Motilal Oswal stops fresh lump sum investments into international funds. What now?

What should investors do now that Motilal Oswal has restricted investing in its international funds? The SEBI rule and alternatives explained.

What should investors do now that Motilal Oswal has restricted investing in its international funds? The SEBI rule and alternatives explained.

Disclaimer: Fund names in the article below are not recommendations to invest in those funds.

An email from Motilal Oswal AMC to investors dated 13-Jan-2022 declared that fresh lumpsum and switch-in investments into the following three funds had been temporarily restricted as of 14-Jan-2022. In contrast, current investments in SIP form will continue as will all types of redemption transactions like direct redemptions, switch-outs, STP and SWPs.

The funds impacted, and their AuM as per AMFI Dec-2021 data, are:

The issue is due to a SEBI enforced limit, as per circular dated 3-Jun-2021, on total allowed investment, at a fund house level, of $1 billion (around ₹7,400 crore) into international stocks. The entire mutual fund industry in India can remit up to $7bn.

We can see above these three funds are already inching towards the ₹7,400cr limit. In addition, the Nasdaq 100 ETF has another ₹1,710cr AuM that is not coming from the FoF and is a direct ETF investment.

SEBI has earlier tweaked this limit twice, moving the limit from $300mn to $600mn and to $1bn in June-2021.

The MOST Nasdaq 100 ETF is not impacted since the ETF is closed-ended by design. There is no concept of fresh investment unless the FoF does it or an investor approaches the AMC to directly buy (or sell) ETF units by committing a large sum of money. Fresh investors seeking Nasdaq 100 exposure can trade in the ETF units via the stock exchange. Still, it remains to be seen what the impact of the new demand will be on how the ETF price behaves relative to NAV. If the price goes above the NAV, investors should not invest in the ETF.

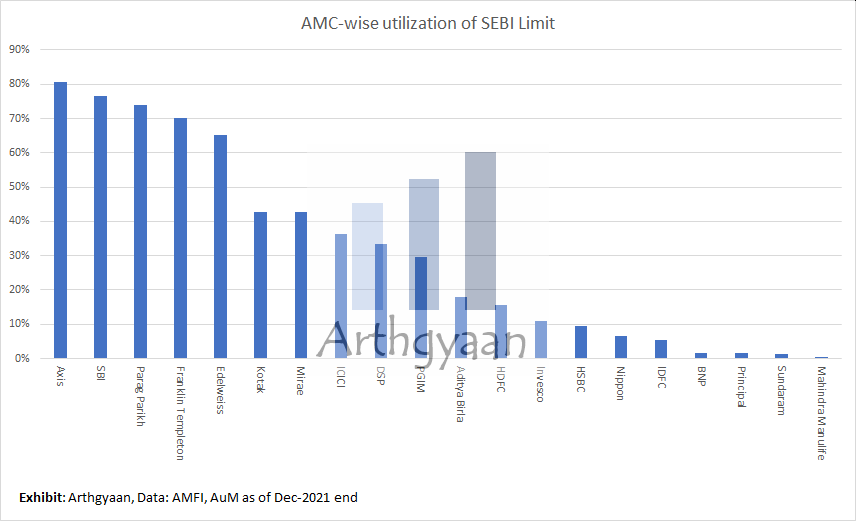

We have used AMFI AuM data for the Dec 2021 quarter to check the total AuM for all mutual funds and identified those with international exposure either partially (like Parag Parikh Flexi) or completely. The SEBI rule only refers to the remitted amount for these funds, and not the capital gains. We have used AuM as a proxy for this remitted amount.

We see that Axis, SBI, Parag Parikh, FT, and Edelweiss are all above the 60% mark, with Axis touching 80% closely followed by SBI. A bulls-driven uptick in the markets, say by 25%, will push these AMCs very close to the SEBI limit. Existing investors in these funds will not have any issue but new investors, looking for investing into these AMCs’s international funds, should be wary of how close the AMC is to the SEBI limit. 100% domestic funds are, of course, not impacted.

We are presenting some alternative funds currently available to Indian investors who wish to invest in a manner similar to the three affected Motilal Oswal funds. The fund names below are not recommendations.

Before investing, investors should carefully check the tracking error and expenses of these funds are acceptable and overall, the funds are a correct fit to their risk profile and goals.

There is no direct replacement. Mirae has a fund called Mirae Asset S&P 500 Top 50 ETF Fund of Fund, which takes the S&P500 and invests only on the top 50 stocks from the S&P500, measured by float-adjusted market capitalization. While most of the index returns tend to come from the largest stocks in a market capitalisation weighted index, this fund will not be a 1:1 replacement of an S&P 500 fund.

Nasdaq 100 funds are available from Aditya Birla, ICICI Prudential and Kotak AMCs.

There is no direct alternative fund currently available in India.

Investors have two alternatives: 1) invest in the alternative funds or 2) simply wait for the SEBI limit to be adjusted just like it has happened in the past. Given investor’s interest in these funds over the last few years, driven by a strong bull-market rally in international stocks, it can be hoped that SEBI will revise the limit upwards.

In the interim, investors may direct lumpsum investments into other funds or take this opportunity to rebalance their portfolios.

Related reading:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Motilal Oswal stops fresh lump sum investments into international funds. What now? first appeared on 16 Jan 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.