Goal-based investing: does it work in India?

This article shows the historical performance of applying goal-based investing principles to single payment goals in India and whether it has worked for reaching the desired corpus.

This article shows the historical performance of applying goal-based investing principles to single payment goals in India and whether it has worked for reaching the desired corpus.

This article is part of a series

Goal setting helps you understand the priorities of your life, set the future of you and your family, understand the various money-related challenges that come and be best prepared for the future financially. Goals give direction and momentum to your financial life:

You will hurt your chances of creating wealth via compounding if goals are not set.

Once you have set a goal, you need to start investing as per these detailed steps: I am now ready to do goal-based investing. What now?.

This article uses historical data to check if the goal-based investing process described above really works in reaching the desired target corpus.

We will start with testing single expense goals, like a house down payment, car purchase or child’s marriage and see if we are reaching the target amount after investing.

The critical assumption needed to start investing is the expected returns over the investment horizon. Suppose you plan to save for a house down payment, for example, in five years. In that case, you need to assume the returns of your investments over this period to calculate how much you need to invest.

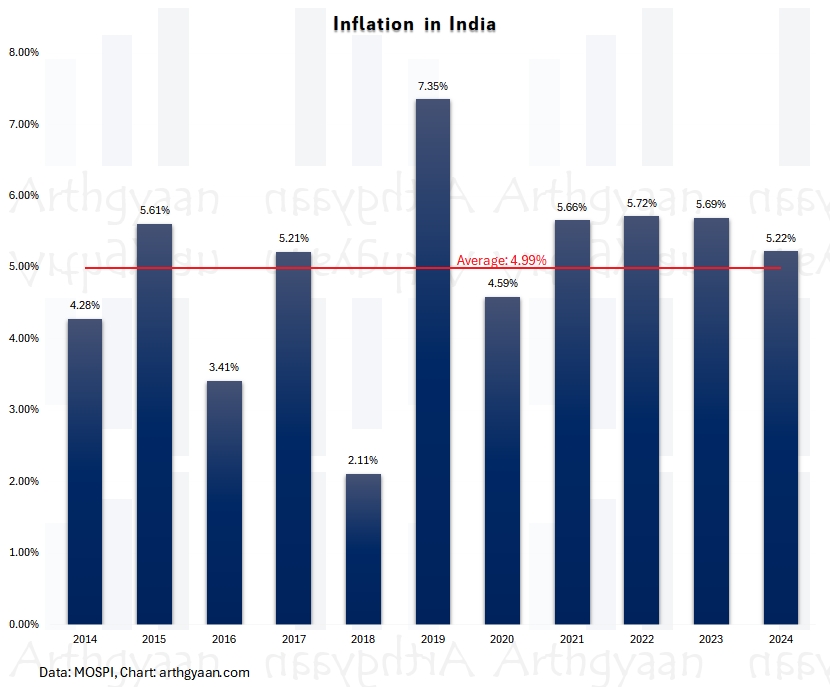

We have multiple data points available to us when we decide to invest. One example is the historical returns of asset classes, like debt and equity, via mutual funds. We also have inflation data for the country as a whole available to us:

We will consider historical data from 1996 for equity (Sensex Total Return Index) and debt (money market fund).

In this example, we will use the inflation data for the last ten years and use that to predict the returns like this:

Equity return = Inflation + 3%

Debt return = Inflation - 2%

Here the offset to inflation is the risk premium.

We will combine the risk premiums with inflation like this:

Expected return = (1 + Inflation) * (1 + Risk Premium) - 1

We get for a 60:40 asset allocation, the expected returns, with 7% inflation and risk premiums as 3% and -3%, respectively, as:

Equity return = 1.07 * 1.03 - 1 = 10.21%

Debt return = 1.07 * 0.97 - 1 = 3.79%

60:40 portfolio return = 0.6 * 10.21 + 0.4 * 3.79 = 7.642%

While this value of 7.642% is higher than inflation, we progressively reduce the asset allocation to more conservative values as the goal becomes closer. This derisking reduces the average return from 7.642% to a lower figure.

| Time left | Equity % | Debt % | Weighted return % | Average return % | Real return |

