A primer on hybrid mutual funds: what are they and when to invest in them

This article talks about the hybrid mutual fund category in India and shows you which ones to invest in as per your goals.

This article talks about the hybrid mutual fund category in India and shows you which ones to invest in as per your goals.

This article is a part of our detailed article series on the concept of hybrid mutual funds in India. Ensure you have read the other parts here:

This article highlights the main differences between arbitrage funds and fixed deposits in India to help investors make the best choice for their financial needs.

This article shows you how different categories of hybrid funds have performed for regular SIP investments for short durations.

This article discusses mutual funds belonging to the aggressive hybrid category for investors to understand if they should invest in such funds.

Hybrid funds offer a mix of multiple asset classes (equity/debt/gold/arbitrage/international stocks) in a single fund. The biggest selling points of a hybrid fund are:

This being an introductory article will skip going into examining the three points above but will do so in a future article.

Hybrid mutual funds are taxed based on their exposure to equity. Any fund with exposure of 65% or more to Indian stocks or arbitrage will be taxed as an equity fund. All other funds will be taxed as debt funds. Since the percentage allocated to equity may vary over the holding period, the investor has to calculate the allocation to equity over the holding period and calculate the tax accordingly.

As per SEBI, there are the following seven types of hybrid funds:

SEBI definition: 10% to 25% investment in equity & equity related instruments; and 75% to 90% in Debt instruments

SEBI definition: 40% to 60% investment in equity & equity related instruments; and 40% to 60% in Debt instruments

SEBI definition: 65% to 80% investment in equity & equity related instruments; and 20% to 35% in Debt instruments

SEBI definition: Investment in equity/ debt that is managed dynamically (0% to 100% in equity & equity related instruments; and 0% to 100% in Debt instruments)

SEBI definition: Investment in at least 3 asset classes with a minimum allocation of at least 10% in each asset class.

SEBI definition: Scheme following arbitrage strategy, with minimum 65% investment in equity & equity related instruments.

SEBI definition: Equity and equity related instruments (min.65%); debt instruments (min.10%) and derivatives (min. for hedging to be specified in the SID).

