Sweep FDs: An Easy Way to Keep Your Money Liquid and get High Interest Income

This articles explains the concept of how sweep FDs can help you earn higher interest rates while keeping your money liquid and safe.

This articles explains the concept of how sweep FDs can help you earn higher interest rates while keeping your money liquid and safe.

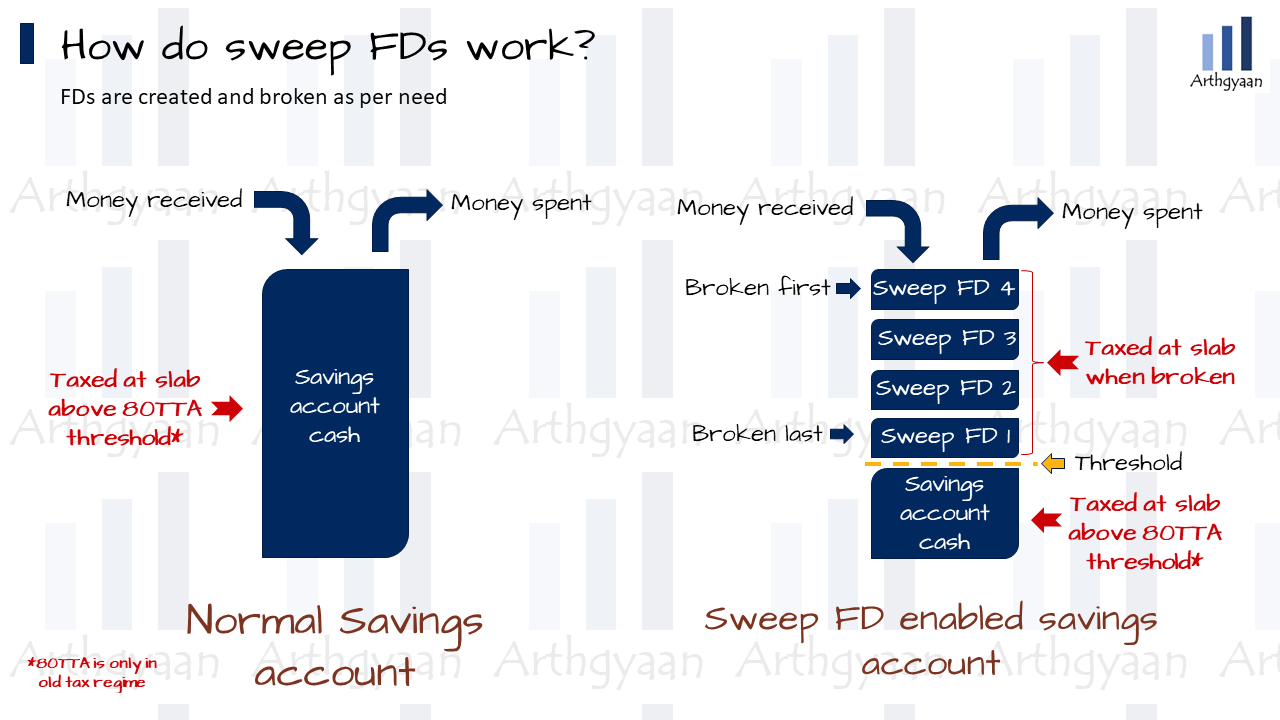

A sweep FD is a feature that many banks offer where money in your savings account above a certain amount automatically become a short-term FD in chunks. Whenever you spend money say via UPI, Netbanking, online payment, debit card payment or ATM withdrawal, the FDs break instantly to let you spend the money. Whenever new cash comes into your account, new FDs are created above the threshold. Old sweep FDs are automatically rolled forward on maturity and the interest is credited to the savings account.

When money is spent, the newest FDs are broken first to allow the oldest ones stay invested. This is the same operating method of a stack of plates in a wedding buffet table: clean plates are kept on the top while diners take the topmost plate first. This is called Last In, First Out (LIFO).

