My EMIs take up all my salary. How do I start investing?

This article shows a few ways to avoid and escape from EMI traps to be able to invest via goal-based investing.

This article shows a few ways to avoid and escape from EMI traps to be able to invest via goal-based investing.

This article is a part of our detailed article series on the concept of paying off loans. Ensure you have read the other parts here:

This article gives the list of people to whom you can give or receive gifts like cash, property, stocks, mutual funds or any other assets without paying tax.

We discuss the two common debt payment methods that exist which can be used to easily pay off multiple loans: the avalanche and snowball methods.

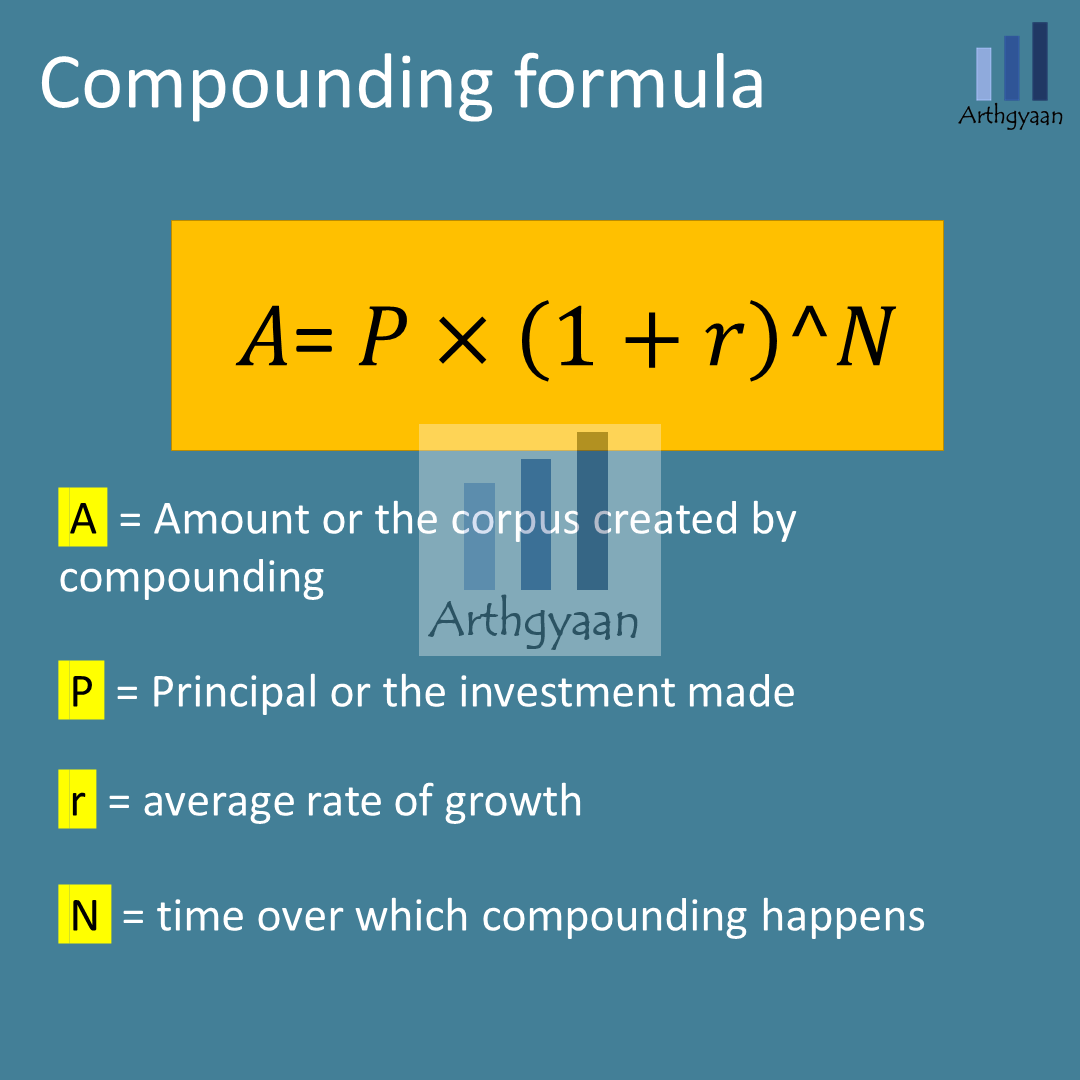

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

This quote is often attributed to Albert Einstein and has profound implications on personal finance. We have covered the “He who understands it, earns it” bit in our previous article: How compounding works: the journey to a 10 crore portfolio.

This article deals with the second half which is “he who doesn’t … pays it”.

Paying EMI is another application of the compounding principle that works in reverse, creating wealth for the lender and not for the borrower. A common misconception regarding EMIs, which ignores the concept of negative compounding, is “If I can afford the EMI, I can afford the product”. This article deals with some typical cases of using EMIs to fund purchases and the best and worst usages of debt.

