What are target date funds and why do we need them in India for retirement?

This article introduces the concept of the target date fund and explains why they are a good option for retirement planning.

This article introduces the concept of the target date fund and explains why they are a good option for retirement planning.

A target date fund (TDF) is a mutual fund created for a long-term goal like retirement. They are popular in the US and are not yet available in India. The premise of a TDF is to allow the investor to invest in a single fund tagged to their desired retirement year. They invest in that fund throughout their earning period and then withdraw from the same fund in retirement. TDFs are typically fund of funds, i.e., mutual funds holding other mutual funds.

This article is a part of our detailed article series on Target Date Funds. Ensure you have read the other parts here:

This article extends the concept of a target date fund for one-time goals like house downpayment for investors in India.

This article explains how to create a target date fund to simplify retirement planning in India.

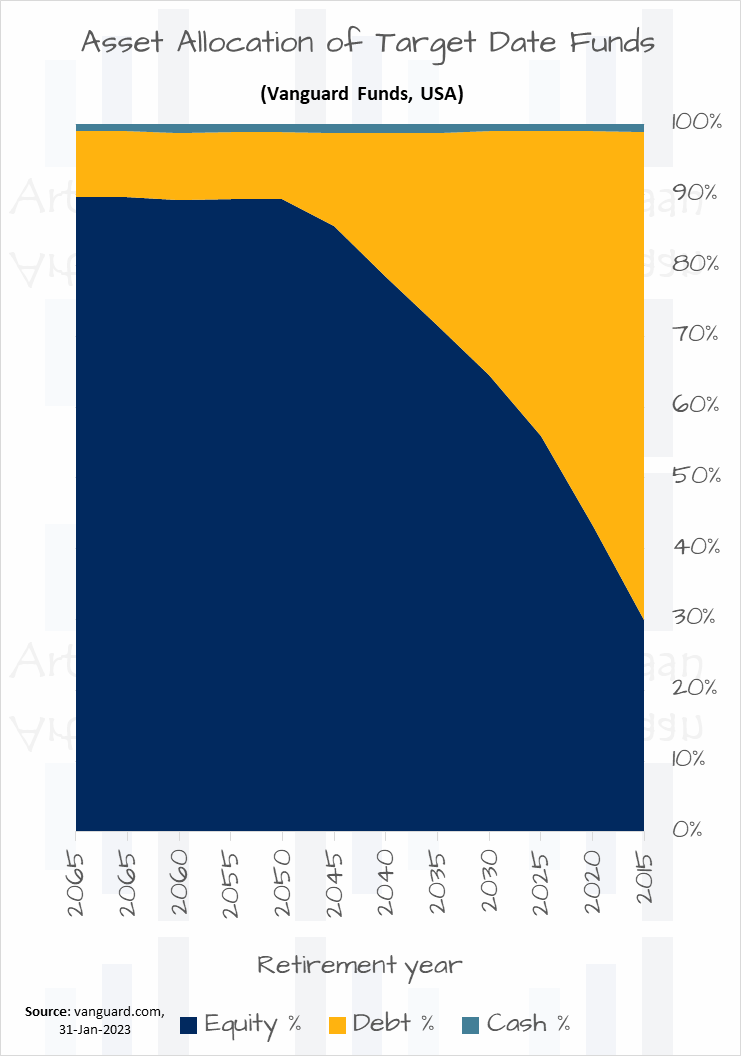

The fund starts with an aggressive allocation to the equity asset class for long-term growth. Then, there is a smaller bond allocation for rebalancing and stability purposes. Over time, as the retirement date comes close, the equity allocation is slowly reduced. Finally, once the retirement year is past, the asset allocation stabilizes to a small percentage of equity for growth and a larger share of bonds (and cash) for income generation.

Simple: The main selling point of a target date fund is simplicity - one fund to invest in, nothing to track and easy to manage. For busy and non-expert investors, both young and old, TDFs work very well.

Diversified: A target date fund is well diversified between equity, debt and cash with a professionally decided asset allocation and glide path that manages risk by rebalancing and moving to a higher portion of safer assets as the retirement date approaches.

Emotion free: The fund’s asset allocation and rebalancing plan happens without the risk of overaction or inaction by the investor. Since the investor has no role in deciding how to react due to market movements, it reduces the risk of taking the wrong decisions like panic selling or not rebalancing due to inaction or fear of taxes.

Customizability: A target date fund does not allow customization. At best, you can mix 2-3 TDFs to replicate a custom asset allocation to have some limited amount of control on the asset allocation and glide path.

