Frequently asked questions on Section 54F: the complete guide

This article compiles an exhaustive list of FAQs on the concept of tax saving while purchasing a house under Section 54F.

This article compiles an exhaustive list of FAQs on the concept of tax saving while purchasing a house under Section 54F.

Please use the Find feature of your browser to look for specific items of interest.

Section 54F of the income tax act allows individuals and HUFs to save capital gains tax if they sell certain long-term capital assets, like mutual funds, shares, gold, etc., and use the proceeds to buy or construct a residential house in India.

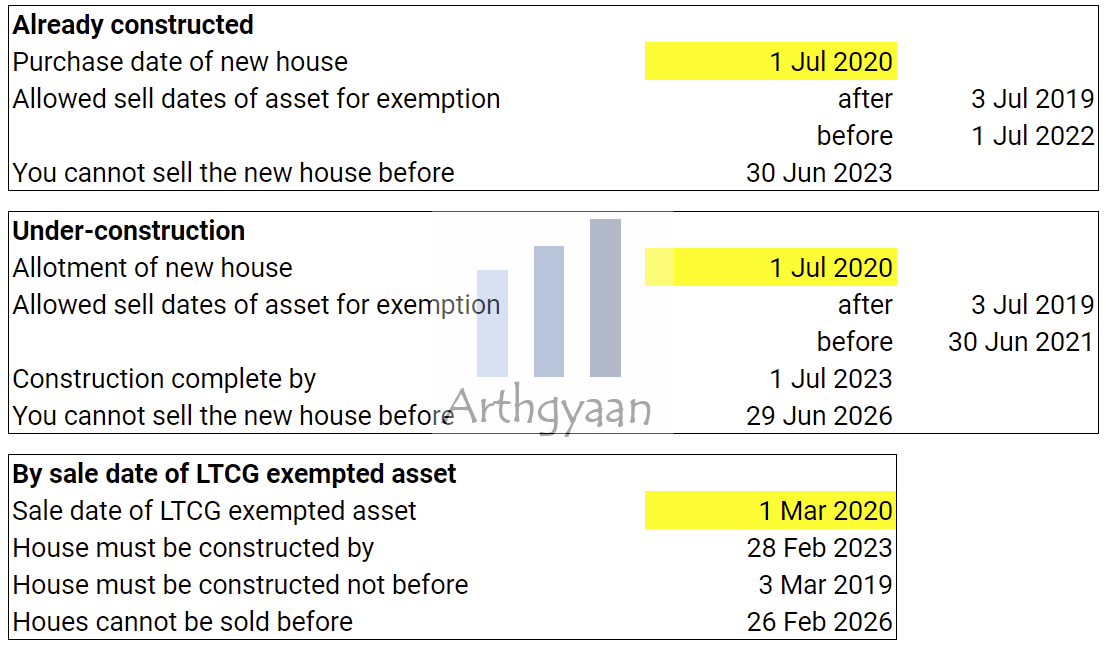

It is allowed to claim Section 54F exemption on the same property multiple times as long as the capital gains are incurred within the set limits. For example, if you have purchased an under construction property on 1st July 2020, then you can sell eligible assets anytime between 1st July 2019 and 1st July 2021 and use that for paying the builder as part of a construction linked plan.

For an NRI to get exemption under Section 54F, there are two conditions to be satisfied:

Section 54F will apply only if you construct a house within 3 years of the asset sale that you are trying to offset capital gains.

If the cost of the new residential house is greater than the proceeds from selling the original asset, then the entire capital gains on the sale of the original asset will be tax-free.

If the cost of the new residential house (X) is less than the proceeds from selling the original asset (Y), then the capital gains exempt from tax will be in the ratio of Y used to buy X. For example, if you sold assets worth 20 lakhs with a capital gains tax of 4 lakhs and the new house costs 15 lakhs, then the tax exemption will be 15/20 * 4 = 3 lakhs, and the remaining 1 lakh of capital gains will be taxable.

Since FD is not a capital asset, the interest on an FD gets added to your income and gets taxed at the slab rate. Therefore, Section 54F benefit is not applicable in the case of an FD.

You can only avail the tax exemption under Section 54F for your first or second house and not for your third house onwards.

Section 54F exemption is applicable even if you take a home loan to buy your new property and not utilise the entire sale proceeds from your sale / MF sale to buy the new house. For example, you sold MF worth 30 lakhs and then bought a 50 lakhs house with 10 lakhs as down-payment from your own pocket and 40 lakhs as home loan. Here the 54F exemption is still applicable on the entire 30 lakhs of MF sale and not just on the 10 lakhs down-payment.

Source: here

If foreign stocks like RSUs are sold 24 months after holding them, then these RSUs are eligible for Long-term Capital Gains. Tax on such gains are exempt under Section 54F if you construct a house in India.

Section 54F tax exemption is not available for stamp duty and property registration costs. Instead, stamp duty and property registration costs is eligible for deduction, up to 1.5 lakhs, under Section 80C for those under the old tax regime.

For Section 54F exemption, the new house that is constructed / purchased has to be in India.

Section 54F tax exemption is available in both old and new tax regimes.

Section 54F tax exemption is available in both old and new tax regimes.

To get Section 54F exemption, both spouses must be co-owners of the property.

