Nifty above 21000: what should you do with your equity SIPs? Start, stop or continue?

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

This article is a part of our detailed article series on what to do when stock markets reach a lifetime high. Ensure you have read the other parts here:

This article shows how an investor should invest a lump sum amount in the stock market when the market has reached an all time high.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

The article shows you what has happened in the past when the stock market hit an all-time high and what the investor should do next.

This article shows a way to decide what to do when stock markets reach all-time or lifetime highs. Should investors buy more or sell to book profits?

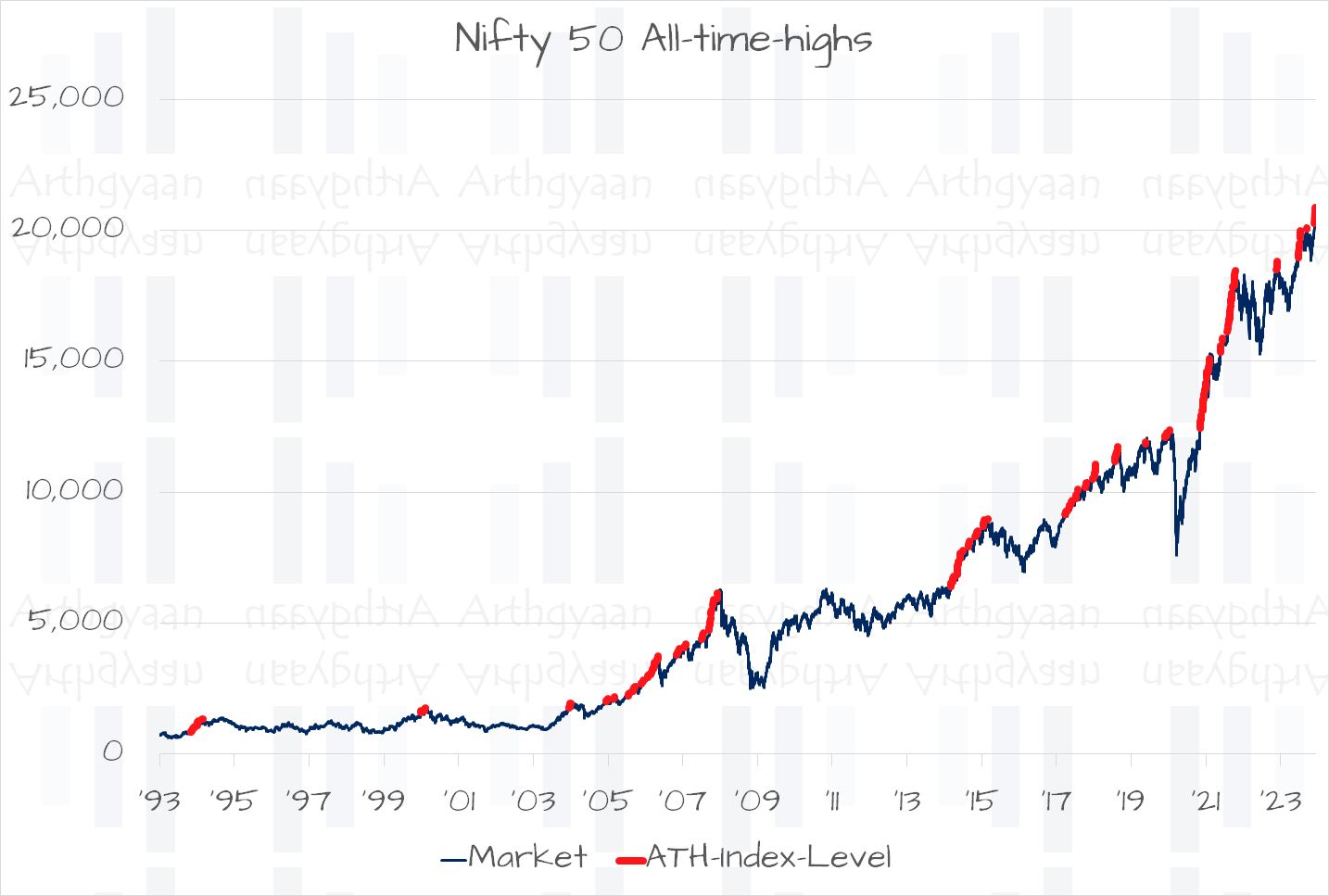

We first wrote about the Nifty 50 reaching an all-time high (ATH) of 18,484.1 on 24-Nov-2022 and then again when the Nifty 50 crossed 19500+ on 14-Jul-2023. Since September, the index has reached ATH levels 4 times, with the latest peak on 08-Dec-2023 when the index touched 21,000 for the first time intraday.