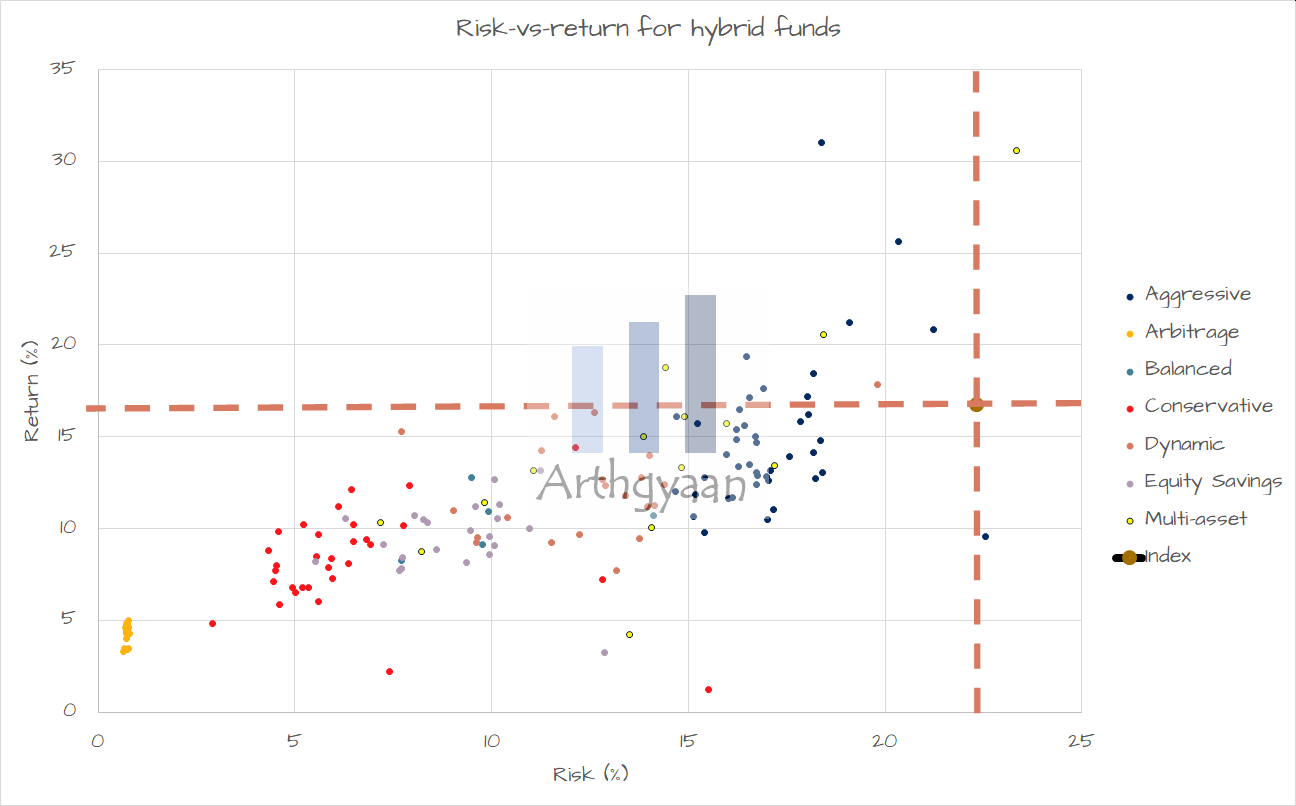

It is generally believed that hybrid funds have returned between pure debt and pure equity funds. It becomes interesting if you consider risk along with returns together. Please note that this chart is at a point of time and does not show rolling performance. It shows last three-years’ risk and return.

We can see the risk vs return, using data from Valueresearchonline, has some distinct clusters e.g. for arbitrage and aggressive hybrid. This is expected since both these categories are rigidly defined.

However, the categories of Conservative Hybrid and Equity Savings display considerable dispersion. We will examine them in more detail in a future article. The table below shows a correlation between risk and return for each category at a high level that shows the same conclusion.

| Category | Correlation |

|---|---|

| Aggressive | 36.3% |

| Arbitrage | 38.9% |

| Balanced | 31.6% |

| Conservative | -4.5% |

| Dynamic | 32.8% |

| Equity Savings | -3.7% |

We are also showing the current position of the Nifty 50 index funds at the intersection of two lines. Our aim, for long-term goals, should be to be invested in funds that lie above and left of the intersection i.e. in the top left quadrant. Funds here have demonstrated lower risk and higher returns than the Nifty 50 index fund. This aim is difficult to achieve since the funds will drift relative to the index but that will be something we will revisit in a future article.

Currently, hybrid fund returns are as per this table:

| Category | Any 1Y SIP | Any 2Y SIP | Any 3Y SIP | Any 5Y SIP | Any 7Y SIP | Any 10Y SIP |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 12.5% | 10.68% | 14.58% | 14.58% | 15.23% | 14.2% |

| Hybrid: Conservative | 8.96% | 8.31% | 9.24% | 8.64% | 8.97% | 8.64% |

| Hybrid: Equity Savings | 9.93% | 9.09% | 10.22% | 9.95% | 10.01% | 9.5% |

| Hybrid: Balanced | 9.74% | 11.06% | 12.02% | 11.47% | 11.42% | 11.53% |

| Hybrid: Arbitrage | 6.47% | 6.73% | 6.53% | 6.28% | 6.19% | 6.29% |

| Category | Any 1Y SIP | Any 2Y 目↑ SIP | Any 3Y 目↑ SIP | Any 5Y 目↑ SIP | Any 7Y 目↑ SIP | Any 10Y 目↑ SIP |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 12.5% | 10.26% | 14.09% | 14.61% | 15.81% | 14.72% |

