How to make sure that you always have money for short-term goals?

This article gives you an easy-to-use tool to create, save and track short-term goals to make sure that you have money to spend on them.

This article gives you an easy-to-use tool to create, save and track short-term goals to make sure that you have money to spend on them.

This article is a part of our detailed article series on the concept of a Sinking Fund. Ensure you have read the other parts here:

This article shows you how to review your sinking fund so that you can keep pace with the inflation of your periodic expenses and short-term goals.

Save money monthly for significant known expenses via a sinking fund.

Disclaimer: Fund names mentioned in the article and in the video are for example purpose and are not recommendations for investing in those funds.

This article is a Guest Post from one of Arthgyaan’s earliest readers who is a fellow personal finance enthusiast.

About the author: Muthu Kannan, also known as Manki, is a software engineer by profession. He is intrigued by all sorts of things in life. One of them happens to be personal finance and investing.

In the personal finance space, his passions include teaching others (which is just a fancy name for learning by answering other people’s questions), building tools (mostly spreadsheets as of now), and writing about his revelations occasionally.

Readers of Arthgyaan may be interested in his blog posts about personal finance. Links to his other work and social media handles are on his home page manki.in.

Now over to Muthu Kannan (aka Manki).

Let me start by stating a few things to set the context:

When I discovered Jupiter Pots, I became a fan instantly. After using Jupiter Pots for a few months, I wanted the same functionality for mutual funds. Within a few months, I got the motivation to make a spreadsheet that’s functionally equivalent to Jupiter Pots! In this post, I am going to show an overview of how I use that spreadsheet.

The spreadsheet is available for anyone to inspect or play with. Open the spreadsheet and make a copy (File > Make a copy) if you want to try it out. (You can look at the “info” tab of the spreadsheet to see if the original spreadsheet has changed after you copied it.)

Editor’s note: Please login to your Google/GMail account on a PC/Laptop/Mac before clicking the link. This way, you will create your copy of the sheet.

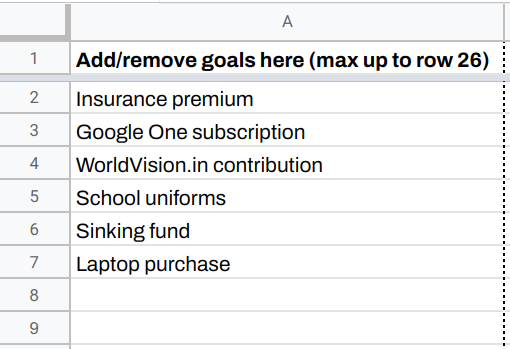

This spreadsheet has 4 sheets:

Finally, there is an “info” sheet which contains meta information, such as when the spreadsheet was last updated, links to this blog post and demo video, etc.

Let’s say your laptop is becoming fairly old, and you want to save every month to buy a new laptop.

The spreadsheet already has some sample goals. Add your goal to the list. (Feel free to delete the sample ones if you decide to use the tracker!)

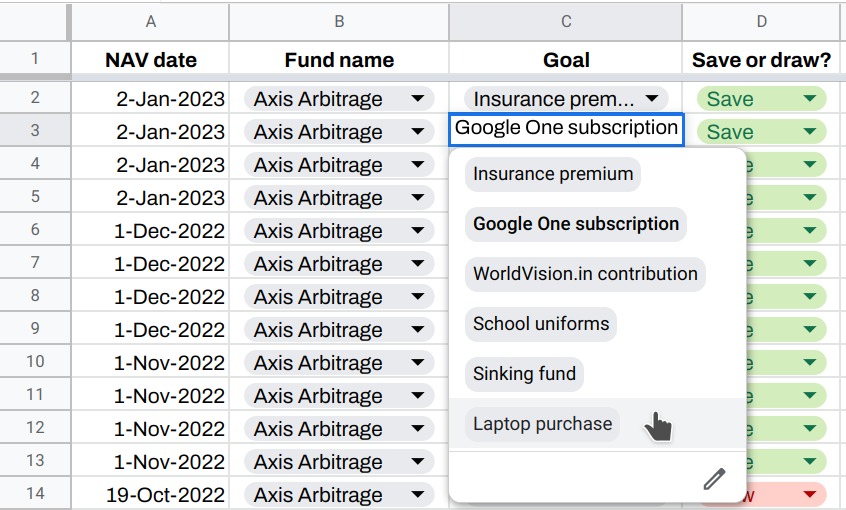

Now the new goal will automatically show up on the ‘Goal’ column of the ‘transactions’ sheet.

