Do you need to pay for children's education or marriage?

This post describes a guilt-free way to prioritize goals for children (education/marriage) over our own retirement

This post describes a guilt-free way to prioritize goals for children (education/marriage) over our own retirement

Every parent considers children’s education to be their most important financial goal. After all, a degree from a prestigious institute like IIT, IIM, AIIMS, Oxbridge or MIT opens up unlimited opportunities. Similarly, a child may wish to pursue a career in arts, music, theatre, science or commerce from any global university or school of repute.

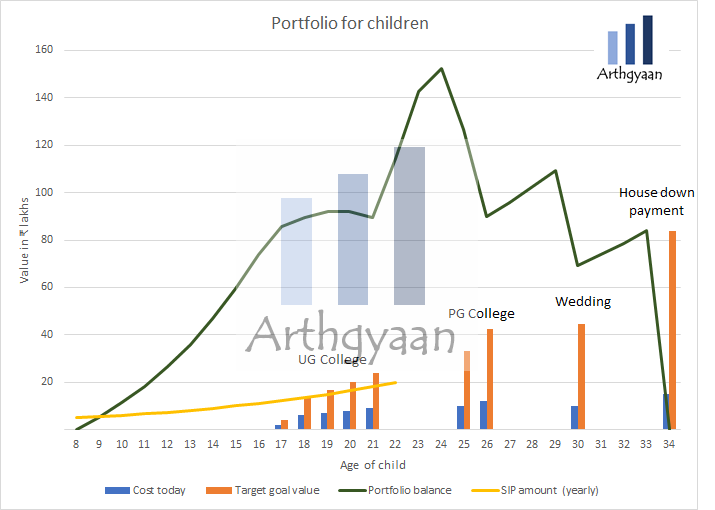

The common thread in all these courses is high course and living fees. The parent needs to invest in advance to reach the necessary corpus. This requirement leads to a question of prioritization vs other financial goals like retirement. Additionally, parents typically wish to pay for a lavish wedding for their children, further stretching the investment needed every month.

This post describes various alternatives in prioritizing investments in these three different goals: retirement, education and marriage to help parents make the right decisions for their families.

As discussed in this post, spending the equivalent of ₹ 1 lakh/month in retirement starting 20 years from now needs a SIP of 1,38,327/month.

Similarly, saving ₹ one crore in 10 years, in time for the child’s education needs SIP of ₹ 56,710/month. The same post shows that saving ₹ 50 lakhs in 20 years, in time for the wedding, needs a SIP of ₹ 8,089/month.

These three SIP amounts add up to over ₹ two lakhs/month. The challenge is to manage these goals if only ₹ 1.5 lakhs/month, for example, is available for investing.

Investing for retirement is usually a substantial component during goal-based investing due to:

Inflation: the impact on your goals and how to choose assets that beat it

The hard reality is that you cannot take a loan for your retirement expenses. Every expense has to come from some form of asset you own: retirement corpus, annuities, second house giving rent or reverse mortgage from the primary residence. Beyond this, there is no other source of money beyond depending upon relatives and children.

A college degree that leads to a job, in the simplest form, is the first step in the journey towards economic independence in the traditional way. The bedrock of the career is the education that allows achieving financial freedom. In a certain way, the ROI of education is infinite since it is an investment for creating an economic asset.

Here we are making an implicit assumption that the course is worthwhile for earning potential from a suitable college. Otherwise, it may be wasteful to spend a lot of money for a degree that may not provide the desired benefit. We need to be mindful of the ROI based on degree cost (both direct and opportunity) vs future earning potential.

Direct cost has multiple components:

There are three sources of funding for a college degree:

Corpus accumulated via goal-based investing comes under this category.

There will be various sources of scholarships that will require some ingenuity in digging up. Institutes, corporates, governments and foundations offer scholarships that you need to identify. Do not self-reject by not applying for a scholarship because you feel you do not fit the criteria. Once you get the grant, ensure you meet any ongoing requirement of marks/grades.

Depending on what is allowed by the college, freelancing, tutoring or side jobs can be a source of income. Beyond the traditional jobs typically done by students (e.g. waiters in a US college town), the so-called Creator Economy can be a source of revenue as long as it does not distract from the main objective of getting an education.

Based on the institute/course reputation (like IIT degrees), banks offer collateral-free education loans that are easy to get. Collateral-based loans are also available for education both in India and abroad. Another source for loans is alumni bodies of the institutes or new-age startups that specifically lend to premium college applicants with a joining offer.

Many of these loans offer no or simple interest during the course period and easy repayment terms. Be mindful of balancing the loan amount vs. the future salary potential.

In many cases, depending on the student’s temperament, taking an educational loan can instill discipline towards getting the degree. Otherwise, there might be a tendency of taking things easy because of free money.

Parents can prioritize funding for college like this

Once the loan EMI starts, offer to match the EMI on a 100% basis every month directly to the lender. This method has multiple benefits

People level criticisms at marriage-related costs like

However, most schools of thought consider marriage a special event that creates a lifetime of memories and experiences.

Spending for marriage can be an exercise in partnership between the parents and the child getting married. The parents contribute towards a base level of expenses. The children pay for whatever extras they desire. The parents can choose the base level as whatever is remaining in the corpus of the parent after they fund the retirement and education goals.

Ultimately, the choice is personal for both the parent and to some extent for the children. There are financial and emotional aspects that cannot be quantified in a spreadsheet but that does not mean that some general thumb rules and optimizations cannot be followed.

We are seeing that education degree costs are going up all over the country while starting salaries remaining stagnant. If you add to this higher rents in major cities, it is essential that down-payment of the child’s first home enters the parent’s goal-planning process at a priority higher than marriage goal. We have covered this topic in detail here: Why parents should invest for the downpayment of their child’s first home?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do you need to pay for children's education or marriage? first appeared on 08 Aug 2021 at https://arthgyaan.com