Should you invest in the DSP Global Innovation Fund NFO?

A new Fund of Fund wants to capture the alpha from innovative technology companies globally. Should you invest?

A new Fund of Fund wants to capture the alpha from innovative technology companies globally. Should you invest?

This article is a part of our detailed article series on new fund offerings (NFOs) in India. Ensure you have read the other parts here:

This article discusses a new offering by HSBC Mutual Fund focusing on companies in the Export sector.

This article discusses the NFO of the Tata Nifty India Tourism Index Fund which is the first fund tracking the Nifty Tourism Index.

This article discusses the NFO of the Bandhan Nifty Total Market Index Fund which is the second fund tracking the Nifty Total Market Index.

This article discusses the NFO of the Motilal Oswal Nifty Defence Index Fund which is the second fund tracking the Nifty Defence Index.

This post discusses new Real Estate feeder funds being launched in India and whether investors should invest in such funds.

This post discusses new Blockchain feeder funds being launched in India and whether investors should invest in such funds.

After the Motilal Nasdaq Q50 ETF NFO, here is another one with the same “Catch them young” tag line. Read more: Should you invest in the Motilal Nasdaq Q50 ETF NFO?

“Catch them young” is literally the title of the second slide of a deck I got by email. The slide discusses how by the time a disruptive technology company is included in a major index, the major gains have already come using examples like Apple, Amazon, Tesla Adobe, and Netflix. For those unaware of this phenomenon, it is called survivorship bias. The presentation goes on to talk about innovation, disruption and related themes.

The NFO of this fund, which is a fund-of-fund investing in a mix of global technology/innovation/disruption themes via ETFs and active funds, runs from 24-Jan to 7-Feb, 2022.

The DSP Global Innovation Fund (DSP GIF) will be investing in the following funds:

| Fund | Weight | TER (Nov-2021) | Type |

|---|---|---|---|

| Morgan Stanley US Insight Fund | 15% | 0.81% | Active |

| BGF World Tech Fund | 20% | 0.75% | Active |

| iShares Semiconductor ETF | 15% | 0.43% | Passive |

| Nikko AM ARK Disruptive Innovation fund | 15% | 0.82% | Active |

| Bluebox Global Technology Fund | 20% | 1.18% | Active |

| Ishares Nasdaq 100 UCITS ETF | 15% | 0.33% | Passive |

The SID says that the fund choices and weights can change as per the fund manager’s discretion.

The fund will be benchmarked against the MSCI ACWI index. This is a rather strange choice since a thematic fund like this is being benchmarked against the World stock market index. Therefore, the AMC should choose a more appropriate benchmark, maybe against the MSCI ACWI IMI Disruptive Technology Index (details here).

It should be noted that as per the presentation documents, the weighted TER of the underlying funds is 0.74%. The FoF will have its own expense ratio on top of that making it a fairly expensive way to get exposure to the disruptive technology theme.

