How is tax calculated on selling shares/MFs and how do to do tax harvesting?

This post discusses the concept of tax calculations and tax harvesting in a simple manner.

This post discusses the concept of tax calculations and tax harvesting in a simple manner.

Originally published: 1-Sep-2021

Updated: 02-Feb-2022 - post Union budget 2022

Updated: 02-Feb-2023 - post Union budget 2023 - no changes in capital gains tax calculation

Updated: 26-Mar-2023 - updated with removal on indexation benefits on most mutual fund categories

Updated: 01-Feb-2024 - no changes in direct/indirect taxes in interim budget 2024

Updated: 23-Jul-2024 - hikes in capital gains tax rates and LTCG exemption limit in Union Budget 2024

Updated: 05-Apr-2025 - Added link to tax harvesting calculator

Disclaimer: Taxation is a dynamic concept and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

This article is a part of our detailed article series on the concept of mutual fund taxation in India. Ensure you have read the other parts here:

This article shows how to calculate the tax on selling inherited shares and equity mutual funds using the grandfathering concept.

This article is expected to give investors in India a complete guide on the topic of calculation of taxes on mutual funds.

This articles discusses some benefits and drawbacks of storing your mutual funds in demat mode with one killer feature that makes transmission possible.

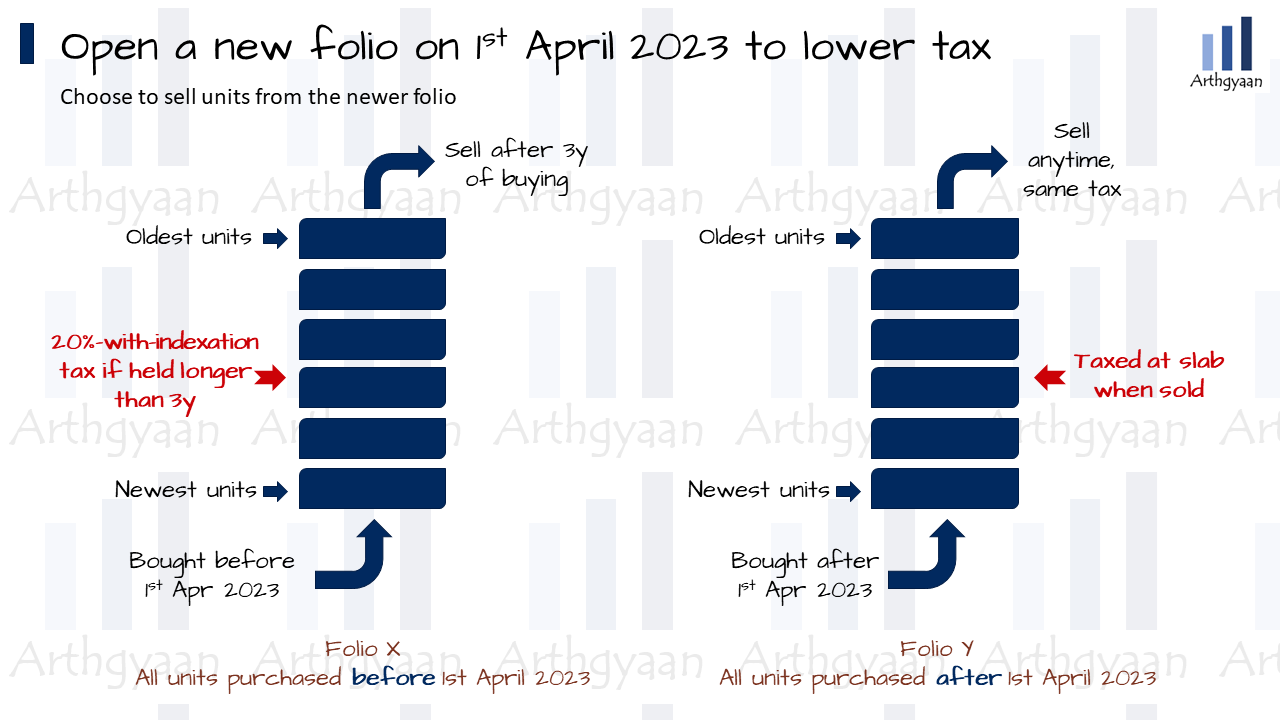

This article shows the way forward for investors in debt, gold, hybrid and international funds which have lost indexation benefits on units purchased after 1st April 2023.

