Should you break your FD and create a new one at new higher rates?

This article lets you calculate if you should break your old FD and create a new one at higher interest rates after adjusting for premature breakage penalty.

This article lets you calculate if you should break your old FD and create a new one at higher interest rates after adjusting for premature breakage penalty.

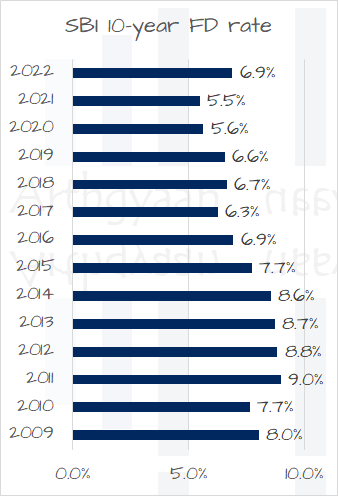

RBI, after hiking the Repo rate from 4.00% to 6.50% in quick succession, has finally started cutting the repo rate:

The hike from 2022 was a part of inflation-taming measures put in place by global central banks.

As inflation had been rising as the economy recovered, the repo rate rise was inevitable. As inflation is now cooling and Budget 2025 has seen tax rates to reduce, the repo rate has been cut for the first time since May 2020.

Since repo rates are going up, Fixed Deposit (FD) rates are following the same trend currently.

Given that rates are now up, and some banks are offering even higher rates above 7-7.5%, does it make sense to break the FD and make a new one? This question should have an obvious answer except for the hitch of FD premature breakage penalties. You see the bank really does not want you to break FDs and move to the higher rate since they will now have to pay more interest. Hence they levy a penalty when you break an FD.

We will, in the sections below, calculate the penalty to see if it makes sense to break the FD or leave it alone.

The penalty has two parts:

FD Maturity Value = Principal * (1+LowerRate-1%) ^ (Time passed) - Principal * 1% (with principal penalty)

or

FD Maturity Value = Principal * (1+LowerRate-1%) ^ (Time passed) [without principal penalty]

This maturity amount will be subject to tax at slab rates.

| FD Duration | Rate when you created old FD (A) | Rate applied at 0.5% penalty (A-0.5%) | Rate applied at 1% penalty (A-1%) | Rate when you want new FD (B) |

|---|---|---|---|---|

| 1 year | 4.0% | 3.5% | 3.0% | 5.5% |

| 2 years | 4.5% | 4.0% | 3.5% | 6.0% |

| 5 years | 5.0% | 4.5% | 4.0% | 6.5% |

| 10 years | 5.5% | 5.0% | 4.5% | 7.0% |

Here LowerRate = the prevailing rate of FD for the duration that has passed at the time of creating the FD. This part is important since the bank will not give you interest at the higher rate since you have held the FD for a shorter period.

For example, the penalty for a ₹3 lakh FD, created at 5.5%, to be broken after 2 years are:

For example, the penalty for a ₹6 lakh FD, created at 5.5%, to be broken after 2 years are:

We have put together an easy-to-use calculator to calculate whether you should break your FD given that the penalty exists. We use the decision-making test as the value of the new FD on the date of maturity of the old FD. You should break the old FD only if the new FD has a higher value on the date the old FD would have matured.

The calculator assumes that the FD is of the cumulative type. If interest gets paid out regularly, the higher interest paid out will be deducted from the principal and the result will be the same.

Important: You should enter data only in the yellow cells.

Box 7: This is an important input. You need to enter the prevailing FD rate, at the time you created the old FD, for the period that you have held the FD. You can get the period from the “Time since old FD was opened” field above. The rate will be available from the bank’s website or you have to assume it to be 1-2% lower than the old FD rate.

Optional: If your bank does have the penalty on the principal, then set the cells in the “Penalty Calculation inputs” for the principal to the right numbers. If your bank does not have the interest penalty or at different rates in your case, then you can change the interest penalty rates here.

Box 8: This is the rate of the new FD. This FD is expected to mature at the same time or later compared to the old FD.

Once you enter the details, you will see the calculator show you the “Benefit of Breaking”. If the number is positive, then you should break it otherwise you should not. Also, you need to decide if the benefits post breaking and reinvesting are worth the effort or not.

Since the calculator uses Google Sheets, you need to be logged into your Google Account on a browser before clicking the link.

Link to the calculator: here. You will get the calculator, which is free for use, in the “fd-break-or-keep” sheet.

Banks do not want you to break FDs and move to the higher rate since they will now have to pay more interest. Hence they levy a penalty on both interest rate and principal when you break an FD.

Banks levy two penalties when you break the FD: 1. On principal of 0.5% (less than ₹5L in FD) or 1% (more than ₹5L in FD). Most banks have now removed this penalty. 2. Interest Rate on the period you have held the FD is reduced by 0.5% or 1% (based on the same ₹5L principal rule) and the rate used to calculate the interest is the rate for the lower period for which you have held the FD, at the time of FD creation, minus the penalty of 0.5% or 1%.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you break your FD and create a new one at new higher rates? first appeared on 20 Nov 2022 at https://arthgyaan.com