Should you invest in hybrid funds via SIP for short-term goals?

This article shows you how different categories of hybrid funds have performed for regular SIP investments for short durations.

This article shows you how different categories of hybrid funds have performed for regular SIP investments for short durations.

This article is a part of our detailed article series on the concept of hybrid mutual funds in India. Ensure you have read the other parts here:

This article highlights the main differences between arbitrage funds and fixed deposits in India to help investors make the best choice for their financial needs.

This article discusses mutual funds belonging to the aggressive hybrid category for investors to understand if they should invest in such funds.

This article talks about the hybrid mutual fund category in India and shows you which ones to invest in as per your goals.

Hybrid funds offer a mix of multiple asset classes (equity/debt/gold/arbitrage/international stocks) in a single fund. The biggest selling points of a hybrid fund are:

We have discussed about the different types of hybrid funds in detail here: A primer on hybrid mutual funds: what are they and when to invest in them

Given that hybrid funds invest in both equity and debt, and the fund manager rebalances them without tax or any action from the investor, they can be considered for a one-stop portfolio for goals. Given that we do not have a long period of data in the Indian context with many different funds existing. We therefore will consider short-term investment horizons via SIP and see how much wealth has been created historically.

We will present a rolling-returns analysis for both fixed SIP (the same amount being invested throughout) and a step-up SIP (where the amount invested/month is increased every year). We have covered the importance of stepping up your SIP here: What is a step-up SIP and how much more wealth does it create vs. a normal SIP?.

We show an analysis, using AMFI end-of-day NAV data

| Average | 1Y SIP | 2Y SIP | 3Y SIP | 5Y SIP | 3Y SIP (10% step-up) | 5Y SIP (10% step-up) |

|---|---|---|---|---|---|---|

| Aggressive Hybrid | 16.3% | 14.0% | 12.9% | 12.0% | 11.9% | 10.5% |

| Conservative Hybrid | 9.8% | 9.2% | 8.8% | 8.1% | 8.1% | 7.0% |

| Equity Savings | 9.7% | 9.1% | 8.8% | 8.4% | 8.1% | 7.3% |

| Dynamic Asset Allocation | 9.8% | 9.3% | 9.2% | 9.0% | 8.5% | 7.8% |

| Balanced Advantage | 13.1% | 11.7% | 10.9% | 10.5% | 10.1% | 9.1% |

| Arbitrage | 6.6% | 6.4% | 6.2% | 6.0% | 5.7% | 5.2% |

| Worst | 1Y SIP | 2Y SIP | 3Y SIP | 5Y SIP | 3Y SIP (10% step-up) | 5Y SIP (10% step-up) |

|---|---|---|---|---|---|---|

| Aggressive Hybrid | -16.3% | -2.9% | -0.6% | 0.0% | -0.6% | 0.0% |

| Conservative Hybrid | -7.3% | 0.0% | 1.5% | 3.9% | 1.2% | 3.2% |

| Equity Savings | -14.5% | -4.5% | -1.6% | 1.8% | -1.7% | 1.2% |

| Dynamic Asset Allocation | -19.1% | -3.7% | -1.3% | 3.1% | -1.4% | 2.3% |

| Balanced Advantage | -21.7% | -2.2% | -0.6% | 0.9% | -0.7% | 0.4% |

| Arbitrage | 3.4% | 3.9% | 4.1% | 4.8% | 3.7% | 4.1% |

We have deliberately skipped showing maximum returns since that exhibit will present a misleading picture to investors due to anchoring bias.

| Risk (Std.Dev) | 1Y SIP | 2Y SIP | 3Y SIP | 5Y SIP | 3Y SIP (10% step-up) | 5Y SIP (10% step-up) |

|---|---|---|---|---|---|---|

| Aggressive Hybrid | 16.7% | 9.9% | 6.6% | 5.8% | 6.2% | 5.2% |

| Conservative Hybrid | 6.3% | 4.4% | 3.5% | 3.0% | 3.2% | 2.6% |

| Equity Savings | 7.2% | 4.9% | 3.8% | 3.3% | 3.6% | 2.9% |

| Dynamic Asset Allocation | 8.7% | 5.4% | 4.1% | 3.8% | 3.9% | 3.4% |

| Balanced Advantage | 11.9% | 7.1% | 5.0% | 4.4% | 4.6% | 3.9% |

| Arbitrage | 2.3% | 2.2% | 2.1% | 2.1% | 1.9% | 1.8% |

| Return/Risk | 1Y SIP | 2Y SIP | 3Y SIP | 5Y SIP | 3Y SIP (10% step-up) | 5Y SIP (10% step-up) |

