How to become a crorepati in 10 years?

This post shows how to reach a goal like 1 crore in 10 years or any such amount in any time you want

This post shows how to reach a goal like 1 crore in 10 years or any such amount in any time you want

A crore is a very large amount for someone who is just starting to invest. It is also a very aspirational target for anyone who has been investing for some time since the first crore of corpus is always special.

We will use the plan Excel workbook as the base for these calculations. There are some assumptions that need to be made in order to get started

The choice of funds for both equity and debt comes after this but does not impact the SIP amount.

In the Excel sheet, the cells in yellow are assumption cells that can be edited.

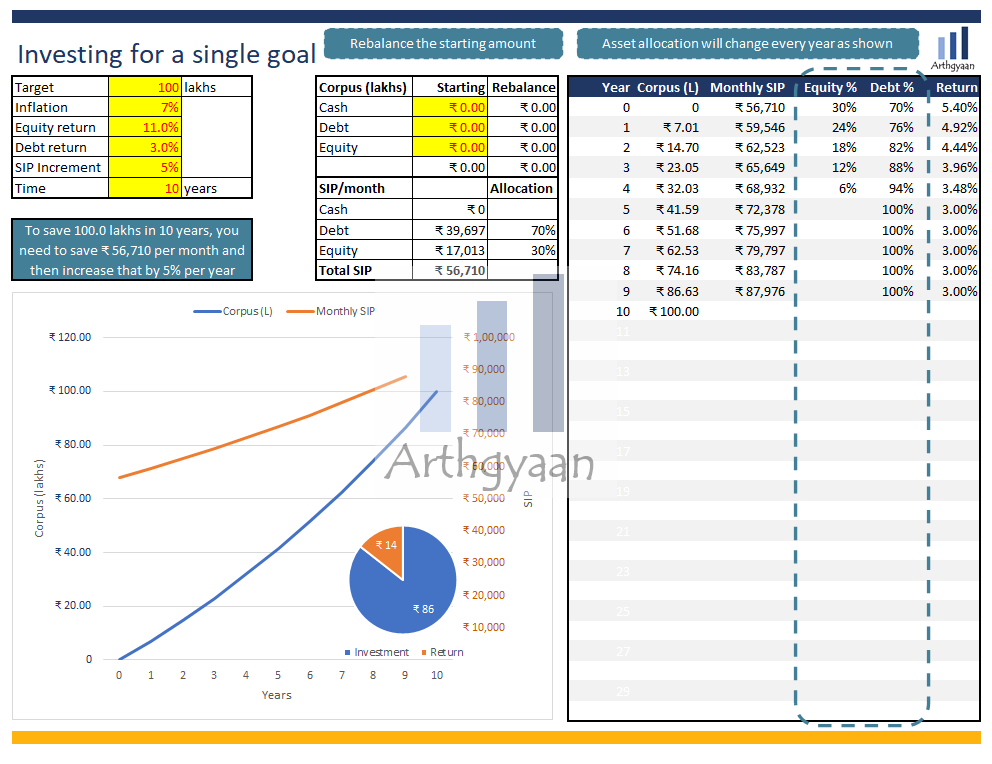

We see that a SIP amount of ₹ 56,710 with a split of 30% in equity (₹ 17,013 as SIP amount) and 70% in debt (₹ 39,697 as SIP amount). This SIP is run for one year and then rebalanced: the new corpus is split 24:76 into equity and debt and a new SIP is started. As the pie chart shows, ₹ 86 lakhs is the expected investment over 10 years and ₹ 14 lakhs is the return on the investment. A few things that need to be noted:

While the table and the chart shows a smooth and linear growth, in real life the returns will fluctuate and the actual path will be different. Here is a calculator that can help you estimate how much you need to invest to reach ₹1 crore:

Required Monthly SIP (₹):

Total Investment (₹):

Target Value (₹):

Inflation-Adjusted Value (₹):