We will refer to this compounding formula throughout this post.

Debt handling is part of handling overall budgeting that should be read together with

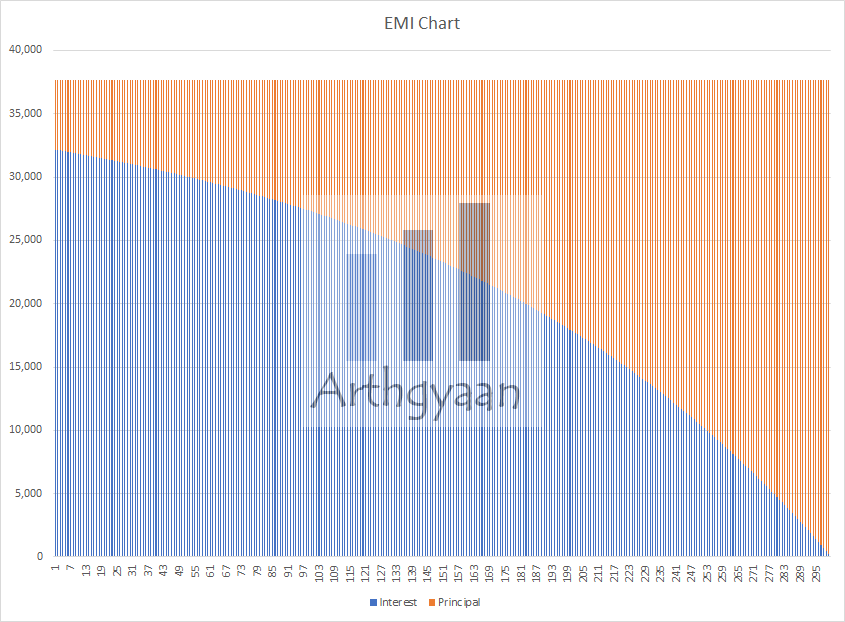

An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making payments of a fixed amount regularly, like monthly, that has both interest and principal in the same payment.

EMI = Principal + Interest

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹37,671. For completeness’ sake, the loan rate typically changes with interest rates in the broader economy. In that case, either the EMI amount or the loan duration will vary to accommodate the new rate. Similarly, if a prepayment is made, the outstanding principal will reduce. In such a case, typically, the loan duration will reduce keeping the EMI the same or, as per the loan terms, the EMI may reduce keeping the time the same.

Before going into the concept of the EMI trap, it will be helpful to understand good and bad debt.

Good debt is essentially a loan taken to purchase an asset that gives a return (either via income or via a price increase). A bad debt is used for buying a consumption item whose value reduces with time. A few examples of good debts are loans for:

In general, a loan for buying things that increase in value, produce an income, increase human capital or are to be used for business purposes is classified as good debt. Such loans typically offer a tax deduction on the interest and in some cases on the principal. Home and educational loans offer deductions to individual taxpayers.

