Case study: how a family in their mid-30s with a newborn kid can FIRE and invest in real estate?

This article shows how a double-income couple with a newborn child can invest for their future goals of FIRE and real-estate investment.

This article shows how a double-income couple with a newborn child can invest for their future goals of FIRE and real-estate investment.

Disclaimer: The purpose of this Case Study article is solely to demonstrate, as a reference guide, how an investor can use the Arthgyaan goal-based investing tool to invest in a do-it-yourself (DIY) manner. This article is not investment advice and does not solicit buying or selling of any security, stock or mutual fund.

🎉 This is post number 250 in this blog

This article uses the Arthgyaan goal-based investing calculator to understand how much corpus is needed to have a comfortable lifestyle in India.

This article shows how a single-income middle-aged couple with two small children reach their retirement and children’s goals.

This article shows how a double-income couple with a 2-year old reach their FIRE dream at the age of 50.

This article shows how a double-income couple with a newborn child can invest for their future goals of FIRE and real-estate investment.

This article shows how a young just-married couple can invest for future goals using the Arthgyaan goal-based investing tool.

Did you welcome a bundle of joy in your 40s? This article will discuss ways of planning the child’s (and your’s financial future)

This article shows how a very typical salaried couple with one child can invest for future goals using the Arthgyaan goal-based investing tool.

The total market value of these assets:

To build a house, you need to first build a strong foundation

Goal-based investing requires completing some steps to ensure that the investment plan is seamlessly executed without breaks due to unforeseen circumstances. We will follow the steps described here: I have heard of goal-based investing. What now?

Risk profiling is a mandatory step that should be completed before investing in goals. A portfolio created for a goal has one purpose: to meet the goal. Therefore, we need to balance risky assets that generally appreciate fast (like equity) and slow-growing assets that provide stability (like debt). The tool that is used to determine this mix of investments is risk profiling. Risk profiling, if not done, leads to a high chance of missing the goal. Being invested in the wrong asset class in the wrong proportion (either equity or debt) can lead to either high risk or poor returns or worse both.

We have a risk-profiling tool here that investors should use before getting started: Do not invest in mutual funds before doing this

A minimum of 6 times total monthly expenses and EMI, which is ₹1.5L x 6 = nine lakhs. They should keep ideally this amount in a joint bank account with sweep FD. Both spouses should have debit cards and net banking access to this bank account to get immediate access in terms of need. However, in this case, they have ₹30 lakhs parked in the home loan overdraft accounts. This amount together with high-value credit cards will easily cover standard emergencies. Just for liquidity purposes, the family should ensure they have 2-3 lakhs in their joint bank account as well.

As expenses increase or the emergency fund is used up, the current month’s investments should be diverted until the fund is rebuilt.

Ashwini has a corporate group cover of ₹1.2 crores as term insurance. Additionally, he has personal term insurance of ₹2.6 crores. Ruchika has a personal term plan for a more modest ₹50 lakhs.

As we will see below, this coverage amount is not enough considering their goals. Given the value of their goals today, they need at least ₹6 crores of insurance between them. Two additional life insurance policies of ₹1.5 crores per head, given their age and 20-year coverage, should cost a total of around ₹36,000/year. Since Ruchika has a lot lower coverage, she should buy her new policy immediately.

Here is a guide regarding purchasing term insurance policies: Term life insurance: what, why, how much to get and from where?

There should generally be the following policies that a family should have at a minimum:

Here is a guide regarding purchasing health insurance policies: Health insurance: what, why, how much to get and from where?

The purpose of the personal accident (PA) insurance policy is to provide a replacement for your income if you have an accident and cannot work after that. Unlike term insurance, where claims are paid on death, a PA cover is applicable when one of the following is the result of an accident:

The family should therefore take ₹1-2 crore personal accident insurance each for Ashwini and Ruchika with a total premium of around ₹17,000-35,000.

Fortunately, the family has no high-interest loans like credit cards or personal loans.

The family is currently having two home loans, both of which are overdraft loans. As a family, they are currently paying an EMI of ₹73k/month plus some small amount as prepayment. However, interestingly, they have parked ₹30L combined in the two OD accounts which reduces their interest outgo.

