Do not make this mistake when investing in mutual funds

Investors should only invest in the Direct Growth plans of mutual funds. Regular and IDCW (Dividend) funds lead to lower returns. Here’s why.

Investors should only invest in the Direct Growth plans of mutual funds. Regular and IDCW (Dividend) funds lead to lower returns. Here’s why.

Mutual funds exist in four different varieties: direct and regular, growth and IDCW. We will cover these below and advise which one is generally best for most investors for investing.

These four schemes are variations of the same underlying fund with an identical portfolio. They differ in how the AMC calculates daily NAV and what is the source of money for dividends.

Regular / Direct: In Regular funds, the expenses for running the fund include brokerage or commission. The investor investing in Direct funds invests directly with the AMC without getting advice from an agent. The TER for Direct does not have any commission.

Growth / IDCW: IDCW stands for “Income Distribution cum Capital Withdrawal option”. IDCW is the new name for mutual funds that declare a dividend. Growth funds do not pay dividends.

Assume an AMC is running a fund called XYZ Large-cap fund. It will generally have four schemes available to investors:

Some funds have more varieties of the IDCW scheme where dividends are declared daily, weekly, monthly or quarterly. We will use this example fund below for explanations.

We calculate Net Asset Value or NAV like this:

NAV = (Fund Assets - Expenses) / Units_OutStanding where

Let us assume that the Fund Assets are 100cr, the TER is 2% and the number of units outstanding is 5cr.

NAV = (100 - 2%/365 * 100) / 5 = [100 * (1-2%/365)] / 5 = 19.9989.

As per this example, we see that the TER is subtracted from the fund daily. The fund assets, after today, is 100 * (1-2%/365). Let’s assume that on the next day, the market rises by 5%. Here (1-2%/365) is the TER factor that reduces the assets daily.

NAV = 1.05 * Current Assets * TER factor / Units = 1.05 * [100 * (1-2%/365)] * (1-2%/365) / 5 = 20.9977

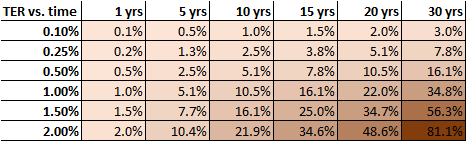

The 1-day change in NAV or the fund return is 20.9977/19.9989 -1 = 4.9943% and is not 5% due to the TER reduction daily. So it is obvious that if the TER was lower, say 0.5%, the 1-day return would have been higher (actually 4.9966%). The extra return may not be much if seen daily. However, over many years, the scheme with lower TER gains faster which we see in the table below:

The percentage figure is the loss due to commissions. 1% difference in TER may look small over 1 year (around 1%) however, over 30 years, the difference is 34.8%. For example, if a Direct fund investor has accumulated 10crs, the Regular fund investor would have made only 6.5crs with everything else remaining the same. The distributor gets commissions continuously as long as the investor is invested in the Regular fund.

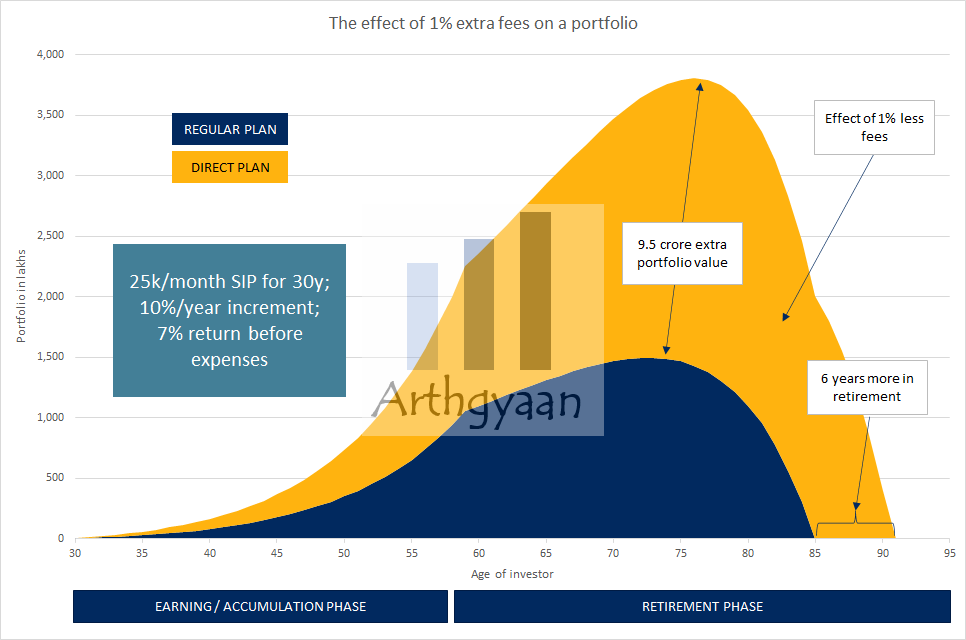

To drive the point home consider this:

