How to invest in mutual funds which are taxed at slab rates from 1st April 2023

This article describes a tweak that investors can implement to plan taxes more efficiently, given that non-equity funds will be taxed at slab rates after 1st April 2023.

This article describes a tweak that investors can implement to plan taxes more efficiently, given that non-equity funds will be taxed at slab rates after 1st April 2023.

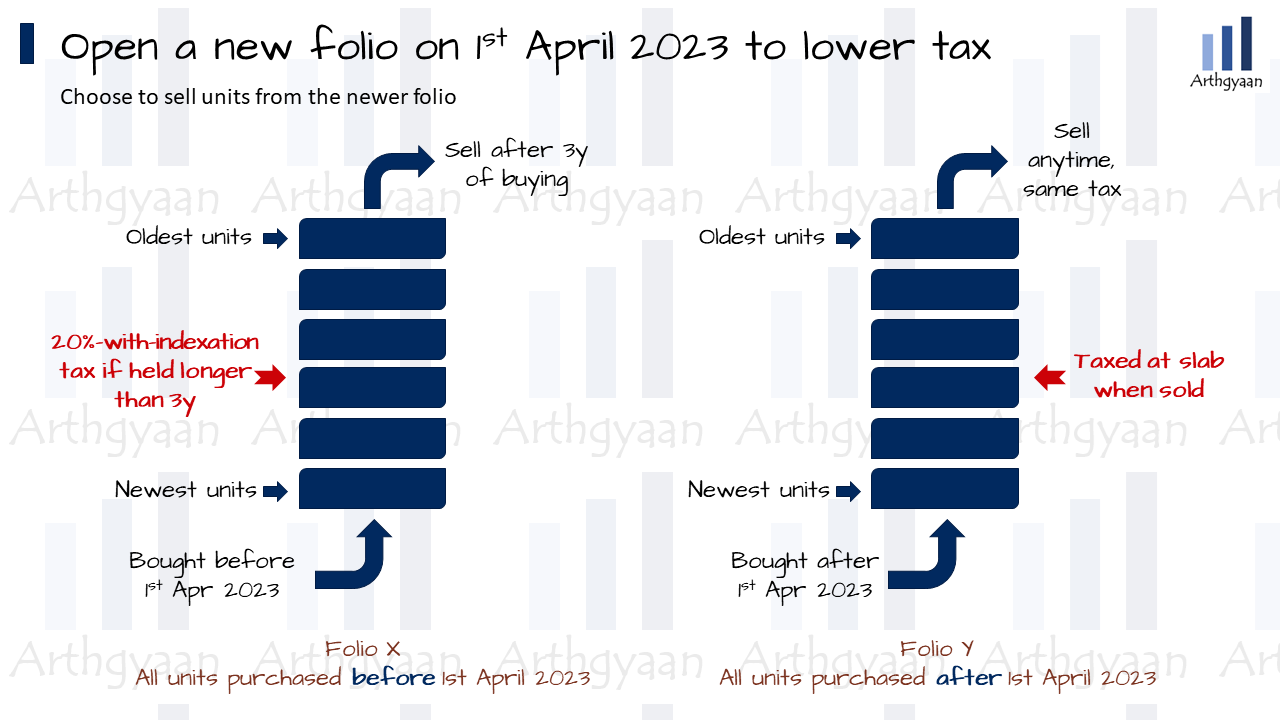

The Finance Ministry, in a surprising move, made all profits taxable at slab rate from most mutual funds that previously had long-term capital gains taxed at 20% post indexation. This rule applies only to units purchased after 1st April 2023. The 20%-post-indexation rule is still applicable to units purchased before 1st April 2023.

The following mutual fund categories are now taxable at the investor’s marginal tax rate or slab rate for all holding periods for units purchased after 1st April 2023. As a result, all mutual funds in the following categories have the same tax calculation irrespective of how long they are held.

Therefore, the rule applies to any mutual fund with a lower than 35% holding in Indian stocks. For any unit in these funds purchased before 1st April 2023, the taxation will continue to be:

As always, a surcharge is applicable on any tax paid as per current taxation rules.

Please read through this article to understand more details on the taxation change: What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?

