How to save tax using Section 54F for an under construction house?

This article shows you the right way to apply Section 54F to save tax when you sell shares and mutual funds to buy an under-construction house.

This article shows you the right way to apply Section 54F to save tax when you sell shares and mutual funds to buy an under-construction house.

This article is a part of our detailed article series on the concept of tax savings using Section 54F. Ensure you have read the other parts here:

This article explains the timelines, rules, and steps to be taken that protect taxpayers claiming Section 54F exemption when builders delay projects.

Section 54F of the Income Tax Act lets you claim tax exemption if you reinvest in property - potentially saving lakhs. This guide helps you calculate how the exemption works, with eligibility criteria, and key timelines.

This article explores how paying home loan EMI via regular withdrawals from mutual funds can be beneficial.

This article compiles an exhaustive list of FAQs on the concept of tax saving while purchasing a house under Section 54F.

Section 54F of the Income Tax Act offers a legal way to avoid capital gains tax-if you meet certain conditions. This guide explains how to qualify, maximize your tax exemption, and avoid common mistakes.

How Can You Save Tax Under Section 54F to purchase an under-construction house or flat?

Section 54F of the income tax act allows individuals and HUFs to save capital gains tax if they sell certain long-term capital assets, like mutual funds, shares, gold, etc., and use the proceeds to buy or construct a residential house in India. If you sell these funds a year before or a year after the allotment date of the new under-construction house then you can save lakhs in capital gains tax.

Introduced in 1983, Section 54F of the Income Tax act, as sourced from the Income Tax website, allows us to save capital gains tax if we sell mutual funds to buy a house.

The basic premise of this tax exemption is very simple:

There is an upper limit of Rs. 10 crores on the exemption amount under Section 54F as per Budget 2023.

We have extensive FAQs on Section 54F here in case you wish to know more: Frequently asked questions on Section 54F: the complete guide

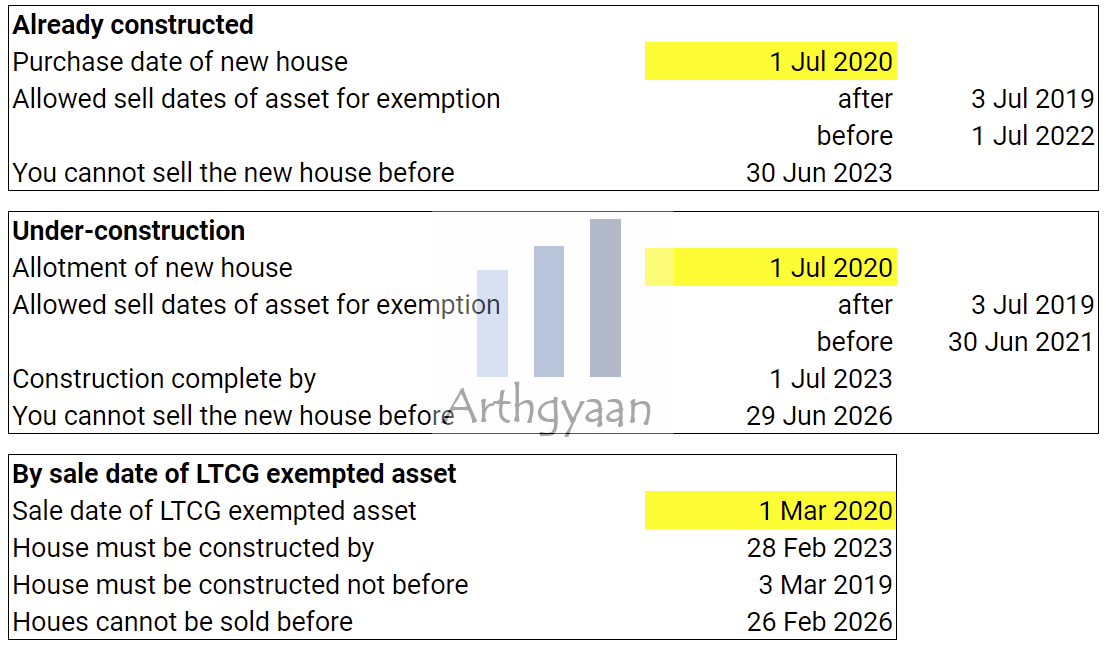

Every calculation is based on the agreement date. Depending on the state, this is also called allotment date or builder-buyer-agreement date

Violation of any of the rules above will invalidate Section 54F exemption.

For more nuances, please refer to the FAQ article linked above.

How to use the Section 54F Exemption Calculator?

The calculator requires you to enter three numbers, one choice of house type, the number of houses you own today and one date:

Now you need to enter one of these dates:

Now click the Calculate Exemption button to get the result.

1.00 Cr

50.00 Lakh

30.00 Lakh

If you want to use a Google Sheets / Excel version, please see below:

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the Sec54F tab of the sheet once you open it. You can export this Sheet to Excel using the File > Download Menu option.

We will now cover some nuances for under-construction properties:

Rule 2: the house has to be constructed within 3 years of the agreement date which is measured by the registration date

Builder delays beyond 3 years from the agreement date will violate rule 2. This rule is not strictly enforced as it is somewhat expected that the construction will be delayed. In such cases, the Income Tax Appellate Tribunal has ruled in favour of the tax-payer.

Capital Gains Account Scheme (CGAS) must be opened if you sell shares/mutual funds before 31st July (the income tax filing last date) and can spend it only after 31st July. In such a case, you must deposit the amount in the CGAS and later withdraw as per need. The CGAS account gives a small amount of interest.

At this point, the investor must weigh the benefit of tax saving using Section 54F by breaking their investments early vs. keeping the money invested longer.

Rule 1: your share/MF sale that gets 54F advantage has to happen within one year before and one year after the agreement date

Here it is important to time the payments required to be made with the asset sale correctly. Once you sell the assets, you will have to deposit the amount in the CGAS in case you need it in the future. You can also prepay the home loan.

If you have multiple payments more than a year after the agreement date, you cannot get Section 54F exemption unless you sold the assets within 1-year. We will give an example:

A house includes payments to the builder as well as reasonable costs for interiors, appliances etc. As long as you have proper GST bill for interiors and other costs, you should get Section 54F benefit.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to save tax using Section 54F for an under construction house? first appeared on 24 Mar 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.