How to invest in a target date fund for retirement in India?

This article explains how to create a target date fund to simplify retirement planning in India.

This article explains how to create a target date fund to simplify retirement planning in India.

A target date fund (TDF) is a mutual fund created for a long-term goal like retirement. They are popular in the US and are not yet available in India. The premise of a TDF is to allow the investor to invest in a single fund tagged to their desired retirement year. They invest in that fund throughout their earning period and then withdraw from the same fund in retirement. TDFs are typically fund of funds, i.e., mutual funds holding other mutual funds.

This article is a part of our detailed article series on Target Date Funds. Ensure you have read the other parts here:

This article extends the concept of a target date fund for one-time goals like house downpayment for investors in India.

This article introduces the concept of the target date fund and explains why they are a good option for retirement planning.

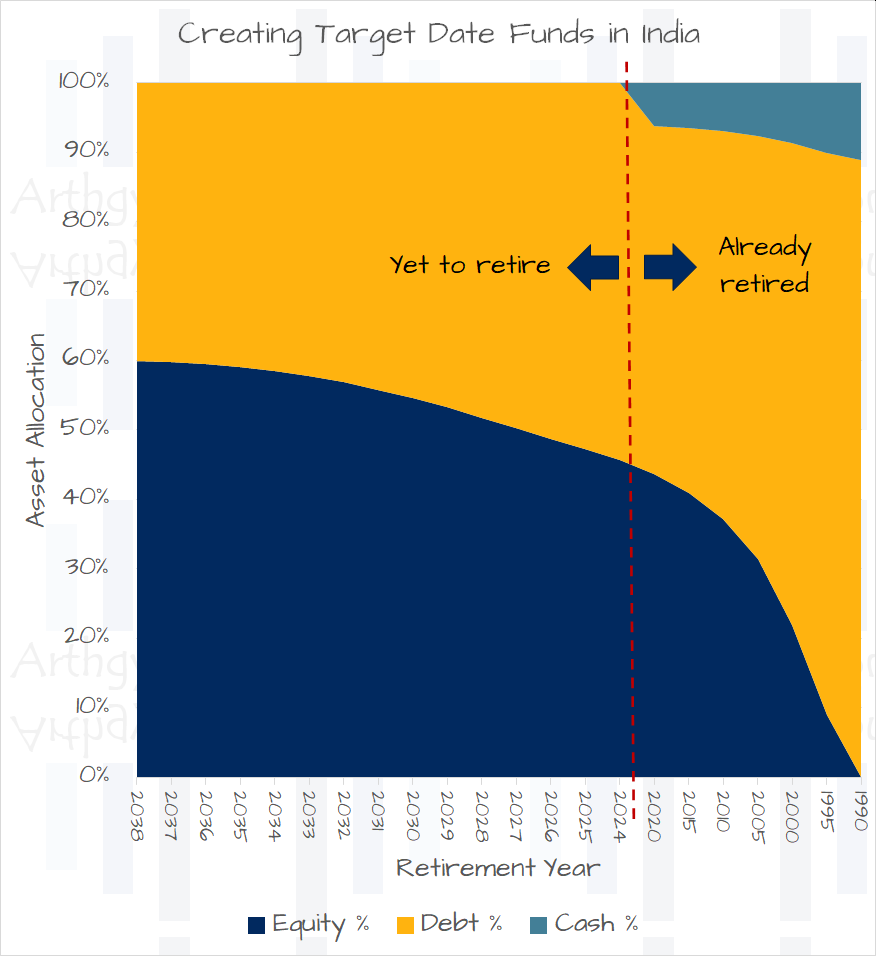

Indian Asset Management Companies (AMCs) do not yet offer a target date fund. This fact means that we will have to create our own. Here’s how to go about it step-by-step:

The year of retirement is well-defined for those in a salaried job. However, professionals like doctors, CAs, lawyers etc., will not have a defined retirement date. Still, they can choose an approximate year after which they will likely scale down their earnings from a peak.

If you are planning to retire early, i.e. go for RE in FIRE, note that the calculations here assume 40 years spent in retirement, which might be too little in your case. Feel free to contact the author directly to understand how to create a TDF for you that will be valid for over 40 years.

Our calculations below assume 40 years spent in retirement. We will take the case of a person retiring in 2035.

