Should you sell off your equity funds since the market is overvalued?

The stock market cannot be predicted, but lessons from history and some basic rules can help you decide what to do as the market keeps moving up.

The stock market cannot be predicted, but lessons from history and some basic rules can help you decide what to do as the market keeps moving up.

Note: This article was updated once the Nifty 50 reached a lifetime high on 24-Nov-22 after a gap from 18-Oct-21.

As stock market indices like the Nifty 50 or Sensex reach a lifetime high, many investors fear an impending market crash. This is a classic example of loss aversion, where the fear of probable loss is stronger than the chance of getting future gains.

Peter Lynch famously said,

“Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.”

This “loss” is due to missed opportunities - the market moves up while the investor either

or, alternatively, there can be a benefit in waiting in case the market eventually corrects.

There are multiple nuances to this, and we will explore them below, including a plan to deal with the current scenario.

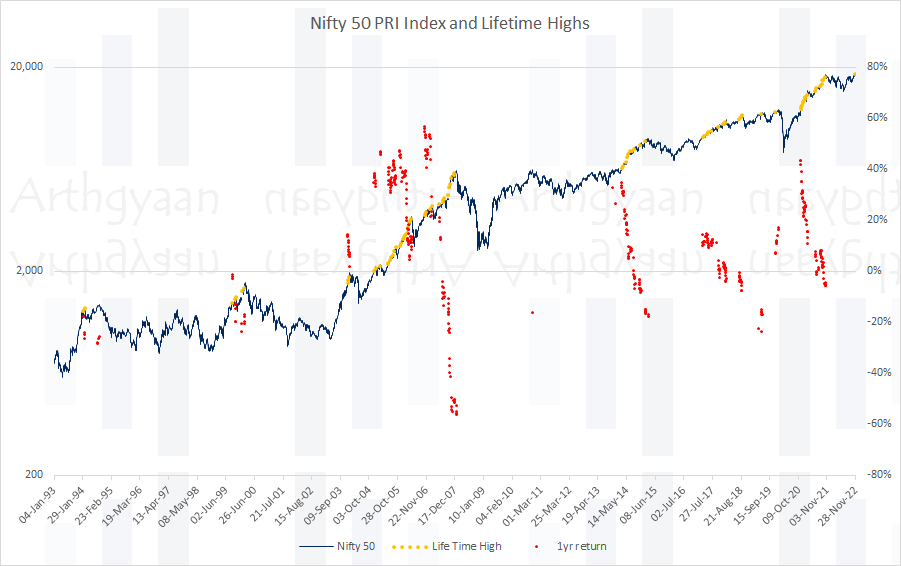

There have been 507 cases of the Nifty 50 price index reaching a lifetime high (highest value ever on that date) from Jan-1993 till date. There has been a further 79 such cases from Mar 2020. This chart shows the Nifty price level (in log scale) in that period, and each lifetime high is shown with a yellow dot. The red dots show the 1-year return from the date of the lifetime-high value (axis on the right side).

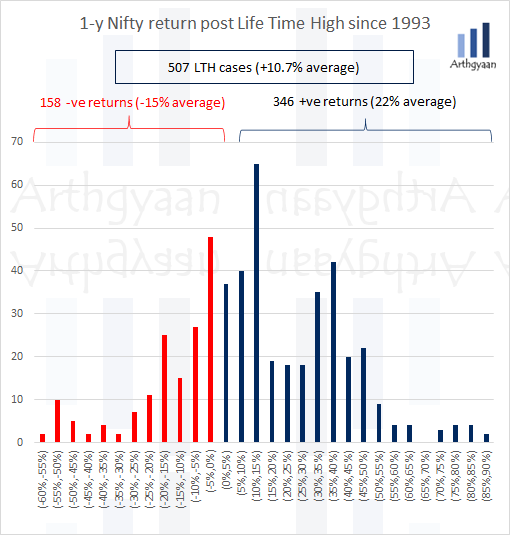

The short answer is nothing horrible happens after investing at the lifetime-high level. From the 507 cases in the chart, the average 1-year return in that date range came at 10/7%. There is a 68% probability (346 out of 507 instances, i.e. around 2 of 3) where the return has come positive (22% average). Of the 1 of 3 (158 of 507) cases, there has been a negative return (average -15% return). The distribution is shown in the figure above.

This means that there is a 2/3 chance of regret, based on past data, that the market will go up from the current high levels while you wait on the sidelines. A probability greater than 50% in finance indicates a trend you should follow. This also shows what is intuitive (highs lead to falls) may only sometimes be supported by data.

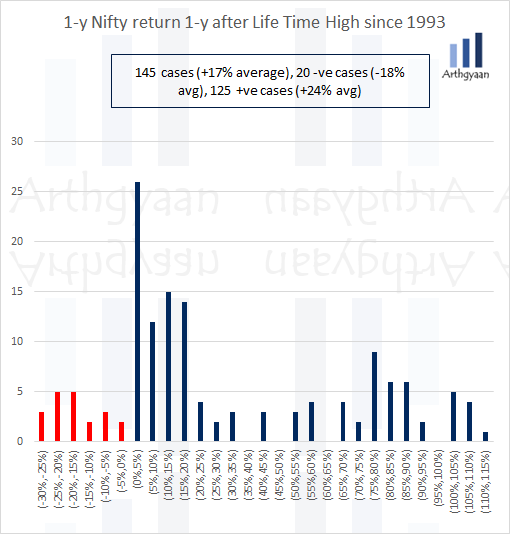

If we look at the 1-year return precisely after one year has passed from the lifetime high in the cases, there was a negative return (i.e. in the 145 cases ) we see that there were 20 cases with negative 1-year return in the 2nd year and 125 cases with positive 1-year return in the 2nd year. This means that out of the 507 lifetime-high cases there are only 20 cases with consecutive negative year-on-year returns, i.e. a probability of 20/507 = 2.5%. So it is unlikely (only 2.5% or 1/40 chance) that if you invest at lifetime highs, you will make negative returns two years in a row.

Investors should be aware of the sequence of returns risk when investing.

If they are at the beginning of their investment journey, a fall will be beneficial for the long-term portfolio

Investors in the accumulation stage should continue investing if their goals are not funded.

However, if you are at the beginning of retirement, a market fall will significantly damage the portfolio. Investors in this life stage should review their retirement buckets and rebalance them in case the allocation is improper.

If you have goals due in the next 3-5 years, they should ideally be in cash i.e. safe investments in a bank FD or similar assets. However, suppose there are a lot of gains in equity. In that case, this is a good time to rebalance to fill the cash bucket to ensure enough money is held in safe assets for these goals.

Each goal should have a suitable asset allocation with its own equity-to-debt proportion. If the market has rallied, then it is likely that asset allocation is now equity heavy. This is a good time to invoke corridor-based rebalancing (if 60:40 is the target and allocation is now 65:35 say then rebalance to debt). If the crash has already happened, it is a trigger to rebalance from debt to equity.

You cannot predict stock markets, but as an investor, you can

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you sell off your equity funds since the market is overvalued? first appeared on 16 Jul 2021 at https://arthgyaan.com