Should the same funds and folios be chosen for different goals?

Investors are often in a dilemma as to the best way of structuring their portfolio for different goals.

Investors are often in a dilemma as to the best way of structuring their portfolio for different goals.

Some common questions among investors getting started with investing in multiple goals are:

For example, which is “better”?

The answer to these is a mix of taxation, usability, behavioural aspects and AMC risk. We will deal with each of these separately.

The simplest or “minimalist” portfolio contains the same funds, folios and AMCs for all goals. The allocations can be kept separate using Excel or a similar tool. However, this approach may not always work in all instances. Ultimately there is no right or wrong answer to this and investors should do what works for them after considering the factors below.

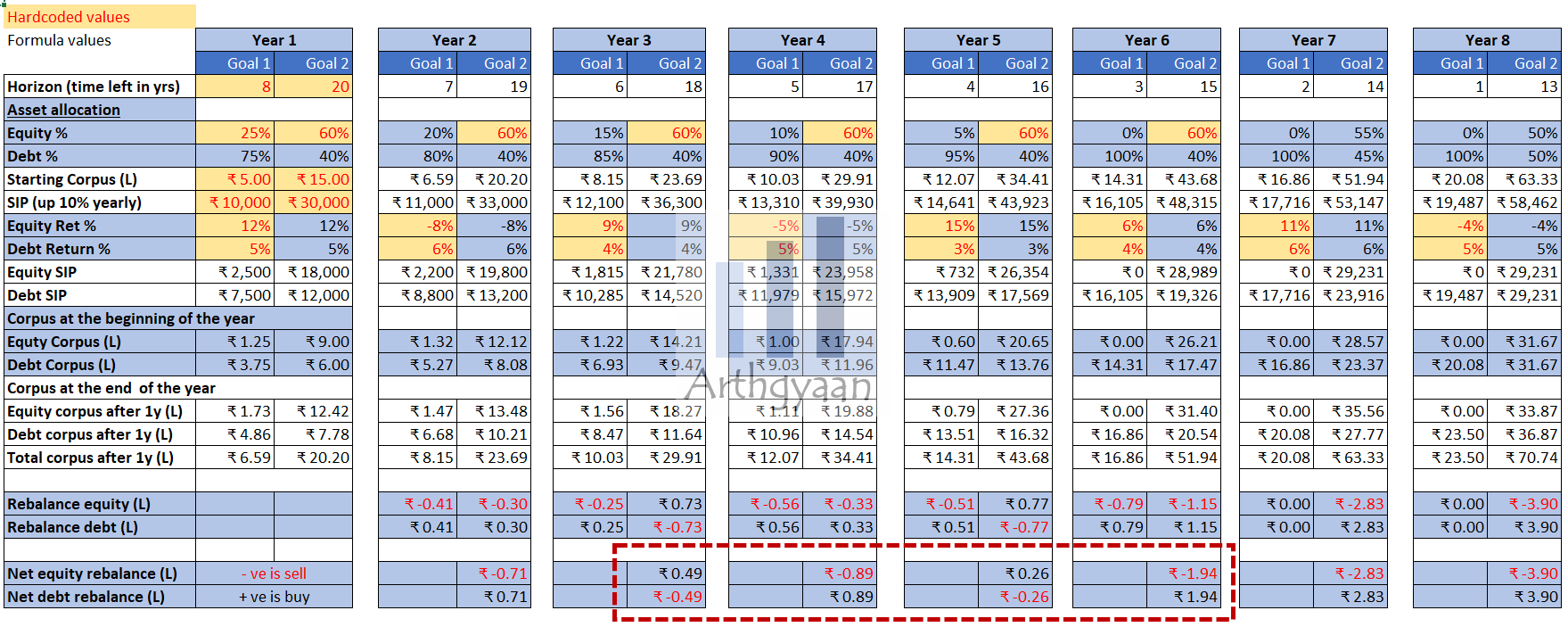

The minimalist portfolio, by design, will minimise the number of transactions, both buys and sells, due to the netting effect across various goals. This leads to lower capital gains taxes to be paid (see figures in red dotted box above where equity and debt rebalancing changes from year-to-year)

Higher the number of funds and folios, there will be lower chances of having offsetting trades and hence more taxes due to selling.

Investors sometimes prefer some goals to be given higher priority. For example, children’s education goal may be considered untouchable in case of an emergency and a physical separation via different AMC’s funds may be needed to maintain that distinction from other goals.

Alternatively, seeing the balances in different folios in a dashboard, with each folio tagged with different goals, may be easier to visualize progress. A large monolithic figure may be difficult to interpret.

Many users will not have the necessary Excel or dashboarding skills to separate the goals and will benefit from separated folios and funds.

Investors can be better off looking at a big-picture view of their portfolios if they look at it frequently.

If the investors habitually look at market levels and portfolio values regularly, then constantly changing values of funds and folios may trigger unexpected emotional responses.

This leads to unnecessary actions being taken: sudden buy/sell, exiting falling markets or acting without following their rebalancing plans.

AMC diversification is needed due to actions beyond the investor’s control. Two classic examples are

Investing in similar funds across AMCs can somewhat mitigate risks like these though this increases the effort needed in tracking many funds and portfolios as discussed here: Do you need multiple mutual funds to keep your money safe?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should the same funds and folios be chosen for different goals? first appeared on 14 Jun 2021 at https://arthgyaan.com