What is the lifecycle of a goal?

This article talks about what you need to do once you start investing for a goal throughout the time horizon.

This article talks about what you need to do once you start investing for a goal throughout the time horizon.

The first step for reaching your financial goals is to identify why you are investing and follow the goal-based investing process. Instead of looking at the problem as “Where should I invest?” goal-based investing starts with the problem statement framed as “Why should I invest?”. We have discussed this before: How Goal-based investing helps you to cut through the clutter and lets you get started with investing.

In this article, we will describe the process after you start investing. The following approach is for a goal with a single payment like a house down-payment, car purchase or child’s marriage. On the other hand, multi-payment goals like college education, recurring vacations, and retirement are a sequence of single payment goals. Therefore, we will handle them in the same way.

The lifecycle of a goal is like this:

At this stage, you are identifying the goal itself, which requires discussion with family and introspection with self to understand the priorities. We have covered this point in considerable detail here:

The goal-based investing process can be described in the above diagram and is covered in considerable detail in this post: I am now ready to do goal-based investing. What now?.

We will move on to the details of the following stages since that is the main point of this post.

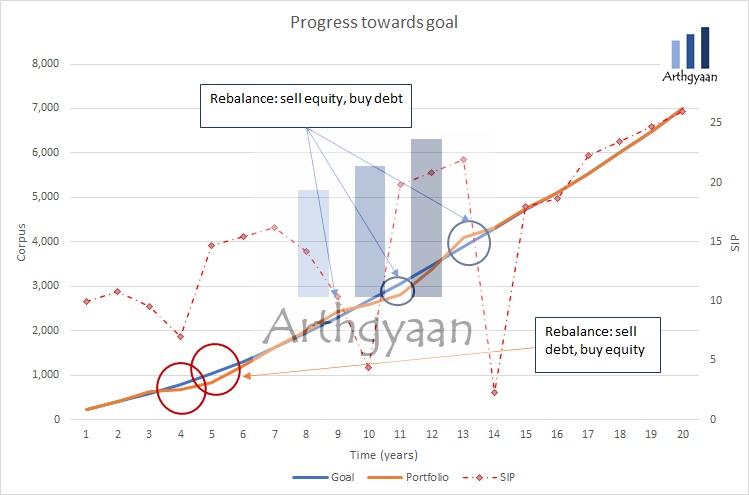

Once you start investing, the process looks like the image above. The blue line is the goal that increases at a smooth rate over the goal horizon of 20 years. This line is smooth since this is theoretical, assuming average returns from the assets in the portfolio, which would typically be equity and debt. The SIP amount is expected to increase linearly by a fixed percentage (like 5% or 10%) to accommodate rising income.

In real life, however, there will be two changes:

The first point (unpredictable returns) is countered using the concept of rebalancing, which manages portfolio risk and by following a glide path. The glide path progressively reduces the exposure to risky asset classes as the goal comes closer, thereby locking in the returns at every point. These two concepts are discussed in more detail here:

The orange line is the portfolio that fluctuates due to market risk. You are essentially trying to keep the orange line above the blue at all times by adjusting the SIP amount and rebalancing to manage risk.

The table shows a case where a goal is started with a lump sum of 100 and a SIP of 10 (increasing at 5% yearly) for 20 years. Assuming average equity returns of 15% (according to historical data) and 3% debt returns, we can expect to reach 7000 in 20 years. We will simulate a path via Monte Carlo simulation (normal return distribution, 15% mean, 20% risk) to show how the goal behaves over time. We will rebalance yearly as per the glide path (60% equity at 15 years or more, 0% equity at five years or less, linearly changing in between). We will deal with shortfalls (and excesses) by adjusting the SIP amount. We assume that the returns are post-tax to keep the calculations simple.

Inflation: the impact on your goals and how to choose assets that beat it

Note: The points we make in this article do not change if a different return expectation is used for the simulation. However, investors should keep in mind that they are takers of market returns and must set their goals with reasonable return expectations from risky asset classes like equity. A more realistic long term equity return expectation will be around 3-4% above inflation. Debt returns will be slightly below inflation. Read more: Can debt funds beat inflation?.

It is critical to note that the SIP amount cannot be arbitrarily increased beyond a limit since income is finite. There could be a situation where your goal ends up in a no man’s land where you have lost too much due to a falling market and there is no time to catch up as per the allowed asset allocation. In such a situation, the target corpus that will be reached will be lower than the desired value. This is an example of the sequence of returns risk. Read more on that here: How does the sequence of return risk affect your goals?.

In the example table above, the increase in SIP amount is limited to not more than 20% of the SIP of that particular year. The example has a specific sequence of returns that leads to success as per this constraint on the maximum SIP amount and the series of returns generated by the simulation.

Readers should note how the -48% equity return in year 18 has no impact on the goal since the portfolio is completely moved out of equity at this point. On the flip side, the 46% return in Year 13 has limited impact on the portfolio since only 18% of the portfolio is in equity at this point. The process of reducing the equity allocation over time prevents extreme events of both types once the corpus has become large.

On the other hand, if your income increases steadily or there is a windfall gain, say from a rich relative or sale of real-estate, you might reach a stage where there is no need to invest more. At this point, the corpus you have is enough to grow on its own to reach the target value on its own. This is the concept of CoastFIRE.

The purpose of goal-based investing is to have a sum of money ready on the date needed for the exact amount that was predicted. We are deliberately not showing the calculation of the portfolio XIRR since that is not relevant here. The objective is to reach the goal, not get a particular XIRR. The sequence of returns that we will get is not under our control, but the amount we choose to invest (up to reasonable limits) is what we can control by increasing our human capital. Human capital is covered in more detail here: Your human capital, not investment returns, is your biggest wealth creator.

The compounding formula shows why the previous statement is true. We do not have control over the “r” term since that is what we get from the market. However, the rest of the terms - how much to invest and how long to stay invested - are both under our control. Read more here: 12 mistakes that interrupt compounding: what to do instead.

Therefore, investors are urged to approach investing using the goal-based approach instead of just starting a SIP and hoping for the best. The investing process: goal definition, asset allocation, review, and rebalancing are crucial for successfully achieving the goal. We have evidence here that goal-based investing works for long-term goals in India: Goal-based investing: does it work in India? which you can implement for yourself using the Arthgyaan goal-based investing tool. Once you implement goal-based investing, you can reach your goals irrespective of stock market returns: How did the Indian stock market perform last year?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the lifecycle of a goal? first appeared on 03 Jan 2022 at https://arthgyaan.com