The stock market has reached an all-time high. Should you buy or sell?

This article shows a way to decide what to do when stock markets reach all-time or lifetime highs. Should investors buy more or sell to book profits?

This article shows a way to decide what to do when stock markets reach all-time or lifetime highs. Should investors buy more or sell to book profits?

This article is a part of our detailed article series on what to do when stock markets reach a lifetime high. Ensure you have read the other parts here:

This article shows how an investor should invest a lump sum amount in the stock market when the market has reached an all time high.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

The article shows you what has happened in the past when the stock market hit an all-time high and what the investor should do next.

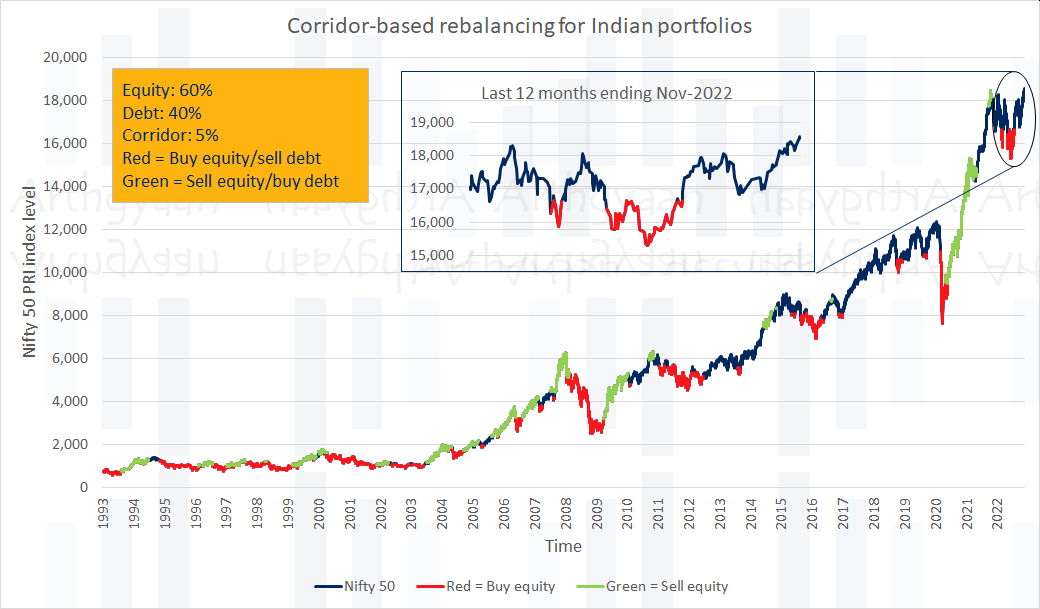

After a gap of more than one year, the Nifty 50 index closed at a fresh all-time high (ATH) of 18,484.1 on 24-Nov-2022 after the previous ATH of 18,477.05 was reached on 18-Oct-2021.

Given that the Indian stock market has given such low returns in the last year leads to questions amongst investors such as:

We will analyse these three investor market outlooks below. But first, let us define a framework for decision-making: buy, hold or sell equity.