This article shows you how the concept of indexation lowers the capital gains tax you pay when you sell debt mutual funds.

This article settles the question of which type of capital gain calculation is better - debt-type funds taxed at 20% with indexation vs equity-type at 10%.

This article explains the concept of equity LTCG grandfathering in detail with multiple case studies and examples.

This article talks about understanding capital gains tax calculations and computing offsets vs other income.

Capital gains are the profit from selling a capital asset like stocks or mutual funds. Capital gains are of two types depending on the holding period (see Table A below):

Tax harvesting is the concept of tax planning where you can offset capital gains in some mutual funds or shares against capital losses in others.

| Type | Portfolio | Short-term capital gains | Taxation | Long-term capital gains | Taxation |

|---|---|---|---|

| Shares, Equity MF or equity-oriented Hybrid MF | >65% Indian equity | <365 days | 20% + cess + surcharge | >= 365 days | <1.25 lakh/year is tax free. Gains above 1.25 lakh are taxed at 12.5% + cess + surcharge |

| Balanced Hybrid funds | >40% Indian equity | <3 years | Taxed at slab rate | >=3 years | 20% + cess + surcharge on gains post indexation |

| Debt or Hybrid funds (debt oriented) or Gold or International funds | <35% Indian equity | <3 years | Taxed at slab rate | >=3 years | 20% + cess + surcharge on gains post indexation for units purchased before 01-Apr-2023 |

| Debt or Hybrid funds (debt oriented) or Gold or International funds | <35% Indian equity | <3 years | Taxed at slab rate | >=3 years | At slab for units purchased after 01-Apr-23 |

where Capital gains = (Selling price - Buying price) * Units sold

and

buying price post indexation = (Buying price) * (Cost Inflation index today / (Cost Inflation index at the time of purchase).

These rates are updated for Union Budget 2024 (23-Jul-2024)

A surcharge on LTCG on all capital assets, including unlisted shares has been capped at 15% in Budget 2022. This will specifically help startup owners who will now pay lower taxes on selling unlisted shares. Earlier only listed shares had this cap.

Note that for equity shares and equity mutual funds, any capital gains incurred before 31-Jan-2018 is not taxable. This is the so-called ‘grandfathering clause’: Pay lower capital gains taxes for equity: understand how grandfathering works

| Due date | Advance tax payable |

|---|---|

| 15th June | 15% |

| 15th September | 45% |

| 15th December | 75% |

| 15th March | 100% |

In each of the above cases, you need to subtract the advance tax already paid.

Every taxpayer with more than ₹10,000/year tax liability should pay tax as per the schedule above. This rule means that before every date in the table above, it is good practice to calculate your capital gains and pay the advance tax.

STT at 0.001% (i.e. 1 rupee per lakh) applies to all equity/equity MF buy and sell transactions. STT for debt MF is zero. This 0.001% amount is small enough to be inconsequential and should be ignored when calculating the effect of taxes on sale transactions.

To perform tax harvesting, you need to sell something and then immediately buy it. The wash sale rule says that you cannot buy the same or very similar security within a short span of selling it. Tax authorities frown upon this practice in general.

India does not have a wash sale rule today. However, from an optics perspective, it will be better for investors to avoid performing a wash sale as much as possible.