Use the Arthgyaan goal-based investing calculator or the web-based calculator to determine the asset allocation of your retirement.

| Retirement year | Years left | Equity % | Debt % |

|---|---|---|---|

| ≥2040 | ≥15 | 60.00% | 40.00% |

| 2039 | 14 | 59.85% | 40.15% |

| 2038 | 13 | 59.55% | 40.45% |

| 2037 | 12 | 59.10% | 40.90% |

| 2036 | 11 | 58.50% | 41.50% |

| 2035 | 10 | 57.75% | 42.25% |

| 2034 | 9 | 56.85% | 43.15% |

| 2033 | 8 | 55.80% | 44.20% |

| 2032 | 7 | 54.60% | 45.40% |

| 2031 | 6 | 53.25% | 46.75% |

| 2030 | 5 | 51.75% | 48.25% |

| 2029 | 4 | 50.25% | 49.75% |

| 2028 | 3 | 48.75% | 51.25% |

| 2027 | 2 | 47.25% | 52.75% |

| 2026 | 1 | 45.75% | 54.25% |

The example above shows that the asset allocation is 57.75% in equity and 42.25% in debt for retiring in 2035. We can create the portfolio in two ways:

🛈 How much to allocate to aggressive hybrid fund?

You can perform rebalancing via switches from the AMC website if these funds are from the same AMC. This feature can vastly simplify the yearly review process.

We can now start a SIP in these funds in the calculated ratio. If there is any lump sum amount that needs to be invested, that amount should also be invested in the same ratio.

📝Note: The asset allocation in the table above assumes “medium” category risk profile of the investor. If your risk profile is more aggressive, then you should choose a fund with a retirement date after your actual one. Conservative investors should choose a fund with a retirement date that is before their actual year.

The calculation above is for investors who are not retired. If you are already retired, you can use this asset allocation:

| Retirement year | Years past | Equity % | Debt % | Cash % |

|---|---|---|---|---|

| 2020 | 5 | 43.72% | 50.03% | 6.25% |

| 2015 | 10 | 41.00% | 52.44% | 6.56% |

| 2010 | 15 | 37.20% | 55.82% | 6.98% |

| 2005 | 20 | 31.50% | 60.89% | 7.61% |

| 2000 | 25 | 22.00% | 69.33% | 8.67% |

| 1995 | 30 | 9.00% | 80.89% | 10.11% |

| ≤1990 | 35 | 0.00% | 88.89% | 11.11% |

Since we have two funds in the portfolio, we must rebalance by ourselves after a year of starting. A year later, the investor is still retiring the same year. Therefore, the asset allocation has changed to a more conservative one. Specifically, the original year of retirement was 10 years away. Now it is 9 years away, the asset allocation needs to be, as per the year left = 9 row in the above table to be 56.85% in equity and 43.15% in debt. You need to rebalance your portfolio to reach the new asset allocation, readjust the SIP proportions and move on.

We will repeat the rebalancing exercise at least once a year or preferably after major market movements.

We review the positives and negatives of TDFs from our introductory article, What are target date funds and why do we need them in India for retirement?, one by one against the implementation we have proposed above.

A single-fund TFD cannot be created in India since no AMC offers it. However, if the investor follows the process described in this article, it is a relatively simple process that needs to be implemented:

If you can locate an out-of-the-box solution that does this, you should use that.

We have chosen an asset allocation and glide path that offers a reasonable chance of meeting retirement goals per our goal-based investing framework. We will share the results in a future article.

There are two ways to implement a target date fund-based retirement portfolio:

An alternative TDF implementation can be found in SEBI’s recent proposal on New Asset Class strategies.

The plan implemented in this article is fully customisable per the investors’ requirements like their investing experience, risk profile and goals.

There are two aspects to the concept of minimising costs. Fund management charges like total expense ratio (TER) and rebalancing charges due to tax are the two primary cost sources in a portfolio.

Suppose you are implementing a TDF of your own. In that case, you can minimise AMC concentration risk by choosing different AMCs for each of the funds. However, if you invest in funds from different AMCs, you must sell and buy in two separate transactions.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to invest in a target date fund for retirement in India? first appeared on 01 Mar 2023 at https://arthgyaan.com