|---|---|---|---|---|---|

| 25 | 60% | 40% | 7.642% | 6.166% | -0.779% |

| 24 | 60% | 40% | 7.642% | 6.105% | -0.836% |

| 23 | 60% | 40% | 7.642% | 6.039% | -0.898% |

| 22 | 60% | 40% | 7.642% | 5.967% | -0.966% |

| 21 | 60% | 40% | 7.642% | 5.888% | -1.040% |

| 20 | 60% | 40% | 7.642% | 5.801% | -1.121% |

| 19 | 60% | 40% | 7.642% | 5.705% | -1.211% |

| 18 | 60% | 40% | 7.642% | 5.598% | -1.310% |

| 17 | 60% | 40% | 7.642% | 5.479% | -1.422% |

| 16 | 60% | 40% | 7.642% | 5.345% | -1.547% |

| 15 | 60% | 40% | 7.642% | 5.194% | -1.688% |

| 14 | 54% | 46% | 7.257% | 5.021% | -1.849% |

| 13 | 48% | 52% | 6.872% | 4.851% | -2.008% |

| 12 | 42% | 58% | 6.486% | 4.684% | -2.164% |

| 11 | 36% | 64% | 6.101% | 4.522% | -2.316% |

| 10 | 30% | 70% | 5.716% | 4.365% | -2.462% |

| 9 | 24% | 76% | 5.331% | 4.217% | -2.601% |

| 8 | 18% | 82% | 4.946% | 4.078% | -2.731% |

| 7 | 12% | 88% | 4.560% | 3.955% | -2.846% |

| 6 | 6% | 94% | 4.175% | 3.854% | -2.940% |

| 5 | 0% | 100% | 3.790% | 3.790% | -3.000% |

| 4 | 0% | 100% | 3.790% | 3.790% | -3.000% |

| 3 | 0% | 100% | 3.790% | 3.790% | -3.000% |

| 2 | 0% | 100% | 3.790% | 3.790% | -3.000% |

| 1 | 0% | 100% | 3.790% | 3.790% | -3.000% |

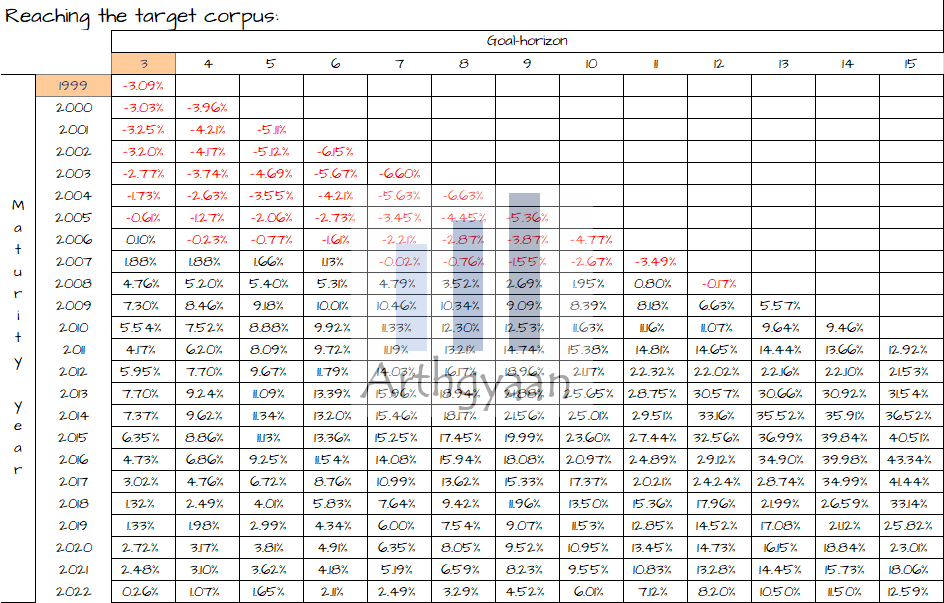

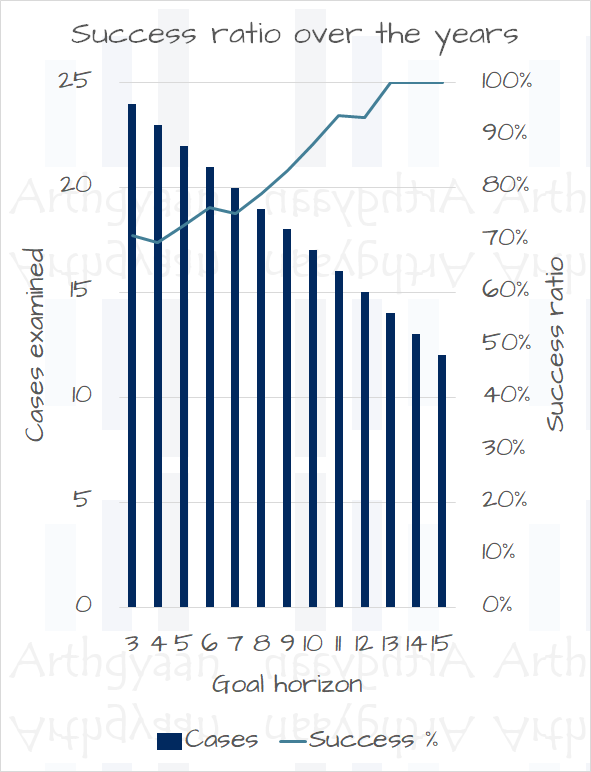

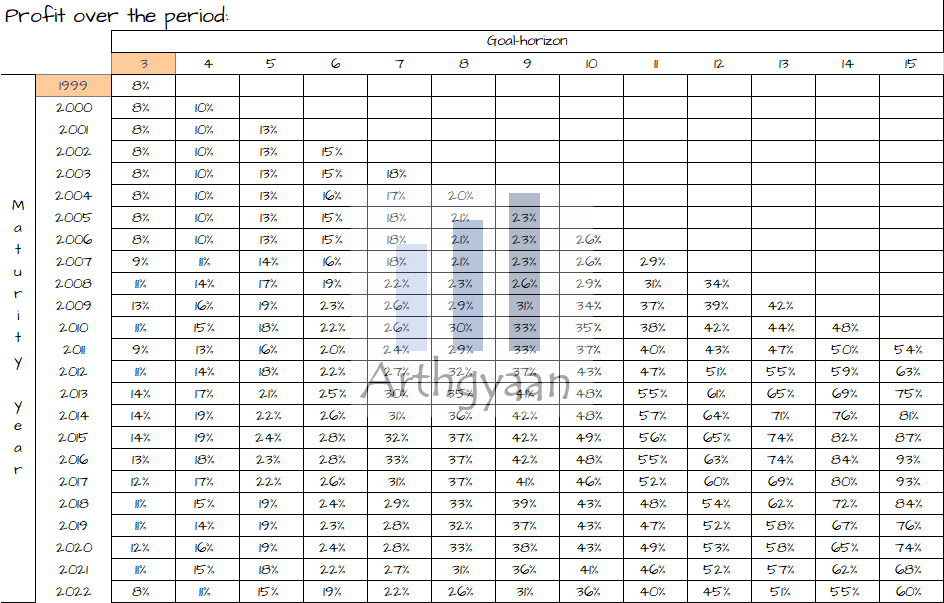

Our calculations below will assume the historical ten-year average inflation and apply a risk premium to calculate the expected equity and debt returns. We will run the calculations for goals due from 3-15 years, starting from 1996 onwards. We are choosing 1996 since Sensex TRI data is available from that date onwards. We will present results like:

