Bajaj Auto Buyback: is it an easy way to make money or lose money?

This article analyses the Bajaj Auto share buyback announced in January 2024 to decide if it is possible to make a quick return by entering the stock before the record date.

This article analyses the Bajaj Auto share buyback announced in January 2024 to decide if it is possible to make a quick return by entering the stock before the record date.

Originally published: 11-Jan-2024

Updated: 16-Feb-2024 - Record date declared

Disclaimer: Please do not trade in a share by reading an article like this. There are risks that require thorough analysis. It is not possible to get rich quickly by participating in share buybacks.

A share buyback is an example of a corporate action where a company uses excess cash it has to buy its own shares from shareholders at a pre-declared price that is higher than the current market price. Existing shareholders, or anyone who purchases the shares after the buyback announcement date, have the right to offer (“tender”) some or all of their shares to the company for buyback. All of the shares being offered in total are not accepted for buyback. The company at its discretion will accept only a small percentage say 5-20% of the offered shares and offer the buy back price for them.

The bought back shares get debited from the demat account on their own and cash comes to the linked bank account. Investors are taxed as per standard capital gains tax rules for shares: Pay lower capital gains taxes for equity: understand how grandfathering works.

The purchased shares are extinguished and the share capital reduces automatically by the same amount.

Investors who offer shares for buy-back make money if:

To understand if you should at all participate in a share buyback:

| Metric | Value |

|---|---|

| Announcement Date | 02-Jan-2024 |

| Buyback size | ₹ 4,000 crores |

| Buyback shares | 4 lakh shares |

| Buyback price | ₹ 10,000 per share |

| Announcement price | ₹ 6,985 per share |

| Premium | 43% |

| Record date | 29-Feb-2024 |

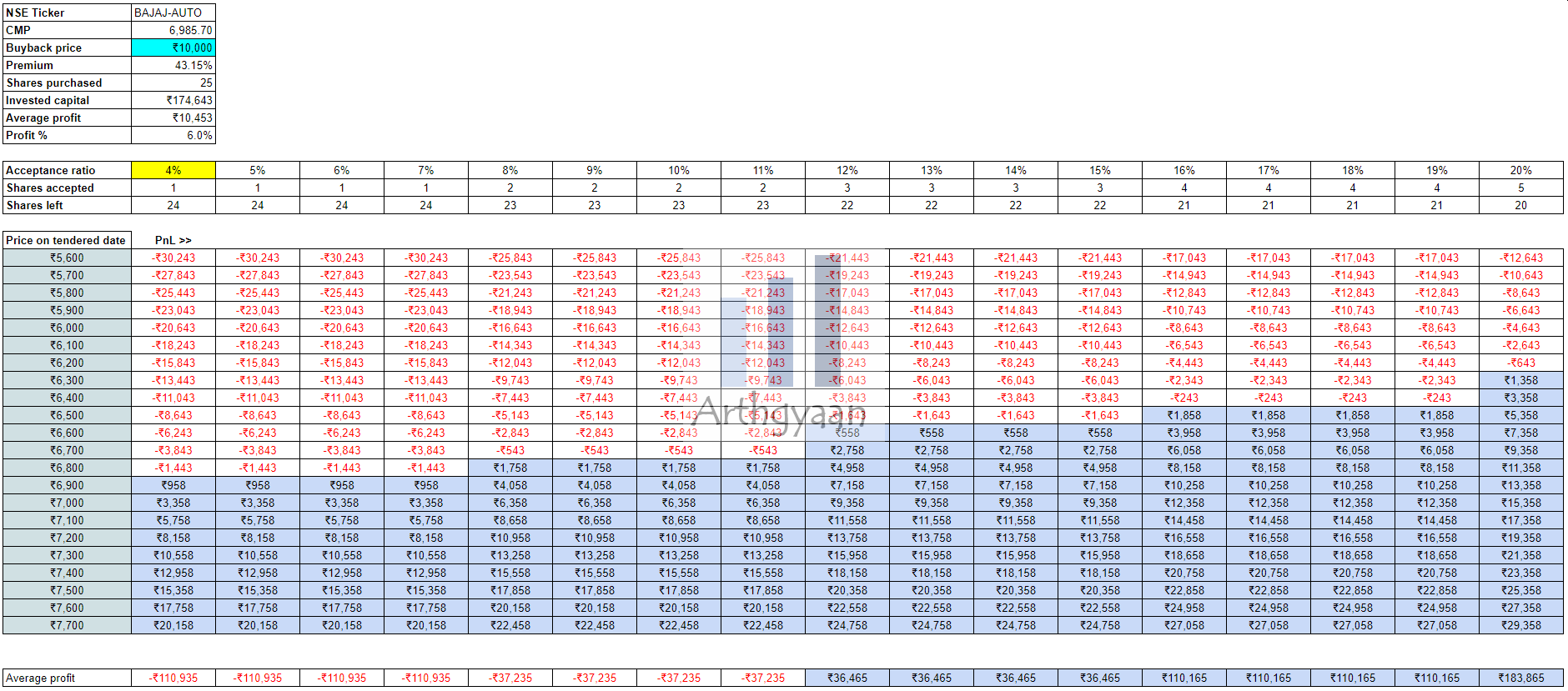

We will explore the situation of a new investor entering the stock solely to profit off the buyback announcement. The share purchase has to be completed before the record date. Only those share holders who hold Bajaj Auto shares on or before the record date are eligible for tendering their shares.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

We have taken the case of an investor who has purchased shares so that the total position is below the ₹2 lakh limit for retail. The investor will sell the shares not accepted for buyback at the current market price.

As the numbers show, the new investor makes money only if:

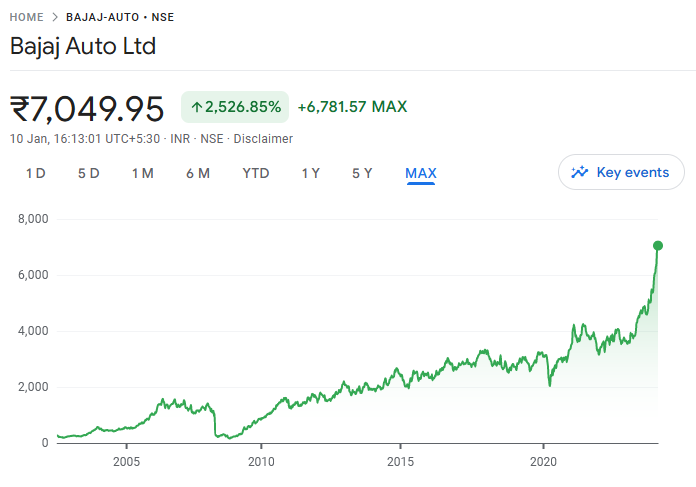

The investor should keep in mind that the stock price is currently at a lifetime high. Whether the price keeps on moving from the record date to the acceptance date is something that needs to be analysed by every investor carefully. It might appear to be a way to make easy money but that may not necessarily be the case.

Existing Bajaj Auto shareholders may consider tendering some shares if they wish to take advantage of exiting some of their holdings at a price a lot higher than the current life-time high.

If you have to consider making any money from a buyback situation, you need to invest an amount of ₹2 lakhs to maximize your chance of getting an acceptance. For a retail investor, it may not always be possible to cough up that amount casually and keep it blocked to make a short-term return. There are always investing options in the market and staying invested, via mutual funds, is the easiest way to ensure that your money is working as hard as possible all the time.

Bajaj Auto 2024 share buyback record date is 29-Feb-2024.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Bajaj Auto Buyback: is it an easy way to make money or lose money? first appeared on 11 Jan 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.