If you can manage your retirement with 15cr (peak portfolio value) and gave up 9.5cr to commissions, your distributor just needs two such clients to fund his own retirement. You studied, worked a job/business and invested for 60 years while the distributor did not do anything except to ensure that you never shifted away from him.

This is the reason why investors should only choose Direct and not Regular funds. In fact, cost reduction is one of the axioms of personal finance?

SEBI recently renamed Dividend mutual funds to IDCW to remove misconceptions among investors regarding the nature of mutual fund dividends. Growth funds do not declare dividends. The entire fund assets are compounded daily in the case of growth funds.

There are two issues with mutual fund dividends:

AMCs do not guarantee any dividends. The fund gets cash from investors or by selling assets like stocks and bonds. This cash is the source of dividend. The NAV falls when a dividend is declared since the cash balance, a part of fund assets has now been reduced.

For example, if a 100cr fund declares 2 rupees as a dividend for 5cr outstanding units, then the fund assets drop by 2 * 5 = 10cr. The previous NAV of 20 (100/5) reduces to 18 (90/5). Each holder of one MF unit initially had a value of 20. Now they have one unit worth 18 and 2 rupees of cash as a dividend. So total wealth of the investor does not change at this point.

However, the dividend is taxable in the hands of the investor at the highest applicable tax rate. So this leads to the loss of the investor’s wealth due to higher tax rates (30% or more) when compared to capital gains tax rates (20% or less). A better alternative will be to use capital gains by selling units to get money from mutual funds when needed.

The investor gets a lower return than the Growth fund since they have to pay tax on the dividend.

As shown in the example above, Direct fund NAVs are higher than Regular. So the same amount of money invested in Direct funds gets lesser units. However, the money invested is now a part of the fund assets. The returns on the investment will be higher due to lower TER.

The value of the NAV does not mean anything since it is just a method of calculation. NAV is NAV = (Fund Assets - Expenses) / Units_OutStanding which means that choosing how many units exist in the fund, the NAV can be set to any value. When the fund is launched then the NAV is set to ₹10 by convention. It could have been ₹1 or ₹100 also and it will make no difference to the return the investor will get. A higher NAV in a fund can be due to age since older funds with good performance will have higher NAV than a new fund. Similarly, a poor performing fund with history of underperformance will have a low NAV. Neither are good criteria to invest. Investors should look at the past performance of the fund and the ability to give good returns in the future before investing.

A common argument in favour of choosing Regular funds goes like this. The distributor is supposed to advise which funds will perform better in the future in advance. The claim here is that investing in “best performing” funds makes the TER difference immaterial. However, since the distributor makes this claim, the investor must examine the distributor’s track record of future predictions of finding such funds. Then there is the taxation cost of switching frequently. Direct funds give guaranteed extra returns over Regular without needing any attempt to predict the future.

Read more on the concept of the agency problem in mutual fund investments here: The agency problem in personal finance. What should you do?.

Mis-selling causes this misconception since, in reality, mutual funds offer no guarantees on either returns or return of the principal either for Growth or IDCW. A portfolio of debt and equity growth funds should be used for regular income, say for retirement purposes. The investor will generally pay lower taxes when selling units to get the money needed.

This is a fallacious argument. If the investor needs advice on the choice of funds, they have the option of engaging with a SEBI Registered fee-only investment advisor for creating a complete financial plan including fund recommendations. However, if the Do-it-yourself (DIY) route is preferred, there are many online resources for educational purposes. For example, they can start here to educate themselves about the goal-based investing process.

We cover these points in more detail in this post: How to switch from regular to direct funds?

Conclusion: Investors should only invest in funds with the words Direct and Growth in the fund name and avoid the rest.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do not make this mistake when investing in mutual funds first appeared on 15 Jun 2021 at https://arthgyaan.com