| Hybrid: Conservative | 8.96% | 7.96% | 9.23% | 9.04% | 9.25% | 8.85% |

| Hybrid: Equity Savings | 9.93% | 8.96% | 10.43% | 10.04% | 10.23% | 9.61% |

| Hybrid: Balanced | 9.74% | 10.81% | 12.77% | 12.85% | 13.34% | 12.7% |

| Hybrid: Arbitrage | 6.47% | 7.08% | 7.33% | 6.97% | 6.59% | 6.48% |

| Category | Any 1Y | Any 2Y | Any 3Y | Any 5Y | Any 7Y | Any 10Y |

|---|---|---|---|---|---|---|

| Hybrid: Aggressive | 10.6% | 14.68% | 14.48% | 14.51% | 14.14% | 13.73% |

| Hybrid: Conservative | 8.34% | 9.82% | 9.5% | 8.57% | 8.74% | 8.63% |

| Hybrid: Equity Savings | 8.89% | 10.68% | 10.3% | 9.67% | 9.53% | 9.14% |

| Hybrid: Balanced | 9.96% | 14.08% | 11.96% | 10.92% | 11.6% | 12.6% |

| Hybrid: Arbitrage | 6.52% | 7.01% | 6.36% | 5.99% | 6.08% | 6.41% |

Use case: These funds have a small allocation to equity and can be suitable for goals due around five years. Once goals come closer, these funds should be exited in favour of safer options.

Use case: These funds maintain a similar proportion of investments in equity and debt with minor variations. Rebalancing is done when the equity or debt levels move beyond pre-determined limits. There are limited options available in this category and even those should be avoided by investors.

Use case: These funds maintain a high allocation to stocks and should only be considered for long term goals. These funds can form the core of a portfolio for long-term goals.

Use case: These funds change their asset allocation between equity and debt based on market movement and valuation as per the fund manager’s discretion. For example, if the equity market has gone up, then some of the profits will be reinvested into the debt portfolio and vice versa. Over time, such rebalancing is expected to enhance returns and keep risks low. Active funds in this category might not be suitable for most investors since the asset allocation may not match goal-specific risk profile.

Use case: These funds can invest in equity, debt and gold (at least 10% in each) and therefore offer diversification amongst these asset classes. The funds provide an easy option to create a diversified portfolio.

Use case: These funds can be used for goals due within three years. They will give returns similar to a savings bank account and are taxed the same as equity mutual funds. However, there might be some short-term fluctuations since most of these funds hold some bonds.

Use case: These funds can be a good option for short term goals with minimum equity exposure. In contrast with conservative hybrid funds, they have a large arbitrage component as well.

10% to 25% investment in equity & equity related instruments; and 75% to 90% in Debt instruments

40% to 60% investment in equity & equity related instruments; and 40% to 60% in Debt instruments

65% to 80% investment in equity & equity related instruments; and 20% to 35% in Debt instruments

Investment in equity/ debt that is managed dynamically (0% to 100% in equity & equity related instruments; and 0% to 100% in Debt instruments)

Investment in at least 3 asset classes with a minimum allocation of at least 10% in each asset class.

Scheme following arbitrage strategy, with minimum 65% investment in equity & equity related instruments.

Equity and equity related instruments (min.65%); debt instruments (min.10%) and derivatives (min. for hedging to be specified in the SID).

Hybrid mutual funds are taxed based on their exposure to equity. Any fund with exposure of 65% or more to Indian stocks or arbitrage will be taxed as an equity fund. All other funds will be taxed as debt funds. Since the percentage allocated to equity may vary over the holding period, the investor has to calculate the allocation to equity over the holding period and calculate the tax accordingly.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled A primer on hybrid mutual funds: what are they and when to invest in them first appeared on 19 Oct 2022 at https://arthgyaan.com