The opposite example are taking a loan like:

A good practice to avoid debt for cases that lie beyond the two classifications above are:

Here is a checklist for taking a new EMI:

Check 1: Is it a good debt like a Home or Educational loan? If yes please plan for it, considering the impact on your finances. Here is an affordability test for taking a home loan: Goal-based investing: how to purchase your dream home

If you are taking a loan to invest in real estate for rental income and price increase in the future, carefully consider the stability of the rental income, maintenance and other costs, taxes, lock-ins for the investment, and future price appreciation potential.

Check 2: How much time does it take to earn the EMI?

We use the concept of the hourly wage, introduced here, to see how long will it take to earn the EMI every month. If the hourly wage is, say ₹500, then a ₹20,000 EMI takes 40 hours to earn. Depending on how you feel about your job, you can balance the enjoyment of using those products you purchased with EMI, a few months after the initial euphoria dies down, versus the time it takes to earn that same amount of money every month.

Check 3: Affording EMI is not affordability:

This statement is the crux of this article and happens due to the interest you pay for the loan. This logic applies to all kinds of loans. For example, if your home loan EMI is too high, you are not investing enough for your other goals like retirement. Similarly, an expensive car taken on loan or lease payment does not create equity. This statement on equity creation means that a good loan once paid off either creates something that has value (like a home or a college degree) or generates income (like a commercial property, car used as taxi). Both of these lead to something that has residual value.

An iPhone or LED TV purchased on EMI or a car taken on loan/lease is used and discarded in say five years. These are consumption items without any residual value beyond a small resale amount.

Related reading: What percentage of my salary should go towards retirement?

Check 4: Increasing EMI leads to increasing interest

When shopping for a high-value product like a car there are two ways to focus on affording the car. The first is how much the car costs, including everything which is the on-road price. You can decide your car budget based on this price and decide, after looking at a few cars, how much above or below you want to go based on seeing a few cars. Let us say that you stretch the budget by 10% upwards. A 10 lakh car with a 2 lakh down payment will have an EMI of ₹13,280 for a seven-year loan at 10% approximately. If the car price goes up by 10% to ₹11 lakhs, and the down payment is the same, the EMI will become ₹14,942 or 12.5% more. The interest paid (EMIxMonths-Principal) is ₹3.15 lakhs and ₹3.55 lakhs, respectively.

The other, and riskier approach, is to look at the EMI instead of the total cost. You decide on a car loan amount that you can pay, say ₹13,000 and have ₹2 lakhs as a down payment. From the previous example, this is a ₹10 lakh car. However, during negotiation, the dealer asks you how much you can afford as EMI. You say, since the increased amount is small, you can afford a ₹18,000 EMI. That implies a ₹13 lakh car which is 30% more than the previous case. The interest payment for ₹18,000 EMI is ₹4.12 lakhs which is quite a jump from ₹3.15 in the last case. If you had needed a ₹13 lakh car, you would have set the budget accordingly from the beginning instead of just paying ₹5,000 extra EMI which is 10 hours of extra work per month.

