How to switch from regular to direct funds?

Investors who have investments in Regular mutual funds should switch to Direct. This post explains how.

Investors who have investments in Regular mutual funds should switch to Direct. This post explains how.

We start this article with two statistics:

Mutual fund distributors received around ₹5,500 crores of commissions from AMCs in FY 2020-21 as per AMFI data (source). This means that investors lost that wealth since it could have been a part of their portfolios.

For equity mutual funds, the average difference in returns between Regular and Direct plans in the last year is 1%. On average, the TER of a Direct fund is less than half that of Regular funds as per the latest MF scheme documents and reported by Valueresearchonline.

Investors who wish to learn more about Direct vs Regular mutual funds should read this article first: Do not make this mistake when investing in mutual funds.

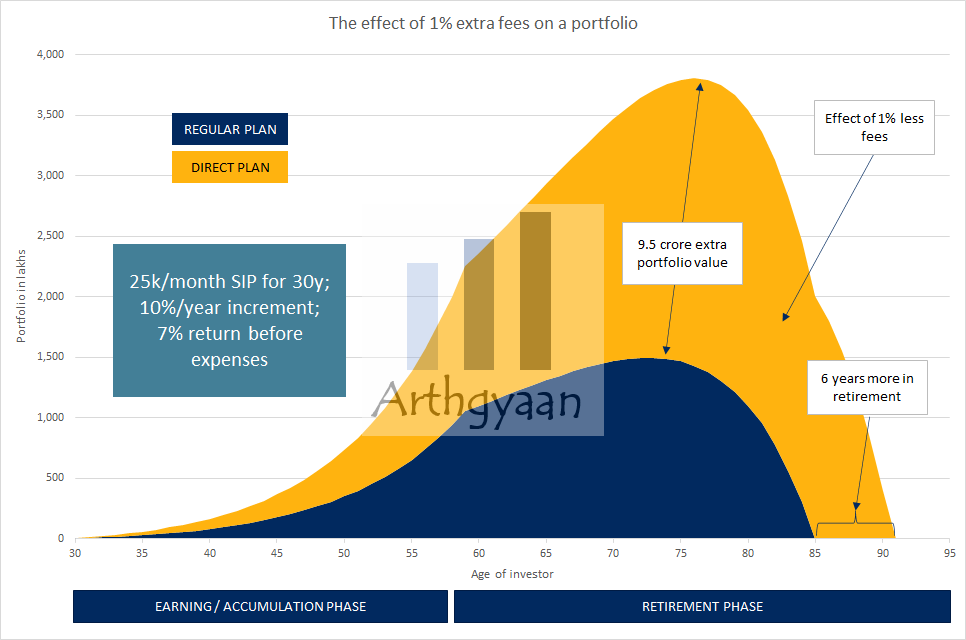

The bottom line is: Regular plans have higher expenses or TER than Direct plans. This TER difference is the distributor commission that is currently 1% on average as per the statistics above. Therefore, the TER difference can become 25-30% over the investor’s working life. If you add the 30-40 years of lifespan post retirement, the difference becomes worse.

Investors should understand why they are losing money by investing in Regular funds and switch to Direct plans as soon as possible. A 25% difference in lifetime corpus value is between 7.5cr and 10cr as retirement corpus. So if you can manage retirement with 7.5cr, your distributor just needs three clients like you to manage their retirement. The investor has worked and invested for 30 years to reach this position under the guidance of the distributor, who ensured that he never switched away.

We discuss a few ways to switch from Regular to Direct plans for any investor. A Direct fund will have the word DIRECT in the name, and without the word DIRECT in the name, the fund is a Regular fund.

An exit from the Regular fund will involve selling units, leading to capital gains taxes. The impact of these taxes is one time. However, the lower returns in Regular funds will persist throughout the holding period. Since we are reducing expenses, we always prefer switching those units with the highest TER first.

Additionally, funds that declare dividends (IDCW plans) should also be avoided since dividends are taxed at the investor’s highest slab rate and reduce overall returns. Investors, therefore, should also switch from IDCW to Growth using the same methods described below.

This step is the most obvious and ensures that no new money is entering the Regular plan. This step can be done online from the AMC website (log in using PAN and Folio number from account statement), CAMS, or Karvy websites. In the worst case, visit your nearest CAMS, Karvy office, to fill and submit a SIP cancellation form.

In order of preference, these would be:

Many of these platforms also offer Regular plans, so check that the fund name has the word Direct. Bank and stock brokers usually offer Regular plans. Please check the fund names before investing.

As described in this post on how to calculate taxes and perform tax harvesting, we will see how we can exit with the least taxes to be paid.

Profits on selling equity fund units purchased over one year are called long term capital gains (LTCG). LTCG is tax-free up to ₹1.25 lakh per financial year. Investors can wait until March to see how much equity LTCG they have accumulated over the year and, for the rest, sell just enough units from the Regular fund to reach up to 1 lakh in gains which is tax-free. We have a tool that can do this:

For example, you calculate on 10 March that you have sold 3 lakhs of equity MF till date in that financial year, which has led to ₹45,000 of LTCG. This means that you can sell additional units over a year old up to ₹80,000 of profits. So start with the Regular funds with the highest TER and sell enough units to reach up to ₹80,000 in profits. If you exceed the total of ₹125,000 in profits, you will have to pay 12.5% tax on the amount over 1.25 lakhs.

Since losses can be offset against gains, if you have losses in some funds, you can sell them and offset that loss against profits in selling other funds. The tax rules say

Since taxation rules may change every year, investors should check the current IT rules before doing anything.

Investors should be mindful of how much the tax is, as a percentage of the amount sold, relative to the TER difference. For example, if the tax is 5% and the TER difference is 1%, that is 5 years of TER, almost that is lost to taxes. In such a case, explore step 3 below.

If the taxation is too much related to the TER difference, sell these funds first when rebalancing.

This post covers the details on how and why of rebalancing: Portfolio rebalancing during goal-based investing: why, when and how?

Suppose you switch to the Direct plan of the same fund (XYZ Regular Plan to XYZ Direct Plan) or from equity to equity (or from debt to debt). In that case, you can do so in a single transaction. There is no need to time the market based on current levels since you move within the same asset class, either equity or debt.

If you are moving from equity to debt or vice versa, ensure that your asset allocation is appropriate for your goals post the switch. Read more here: What should be the Asset Allocation for your goals?. If you end up with a large amount due to switches, use this chance to fix your asset allocation for your goals.

Suppose you have invested in high TER active funds. In that case, this is an excellent opportunity to switch to low TER active funds or simple index funds. This step not only reduces portfolio cost and simplifies portfolios, but the investor will also benefit from the impact of less active decision making in managing their portfolio. This point is made in more detail in the following posts:

Ultimately, the investor should understand the negative impact of distributor commission on their future portfolio values and make every effort to switch to Direct plans. The tax they will be paying today will be a minuscule percentage of the benefit to their portfolio over decades. Our official recommendation will be a one time switch from active equity funds to index funds. Investors requiring fund names to invest can benefit from the fund choosing methodology described in this post: Which funds should I invest in?.

If the investor needs advice on the choice of funds, they have the option of engaging with a SEBI Registered fee-only investment advisor for creating a complete financial plan including fund recommendations. However, if the Do-it-yourself (DIY) route is preferred, there are many online resources for educational purposes. For example, they can start here to educate themselves about the goal-based investing process.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to switch from regular to direct funds? first appeared on 11 Dec 2021 at https://arthgyaan.com