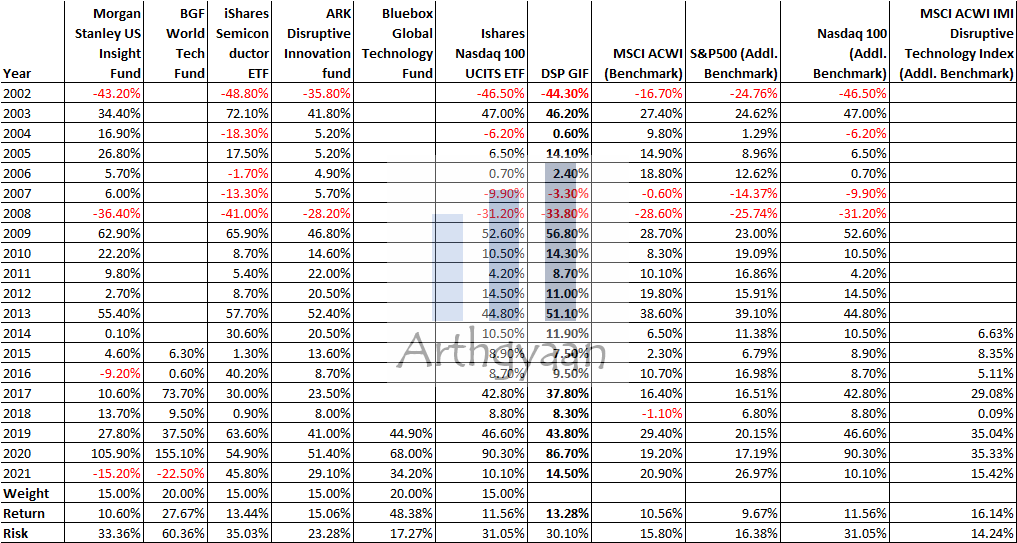

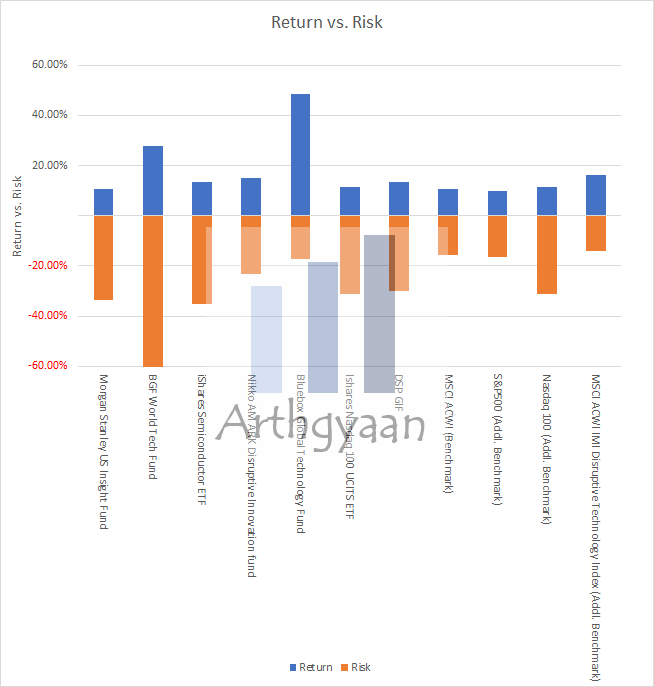

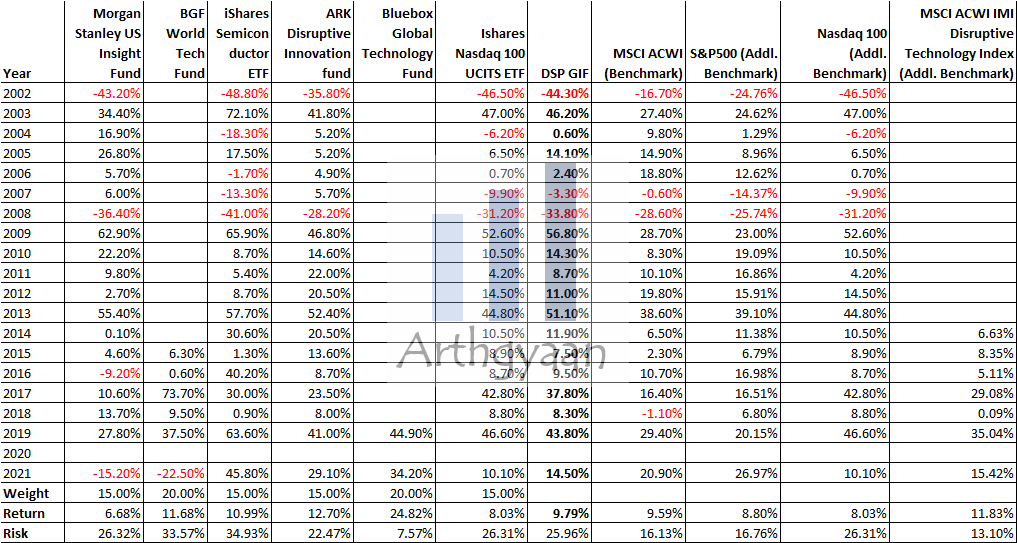

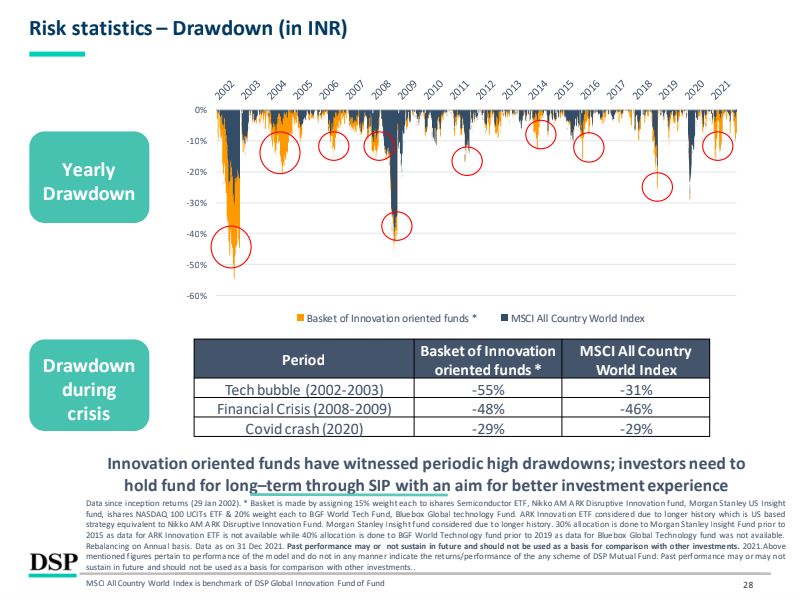

We have been provided past price performance of the underlying funds.

We have added the S&P500, Nasdaq 100 and MSCI ACWI IMI Disruptive Technology Index values in INR for comparison.

