Why parents should invest for the downpayment of their child's first home?

This article explains why parents should add a new goal in their financial plan to save for their child’s first home in a major metropolitan city.

This article explains why parents should add a new goal in their financial plan to save for their child’s first home in a major metropolitan city.

🎉 Our second anniversary is in March 2023

Source: © Twitter

The above image has recently gone viral on social media due to rents in cities like Bangalore increasing 30-40% compared to the pre-COVID period. Our thesis in this article, what buying a home in a major city is essential, is based on two observations:

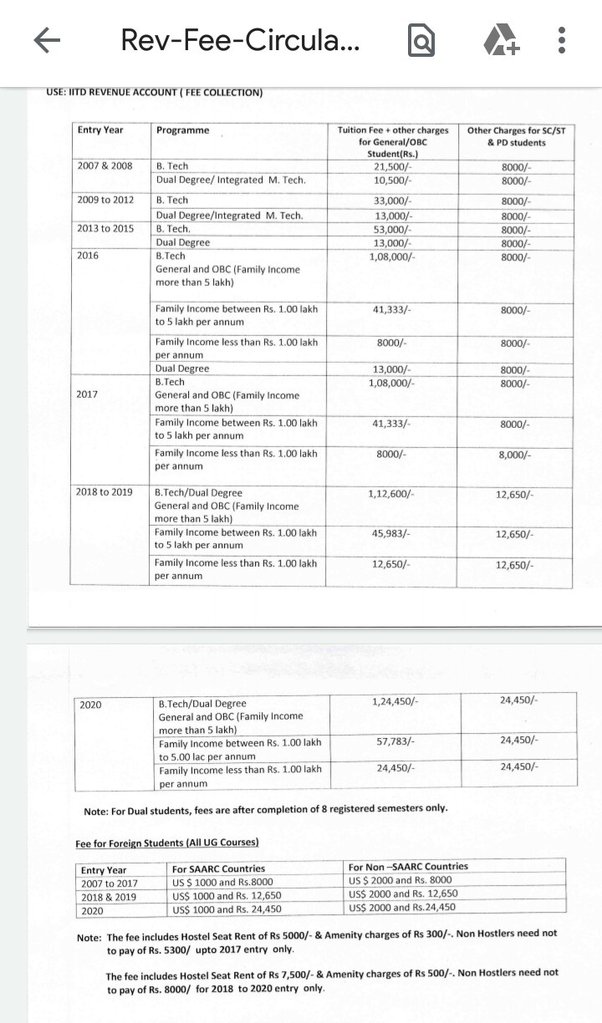

For the first point, here is an image showing how fast IIT fees have increased over the last 15 years.