Fund expenses: Implementation of the target date fund is important from a cost perspective. In India, mutual funds offer tax-free rebalancing inside the fund. However, it is difficult to fund such hybrid funds at lower expense ratios. Most of these funds are also active funds which make it difficult to know what will happen next with the asset allocation due to calls being made by the fund manager.

AMC risk: If you are investing in a TDF, you now have AMC concentration risk since TDF underlying funds are usually from the same AMC.

Image © livemint.com

Image © livemint.com

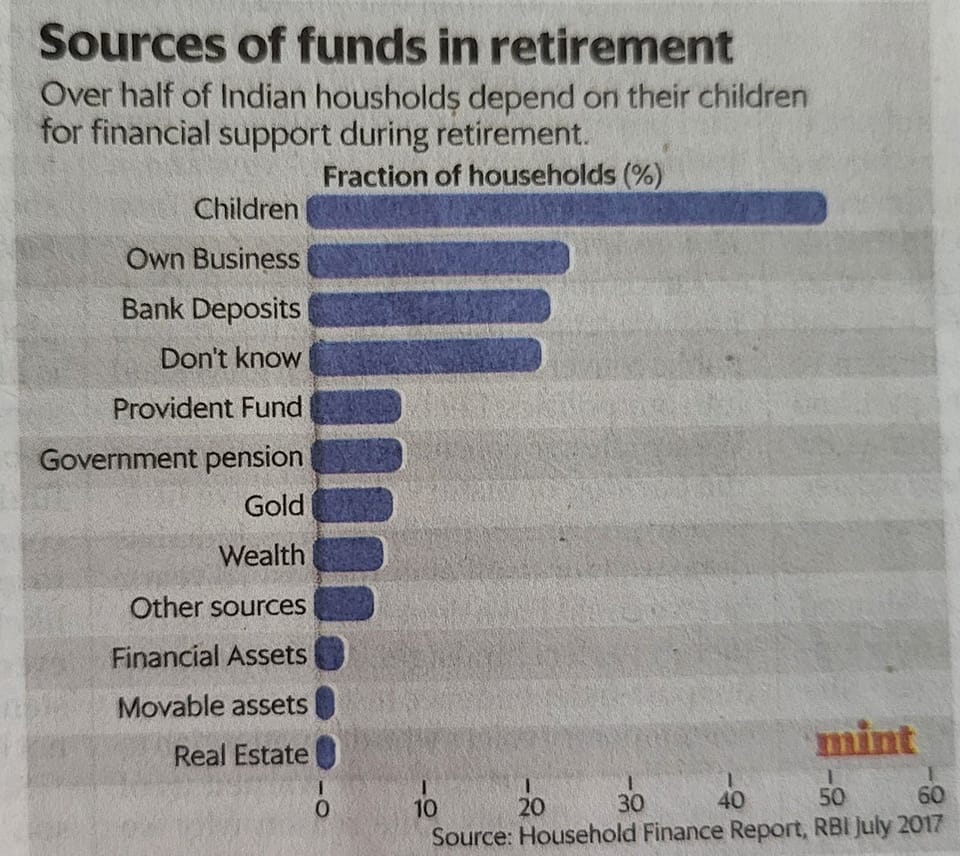

The chart shows that more than half of Indian households depend on their children as their retirement fund. There are many reasons for this, but one factor is complexity and an excessive number of choices, e.g. there are 10,000+ mutual funds, that make investment planning and management difficult.

