Which funds should I invest in?

Once goals are set, use this framework to choose mutual funds

Once goals are set, use this framework to choose mutual funds

In this post, we address the biggest problem that many investors are concerned with: which fund to invest. The solution is the 3-fund portfolio.

The 3-fund portfolio is a very simple portfolio that uses diversified low-cost index funds to get as much exposure as possible to stock and bond markets. This concept has been popularized by the followers of Vanguard founder and investor advocate John Bogle.

The 3-fund portfolio may not necessarily have exactly 3 funds but the concept can be used by Indian investors quite easily to invest for their financial goals.

Having a simplified portfolio is one of the axioms of personal finance?.

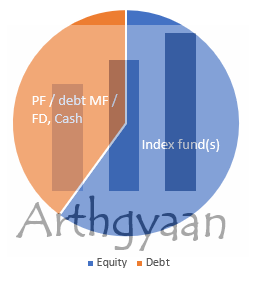

The simplest 3-fund portfolio has 2 asset classes and 1-2 funds in each

in a proportion (asset allocation) as per the risk profile of the goal. If mutual funds are being chosen, the funds should be DIRECT GROWTH funds only.

This is the simplest possible portfolio that can be chosen for any goal beyond 5 years until the end of retirement. For a goal closer than 5 years, the equity component should be zero depending on the risk profile. Typically for long term goals of 15 years or more, provident fund (EPF, PPF, VPF, Sukanya Samriddhi) can be used as long as there is enough holding in open-ended debt funds to allow rebalancing.

This portfolio is simple, has extremely low cost and is easy to maintain. The returns will be very close to the overall stock market since only index funds are recommended in the equity section. It is very difficult to beat an index fund due to both cost and the human element that otherwise causes poor returns in the portfolio of active fund investors.

Such a portfolio, when rebalanced regularly with debt, will be both low maintenance and suitable for DIY investors who do not want the hassle of worrying about which fund to invest next.

Typically International funds and Gold may also be added to the portfolio. The right reason to do this is not “increase returns” but instead risk reduction via diversification. Ensure a robust and frequent rebalancing plan is prepared and followed if international equity or gold is needed.

Read more: How to choose a gold mutual fund

Any investors want to get exposure to midcap and smallcap funds as well in their equity portfolio. While this is certainly possible, it again increases the amount of active decision-making (how much exposure?, SIP or Lump sum in small-caps?), timing considerations (is this the right time to invest in midcaps?) etc to creep into the decision-making process. While this may be an exciting pastime for many, the remaining investors will be better off with simpler portfolios. An investor wishing to know more is advised to review this post on core-satellite portfolio construction. Once funds have been chosen, please look at this detailed post regarding whether same or different funds are to be chosen for different goals.

This post specifically covers investments for investors either saving for or already in retirement.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which funds should I invest in? first appeared on 08 Jun 2021 at https://arthgyaan.com