Budget 101: How to save for periodic expenses: the sinking fund

Save money monthly for significant known expenses via a sinking fund.

Save money monthly for significant known expenses via a sinking fund.

Read on to find out how to manage such periodic expenses.

This article is a part of our detailed article series on the concept of a Sinking Fund. Ensure you have read the other parts here:

This article shows you how to review your sinking fund so that you can keep pace with the inflation of your periodic expenses and short-term goals.

This article gives you an easy-to-use tool to create, save and track short-term goals to make sure that you have money to spend on them.

Periodic expenses are known expenses that are usually mandatory (insurance payments). Still, some can also be discretionary (like mobile phone replacement). The key here is that the expense is periodic at a frequency lower than once a month. Recurring monthly expenditures like rent, mobile/Netflix bill, EMI etc., come from monthly salary.

Periodic expenses can be once a quarter, every six months, annually or every 2-3 years. Even some longer-term payments can be recurring as explained below. Some typical examples:

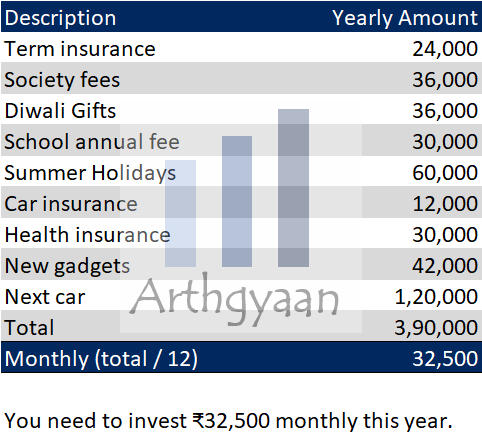

Take a piece of paper (or Excel / free Google Sheets) and write down every periodic expense using the examples above.

Convert them into annual values and add them up. For example, 3 lakhs of foreign vacation every 2 years is 1.5 lakhs a year; you can directly add annual amounts like insurance payments; you can make quarterly things like building maintenance 4 times to make it annual.

Now, divide the total annual figure by 12 to get the monthly amount you need to save from your salary every month.

Even one-time purchases (first car in 3 years etc.) can come under this, where you consider the total amount you need, divide it by the number of months you have and add that to your monthly sinking fund contribution. Over time, as expenses change, revisit the calculation to adjust the monthly figure.

Wikipedia: A sinking fund is a fund established by an economic entity by setting aside revenue over some time to fund a future capital expense.

A sinking fund is an account where you save money monthly that is entirely different from your long-term goals (retirement, child education etc.) and your emergency fund (for job loss, car trouble, medical emergency etc.) Use the figure from step 3 above and open a SIP in a liquid fund. If mutual funds do not work for you, just put them in a separate saving account dedicated to this. Interest in the savings account is unimportant as the amount you will be saving will be much less than your total wealth. Keep things simple. This account or mutual fund folio is the sinking fund. However, do not invest this money in the stock market since you need it soon and cannot lose any of it if stock markets suddenly go down.

When payment comes, make it from a credit card (for points) if possible or from a general savings account. Refill the savings account or pay the credit card bill by redeeming it from your sinking fund. Keep a watch on the sinking fund to ensure that you do not overdraw (buy a ₹30,000 phone while you had budgeted for ₹20,000) to ensure the fund always has enough money for what you need.

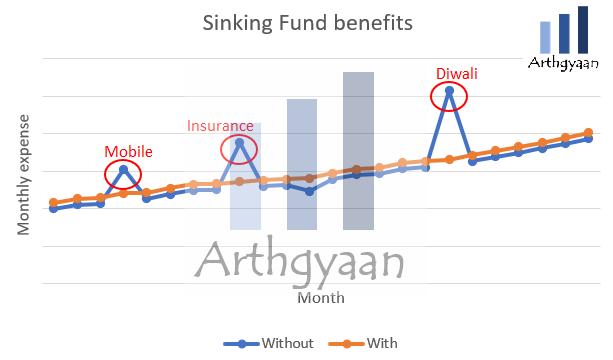

First, the money you need is always available for things you need to buy/spend money on.

Second, your monthly expenses are predictable and not sudden. Without a sinking fund, a high cost, like insurance payment, makes a sudden dent in the monthly budget. You may need to resort to a credit card. However, the interest costs are prohibitive unless you pay it off entirely by the next cycle.

Third, you can align purchases with sales/offers/discounts and get the best deals. For example, if you purchase a mobile every 2 years, align that with the right sale, which has the best offers and buy then. You may also get the best offers if you pay the whole amount upfront.

This article has an easy-to-use tool that you can use to implement the concept of sinking funds: How to make sure that you always have money for short-term goals?.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Budget 101: How to save for periodic expenses: the sinking fund first appeared on 08 Mar 2021 at https://arthgyaan.com