NRI Guide: Save on Crores in Capital Gains Tax with Sections 54, 54EC, and 54F in India

This article explains the benefits of Section 54, 54EC and 54F for NRIs looking to buy and sell real-estate in India.

This article explains the benefits of Section 54, 54EC and 54F for NRIs looking to buy and sell real-estate in India.

This article is a part of our detailed article series on the concept of taxes to be paid by NRIs in India. Ensure you have read the other parts here:

This guide simplifies the rules for income earned in India and abroad, including taxability, exemptions and DTAA application.

This article deals with complex taxation rules around NRO and NRE accounts and how TDS and TCS applies to them.

This guide breaks down how these accounts handle rental income, property sales, and capital gains. Learn how TDS applies, whether DTAA helps avoid double taxation, and how to legally repatriate funds abroad.

This guide covers when NRIs become RNORs, what taxes they must pay on Indian and foreign income, and how to take advantage of Double Taxation Avoidance Agreements (DTAA).

This article provides a ready-reckoner list of Tax Deduction at Source (TDS) rates applicable to NRIs for their income in India.

NRIs must file your income tax return on rental income from Indian property the right way. Learn about the tax deductions you can claim and how to file your return without hassles.

Under Section 54, you can save long-term capital gains (LTCG) tax if you have sold immovable property like land or buildings after holding them for 2 years or more. For property held for 2 years or sell, tax is applicable at slab rate.

The logic here for saving LTCG tax is like this:

Under Section 54EC, you can save long-term capital gains (LTCG) tax if you have sold immovable property like land or buildings.

The logic here is like this:

Introduced in 1983, Section 54F of the Income Tax act, as sourced from the Income Tax website, allows us to save capital gains tax if we sell mutual funds to buy a house.

The basic premise of this tax exemption is very simple:

There is an upper limit of Rs. 10 crores on the exemption amount under Section 54F as per Budget 2023.

We take the example of an apartment purchased in the 2010s and sold anytime after 23rd July 2024:

Under DTAA, you should apply for a foreign tax credit for ₹5 lakhs in your home country.

If you don’t want to take Section 54EC benefit and have a property deal lined up, you can save the entire ₹90 lakhs capital gains tax by investing the entire ₹1.5 crores.

If you invest the complete post-tax capital gains in mutual funds, can you get higher returns?

Here is the same example: you either take 54EC, invest in a new property for investment (7% return in 5 years), or do neither and invest in Indian mutual funds by paying off the entire capital gains tax.

| Heading | Section 54EC | Section 54 | MF Investment |

|---|---|---|---|

| Capital gains | 90.00 | 90.00 | 90.00 |

| Bond investment | 50.00 | - | - |

| Taxable LTCG | 40.00 | 90.00 | 90.00 |

| 12.5% LTCG tax | 5.00 | 11.25 | 11.25 |

| Bond interest (5y) | 12.50 | - | - |

| Investment in RE | - | 90.00 | - |

| MF Investment at 12% | 35.00 | - | 78.75 |

| Corpus after 5y | 111.68 | - | 138.78 |

| RE after 5y at 7% | - | 126.23 | - |

| Total | 111.68 | 126.23 | 138.78 |

The 12% return in mutual funds is more than realistic if you see the median returns for a 5-year lump sum investment for AMFI data from 2013 to date:

| Category | Any 5Y |

|---|---|

| Equity: Large Cap | 14.32% |

| Equity: Mid Cap | 20.76% |

| Equity: Small Cap | 23.75% |

The breakeven point, pre-tax, for section 54 and MF investment is real estate appreciating at 9% or more and mutual fund giving less than 12% over 5 years.

To understand Section 54F, we need to first understand a few terms:

If your new house costs more than the mutual funds you sold, you can save lakhs in capital gains tax

If the cost of the new asset is X and the sale proceeds from original asset sales is Y, then

If another house is constructed/purchases within the same period (1 year for purchase / 3 year for construction) which is eligible for ‘income from house property’ i.e. given on rent, then the tax benefit received on the new asset construction is reversed and has to be paid in the previous financial year. This rule effectively means that:

If the new house is sold within three years of purchase / construction, the capital gains tax becomes payable in the financial year preceding the purchase of the house.