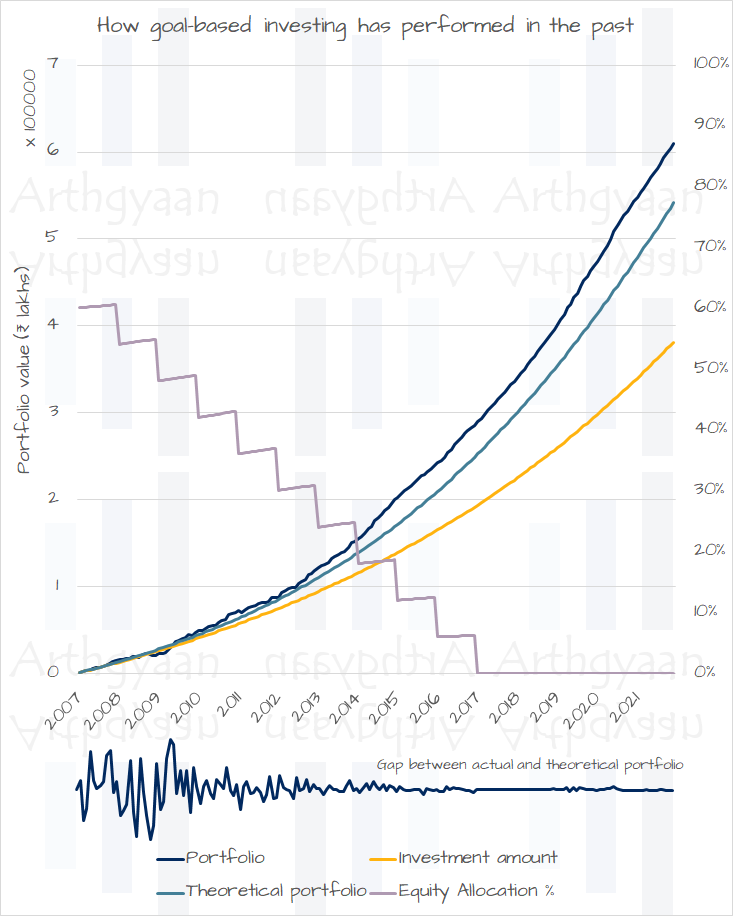

We show this example of a goal for which investment was started in 2007. Every year, the invested amount was increased by 10% as a step-up SIP, and the asset allocation was made more and more conservative over time. We can see how the equity allocation was reduced to zero as the goal moved closer.

The key learning here is that the variability between the actual and theoretical portfolios slowly came close to zero over time.

We see that except for goals maturing before 2008, in all other cases, the return has been higher than the theoretical return like this:

But there has not been a single case where the ending value has been lower than the starting value:

This article shows that goal-based investing for single-period goals has worked for historical data in India. Of course, predicting the future is impossible. Still, based on our information, we can follow a process for reaching our target corpus with reasonable certainty. You can apply this concept like this: SMART goals: investing step-by-step for buying your dream home.

In the next part of this article series, we examine how lump sum investments work if you apply the concept of goal-based investing to them: Goal-based investing: does it work in India for lump sum investing?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Goal-based investing: does it work in India? first appeared on 18 Dec 2022 at https://arthgyaan.com