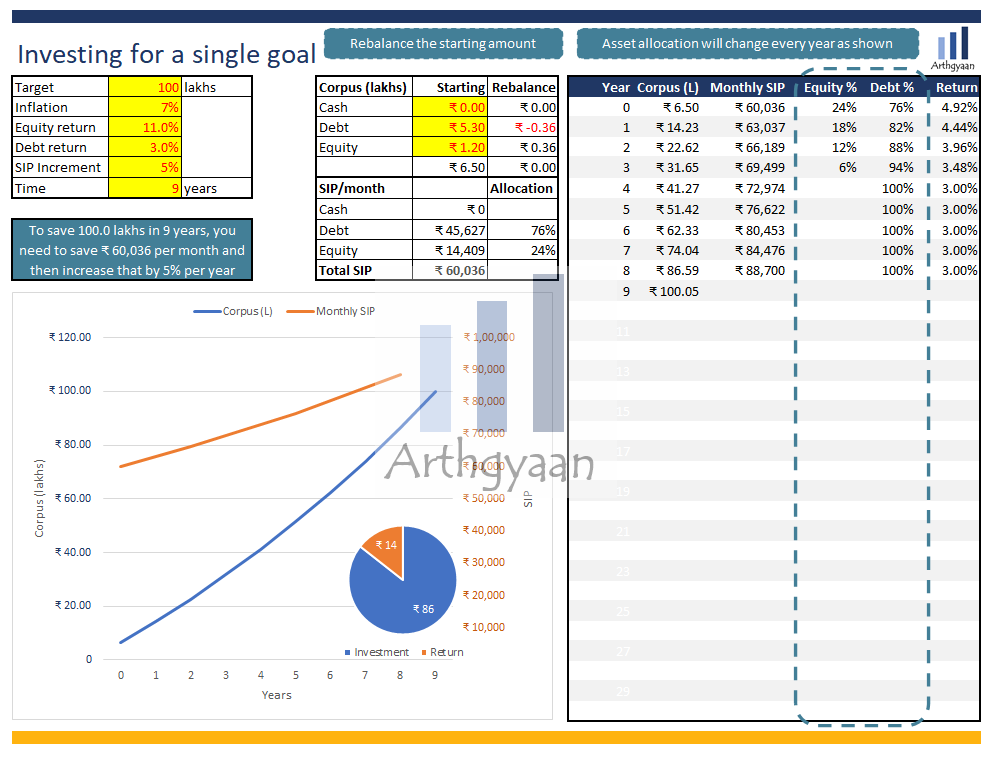

If you found this useful, check out the Arthgyaan step-up SIP calculator.This is a very important step since just by starting a SIP, there is no guarantee that the goal will be reached. After one year, this is now a 9-year goal with some non-zero corpus (say ₹6.5 lakhs - should have been ₹ 7.01 lakhs but the market gave lower return), a new asset allocation (24:76 equity to debt) and a new SIP amount of ₹ 60,036 (₹ 14,409 in equity, ₹ 45,627 in debt) as shown below. The SIP is bumped up by 5.9% from ₹ 59,546 (previous estimate for the second year) to ₹ 60,036 due to the underperformance in equity. Also, there is a requirement to rebalance as well between debt, equity and cash that needs to be done every year to ensure the appropriate asset allocation is adhered to.

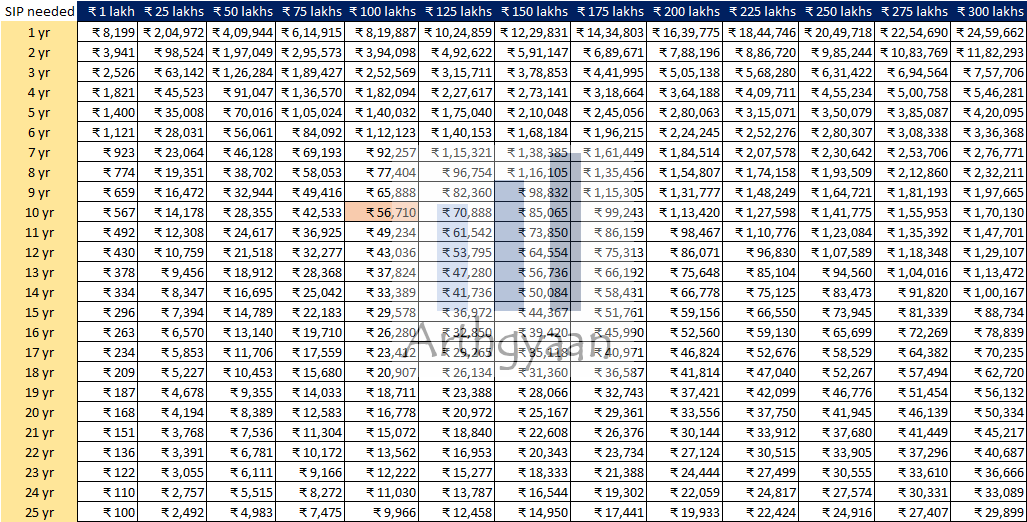

Using this Excel workbook, you can plan for any target amount for any period of time from 1 to 30 years. Some sample SIP values (starting with zero lump sum investment) are shown below:

Due to inflation, the worth of ₹ 1 crore will be almost ₹ 50 lakhs or less in 10 years. This is because, at 7% lifestyle inflation (this will obviously be different from government figures), the value of 100 lakhs in 10 years is reduced to 100/(1+7%)^10 ~= 50 lakhs. This means that you can purchase, after 10 years, only that which costs 50 lakhs today. To purchase what costs 1 crore today, you need to target 100 * (1+7%)^10 ~= 2 cr in 10 years.

Inflation: the impact on your goals and how to choose assets that beat it

As we have covered here on the requirement to set goals before investing, just by having a numeric target like 1 crore in 10 years does not serve any purpose. The question you need to ask is - what am I supposed to do with 1 crore? Where will I spend it? What will that 1 crore become in 20 years? These questions will lead to the next step of the journey and provide the necessary clarity.

These posts cover the entire goal-based investing journey in detail:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to become a crorepati in 10 years? first appeared on 23 Jul 2021 at https://arthgyaan.com