Should you pay home loan EMI by SWP from mutual funds?

This article explores how paying home loan EMI via regular withdrawals from mutual funds can be beneficial.

This article explores how paying home loan EMI via regular withdrawals from mutual funds can be beneficial.

This article is a part of our detailed article series on the concept of tax savings using Section 54F. Ensure you have read the other parts here:

This article explains the timelines, rules, and steps to be taken that protect taxpayers claiming Section 54F exemption when builders delay projects.

Section 54F of the Income Tax Act lets you claim tax exemption if you reinvest in property - potentially saving lakhs. This guide helps you calculate how the exemption works, with eligibility criteria, and key timelines.

This article shows you the right way to apply Section 54F to save tax when you sell shares and mutual funds to buy an under-construction house.

This article compiles an exhaustive list of FAQs on the concept of tax saving while purchasing a house under Section 54F.

Section 54F of the Income Tax Act offers a legal way to avoid capital gains tax-if you meet certain conditions. This guide explains how to qualify, maximize your tax exemption, and avoid common mistakes.

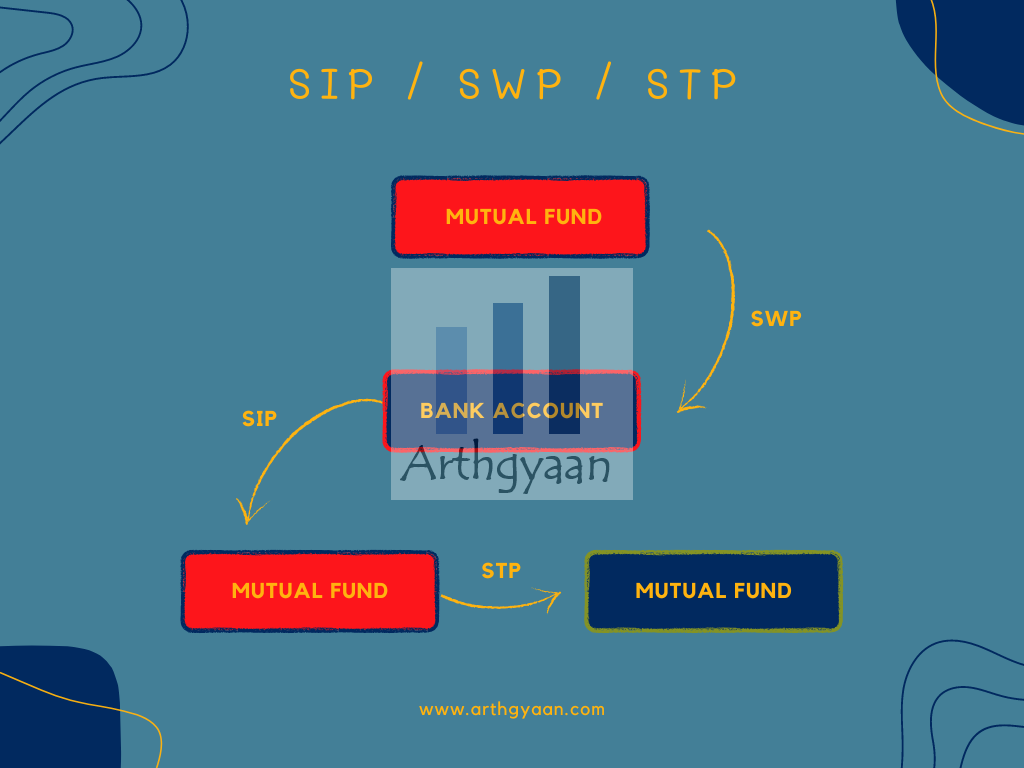

All of these are standing instructions that get executed as per a schedule you specify:

A Systematic Withdrawal Plan (SWP) is an instruction to a mutual fund to sell a fixed amount every month and send that amount to your bank account.

An SWP can be an option for:

Since the SWP is essentially a regular sell transaction in mutual funds, each sell transaction will require you to pay capital gains tax: How to calculate and save tax on mutual funds?

In this article, we will explore the situation where you can use an SWP from mutual funds to pay your home loan EMI but still save capital gains tax.

Of course, if you do not have any source of income, then selling your investments, whether by SWP or not, is the only way to pay off a home loan. In this article, we will explore the case of:

Section 54F of the Income Tax Act makes the last bit, i.e., not paying any tax on the SWP, possible under certain conditions.

Introduced in 1983, Section 54F of the Income Tax act, as sourced from the Income Tax website, allows us to save capital gains tax if we sell mutual funds to buy a house.