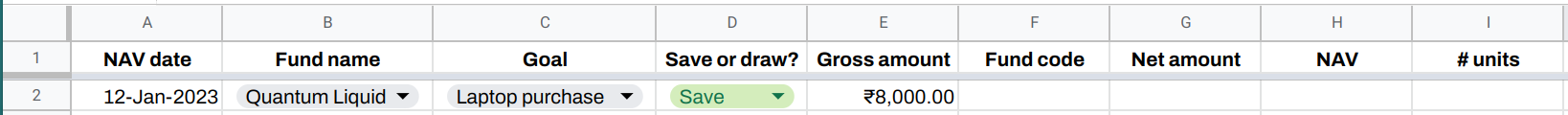

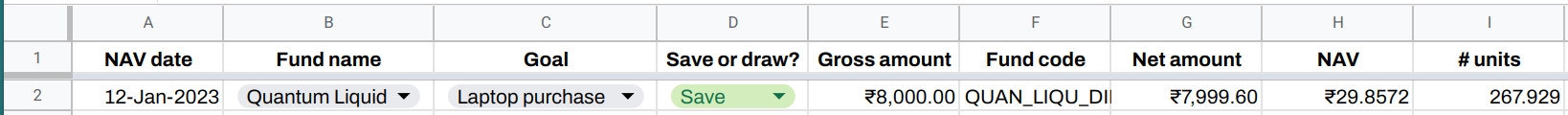

Let’s say you have bought Quantum Liquid fund for ₹8,000 towards your laptop purchase goal. To track this, you’ll add a new entry to the ‘transactions’ sheet. I like to keep my records reverse-chronological (i.e. most recent first) so I add new rows at the top, but the order within the sheet does not matter. After inputting data for columns A through E, the row looks like this:

Columns F through I can be calculated using formulas. Copy-paste these columns from a neighbouring row, and the values will be populated:

Something to keep in mind: Google Finance has a lag in getting the latest NAVs. If the formula does not show a value for your transaction, you may just have to wait for a day or two.

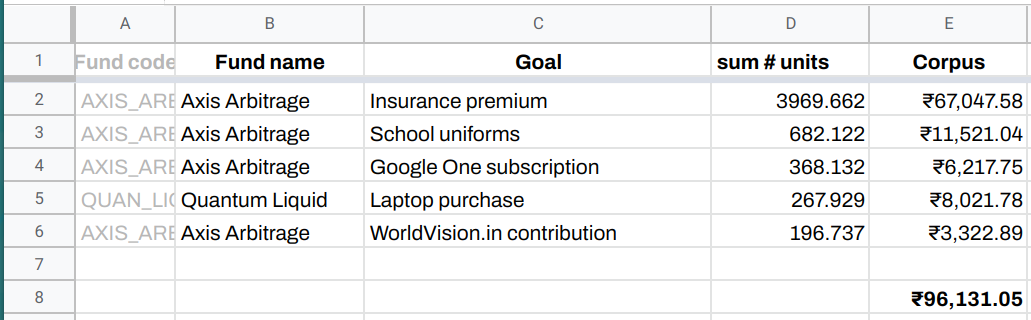

Now if you switch to the ‘summary’ sheet, you’ll see that a new row has been added for the ‘Laptop purchase’ goal. (The column E is manually added. If a cell is empty, copy-paste the E cell from a neighbouring row.) You can see that the ₹8,000 invested for laptop purchase has now grown to ₹8,021.78.

Here is a video tutorial for the sheet:

When you have saved enough and sell your MF units to buy the laptop, you’ll add a ‘Draw’ transaction and specify the amount (in INR) you have withdrawn. You can also remove old goals from the ‘goals’ sheet to keep the ‘goal’ dropdown clutter-free.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to make sure that you always have money for short-term goals? first appeared on 26 Apr 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.