Source: © Quora

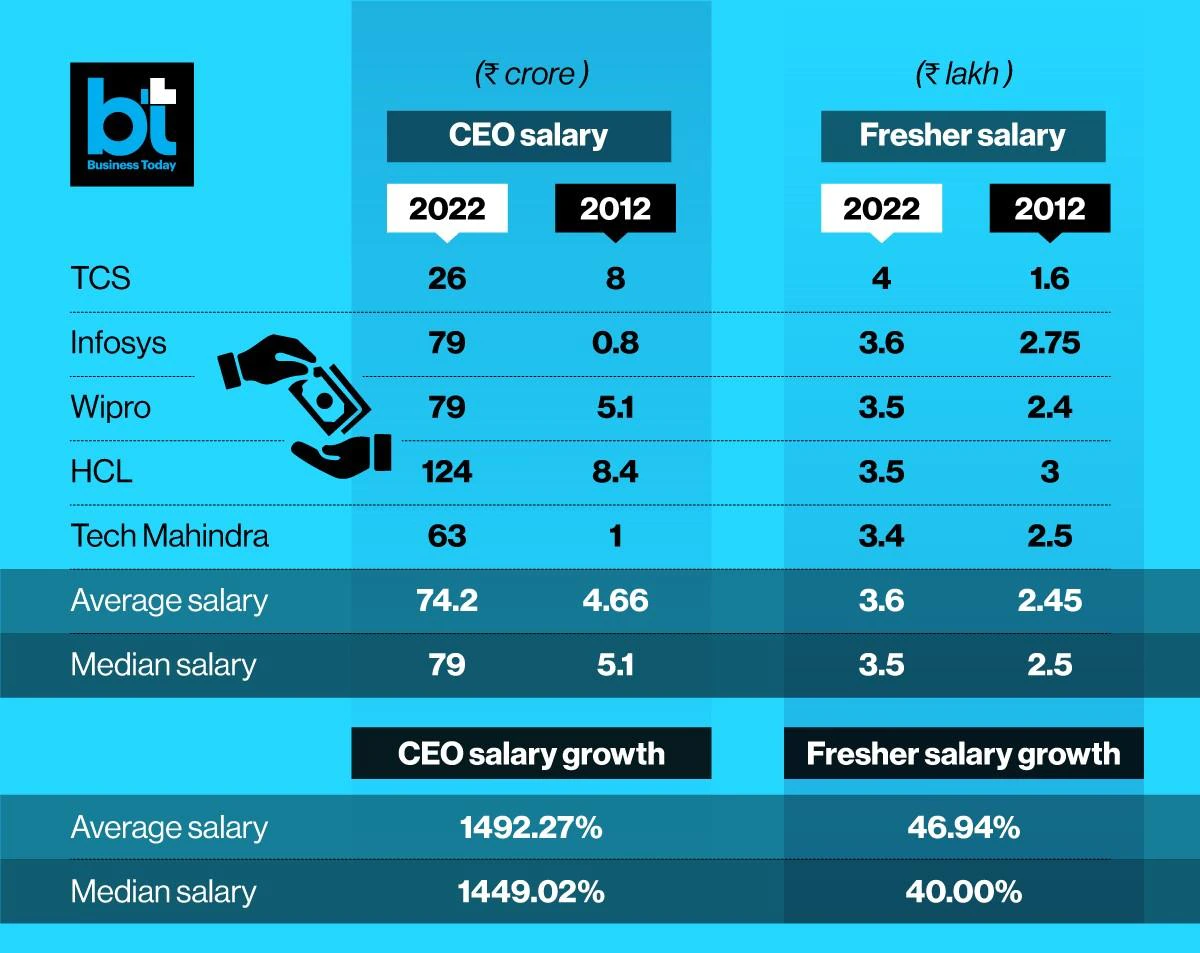

Fees in private colleges have grown faster, especially for medical degrees. In contrast, starting salaries, taking IT fresher intake as an example, have seen slow growth.

Source: © Business Today

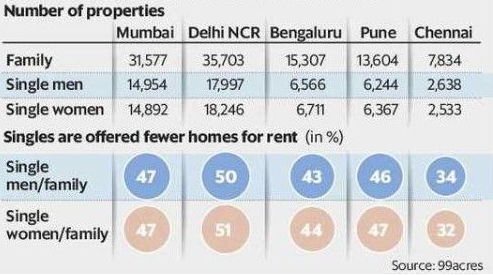

In major cities of India, where most of our children will be starting their careers, there is a much smaller proportion of houses available for singles / bachelors.

Source: © Livemint

This phenomenon, while not new, makes house hunting a difficult proposition for many new joiners.

In such a situation, the combination of

builds a strong case for creating a real-estate asset solely to stay in it, not investment, at the beginning of the career. If the house purchase is delayed, we are implicitly assuming that the child or parent has the ability to create greater wealth via financial assets, like mutual funds.

The fundamental investing and income equation applicable to this case is

Lifetime income of both parents and child is used to fund

education, house purchase and other child-related goals

Whether there is an educational loan, a home loan, or both, the parent and child ultimately pay for these goals. There is no alternative.

If the child starts their first job in a major Tier 1 city, it can be chosen for the house. If they later shift jobs and go somewhere else, the house can be sold or given on rent, and the same rent can be used for the new city.

To make it easier to sell the property when needed, under-construction properties, though cheaper, should be avoided.

If the city is not a major Tier 1 city, choose one in the nearest big city of the same region where the parents can be selected. For example, if the parents are from the north of India, Delhi NCR may be chosen. Or if they are from the South, then Chennai/Bangalore/Hyderabad etc, may be selected. The same logic can be extended pan-India.

There are three things to keep in mind here:

Under-construction properties may go into dispute or face delays and, therefore, should be avoided.

Recently completed apartment complexes of big brands, where many young families are already staying, can be an option. Choose the size (2/3/4 BHK) depending on where the decent amount of demand is so that exiting is easy later.

There is always the possibility that the child goes abroad for higher studies or job opportunities. In such a case, there are two options:

The house purchase can be structured in this way:

As long as the loan is active, the parent should maintain partial ownership, up to and not beyond 50% of the asset. Once the loan is paid off, the parent may choose to withdraw their ownership claim on the asset, replacing their ownership with that of the child’s spouse, if any.