We support this amount parked in the OD accounts since:

We will use this retirement expense estimation tool to calculate today’s expenses and determine how much to spend in retirement.

To know how much you can invest for goals (the investible surplus), you need to classify and figure out approximately the major monthly expense heads under the three main buckets below:

Given that they have a 1-year old baby, their expenses will likely shoot up once the child starts going to school. The current expenses do not consider this point.

Having clear financial goals is the first and vital step before investing. We will use the SMART framework to write down goals:

We will assume that the family can increase its investments by 7% every year via upskilling and improving their human capital: Your human capital, not investment returns, is your biggest wealth creator. Given the importance of human capital, the family should allocate an upskilling line item in the monthly budget. The family can use this for courses, books and other related purposes.

Before going into the details of the goals, if you, dear reader, wish to cover another scenario as a Case Study, click the button below:

Please note that this is a paid service.

The SMART framework is applied like this:

Children’s goals are very precious for a family. However, given the much shorter horizon for purposes like an UG degree, the monthly investment amount can be surprisingly higher.

The family wishes to buy an investment property, for rental income in ten years:

The table shows the SIP amounts split amongst different goals and the portion of the current corpus allocated to each goal. Investors have two approaches to investing:

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

For most investors, this is the most critical question. It is a variation of finding the ‘best’ of everything: the best mutual fund, PMS service, insurance policy, etc. However, if you have followed the process until now, you will realise that coming to this stage is the very end of the goal-based investing strategy.

We will keep this simple with some typical investments that the family can follow and should be sufficient for their purpose.

As time passes, three things happen:

These factors will require a portfolio review exercise every 6-12 months. Then, the process goes through the above steps: goal setting, capturing current asset values, and feeding them into the model to recalculate the numbers. The concept is explained here: Are your investments on track for your goals?

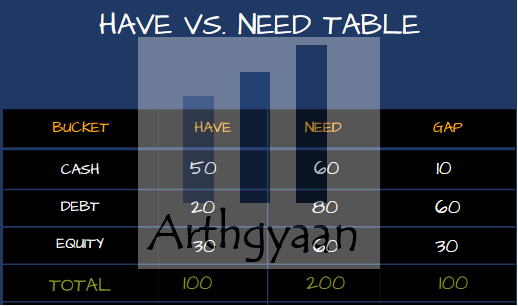

This section shows the current and target asset allocations for equity, debt and cash. The action on the investor will be to immediately implement the rebalancing plan as shown in the image.

The plan requires that a good amount of the equity allocation to be moved to debt and cash today. This allocation choice enables a larger part of the monthly EMI to be invested in equity and therefore leads to a lower SIP amount required per month. If selling a large chunk of equity investments is not possible immediately, the family can invest more in debt mutual funds until the gap narrows.

The family has some vested RSUs this year as well as some LIC policies maturing soon. These lump sum amounts should enter the cash balance of the portfolio first and then reinvested as the asset allocation of that time using the Arthgyaan Have-vs-Needs framework for investing lump sum amounts.

The family has an in-hand income of ₹4.27L/month including ₹52,000/month going into EPF. Along with the ₹73k/month home EMI payments, they spend a total of ₹1.67L/month. These expenses leave them with an investible surplus of ₹2.60L/month which is broadly in line with the requirement as per the model output.

There are some common mistakes that investors make which prevent them from benefiting from compounding. We cover this concept in more detail here: 12 mistakes that interrupt compounding: what to do instead.

In this case, the family is doing well in creating and following a goal-based investment process and they should continue it.

We are a big advocate of both

This position is due to our opinion that real-estate investments, after buying the primary residence, should be attempted only after primary goals (retirement / FIRE, children-related etc.) are fully funded vs. market-linked assets like stocks and bonds. We are also seeing the rapid increase in real-estate in major metro cities. We have made our case on this topic in detail here: Why parents should invest for the downpayment of their child’s first home?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Case study: how a family in their mid-30s with a newborn kid can FIRE and invest in real estate? first appeared on 30 Apr 2023 at https://arthgyaan.com