As per Budget 2023, there is a cap of Rs. 10 crores for Section 54F exemption and this includes the amount deposited in a Capital Gains Savings Account (CGAS).

There is an upper limit of Rs. 10 crores on the exemption amount under Section 54F as per Budget 2023.

You can use the concept of Section 54F tax deduction to reduce future taxes on a part of your mutual fund portfolio by using an SWP to pay your EMI and investing the EMI amount back into mutual funds.

Click here to read the related article.

To avail the tax exemption under Section 54F, the following conditions must be met:

If you purchase or construct another residential house within a year of selling the original asset, and that new house is eligible for ‘income from house property,’ then the tax benefit received on the new asset construction under Section 54F will be reversed. The capital gain arising from the transfer of the original asset will be considered as income chargeable under the head ‘Capital gains’ in the previous year in which the new residential house is purchased or constructed.

If you sell the new residential house within three years of its purchase or construction, the capital gains tax exemption that you received earlier on the basis of the cost of the new asset will be reversed. The capital gain arising from the transfer of the original asset will be considered as income chargeable under the head ‘Capital gains’ in the previous year in which the new residential house is sold.

Even if the construction of the new house is not completed within three years, Section 54F exemption is available. This is possible if the allotment letter of the new house is obtained within the limits of Section 54F.

Source: https://www.charteredclub.com/cap-gain-exemption-if-construction-not-completed-in-3-years/

A common situation could be that shares were sold before 31st July (the tax filing deadline) say on 1st Jan 2020, the return was filed before the deadline, say on 1st July 2020 and then the new house was purchased say on 1st October 2020. In such a case, the return filed required paying the capital gains tax as self-assessment tax on 1st July. Section 54F exemption is not possible in such as case. The solution here is that before filing the tax return, the proceeds from the share should have been deposited into a Capital Gains Savings Account (CGAS). Then the tax return would have been filed with the appropriate declaration and then the money in the CGAS should have been withdrawn on 1st October to buy the new house.

A ‘long-term capital asset’ refers to a capital asset that is held for a specific period, which is more than one year for equity mutual funds and shares, and more than three years for debt mutual funds. Real estate is not considered as a capital asset for Section 54F exemption.

Section 54F requires that the new house is purchased within one year before or after the date of selling the original asset, or the construction of the new house should be completed within three years of the sale. Given that is is allowed to buy the house first and then sell shares within a year, it means that the proceeds from share sale need not be the exact same pile of cash, so to say, that was used to buy the house a year back. Therefore, the Section allows fungibility of the funds. As long as the conditions of the capital gains and house purchase are fulfilled you can interchangeably get the exemption even with a home loan.

Source: here

The date of the builder-buyer agreement or allotment date is considered for calculating the start date of the 54F clock. You can sell assets between one year before and one year after that date.The house must be registered within three years of the same allotment date.

To get Section 54F exemption, the date of construction will be the date on which you sign the allotment letter with the builder. It is not the possession or registration date.

Source: here

Section 54F Exemption is the minimum of Value of shares sold vs (Cost of new house x Capital Gains / Value of shares sold). For example, you sold 20 lakhs of assets and have a capital gains tax of 4 lakhs. The house costs 15 lakhs. The capital gains exempt from tax will be 15/20 * 4 = 3 lakhs. The other 1 lakh of capital gains will be taxable. If instead, the cost of the next house was 25 lakhs, the exemption amount would have been minimum of (4 and 25/20 * 4) which is 4 lakhs.

Here Value of shares sold loosely refers to the net consideration of the sale for funding the house.

Net Consideration = Sale Value - Transfer Expenses

When you sell any asset, there are associated costs called transfer expenses. A ggood example is brokerage and STT on selling shares. If you sell shares worth 100 and the brokerage plus STT was 1, then the net cosideration is 99. Lowering the net consideration by subtracting the transfer expenese reduces the capital gains tax since

Capital Gains = Sale Value - Transfer Expenses - Indexed Purchase Price

Here Indexed Purchase Price = Purchase Price * CII of the sale year / CII of the purchase year.

Before filing the income tax return, you must deposit the sale proceeds into a Capital Gains Savings Account (CGAS). Then the tax return would have to be filed with the appropriate declaration regarding the CGAS. Then the money in the CGAS should have been withdrawn later to buy the new house. If you have already filed the return without depositing the amount in the CGAS, then you cannot get Section 54F exemption.

Section 54F was introduced in the Income Tax Act in 1983.

Long-term capital asset sales like mutual funds, shares, and gold, commercial and rented real estate, plots but not residential real estate, are eligible for tax exemption under Section 54F if the proceeds from their sale are used to purchase or construct a residential house in India.

For a ready to move property, the date you signed the sale deed is the right date for calculating the 54F exemption date.

How to use the Section 54F Exemption Calculator?

The calculator requires you to enter three numbers, one choice of house type, the number of houses you own today and one date:

Now you need to enter one of these dates:

Now click the Calculate Exemption button to get the result.

1.00 Cr

50.00 Lakh

30.00 Lakh

If you want to use a Google Sheets / Excel version, please see below:

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the Sec54F tab of the sheet once you open it. You can export this Sheet to Excel using the File > Download Menu option.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Frequently asked questions on Section 54F: the complete guide first appeared on 26 Jul 2023 at https://arthgyaan.com