Image © bqprime.com

Image © bqprime.com

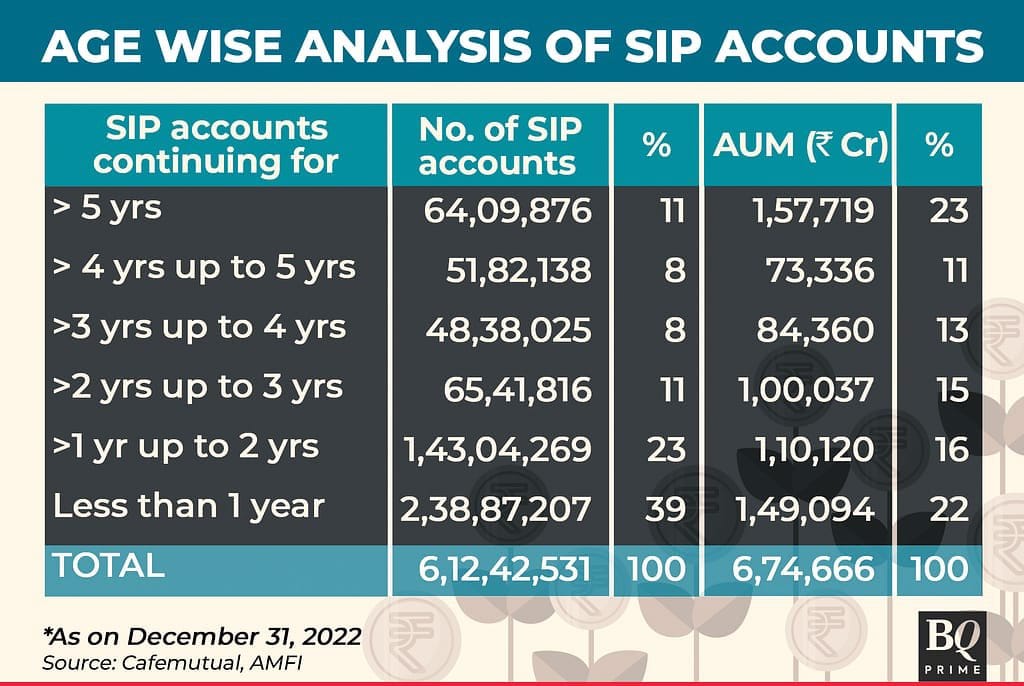

This table shows evidence that the post-COVID-19 bull run has attracted most of the current mutual fund AuM. However, the average asset per folio is higher in the older folios, which means that the investors who have the conviction to hold into equity are the ones who have built up a substantial corpus. The average assets in the top 2 categories (4 years or above) are 3x of those in the bottom 2 (less than 2 years).

There are 10,000+ mutual funds, more than 5,000 listed stocks, 50+ insurance companies, 1,000+ bonds and 2,00,000+ distributors and insurance agents in the country. If you add media to this mix, i.e. print, electronic and social leads to cluttered portfolios, a lack of planning and compounding mistakes.

There is a potential for improvement here in retirement goal planning via simplification. Target date funds can serve this purpose. In this article, we have covered the implementation of TDFs in India using existing products since no AMC offers this product today.

A target date fund (TDF) is a mutual fund created for a long-term goal like retirement. It is designed to allow the investor to invest in a single fund tagged to their desired retirement year. They invest in that fund throughout their earning period and then withdraw from the same fund in retirement. TDFs are typically fund of funds, meaning they are mutual funds which hold other mutual funds.

A target date fund starts with an aggressive allocation to the equity asset class for long-term growth. Then, there is a smaller bond allocation for rebalancing and stability purposes. Over time, as the retirement date comes close, the equity allocation is slowly reduced. Finally, once the retirement year is past, the asset allocation stabilizes to a small percentage of equity for growth and a larger share of bonds (and cash) for income generation.

There are several benefits of investing in a target date fund for retirement:

1. Simplicity: One fund to invest in, nothing to track and easy to manage.

2. Diversification: A target date fund is well diversified between equity, debt and cash with a professionally decided asset allocation and glide path that manages risk by rebalancing and moving to a higher portion of safer assets as the retirement date approaches.

3. Emotion-free: The fund's asset allocation and rebalancing plan happens without the risk of overaction or inaction by the investor. Since the investor has no role in deciding how to react due to market movements, it reduces the risk of taking the wrong decisions like panic selling or not rebalancing due to inaction or fear of taxes.

There are two main disadvantages of a target date fund for retirement:

1. Customization: A target date fund does not allow customization. At best you can mix 2-3 TDFs to replicate a custom asset allocation to have some limited amount of control on the asset allocation and glide path.

2. Implementation: Implementation of the target date fund is important from a cost perspective. In India, mutual funds offer tax-free rebalancing inside the fund. However, it is difficult to fund such hybrid funds at lower expense ratios. Most of these funds are also active funds which make it difficult to know what will happen next with the asset allocation due to calls being made by the fund manager. If you are investing in a TDF, you now have AMC concentration risk since TDF underlying funds are usually from the same AMC.

There are several reasons why we need target date funds in India:

1. Indian investors do not invest enough for retirement. More than half of Indian households depend on their children as their retirement fund due to complexity and an excessive number of choices, e.g. there are 10,000+ mutual funds, that make investment planning and management difficult.

2. Indian investors do not invest with a plan. The post-COVID-19 bull run has attracted most of the current mutual fund AuM. However, the average asset per folio is higher in the older folios, which means that the investors who have the conviction to hold into equity are the ones who have built up a substantial corpus

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are target date funds and why do we need them in India for retirement? first appeared on 26 Feb 2023 at https://arthgyaan.com