How to review your sinking fund to always have money since cost of goals are increasing?

This article shows you how to review your sinking fund so that you can keep pace with the inflation of your periodic expenses and short-term goals.

This article shows you how to review your sinking fund so that you can keep pace with the inflation of your periodic expenses and short-term goals.

This article is a part of our detailed article series on the concept of a Sinking Fund. Ensure you have read the other parts here:

This article gives you an easy-to-use tool to create, save and track short-term goals to make sure that you have money to spend on them.

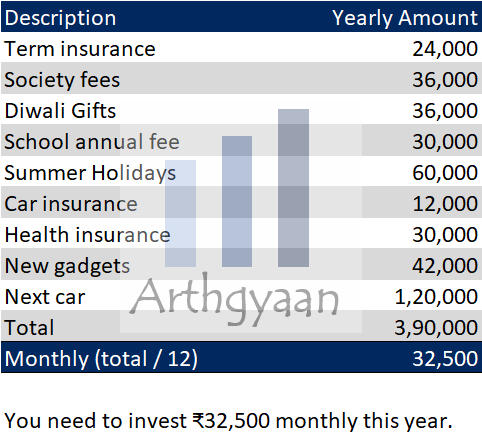

Save money monthly for significant known expenses via a sinking fund.

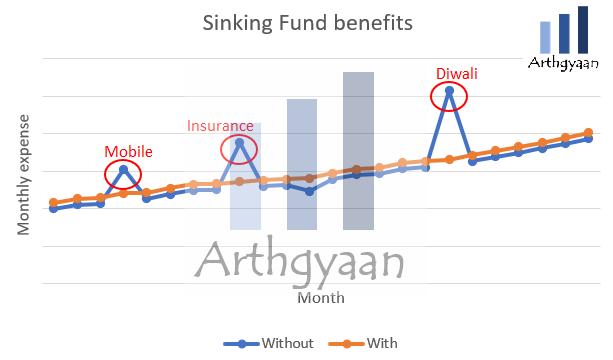

A sinking fund is an account where you save money every month to be spent for large amounts like insurance payments, school annual fees or festival gifts. The sinking fund smoothens out your monthly budget since you already have the money with you whenever you need it.

We have covered the concept in detail here: Budget 101: How to save for periodic expenses: the sinking fund.

A regular reader posted this query:

When I plan for Sinking fund, should I consider current value of expenses or some inflated expenses. For instance last year I have started my kids school fee as 65K and saved Sinking fund for 1 year, now the fee is hiked to 72K.

Likewise other expenses like insurance premium, summer vacations all are raising so far within a year . Should we add some inflation to plan for savings in sinking fund ?

Both of these questions require that your sinking fund be reviewed at least annually or as soon as one expense increases. We will now discuss how to review the sinking fund so that you can use it when the costs of your goals go up.

We will now describe the steps for reviewing your sinking fund one by one.

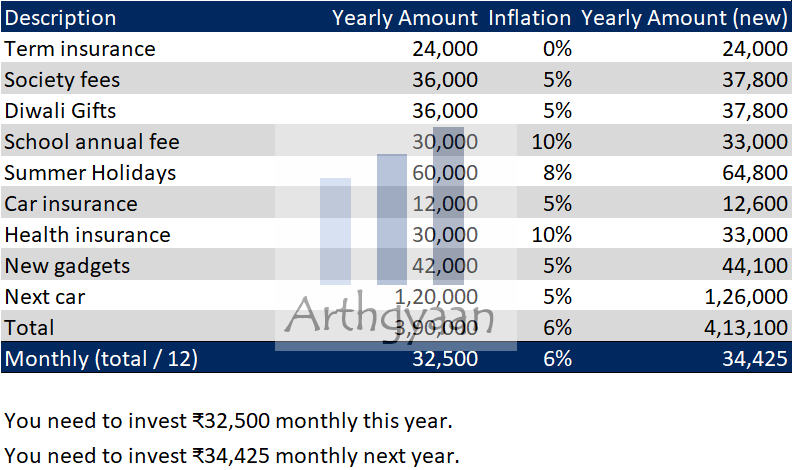

For each of the goals in your sinking fund, assume an inflation factor at which the goal grows. One example is to assume that your health insurance premium can grow by 10% every year. If you don’t have inflation numbers, assume 7% which means that the cost of the goal doubles in 10 years.

Once you have the inflation value, then

New Goal Value = Old goal * (1 + Inflation)

For example, if your health insurance premium is ₹30,000 and that increases by 10%, then the new premium is ₹30,000 * 1.1 = ₹33,000.

If you already know the new value of the goal, take the new value. In the reader query above, the school fee is hiked to 72k from 65k.

If your child starts school next year, or you just took a new insurance policy, then you can add the new goal to the list.

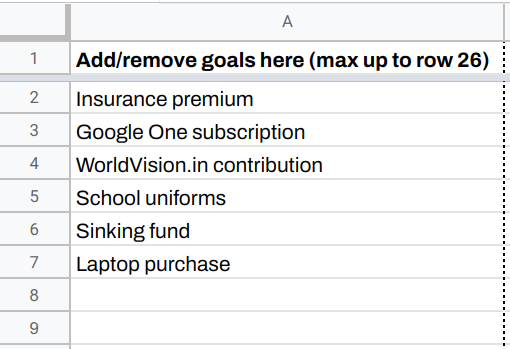

If you are using this spreadsheet tool to manage your sinking fund, and you should if you have not already, then check out this guide: How to make sure that you always have money for short-term goals?

Once you have the new values or the inflations, just add them up and divide by 12 to get the amount you need to invest per month.

For most goals, a yearly review is fine. If you already have the new goal value, you can simply update the new value now instead of waiting for the next annual review. Unless you are adding or removing goals, the change in the monthly value will not be very different from your current amount.

You can easily update your SIP amount if you are using a debt mutual fund to save the new amount. If you are saving a fixed amount via recurring deposit or fund transfer standing instruction, then you can update the amount by changing the RD or standing instruction.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to review your sinking fund to always have money since cost of goals are increasing? first appeared on 03 May 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.