There are some challenges with the data here:

The last point is called the recency effect since a lot of the of gains in the stock, and as a result, the attractiveness of the theme comes from something that happened in the recent past. The risk of using recent returns when choosing a theme is

Using portfolio disclosures of the underlying funds, we can construct a tentative portfolio of the DSP GIF. Given that it is difficult to get the entire underlying portfolio of these funds, the numbers in the table for DSP GIF are minimum values. For example, if Amazon is present in the top 10 in Fund X and below top 10 in Fund Y, the total will not count the contribution from Amazon from Fund Y and the total for Amazon will be slightly lower than the actual value.

We see that top 10 stocks constitute around 20% of the portfolio, and the fund avoids the usual concentration found in the technology heavy indices.

| Companies | DSP GIF | N100 | S&P500 | MSCI ACWI IMI DT |

|---|---|---|---|---|

| Microsoft | 3.49% | 9.84% | 5.97% | 5.78% |

| Apple | 2.63% | 11.78% | 6.83% | 5.06% |

| Tesla | 2.56% | 4.43% | 2.25% | 0.00% |

| Lam Research Corp | 1.75% | 0.66% | 0.24% | 0.00% |

| Broadcom | 1.66% | 1.77% | 0.64% | 0.00% |

| NVIDIA | 1.65% | 4.02% | 1.75% | 4.77% |

| Alphabet | 1.64% | 7.15% | 4.11% | 5.06% |

| Shopify | 1.49% | 0.00% | 0.00% | 0.00% |

| Applied Materials | 1.45% | 0.98% | 0.36% | 0.00% |

| Amazon.com | 1.44% | 6.83% | 3.60% | 4.64% |

Here we see some of the premise of having sufficient allocation to upcoming stocks, which have the potential for high returns since they are in the disruptive technology field.

| Companies | DSP GIF | N100 | S&P500 | MSCI ACWI IMI DT |

|---|---|---|---|---|

| Block (Square) | 1.36% | 0.00% | 0.00% | 0.00% |

| Zoom | 1.26% | 0.28% | 0.00% | 0.00% |

| ASML Holding | 1.25% | 0.41% | 0.00% | 0.00% |

| Marvell Technology | 1.20% | 0.48% | 0.00% | 0.00% |

| Qualcomm | 1.18% | 1.42% | 0.52% | 0.00% |

| Coinbase Global | 0.98% | 0.00% | 0.00% | 0.00% |

| Unity Software | 0.92% | 0.00% | 0.00% | 0.00% |

| Snap | 0.89% | 0.00% | 0.03% | 0.00% |

| Snowflake | 0.88% | 0.00% | 0.00% | 0.00% |

| Intel | 0.87% | 1.54% | 0.57% | 0.00% |

| Roku | 0.82% | 0.00% | 0.00% | 0.00% |

| Teladoc Health | 0.81% | 0.00% | 0.00% | 0.00% |

| TSMC Ltd | 0.78% | 0.00% | 0.00% | 3.88% |

| Cadence Design Systems | 0.78% | 0.32% | 0.12% | 0.00% |

| Synopsys | 0.78% | 0.35% | 0.13% | 0.00% |

| Adobe | 0.77% | 1.72% | 0.63% | 0.00% |

| Cloudflare | 0.76% | 0.00% | 0.00% | 0.00% |

| Advanced Micro Devices | 0.76% | 1.13% | 0.41% | 0.00% |

| DoorDash | 0.75% | 0.00% | 0.00% | 0.00% |

| 0.74% | 0.00% | 0.08% | 0.00% | |

| Meta Platforms | 0.73% | 4.83% | 1.97% | 0.00% |

| Mercadolibre | 0.72% | 0.42% | 0.00% | 0.00% |

| Micron Technology | 0.65% | 0.72% | 0.27% | 0.00% |

| KLA Corp | 0.61% | 0.45% | 0.16% | 0.00% |

| Spotify Technology | 0.59% | 0.00% | 0.00% | 0.00% |

| Roblox | 0.54% | 0.00% | 0.00% | 0.00% |

| Bill.com Holdings | 0.54% | 0.00% | 0.00% | 0.00% |

| Twilio | 0.53% | 0.00% | 0.00% | 0.00% |

| Kakao Corp | 0.41% | 0.00% | 0.00% | 0.00% |

| PayPal Holdings | 0.37% | 1.42% | 0.55% | 2.48% |

| Cisco Systems | 0.27% | 1.78% | 0.65% | 0.00% |

The following are the sources of active risk in this fund:

The standard recommendation regarding NFO investment is

In summary, investors should avoid investing:

Alternative investments in the same theme

The fund names below are not recommendations and are mentioned below to start the research process. Indian investors looking at investing in technology and disruptive innovation themes already have a few options in the market:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you invest in the DSP Global Innovation Fund NFO? first appeared on 15 Jan 2022 at https://arthgyaan.com