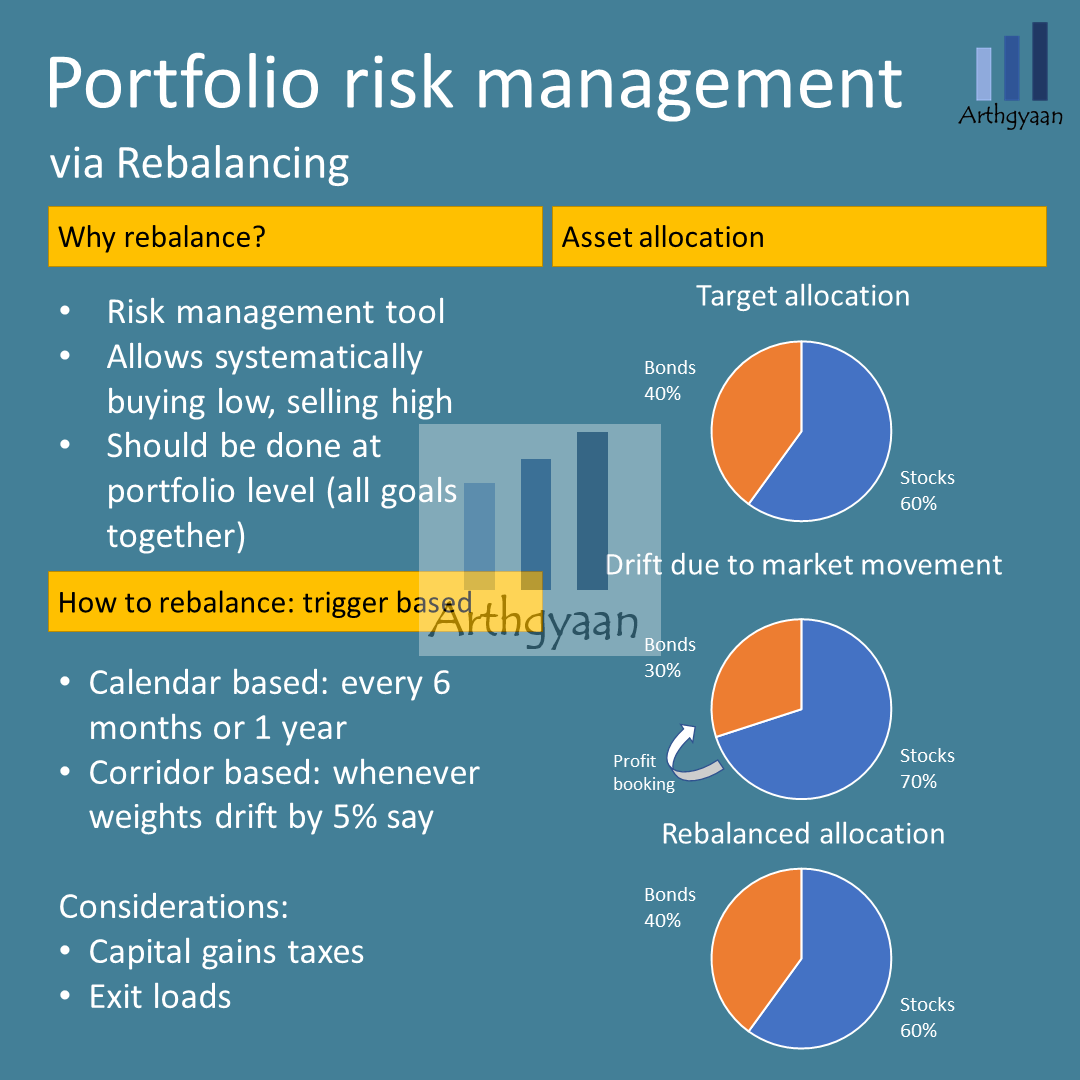

Rebalancing is a risk-management tool that allows you to systematically buy low and sell high.

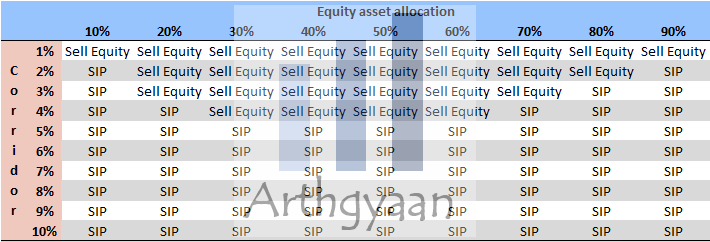

We will use corridor-based rebalancing as the decision-making framework here. We will use 5% as a corridor and a target asset allocation between two asset classes equity and debt. We will rebalance if the market movement shows that the current allocation has deviated by 5% from the target. If you are unaware of the concept of rebalancing, then please review this article before proceeding: Portfolio rebalancing during goal-based investing: why, when and how?

As the table shows, based on the market movement in the last 12 months, the investor who has a 60:40 target ratio for equity and debt and uses a 5% corridor, should simply continue their SIP in the same ratio. If the corridor used is lower, say 3% or less, then the investor should sell equity (“book profit”) and rotate into debt assets. There is debt to equity rebalancing signal as per this market.

The rebalancing signal is to:

I have been investing since 2022. The market has moved up to a lifetime high. Should I book profits and exit?

A lifetime high does not mean that the market will fall immediately afterward. Investors should continue investing as per their investment plan. Here is an article that talks about this point in detail.

I started investing after markets began a bull run in March 2020 after the COVID fall. But in the last year, the returns have been poor compared to the year before. Now markets are at a lifetime high. Should I invest more? I am afraid that the market will fall given inflation and other concerns.

If the investor has a long time horizon for their goals, it will be advisable to keep investing as per the asset allocation of their goals. Sideways markets like Oct-21 to Nov-22 are good options to pick up more units at lower prices

I have been investing for some time now. Now that markets are finally moving up, I am thinking about redeeming some debt funds and investing more in equity.

This kind of investor is thinking that the market is finally free from the factors holding it back and will continue to go up for some time. This investor should exercise caution that they are not taking an excessive amount of risk looking for a momentum opportunity.

We have a few articles discussing the concept of implementing asset allocation. For example, here is a step-by-step guide for determining the asset allocation plan for your retirement portfolio: Low-stress retirement planning calculations: worked out example.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The stock market has reached an all-time high. Should you buy or sell? first appeared on 30 Nov 2022 at https://arthgyaan.com