Given that short-term FD rates are higher than savings bank rates, this facility allows you to get higher returns compared to a savings account.

An example to make this feature for my primary bank:

For example, if I have ₹85,000 in the account:

If I spend ₹24,000, the new balance becomes ₹61,000 and the newest two FDs break automatically. If I had spent ₹26,000 instead, the new balance would have been ₹59,000 and the newest 3 FDs would have broken. All of this happen instantly and without me doing anything extra.

Sweep FDs are created for short durations and then rolled forward. The current interest rates will be available on the respective bank websites.

Investors should note that a premature breaking of a sweep FD will lead to a lower interest rate due to the penalty rule on premature FD breakage.

Most major banks like SBI, HDFC, ICICI, Kotak etc offer sweep FDs though the name might differ from bank to bank. You might have to visit the branch or contact your bank Relationship Manager (RM) to activate the facility. It is imperative however not to get convinced to purchase an ULIP or equivalent garbage if you are speaking to your RM.

There are two considerations here:

FD interest is taxable at slab for all investors. If the interest exceeds ₹40,000/year then there is TDS applicable. There is no tax deduction available on FD interest unlike savings account interest.

Under Section 80TTA, a deduction up to ₹10,000 is available per financial year for savings account interest for all investors in the old tax regime. This means that for a bank account that gives 3% interest a year, up to ₹3.33 lakhs (₹10000/3% = ₹3.33 lakhs) is tax free. If you are keeping money in a sweep FD, which is taxable at slab, then that sweep FD interest has to be above 3% post tax to be beneficial.

If the investor is in the new tax regime, then 80TTA is not applicable and both savings account and FD interest is taxable at slab rates. Here as well, it makes sense to active sweep FD only if short-term FD rates are above savings account rates which is expected.

Related: Which is the best tax regime to choose from April?

Given that savings account with sweep FD gives higher interest income and instant liquidity, sweep FDs are best for keeping your emergency fund. There are two benefits here: emergencies like hospitalisations or accidents require instant access to cash which savings accounts offer. However, the higher interest rate scratches the itch of money staying “idle” in a savings account. Many people have the propensity of looking for high returns for their emergency fund, like gold, mutual funds, or P2P loans without accounting for liquidity and credit risk.

Also, given that banks operate online and via ATMs or debit cards 24/7, sweep FDs work anytime and anywhere even on weekends when mutual funds will not allow redemption.

Read more on emergency funds here: Emergency fund: what, why, how much to save and where?.

Sweep FD linked savings account are excellent for saving money for recurring large expenses like insurance premiums, festival expenses or paying quarterly school fees. This is the concept of the sinking fund that we have covered in detail here: Budget 101: How to save for periodic expenses: the sinking fund. Arbitrage mutual funds are also an alternative here.

High-Yield Savings Account (HYSA) is a concept popular in the US where banks offer special online-only accounts for parking short-term cash. The concept does exist in India, though not be the same name, but not all banks offer HYSAs. Instead Sweep FDs can be used instead since you might already have the facility in your existing bank.

Here we will compare only liquid and money market debt mutual funds since the other categories of debt funds (there are 17 categories) differ both in terms of risk and return compared to sweep FDs. In fact, since Sweep FDs are short-term FDs with instant redemption, they are better than all mutual funds which take at least a working day. There are a few liquid mutual funds which offer instant redemption via IMPS, those are capped at ₹50,000 or 90% of the holding value whichever is lower.

Also, taxation of debt mutual funds for units purchased after 1st April 2023, are anyway at slab rates which is the same as that in Sweep FDs.

If you consider returns, the yields of debt mutual funds vary on a daily basis while that of an FD, once it is made, is fixed.

Therefore, from liquidity, returns, and taxation perspective, there is no major benefit of debt mutual funds over Sweep FDs and therefore for short-term requirements, sweep FDs may be chosen over debt mutual funds.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Sweep FDs: An Easy Way to Keep Your Money Liquid and get High Interest Income first appeared on 05 Nov 2023 at https://arthgyaan.com