|---|---|---|---|---|---|---|

| Aggressive Hybrid | 0.98 | 1.41 | 1.96 | 2.07 | 1.93 | 2.03 |

| Conservative Hybrid | 1.55 | 2.10 | 2.52 | 2.73 | 2.50 | 2.71 |

| Equity Savings | 1.34 | 1.88 | 2.29 | 2.52 | 2.25 | 2.48 |

| Dynamic Asset Allocation | 1.13 | 1.73 | 2.25 | 2.38 | 2.21 | 2.34 |

| Balanced Advantage | 1.10 | 1.65 | 2.21 | 2.37 | 2.18 | 2.32 |

| Arbitrage | 2.82 | 2.91 | 2.97 | 2.82 | 2.97 | 2.82 |

Using a recurring deposit or a “safer” fund type like equity arbitrage is a common choice given to investors looking at short-term goals. We have therefore shown how these funds have performed vs. a post-tax 5% return from a recurring deposit. The table shows the percentage of cases where the hybrid fund has beaten the recurring deposit.

| More than FD | 1Y SIP | 2Y SIP | 3Y SIP | 5Y SIP | 3Y SIP (10% step-up) | 5Y SIP (10% step-up) |

|---|---|---|---|---|---|---|

| Aggressive Hybrid | 69% | 78% | 82% | 81% | 81% | 80% |

| Conservative Hybrid | 73% | 81% | 86% | 84% | 84% | 83% |

| Equity Savings | 70% | 79% | 82% | 82% | 80% | 78% |

| Dynamic Asset Allocation | 67% | 76% | 82% | 82% | 80% | 78% |

| Balanced Advantage | 70% | 80% | 82% | 83% | 81% | 83% |

| Arbitrage | 73% | 71% | 73% | 77% | 65% | 47% |

To understand how to use this data about hybrid funds:

We have captured average and worst returns over a 10-year period. However, the last 10-years has seen a massive bull-run and therefore all return figures are high in general. The only falls are due to the COVID-19 market crash in March 2020.

Generally, drawing any conclusion from such short-term data is not wise. Investors should be careful putting the conclusions in practice.

Once you understand the caveats described above, you will realise that with a bit of prudent risk management, you can use hybrid funds for certain short-term goals:

Ultimately, short-term goals will have to be managed together along with long-term goals like retirement and children’s college education like this.

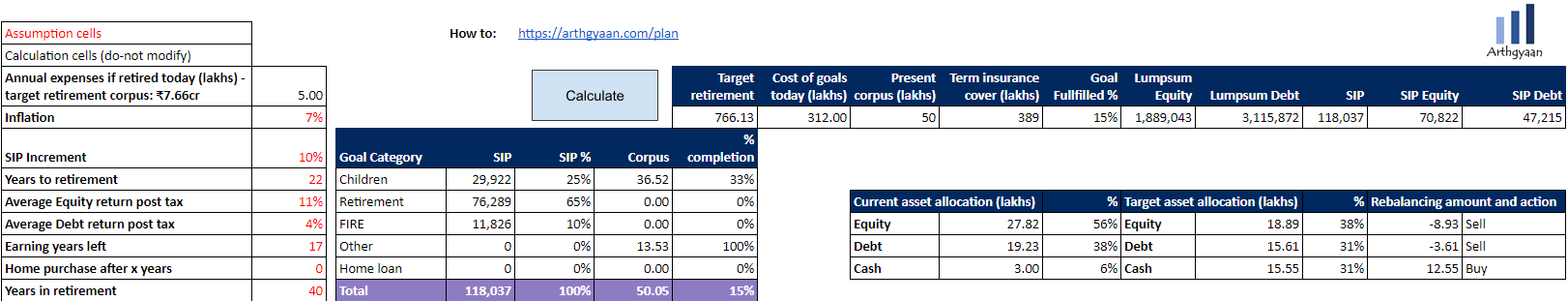

Once you combine all of them together, a tool like the Arthgyaan Goal-based investing calculator, then you can see the asset classes required at a portfolio level.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you invest in hybrid funds via SIP for short-term goals? first appeared on 20 Mar 2024 at https://arthgyaan.com