Bajaj Auto Buyback record date is 29-Feb-2024: should you buy the stock?

With only a few days to go, is it possible to make money by buying the Bajaj Auto stock before the record date?

With only a few days to go, is it possible to make money by buying the Bajaj Auto stock before the record date?

Disclaimer: Please do not trade in a share by reading an article like this. There are risks that require thorough analysis. It is not possible to get rich quickly by participating in share buybacks.

The company will allow only those people who own shares of Bajaj Auto on the record date, i.e. 29-Feb-2024, to participate in the buyback.

Here is a recap of the terms of the buyback:

| Metric | Value |

|---|---|

| Announcement Date | 02-Jan-2024 |

| Buyback size | ₹ 4,000 crores |

| Buyback shares | 4 lakh shares |

| Buyback price | ₹ 10,000 per share |

| Announcement price | ₹ 6,985 per share |

| Announcement Premium | 43% |

| Record date | 29-Feb-2024 |

| Record date announced on | 16-Feb-2024 |

| Closing price on 16-Feb-2024 | ₹ 8,344 per share |

| Premium on 16-Feb-2024 | 20% |

The incentive for retail investors, i.e. those who hold shares worth ₹2 lakhs or less as on 29-Feb-2024, is to tender a part of their holdings at ₹ 10,000 per share.

The plan of making a quick buck does not work when:

We will now discuss these risks one by one:

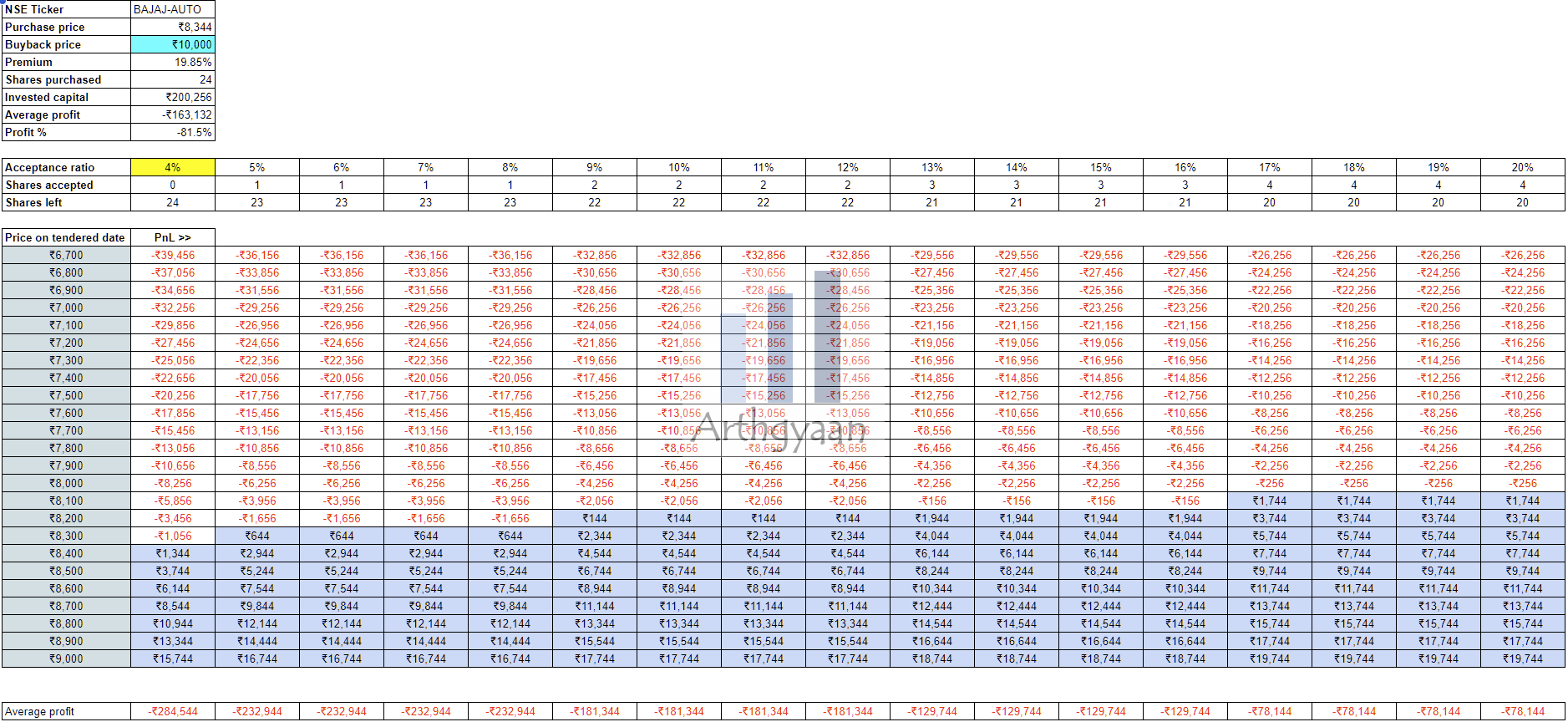

The word on the street, via news articles, is that the acceptance ratio will be in the low single digits. At the current price of ₹ 8,344 per share, holding just 24 shares will tip you past the retail category. To get even 1 share accepted at ₹ 10,000 per share, the acceptance ratio will have to be 5%. The remaining 23 shares will have to be sold if the investor has entered only to make money via buy-back.

Profit = Shares accepted * 10000 + Rest shares sold * Sale price - 24 * Buy Price

So the profit depends completely on the selling price for the shares not accepted in the buyback.

The next wrinkle in the plan is what happens to the number of shares not accepted for buyback. They will be impacted by the stock moving both up or down as per the scenarios shown above.

To understand if you should at all participate in a share buyback:

Prediction is very difficult, especially if it’s about the future. - Niels Bohr (apparently)

The stock price of Bajaj Auto has moved up quite a bit post the buyback announcement due to the aggressive stance of the management in putting a buyback premium of 43% at the time of announcement:

However, to understand if the stock price will continue to move up requires complete understanding of the company’s potential for at least the next few months.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

We have taken the case of an investor who has purchased shares so that the total position is below the ₹2 lakh limit for retail. The investor will sell the shares not accepted for buyback at the current market price.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Bajaj Auto Buyback record date is 29-Feb-2024: should you buy the stock? first appeared on 16 Feb 2024 at https://arthgyaan.com