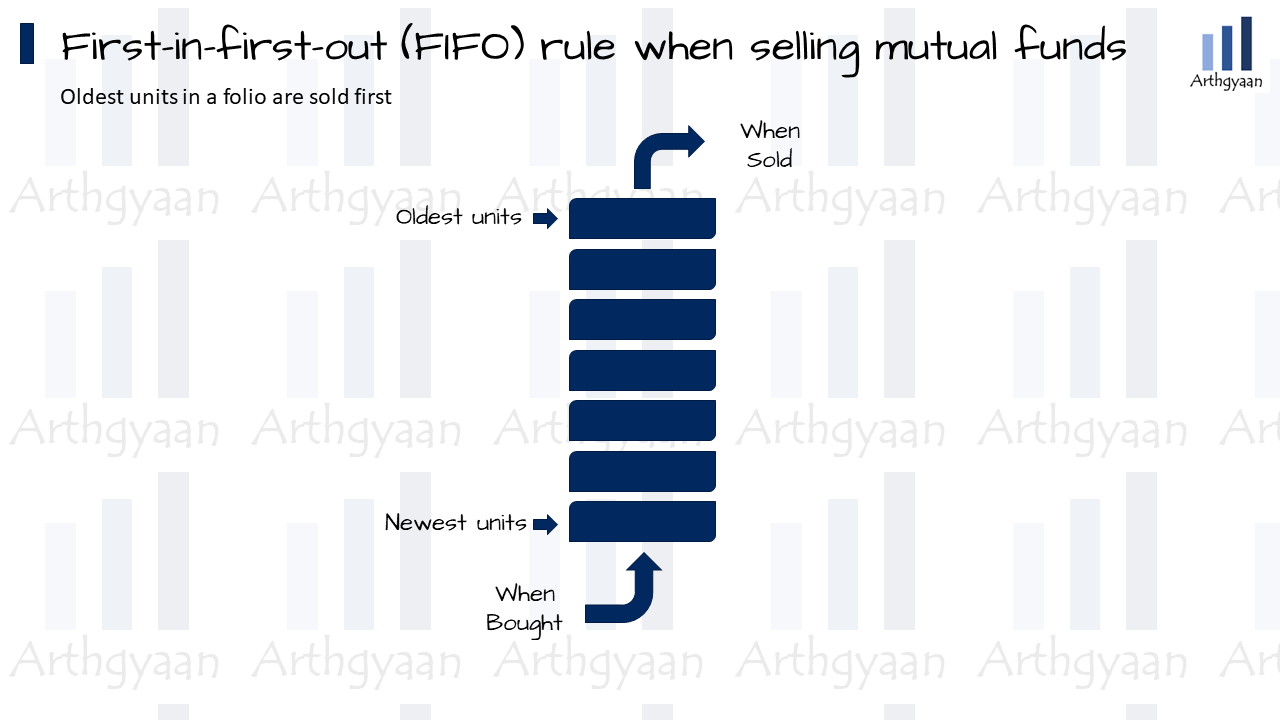

First-in-first-out (FIFO) is the rule that needs to be followed when you are selling shares and mutual funds. The oldest shares/units are the ones that are used for calculating the purchase price.

| Date | Folio | Transaction | Units | Price |

|---|---|---|---|---|

| D1 | A | Buy | 100 | 50 |

| D2 | A | Buy | 100 | 60 |

| D3 | A | Sell | 50 | 70 |

| D4 | A | Sell | 70 | 80 |

In the example above, there are two buys and two sells. The units sold on D3 were purchased on D1 at price 50. The purchase value is ₹50 * 50 = ₹2500. The sold value is ₹70 * 50 = ₹3500.

For the 70 units sold on D4, 50 were purchased on D1 at ₹50/unit and the rest 20 were purchased on D2 at ₹60/unit. The profit on the first 50 units is ₹(80-50) * 50 = ₹1500 and that on the last 20 units is ₹(80-60) * 20 = ₹400.

Mutual funds held in different folios have different tax treatments. The first-in-first-out rule applies to units at a folio level. Suppose there are two folios A and B, where the units in B are bought after those in A and later sold, then only those in B will be considered for tax calculation.

| Date | Folio | Transaction | Units |

|---|---|---|---|

| 1 | A | Buy | 100 |

| 2 | B | Buy | 100 |

| 3 | B | Sell | 50 |

In the example above, for tax computation, only those units from Folio B are considered.

Imagine the situation of an investor with only capital gains from stocks/MF as taxable income. Salary, interest income, and other income are taxed at the slab rate and capital gains are taxed at special rates as discussed above. However, the basic ₹2.5 lakh exemption limit (₹3 lakh for senior citizens) applies here as well.

