SEBI stops new international MF lumsum investments. What should investors do now?

Post Motilal Oswal stopping lump sums in its international funds, other AMCs will stop taking international fund investments from 2-Feb-2022.

Post Motilal Oswal stopping lump sums in its international funds, other AMCs will stop taking international fund investments from 2-Feb-2022.

Disclaimer: Fund names in the article are not recommendations to invest in those funds.

We will take a call at the right time when we feel confident that the rupee is stable on a durable basis - RBI governor Shaktikanta Das on 11-Jan-2024.

Essentially the decision to raise the limit depends on the RBI’s assessment of rupee stability.

From 31-Jan-2022, many Mutual fund investors have received emails like this:

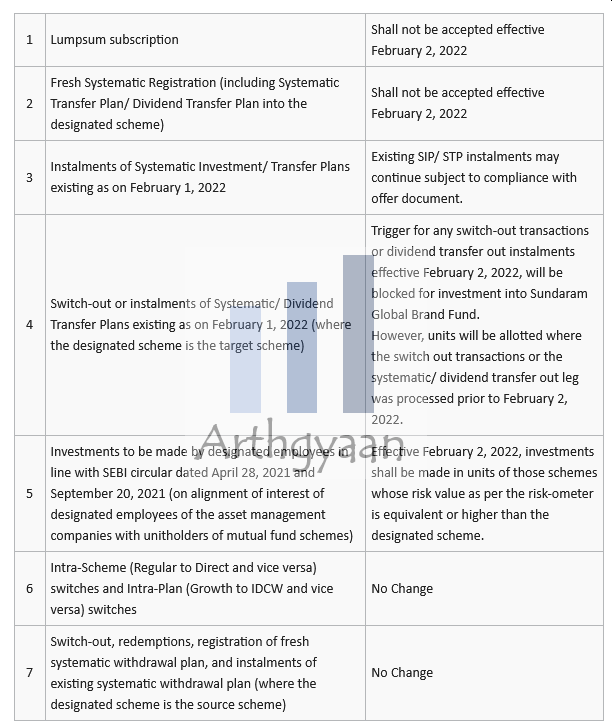

Pursuant to SEBI’s email dated January 28, 2022, and AMFI clarification dated January 30, 2022, to avoid a breach of industry-wide overseas limits as allowed by RBI and in terms of SEBI circular no. SEBI/HO/IMD/IMDII/DOF3/P/CIR/2021/571 dated June 03, 2021, the Trustees of Sundaram Mutual Fund have decided to stop subscriptions in the designated scheme with effect from February 02, 2022, till further notice

After Motilal Oswal stopped lumpsum investments in its international funds from 14-Jan-2022, covered here, all other mutual funds will stop lump sum investments in international funds from 2-Feb-2022. This is post a circular from Association of Mutual Funds in India (AMFI) board (linked below).

Points to be noted:

SEBI enforces the following rule for the entire mutual fund industry in India regarding the amount remitted to date to invest in international assets like stocks, mutual funds and ETFs:

This means:

