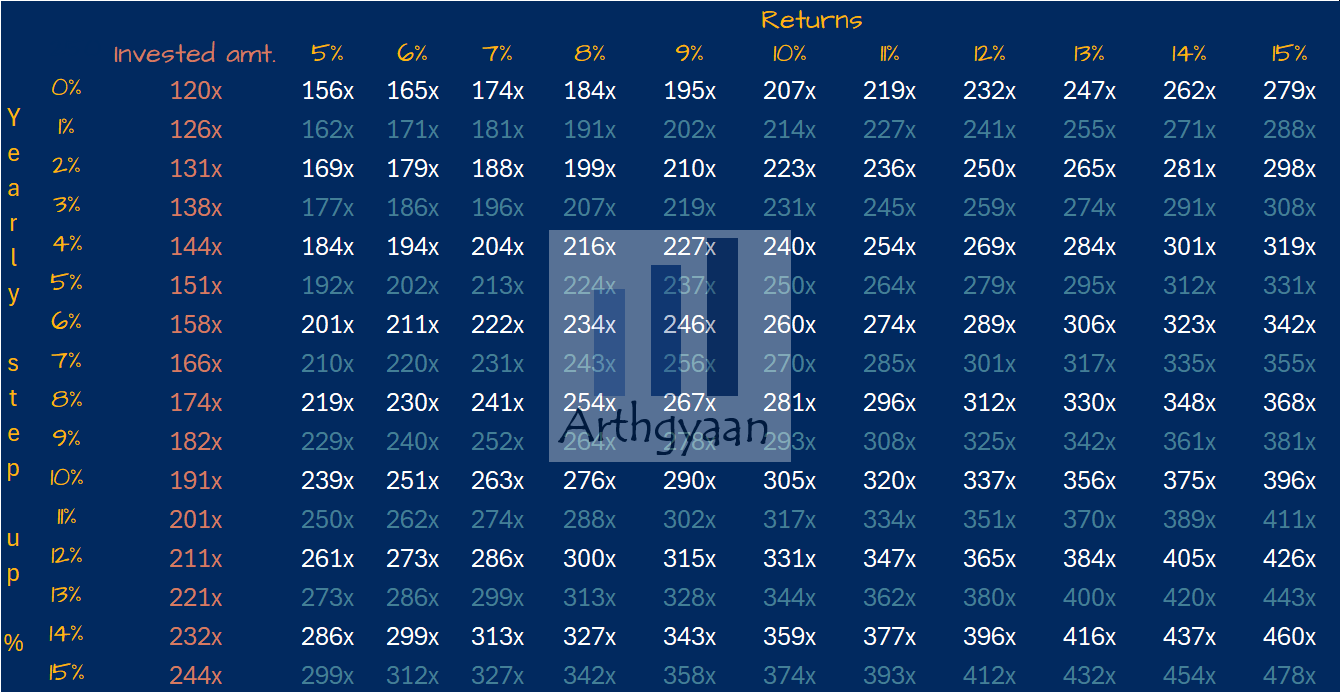

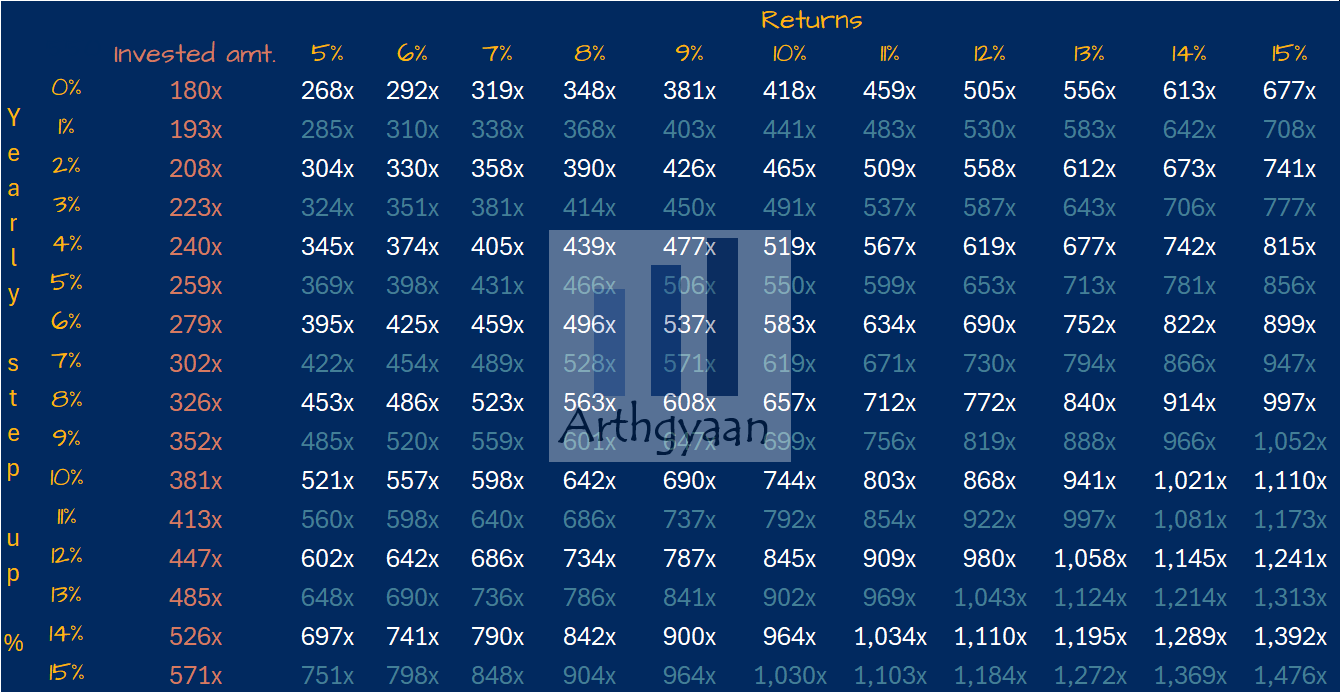

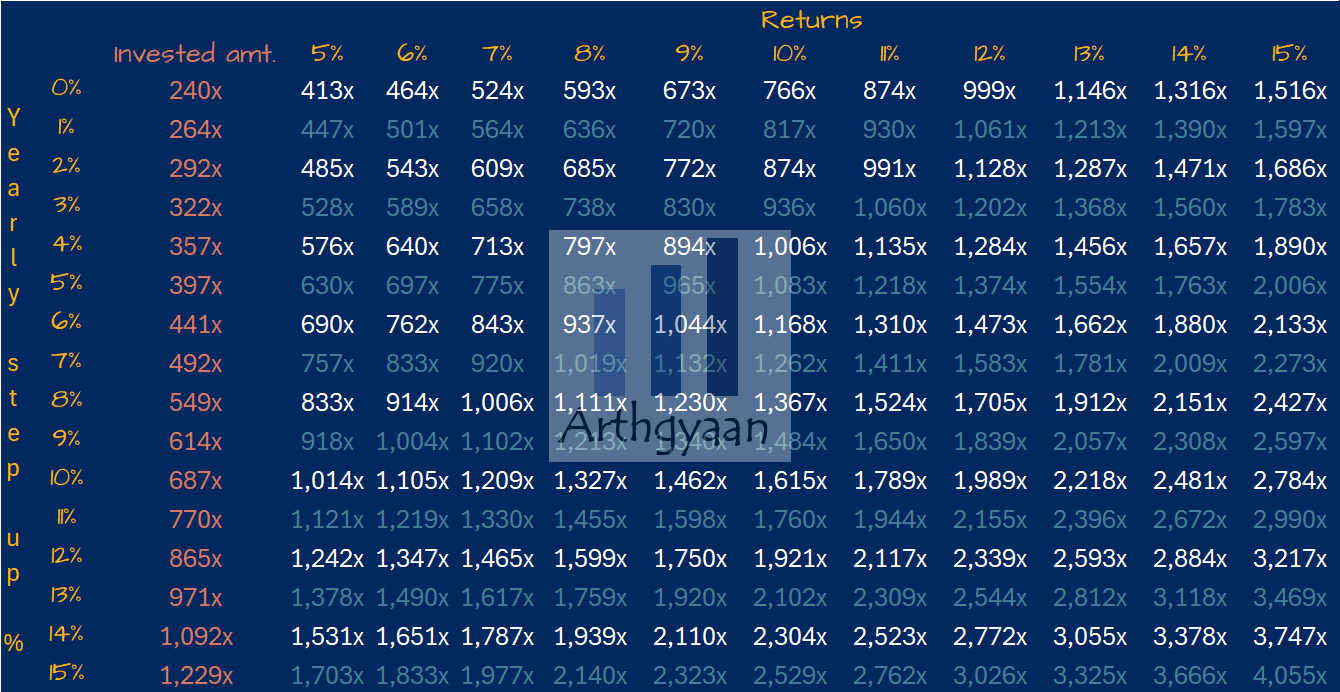

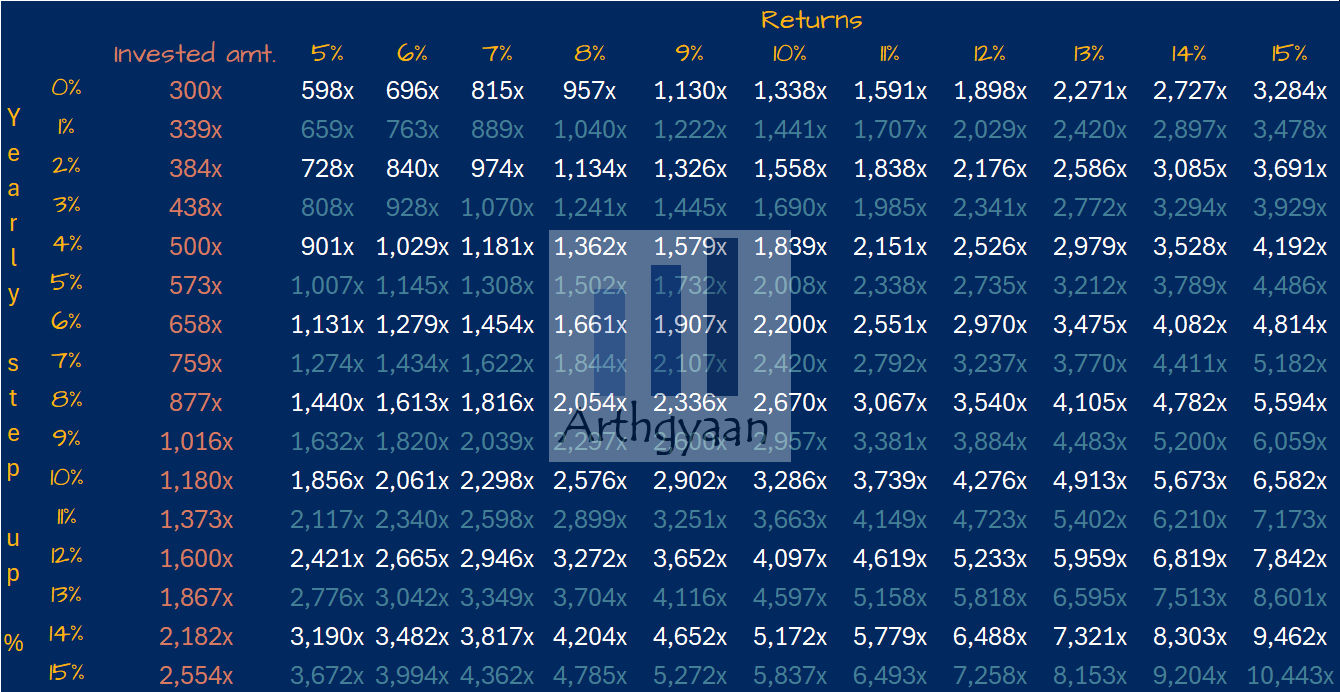

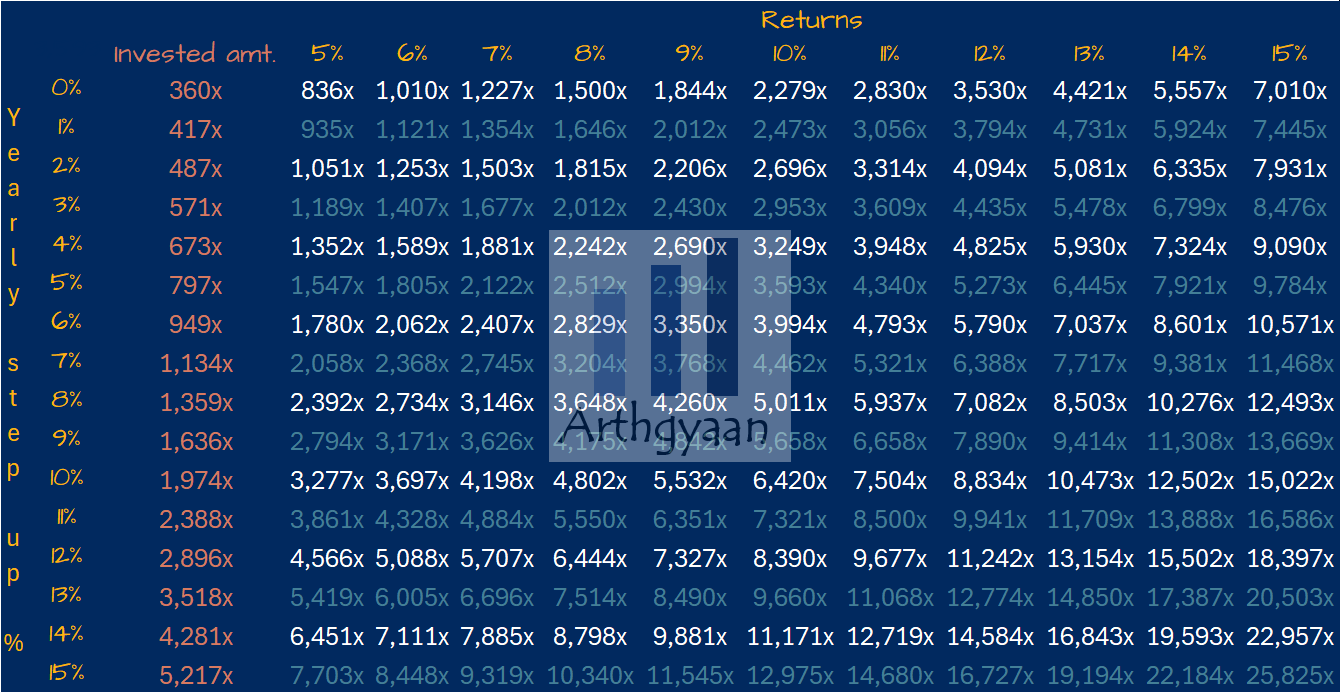

If you found this useful, check out the Arthgyaan step-up SWP calculator.In each of the tables below, we show:

If the table shows a value of 50x, and the first value in the row is 10x, then it means that if the initial SIP is ₹10,000/month

Similarly, if the initial SIP is ₹50,000/month

Many investors do not have a step-up SIP already in place for their funds. Depending on the platform you have to follow one of the following steps:

We have a detailed article on this concept below: Does a step-up SIP provide a higher return than an ordinary SIP?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is a step-up SIP and how much more wealth does it create vs. a normal SIP? first appeared on 14 Feb 2024 at https://arthgyaan.com