Save ₹15,625 in Taxes: How to Harvest Taxes in Your Mutual Funds for Free

This article explains the concept of tax harvesting and provides a free tool that can help you locate those mutual funds in your portfolio that can save tax by harvesting.

This article explains the concept of tax harvesting and provides a free tool that can help you locate those mutual funds in your portfolio that can save tax by harvesting.

What is tax harvesting?

Tax harvesting allows investors to strategically sell mutual fund units to take advantage of the ₹1.25 lakh exemption on long-term capital gains tax, as per Budget 2024. By selling and immediately repurchasing these units, investors can effectively increase the purchase price of their holdings, leading to significant tax savings in the future. This method ensures compliance with tax regulations while optimizing investment returns.

Budget 2024 announced in July 2024 that equity shares and mutual funds with equity-like taxation offer an opportunity for tax harvesting and saving up to ₹15625 in capital gains tax.

Tax harvesting can be applied to:

Capital gains tax calculation for equity-taxed funds:

The rule that lets us save tax is:

No long-term capital gains tax below ₹1.25 lakhs per PAN in this category per financial year.

Therefore, if we sell off some mutual funds where the eligible long-term capital gains (LTCG) do not exceed ₹1.25 lakh in the current financial year, i.e. FY2025-26, then we can save 12.5% of 1.25 lakhs or ₹15,625 in tax in the future. We need to immediately reinvest the amount sold back into similar funds so that the benefit of compounding is not lost.

This tax saving does not happen today. Since you are selling and reinvesting, you are effectively increasing the purchase price of your holdings and you get the benefit in the future when you actually sell those units.

This plan is called “Tax Harvesting” and with the right tools will help you save ₹15625 of LTCG tax.

If units sold in different funds are sold at a price higher than the purchase price and the total profit is:

So if the LTCG is ₹145,000, then the tax payable is ₹20,000 * 12.5% = ₹2,500 + cess + surcharge.

This feature of the tax code gives an opportunity to book ₹125,000 profit every year in equity funds or stocks to save ₹10,000 in taxes. Note that this feature is calculated on ₹1.25 lakh of profits and not on the sale consideration.

For example:

| Item | Price/Amount |

|---|---|

| Purchase price (A) | 100 |

| Units (B) | 10,000 |

| Book value (C=A*B) | 10,00,000 |

| Current price (D) | 250 |

| A year or more later | – |

| Units sold (F) | 840 |

| Market value (G=F*D) | 210000 |

| Capital gains H=(D-A)*F | 126,000 |

| Taxable capital gains = H - 1.25lakh | 1,000 |

| Tax @ 12.5% = T1 | 125 |

| Units repurchased at 250 = U = G/D | 840 |

| A year or more later | – |

| Current price (D2) | 350 |

| All units sold F2 = B-F+U | 10,000 |

| Market value M=F2 * D2 | 35,00,000 |

| Purchase amount = X = (B-F)*A + G | 11,26,000 |

| Profit = P = X-M | 23,74,000 |

| Taxable capital gains = P - 1.25lakh | 22,49,000 |

| Tax @ 12.5% = T2 | 281,125 |

| Total tax = T1+T2 | 281,250 |

| Item | Price/Amount |

|---|---|

| Purchase price (A) | 100 |

| Units (B) | 10,000 |

| Book value (C=A*B) | 10,00,000 |

| A year or more later | – |

| Current price (D) | 350 |

| All units sold (B) | 10,000 |

| Market value (E=D*B) | 35,00,000 |

| Capital gains (F=E-C) | 25,00,000 |

| Taxable capital gains G=F-1.25 lakh | 23,75,000 |

| Tax @ 12.5% = G * 12.5% | 296,875 |

| Tax with harvesting | 281,250 |

| Tax saved due to harvesting | 15,625 |

This example shows that harvesting 840 units after year 1 saved ₹15,625 tax. While using this method, the investor has to be mindful of the concept of the wash sale rule. It is better to combine LTCG harvesting along with portfolio rebalancing so that the sale proceeds are invested in different funds. You can do this either in March or throughout the year. The exemption is for total sales over the year.

All funds that have equity taxation can be used to do this tax-harvesting.