You cannot take a loan for retirement

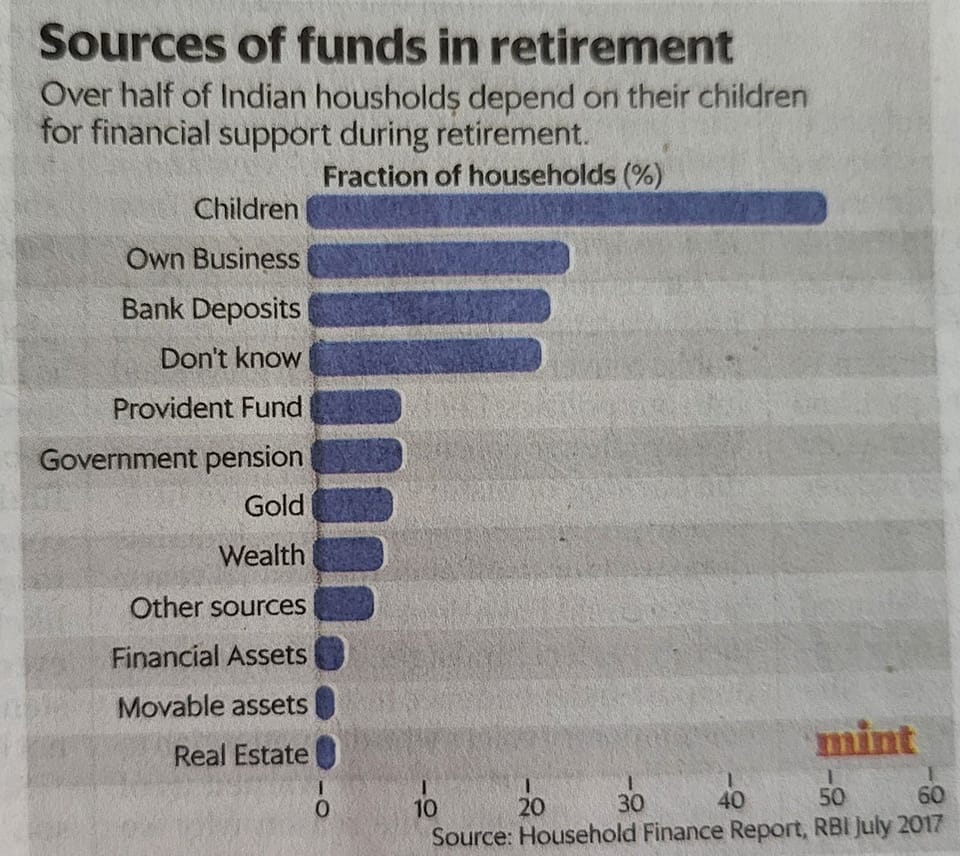

The priority of the parents when they are investing their money is to invest for their retirement.

Image © livemint.com

Image © livemint.com

If their retirement is sorted, they need not depend on their children for financial support when retired. We have also written about this concept: Do you need to pay for children’s education or marriage?

We are, therefore, talking about those parents who have enough investible surplus for their child’s goals like college education, marriage and now house down-payment. If there is a need to prioritize between these goals, here is an easy framework to use:

Of course, you can take loans for all of these goals, but then again, ultimately, someone like the child, parent, or both will be paying the EMI of those loans.

Our goal-based investing framework, for children, already has house down-payment as a built-in goal. You can learn more about it here: Goal-based investing: How to save for children’s future.

Parents can pay part or whole of the down-payment and other closing costs, while the child pays the EMI on a best-efforts basis. Any EMI amount the child cannot pay needs to be paid by the parent.

If the child starts their first job in a major Tier 1 city, it can be chosen for the house. If they later shift jobs and go somewhere else, the house can be sold or given on rent. To make it easier to sell the property when needed, under-construction properties should be avoided. If the city is not a major Tier 1 city, choose one in the nearest big city of the same region where the parents can be selected. The same logic can be extended pan-India.

The property should not be too big or too small, easy to buy now and sell later, and the builder should be reputed and not currently under any dispute. Recently completed apartment complexes of big brands, where many young families are already staying, can be an option. Choose the size (2/3/4 BHK) depending on where the decent amount of demand is so that exiting is easy later.

If the child goes abroad for higher studies or job opportunities, the property can be sold to fund the course or settling-down/property down payment costs in the new country. It is essential to buy a property that is easy to sell. Alternatively, the property can be kept on rent if there are adequate assets in the family, and keep the option open for the child to return to India and stay in their own house.

The parent pays part or whole of the down-payment and other closing costs while the child pays the EMI on a best-efforts basis. Any EMI amount the child cannot pay needs to be paid by the parent. As long as the loan is active, the parent should maintain partial ownership, up to and not beyond 50% of the asset. Once the loan is paid off, the parent may choose to withdraw their ownership claim on the asset, replacing their ownership with that of the child's spouse, if any.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Why parents should invest for the downpayment of their child's first home? first appeared on 05 Mar 2023 at https://arthgyaan.com