You do not pay any tax if total income plus taxable capital gains (after all offsets within capital gains and losses) does not exceed ₹2.5 lakh. All taxpayers should also check if they are eligible for a rebate under Section 87A where they can reduce their taxes by a further ₹12,500 if their total income is under ₹500,000.

Income tax returns must be filed to take advantage of the deductions and offsets. Some additional use cases and examples using real estate transactions are present here: How to calculate taxes from capital gains and combine them with your other income

References from incometaxindia.gov.in:

Tax harvesting is one of the tasks that you must perform in the month of March every year.

The profits obtained from the sale of some funds can be offset by deliberately selling other funds whose oldest units are at a loss.

| Date | Folio | Fund | Transaction | Units | Price | Comment |

|---|---|---|---|---|---|---|

| 1 | A | X | Buy | 100 | 10 | First buy |

| 2 | B | Y | Buy | 100 | 12 | First buy |

| 3 | A | X | Sell | 50 | 12 | 50*2=100 profit |

| 4 | B | Y | Sell | 25 | 8 | 25*(12-8)=100 loss |

For example, we sell 25 units of fund Y to offset the profit from selling 50 units of fund X.

If you are planning to keep investing in fund Y, selling units from Y now lowers the average purchase price of the remaining units. This leads to higher taxes in the future and needs to be weighed vs. saving taxes today.

Some investors prefer to segregate portfolios using different folio numbers and tag them to different goals as described here. This leads to a logical separation of goals and allows the booking of capital gains as per requirement.

If units sold in different funds are sold at a price higher than the purchase price and the total profit is:

So if the LTCG is ₹145,000, then the tax payable is ₹20,000 * 12.5% = ₹2,500 + cess + surcharge.

This feature of the tax code gives an opportunity to book ₹125,000 profit every year in equity funds or stocks to save ₹10,000 in taxes. Note that this feature is calculated on ₹1.25 lakh of profits and not on the sale consideration.

For example:

| Item | Price/Amount |

|---|---|

| Purchase price (A) | 100 |

| Units (B) | 10,000 |

| Book value (C=A*B) | 10,00,000 |

| Current price (D) | 250 |

| A year or more later | – |

| Units sold (F) | 840 |

| Market value (G=F*D) | 210000 |

| Capital gains H=(D-A)*F | 126,000 |

| Taxable capital gains = H - 1.25lakh | 1,000 |

| Tax @ 12.5% = T1 | 125 |

| Units repurchased at 250 = U = G/D | 840 |

| A year or more later | – |

| Current price (D2) | 350 |

| All units sold F2 = B-F+U | 10,000 |

| Market value M=F2 * D2 | 35,00,000 |

| Purchase amount = X = (B-F)*A + G | 11,26,000 |

| Profit = P = X-M | 23,74,000 |

| Taxable capital gains = P - 1.25lakh | 22,49,000 |

| Tax @ 12.5% = T2 | 281,125 |

| Total tax = T1+T2 | 281,250 |

| Item | Price/Amount |

|---|---|

| Purchase price (A) | 100 |

| Units (B) | 10,000 |

| Book value (C=A*B) | 10,00,000 |

| A year or more later | – |

| Current price (D) | 350 |

| All units sold (B) | 10,000 |

| Market value (E=D*B) | 35,00,000 |

| Capital gains (F=E-C) | 25,00,000 |

| Taxable capital gains G=F-1.25 lakh | 23,75,000 |

| Tax @ 12.5% = G * 12.5% | 296,875 |

| Tax with harvesting | 281,250 |

| Tax saved due to harvesting | 15,625 |

This example shows that harvesting 840 units after year 1 saved ₹15,625 tax. While using this method, the investor has to be mindful of the concept of the wash sale rule. It is better to combine LTCG harvesting along with portfolio rebalancing so that the sale proceeds are invested in different funds. You can do this either in March or throughout the year. The exemption is for total sales over the year.

If you are planning to perform equity LTCG harvesting, please use our free tool:

To do this kind of harvesting in practice: Save ₹15,625 in Taxes: How to Harvest Taxes in Your Mutual Funds for Free

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How is tax calculated on selling shares/MFs and how do to do tax harvesting? first appeared on 01 Sep 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.