How should you invest for goals after your retirement or FIRE?

This post shows how to reach a goal without saving throughout the time horizon of the goal

This post shows how to reach a goal without saving throughout the time horizon of the goal

As we showed in our article of creating a corpus of 1 crore in 10 years, you can reach that goal by investing in debt and equity assets every year, and performing a review/rebalancing throughout the journey. There is another case where you can invest only for a limited period which less than the goal horizon and this post deals with such cases.

Some examples are:

In such goals, there are two distinct phases,

When the tipping point comes, enough corpus must be reached so that the goal can be achieved within the return expectations in the next phase since, after this, the corpus needs to grow without additional contributions. There is a risk here that is discussed below.

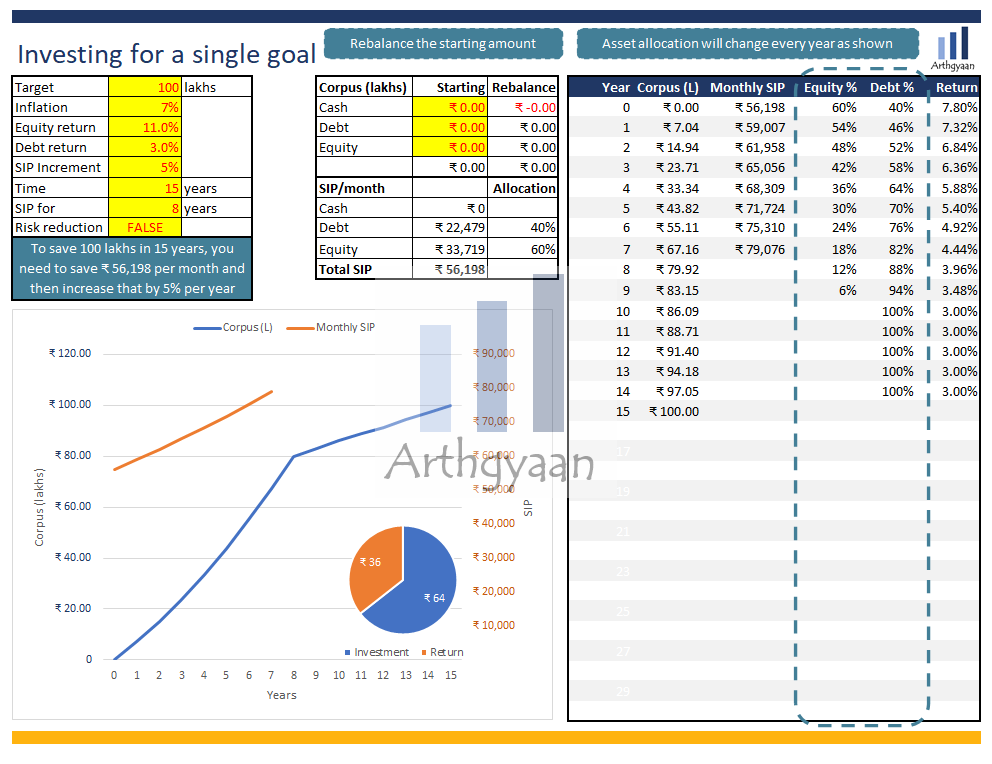

We show a situation where a target corpus of ₹ 1 crore needs to be reached in 15 years for a child’s education goal which is expected to occur 7 years after the parent’s retirement. Investments are happening for only the first 8 years in this goal.

This is a fairly straightforward process as described in the standard single goal investing process:

In this case, we start saving ₹ 56,198 as a monthly SIP (60% in equity, 40% in debt) and increase that by 5% a year. We expect to invest ₹64 lakhs of capital over the next 8 years and stop investing after that.

We need proper risk management in phase 2 by slowly reducing the equity component over time. In the example at the point when phase 2 begins, the corpus has 12% in equity which is reduced to 0% in the next 2 years so that when 5 years are left, the corpus is fully in debt assets that maximize the chances of hitting the 1 crore goal by shifting to safe debt instruments like bank FD or suitable debt mutual funds.