Constructing a house after returning to India is normal for many NRIs. This section deals with the rules for getting Section 54F exemption for such a house.

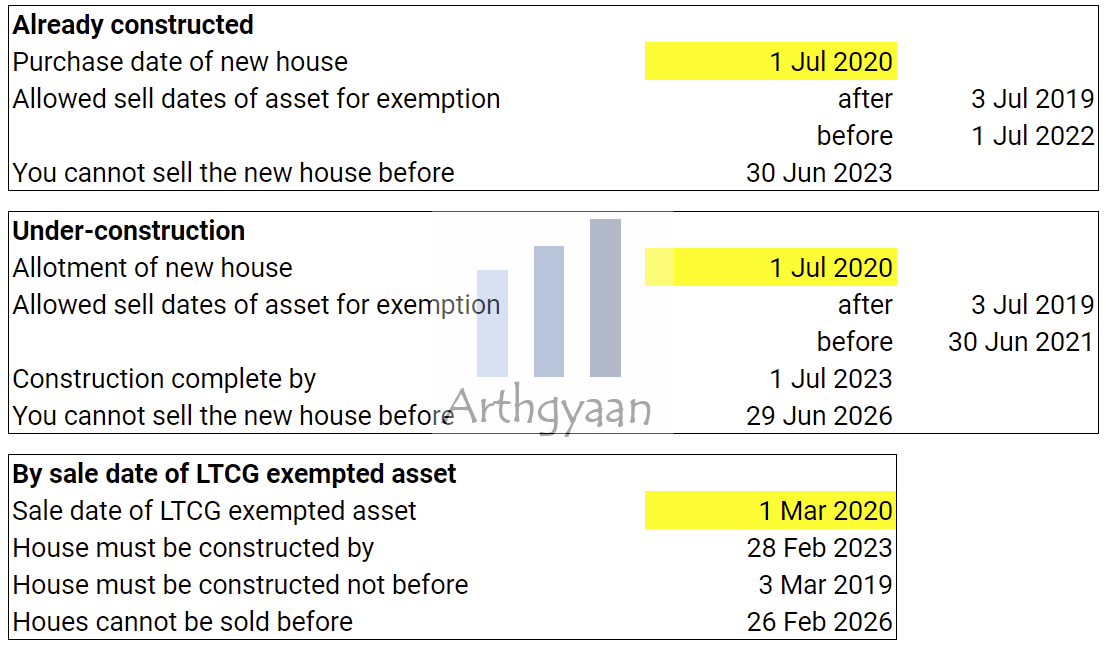

Every calculation is based on the agreement date. Depending on the state, this is also called allotment date or builder-buyer-agreement date

Violation of any of the rules above will invalidate Section 54F exemption.

Our simple-to-use calculator gives you a quick answer while analysing the appropriate dates for selling mutual funds and other eligible assets to buy a house and save capital gains tax. If you have already purchased or have been allotted the house, you can use this calculator to find suitable dates for selling assets to finance the house purchase.

How to use the Section 54F Exemption Calculator?

The calculator requires you to enter three numbers, one choice of house type, the number of houses you own today and one date:

Now you need to enter one of these dates:

Now click the Calculate Exemption button to get the result.

1.00 Cr

50.00 Lakh

30.00 Lakh

We have a large list of FAQs on this topic here: Frequently asked questions on Section 54F: the complete guide.

We have an easy-to-use calculator for Section 54F exemption calculation that works in any browser using Google Sheets.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the Sec54F tab of the sheet once you open it. You can export this Sheet to Excel using the File > Download Menu option.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled NRI Guide: Save on Crores in Capital Gains Tax with Sections 54, 54EC, and 54F in India first appeared on 09 Apr 2025 at https://arthgyaan.com