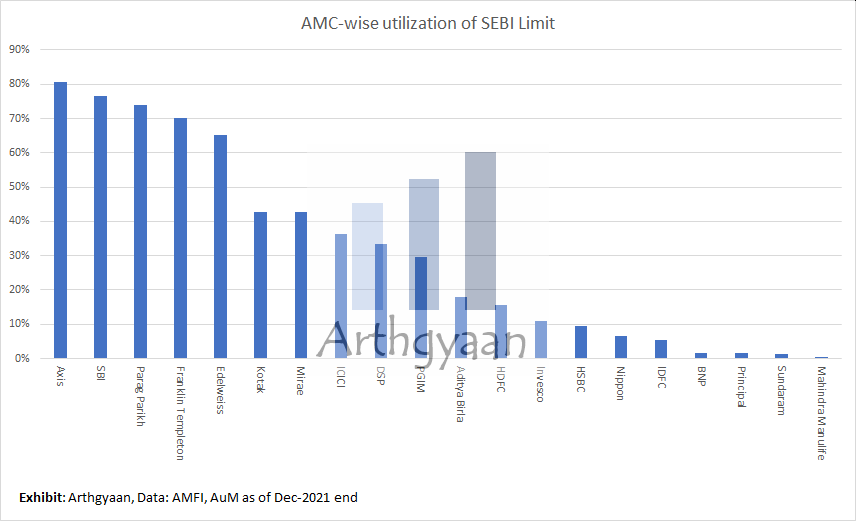

It appears that the industry is quite close to the $8bn limits. The individual AMCs level limit, as per AMFI AuM data from Dec-2021, is this:

A recent impact of this limit is the NFO of DSP Global Innovation fund which changed its mandate to invest only in two ETFs, out of the original fours MFs and two ETFs, to utilise the room in the $1bn ETF limit, as per SEBI advice. Read more: Should you invest in the DSP Global Innovation Fund NFO?

The industry-wide limit that is currently $7bn for funds, was last updated by RBI in 2008. Source.

Given investor’s interest in these funds over the last few years, driven by a strong bull-market rally in international stocks, it can be hoped that SEBI will revise the limit upwards.

Any running SIP or STP transaction currently registered with the AMC will not be impacted. There are two caveats:

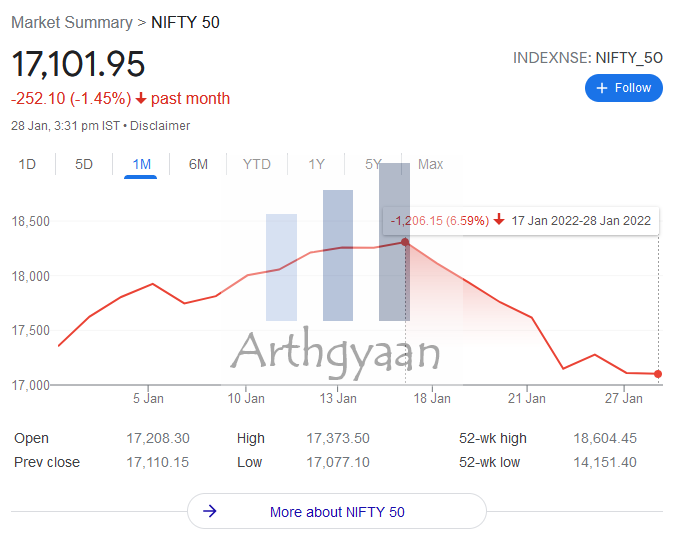

The SEBI rule does not impact any fund that invests entirely in the domestic market. Investors may direct lumpsum investments into other funds or take this opportunity to rebalance their portfolios by buying more Indian equity, given the recent fall in Indian equity markets.

The Nifty 50, for example, is currently down 6.5% from mid-Jan highs and any lump sums can be directed into Indian markets while we wait for SEBI to increase the limit.

Extra cash may also be used to top-up the emergency and sinking funds in the case that has been neglected for some time:

Investors should remember that minor speed bumps like this should not materially impact their portfolios or goals. If they were investing majorly in any of the affected schemes, they need to review that plan in case of similar regulatory hurdles in the future.

Our recommendation will continue to be not to jump to LRS mode to invest in US-traded stocks or US-domiciled MF/ETFs.

If you are already investing in such funds, please keep in mind that the thesis supporting international diversification is still sound. Read more here: Should you invest in international stocks?.

Investors should understand that nothing has changed fundamentally with either global markets, where these funds are investing, nor with their investment plans overnight. The rule is essentially RBI, as the country’s central bank, being concerned about the amount of foreign currency flowing out of the country due to these investments. In the worst case the limit does not get extended and after a while all investments in such funds stop, including SIP.

Investors should not:

Related reading:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled SEBI stops new international MF lumsum investments. What should investors do now? first appeared on 31 Jan 2022 at https://arthgyaan.com