Tax Treatment for selling mutual funds during FY2025-26

| Fund category | Purchase date | STCG Rate | LTCG After | LTCG Rate |

|---|---|---|---|---|

| Debt Funds | Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| Debt Funds | Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| Equity Funds | Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| Hybrid Funds | Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| Dynamic Hybrid Funds (Equity Taxation) |

Bought Anytime | Slab | After 2Y | 12.5% |

| Hybrid Funds w/ equity between 35-65% |

Bought Anytime | Slab | After 2Y | 12.5% |

| Hybrid Funds w/ equity upto 35% |

Bought Anytime | Slab | After 2Y | 12.5% |

| Dynamic Hybrid Funds (Debt Taxation) |

Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| Dynamic Hybrid Funds (Debt Taxation) |

Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| Dynamic Hybrid Funds (Specified Taxation) |

Bought Anytime | Slab | Always STCG | Slab |

| Multi Asset Hybrid Funds (Equity Taxation) |

Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| Multi Asset Hybrid Funds (Debt Taxation) |

Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| Multi Asset Hybrid Funds (Debt Taxation) |

Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| Multi Asset Hybrid Funds (Specified Taxation) |

Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| Multi Asset Hybrid Funds (Specified Taxation) |

Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| FoF with 90%+ in domestic stocks |

Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| FoF in Equity Funds | Bought Anytime | Slab | After 2Y | 12.5% |

| FoF in Debt ETFs | Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| FoF in Debt ETFs | Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| Gold Funds | Bought Anytime | Slab | After 2Y | 12.5% |

| Gold/Silver Funds | Bought Anytime | Slab | After 2Y | 12.5% |

| Income Plus Arbitrage FoF | Bought Anytime | Slab | After 2Y | 12.5% |

| Silver Funds | Bought Anytime | Slab | After 2Y | 12.5% |

| Overseas Funds | Bought Anytime | Slab | After 2Y | 12.5% |

| FoFs (Specified Taxation) |

Bought Anytime | Slab | Always STCG | Slab |

| FoF other than above |

Bought Anytime | Slab | After 2Y | 12.5% |

| Gold ETFs | Bought Anytime | Slab | After 1Y | 12.5% |

| Index Funds Domestic Equity |

Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| Index Funds Domestic Debt |

Bought Anytime | Slab | Always STCG | Slab |

| Index Funds Other |

Bought Anytime | Slab | Always STCG | Slab |

| ETFs with Equity Taxation | Bought Anytime | 20% | After 1Y | 12.5% (above 1.25L) w 31Jan18 exemption |

| Silver ETFs | Bought Anytime | Slab | After 1Y | 12.5% |

| Debt ETFs | Bought Anytime | Slab | After 1Y | 12.5% |

| Overseas ETFs | Bought Anytime | Slab | After 2Y | 12.5% |

| ETFs investing in Foreign Stocks |

Bought Anytime | Slab | After 1Y | 12.5% |

| ETFs investing in domestic bonds |

Bought Before 1 Apr 2023 |

Slab | After 2Y | 12.5% |

| ETFs investing in domestic bonds |

Bought After 31 Mar 2023 |

Slab | Always STCG | Slab |

| ETFs (Specified Taxation) |

Bought Anytime | Slab | Always STCG | Slab |

| Solution Funds | Bought Anytime | Slab | Always STCG | Slab |

Important considerations for using this table:

To do tax harvesting, you need to follow these steps:

