EMI Calculator: know your EMI per lakh to easily know how much total EMI you have to pay

This article shows you an easy way to know your EMI for any home, car, personal, gold or credit card loan.

This article shows you an easy way to know your EMI for any home, car, personal, gold or credit card loan.

Using the example of a home loan, this is how an EMI works. This is not the only way to calculate how much a loan payment works but it is the most common method.

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that has both interest and principal in the same amount.

EMI = Principal + Interest

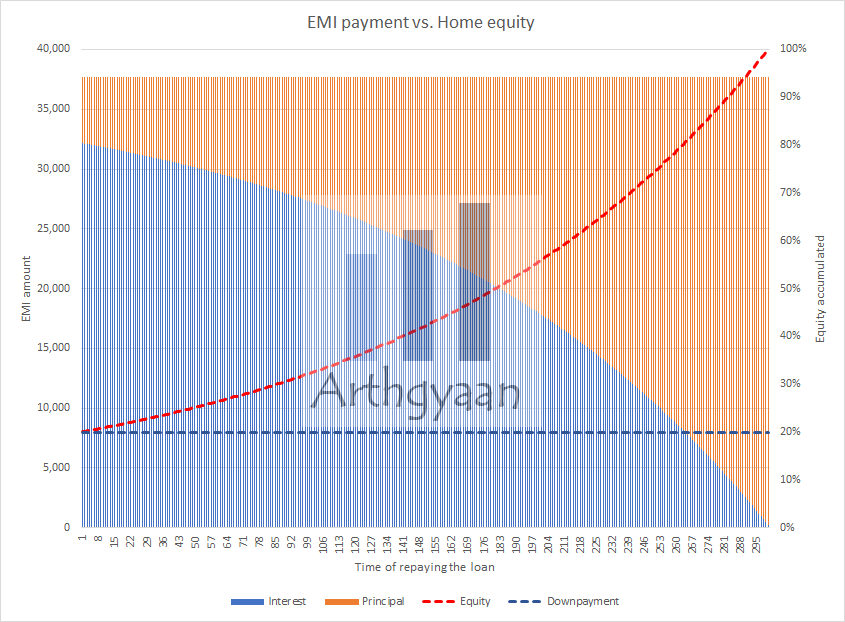

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

We can use this Excel formula to calculate the EMI:

EMI = PMT(r/12 , y * 12, -p * 10^5 , 0 , 0) where r = interest rate in %, y = years and p = amount borrowed in ₹ lakhs