As mentioned earlier, there are two risks when the second phase starts:

In the example above, the corpus needs to be ₹80 lakhs after 8 years of investing to reach the 1 crore target in another 7 years. If the corpus is lower, then additional money has to be brought in at this stage or the goal amount will not be reached. If there is excess corpus, it can be repurposed for other goals.

On the other hand, if your income increases steadily or there is a windfall gain, say from a rich relative or sale of real-estate, you might reach a stage where there is no need to invest more. At this point, the corpus you have is enough to grow on its own to reach the target value on its own. This is the concept of CoastFIRE.

Depending on the asset allocation at the point when SIP stops there could be a risk of falling short in case of a fall in equity markets. This is the same as the standard sequence of returns risk where you need to leave a corpus exposed to market movements without the ability to add additional capital.

To mitigate this risk you need to

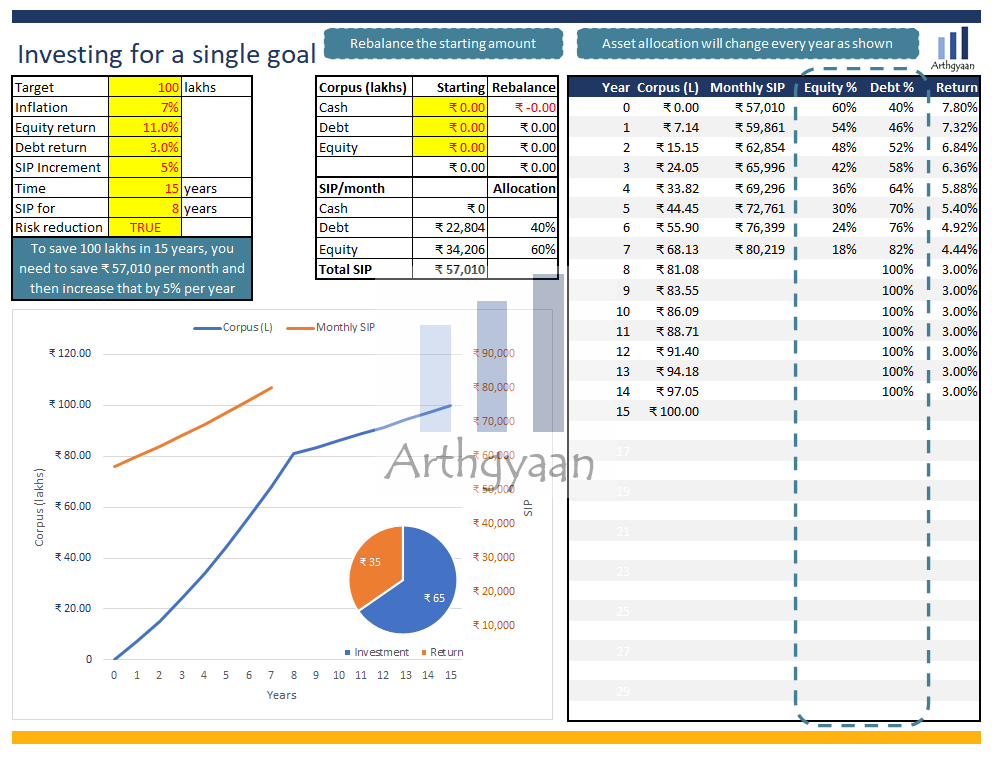

In both cases, more investments are needed and it is the only way to mitigate the sequence of return risk. The lower return in the more conservative second phase is compensated by investing a bit more in the accumulation phase.

Using the same example as before, we start at a higher SIP amount than before i.e. ₹ 57,010 and target reaching a higher corpus of ₹ 81.08 lakhs in 8 years. Once we reach this point, the entire corpus is shifted to safe debt instruments like bank FD or suitable debt mutual funds so that reaching the target 1 crore corpus is most likely. In the Excel sheet, we toggle the “Risk reduction” flag to TRUE to achieve this change in phase 2 asset allocation.

This is the Excel workbook used to create the examples.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How should you invest for goals after your retirement or FIRE? first appeared on 27 Jul 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.