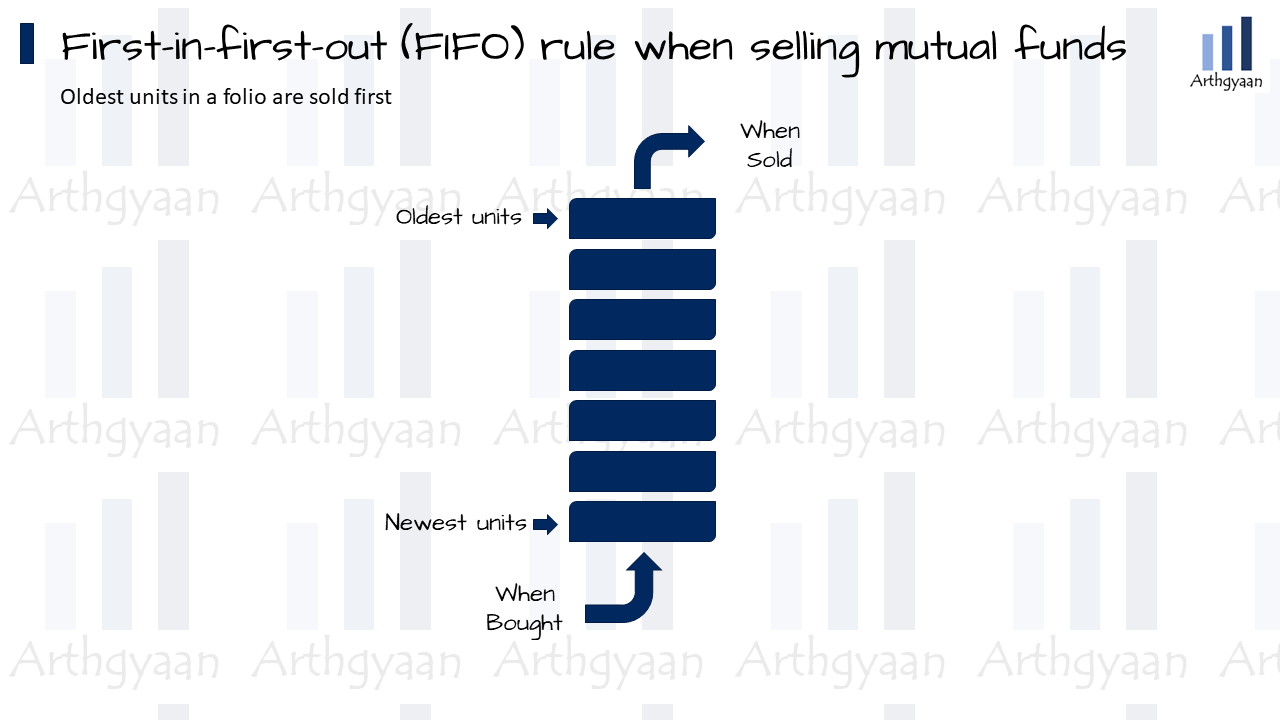

Note: Mutual funds follow the First-in-first-out (FIFO) rule for calculating which units will be taxed when you sell them.

First-in-first-out (FIFO) is the rule that needs to be followed when you are selling shares and mutual funds. The oldest shares/units are the ones that are used for calculating the purchase price.

| Date | Folio | Transaction | Units | Price |

|---|---|---|---|---|

| D1 | A | Buy | 100 | 50 |

| D2 | A | Buy | 100 | 60 |

| D3 | A | Sell | 50 | 70 |

| D4 | A | Sell | 70 | 80 |

In the example above, there are two buys and two sells. The units sold on D3 were purchased on D1 at price 50. The purchase value is ₹50 * 50 = ₹2500. The sold value is ₹70 * 50 = ₹3500.

For the 70 units sold on D4, 50 were purchased on D1 at ₹50/unit and the rest 20 were purchased on D2 at ₹60/unit. The profit on the first 50 units is ₹(80-50) * 50 = ₹1500 and that on the last 20 units is ₹(80-60) * 20 = ₹400.

Finding the right funds and the correct number of units can be a tricky exercise:

However, both of the above steps can be done easily as a part of the Arthgyaan Free Mutual Fund Review Service that includes a table for funds with harvest-eligible units.

There are a few rules that you should follow when doing tax harvesting:

To perform tax harvesting, you need to sell something and then immediately buy it. The wash sale rule says that you cannot buy the same or very similar security within a short span of selling it. Tax authorities frown upon this practice in general.

India does not have a wash sale rule today. However, from an optics perspective, it will be better for investors to avoid performing a wash sale as much as possible.

If there is a sharp upward movement in the market when you have sold the fund units and are waiting for the cash to hit your bank account, then you can lose out on the benefits since your repurchase level will be higher than the current level.

To solve this problem, whenever you sell units for the purpose of tax-harvesting, ensure you place a buy order for the same amount 1-2 days before. Placing the buy order early ensures that your NAV allocation date is as close as possible to the selling date.

You can do this as a series of sell-and-buy transactions until you have used up the entire limit. This allows you to stagger the trades as per market movements and let’s to sell only those funds that should be sold at that time.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Save ₹15,625 in Taxes: How to Harvest Taxes in Your Mutual Funds for Free first appeared on 06 Apr 2025 at https://arthgyaan.com