How Goal-based investing helps you to cut through the clutter and lets you get started with investing?

This post is targeted towards investors facing too many choices in funds, stocks, and insurance policies, making it difficult to get started.

This post is targeted towards investors facing too many choices in funds, stocks, and insurance policies, making it difficult to get started.

A dilemma faced by investors comes from having too many choices. As of today in India, we have:

Having too many choices is indeed a problem that is overwhelming for both new and seasoned investors. Both traditional and social media provide a steady flow of noise in the name of information that makes things worse. Investors, as a result, start focusing on the following generic questions:

These questions add to the confusion and do not move the investor away from the analysis-paralysis situation. Therefore, this post will cut through the clutter and reframe the problem statement with some actionable steps.

We will reframe this problem by shifting from a solutions mindset (“best mutual fund”) to a requirements-driven one. Therefore, the first question we will ask is, “Why are you investing?”. This is the basic tenet of goal-based investing as we have covered in this post.

Setting a goal gives you purpose, direction, and momentum that lays the foundation of the investing process. Goals can be:

Goals need a date, a target corpus amount, and a priority. You can set goals in many ways:

This post is a classic example of where many investors are regarding investing: they have some money in the bank and are trying to get started.

Given the importance of children’s education-related goals, we have covered that in more detail here.

This step gets slightly technical, but it is an essential one that cannot be skipped.

A portfolio created for a goal has one purpose: to meet the goal. Therefore, we need to balance risky assets that generally appreciate fast (like equity) and slow-growing assets that provide stability (like debt). The tool that is used to determine this mix of investments is risk profiling.

Once risk profiling is done, along with the horizon and priority of the goal, the next step is the goal-wise asset allocation. The basic premise of asset allocation is a balance of the investor’s goal priority (needs vs. wants) and the time horizon of the goal like this:

A few general thumb rules are:

You will get more details here:

This step deals with the monthly investment that you need to make for every goal. There are calculators available that can help you based on the target amount, goal horizon, and priority. You can use:

There are a few common questions that we have discussed earlier:

This is the step where we finally describe where to invest. If you have followed the process so far in this post, you should realise that while this step is important, it is not as important as new investors think it to be. In fact, a combination of a provident fund (that most salaried investors already have) and just two mutual funds is sufficient for all goals. This conclusion will surprise many investors, but it is a key step to cut through the clutter:

There are a few common questions and issues that we have discussed earlier:

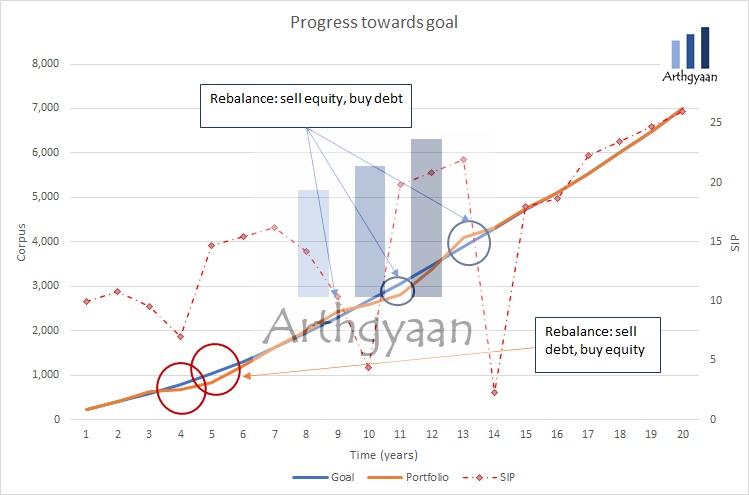

Following all the steps above will get you started in goal-based investing but that does not mean you are done. Since stock markets do not move up straight like an FD, you need to review and rebalance every year by performing the same steps so far: check the list of goals, review goal target corpus, corpus accumulated and find out new SIP amounts. The process is described in more detail in this post.

There are a series of health checks that you can do depending on your life stage:

We have come to this step last, but this is the first step that needs to be implemented. Completing these four prerequisites will ensure that you are on firm footing and that any emergency will not derail your financial plans.

At all times, ensure that you have the following in place

These four measures will ensure that investments made for long-term goals can continue and compounding is not interrupted.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How Goal-based investing helps you to cut through the clutter and lets you get started with investing? first appeared on 14 Sep 2021 at https://arthgyaan.com