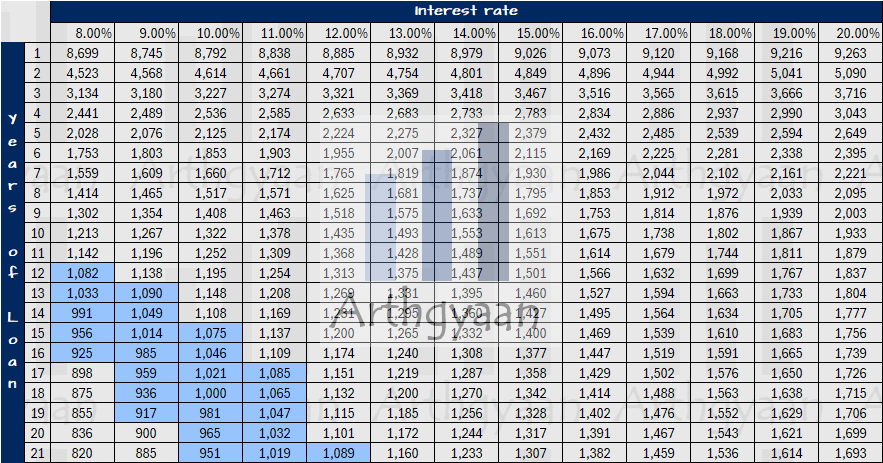

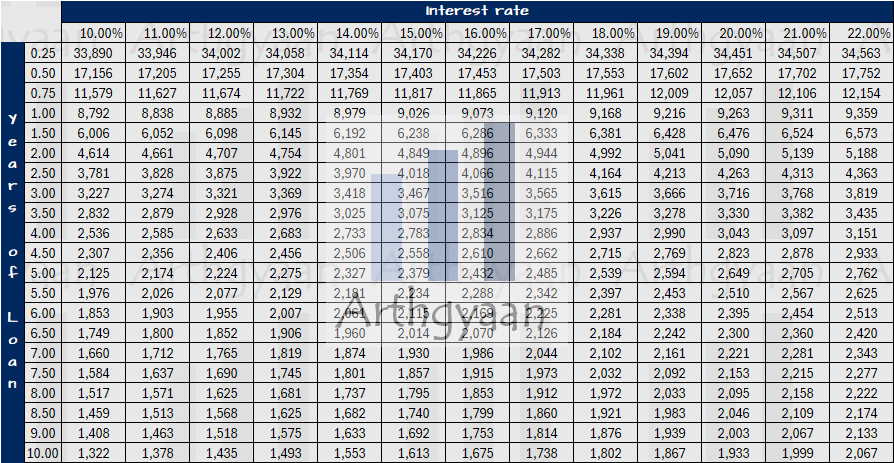

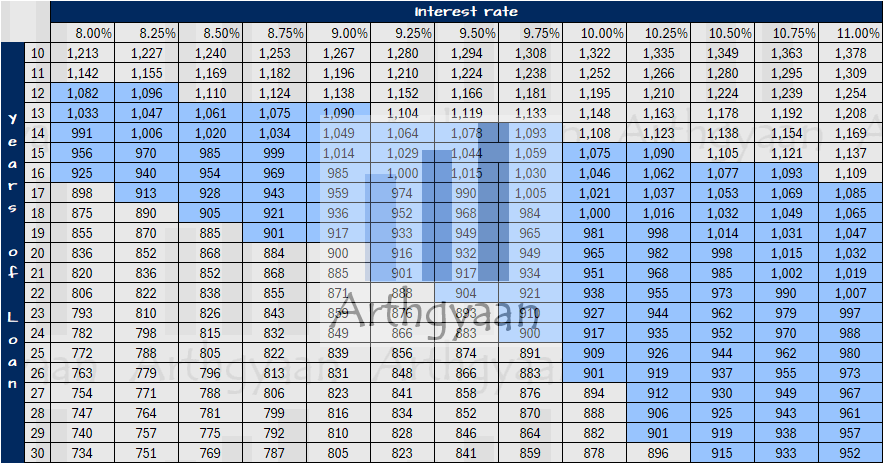

In the sections below, we will show the EMI for a ₹1 lakh outstanding loan balance. You can simply multiply the numbers in the tables with your actual loan balance to find your EMI number. In each case we have used a consistent number of years in the loan and the interest rate range is as per current market rates.

EMI per lakh figures near a ₹1,000/month are in blue. To understand how EMIs will afftect your future cashflow:

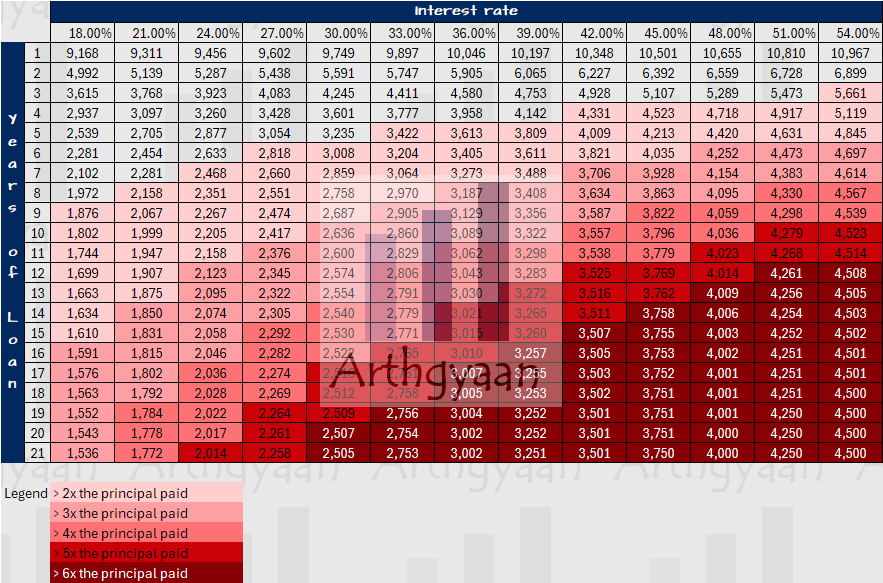

The EMI amount does not seem too bad until you realise that for each deepening of the shade if red, the amount of principal repaid increases by 100%. The numbers in the table exclude GST on interest.

We have a detailed article on this topic of home loan EMIs here: How much EMI do I have to pay for my home loan?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled EMI Calculator: know your EMI per lakh to easily know how much total EMI you have to pay first appeared on 10 Jan 2024 at https://arthgyaan.com