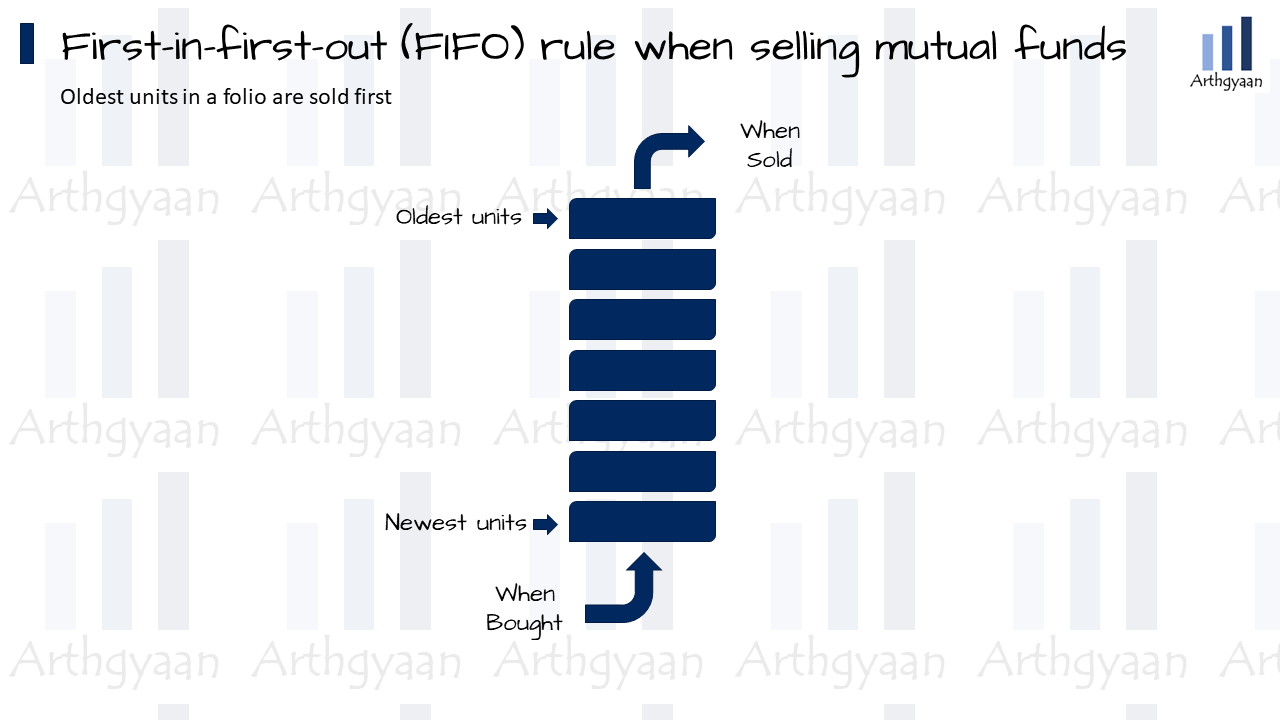

First-in-first-out (FIFO) is the rule that needs to be followed when you are selling shares and mutual funds. The oldest shares/units are the ones that are used for calculating the purchase price.

| Date | Folio | Transaction | Units | Price |

|---|---|---|---|---|

| D1 | A | Buy | 100 | 50 |

| D2 | A | Buy | 100 | 60 |

| D3 | A | Sell | 50 | 70 |

| D4 | A | Sell | 70 | 80 |

In the example above, there are two buys and two sells. The units sold on D3 were purchased on D1 at price 50. The purchase value is ₹50 * 50 = ₹2500. The sold value is ₹70 * 50 = ₹3500.

For the 70 units sold on D4, 50 were purchased on D1 at ₹50/unit and the rest 20 were purchased on D2 at ₹60/unit. The profit on the first 50 units is ₹(80-50) * 50 = ₹1500 and that on the last 20 units is ₹(80-60) * 20 = ₹400.

Mutual funds held in different folios have different tax treatments. The first-in-first-out rule applies to units at a folio level. Suppose there are two folios A and B, where the units in B are bought after those in A and later sold, then only those in B will be considered for tax calculation.

| Date | Folio | Transaction | Units |

|---|---|---|---|

| 1 | A | Buy | 100 |

| 2 | B | Buy | 100 |

| 3 | B | Sell | 50 |

In the example above, for tax computation, only those units from Folio B are considered.

New units in the impacted funds should be purchased in a new folio from 1st April onwards. Older units, i.e. those purchased before 1st April 2023, should be left as is. The basic premise here is that the old 20%-post-indexation tax benefit is still there in the older units, which need not be sold, due to the FIFO rule, when there is a need for selling these funds.

For example, you have 1000 units in a debt fund purchased more than three years ago kept in Folio X. These units are eligible for LTCG as per the old rule.

You are planning to invest 100 units more today. If you invest in the existing folio X and sell 50 units a year from now, the oldest 50 units in X with lower tax will be sold off. Depending on the prices at which these units were purchased, one of the two folios will have a lower tax payable, and you can choose that. You do not have that choice if you have only one folio.

Your older folios can be used without any hassle. The only downside is that a few years later, you need to carefully calculate the cost price, with or without indexation, based on the purchase date being before or after 1st April 2023.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to invest in mutual funds which are taxed at slab rates from 1st April 2023 first appeared on 29 Mar 2023 at https://arthgyaan.com