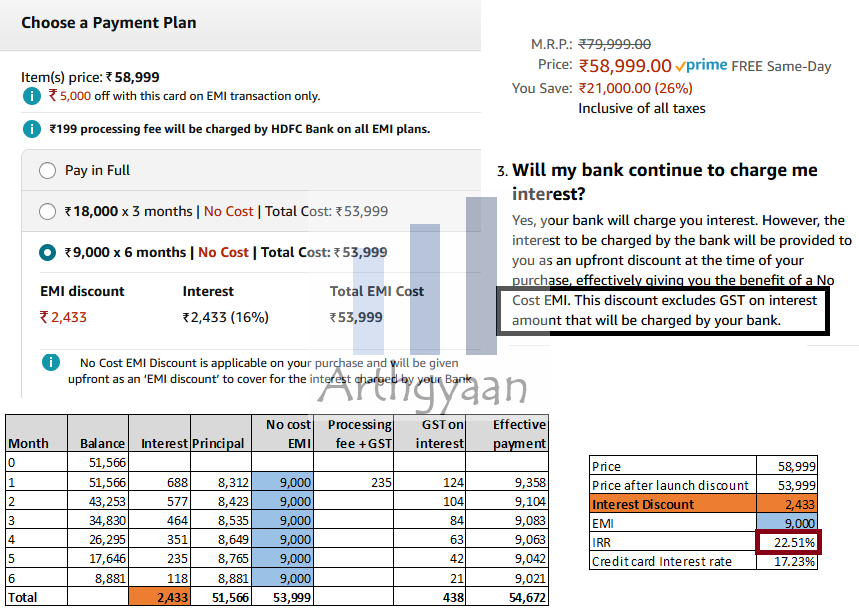

We have all seen 0% EMI offers on e-Commerce and physical stores. However, these offers are not 0% due to the way processing fees and GST works. We show it with an example where we show a no-cost EMI costing 22.5%.

The product (a newly launched flagship phone) is available at ₹53,999 after the instant discount if you pay in full using a credit card. If you decide to take the product on a no-cost six-month EMI, each EMI is ₹9,000, which is the same as ₹54,000. The interest charged on the EMI payments via credit card is ₹2,433, which given is an upfront discount on ₹53,999 to make the starting balance as ₹51,566. If this were all there to it, it would have been zero cost. However, there are two more things:

If we write down these figures against the ₹9,000 EMI (processing fee plus GST and the GST on interest on the monthly interest), then the amount you pay for six months becomes ₹9358, ₹9104, ₹9083, ₹9063, ₹9042, and ₹9021. Sending these six values along with ₹51,666 into the IRR function in Excel gives 22.51% as the effective rate of interest. If the IRR is run using ₹53,999 as the input, the IRR comes to a slightly more reasonable 4.36%. In both cases, EMI does not come to be zero cost.

Here, a point can be made that the amount of interest is not large irrespective of the effective rate of interest. There are two things:

Related reading: How to climb the wealth ladder in India?

If you have more than one outstanding loan, the least you need to do is pay all the exact EMI amounts every month. However, if you have extra money available, there are two ways to pre-pay: pay off the highest-interest loan first (Avalanche method) or the lowest balance loan first (debt snowball method). These methods are discussed in more detail here: Which debt to pay off when you have more than one loan?.

Here we introduce a metric called EMI to income that will show how healthy the financial condition is for the family. If you are paying out more than 30% of your income as EMIs, you are at high risk if anything impacts your income. You also need to allocate more to the emergency fund to take care of the EMIs in a case due to job loss or medical reasons, you or other earning family members cannot work for some time.

If you have credit card debt at 30-40% interest rate, instead of paying EMI, pay off the balance by selling other assets like stocks and mutual funds. If you do not have other assets, consider a personal loan at lower rates (10-15%) or a loan from family and friends.

For discretionary purchases, there are two steps to avoid EMIs.

Step 1:spending prioritisation

You can sit down with your family and make a priority list to spend money. For example, out of white goods/gadgets, entertainment, travel and shopping, you can choose two which give you the most satisfaction and create a monthly spending budget called the fun budget. The others items will have a minimal budget allocated to them.

Step 2:sinking fund

A part of the fun fund will be spent monthly (say on ongoing entertainment expenses), while the rest goes into a sinking fund (use RD or liquid mutual funds) to be spent when there is enough. So if you want a ₹53,999 phone, for example, line up the sinking fund so that you purchase the phone during one of the numerous online sale events to maximise discounts and minimise the amount of interest being paid. Some more details on this are here: Keep a sinking fund to pay for known but irregular expenses.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled My EMIs take up all my salary. How do I start investing? first appeared on 13 Jan 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.