The basic premise of this tax exemption is very simple:

There is an upper limit of Rs. 10 crores on the exemption amount under Section 54F as per Budget 2023.

Complete details on the concept of Section 54F are here: Sec 54F: a hack that can save lakhs in taxes when you buy a house

The steps to follow are:

When setting up the SWP, you should be 100% certain that the units are older than the LTCG limit or will be on the SWP execution date.

You can get Section 54F exemption for either your first or second house. If you have, or had in the past, multiple houses, then 54F exemption is not possible.

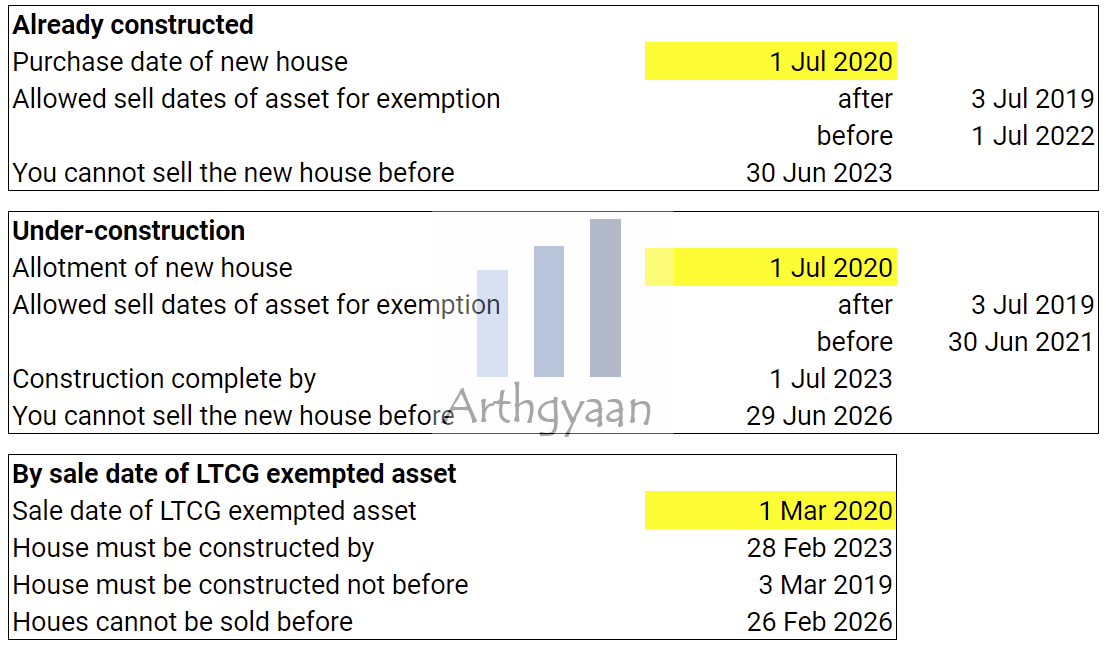

Using the SWP method to pay off a home loan makes sense only as long as you have 54F tax benefits. Otherwise, you are unnecessarily paying capital gains tax. Section 54F benefits are available only within a particular date range depending on when the house was purchased.

We have an easy-to-use calculator for Section 54F exemption calculation.

How to use the Section 54F Exemption Calculator?

The calculator requires you to enter three numbers, one choice of house type, the number of houses you own today and one date:

Now you need to enter one of these dates:

Now click the Calculate Exemption button to get the result.

1.00 Cr

50.00 Lakh

30.00 Lakh

If you want to use a Google Sheets / Excel version, please see below:

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the Sec54F tab of the sheet once you open it. You can export this Sheet to Excel using the File > Download Menu option.

For under-construction properties, you can get 54F benefits within one year before and one year after the agreement or allotment or Builder Buyer Agreement (BBA) date.

Your SWP must end within a year of this date, or else you will not get any 54F benefit.

For a resale or ready-to-move house, you will get a 54F benefit within one year before and two years after the registration date.

Your SWP must end within two years of the registration date, or else you will not get any 54F benefit.

In either case, you should replenish your mutual funds by investing the EMI amount back into the portfolio.

To understand which funds to sell for your home loan repayment:

We are assuming that you are doing SWP only for Section 54F benefits and investing the EMI back.

This point helps you to save taxes in the future. Imagine that:

It is possible that over time you have accumulated particular mutual funds that you do not want today. This concept of Section 54F benefit will allow you to get rid of them without worrying about tax. The same can be true if you are planning a tax-free switch from regular to direct funds.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you pay home loan EMI by SWP from mutual funds? first appeared on 17 Jul 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.