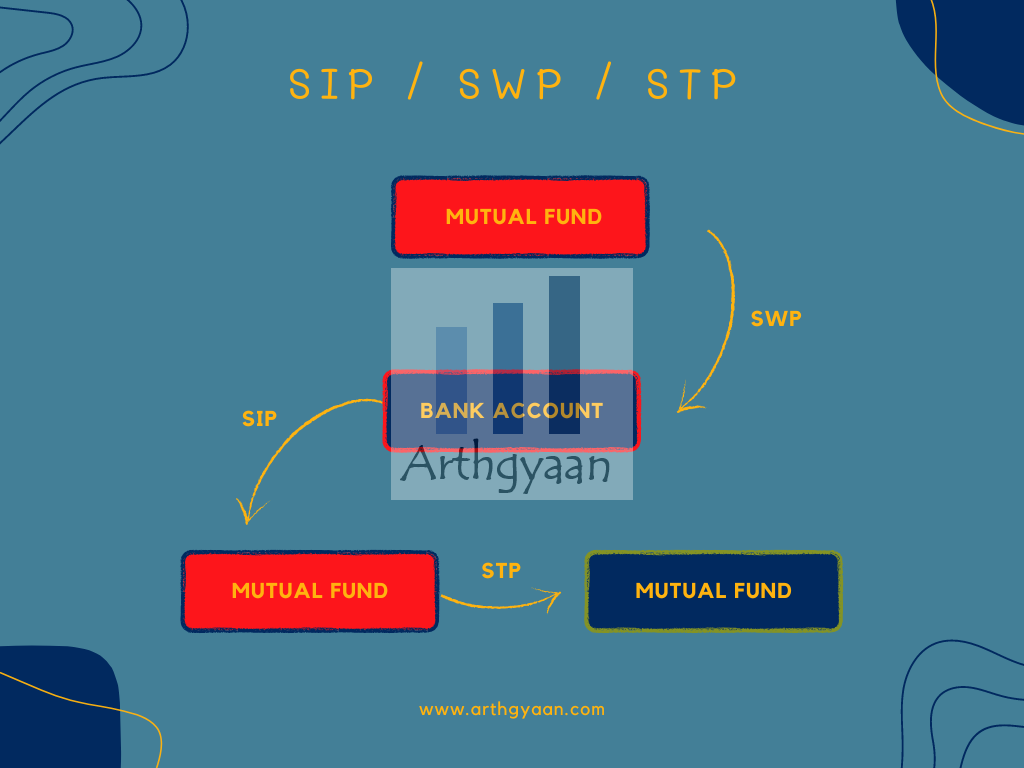

Investors, both new and old, wonder what should they do with their equity investments running in SIP form: start, continue or stop? At this point, investors should quickly review the definition of SIP, SWP and STP before continuing:

All of these are standing instructions that get executed as per a schedule you specify:

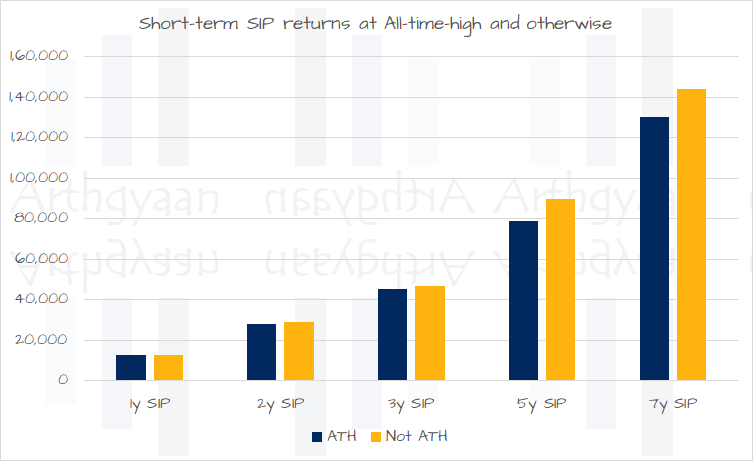

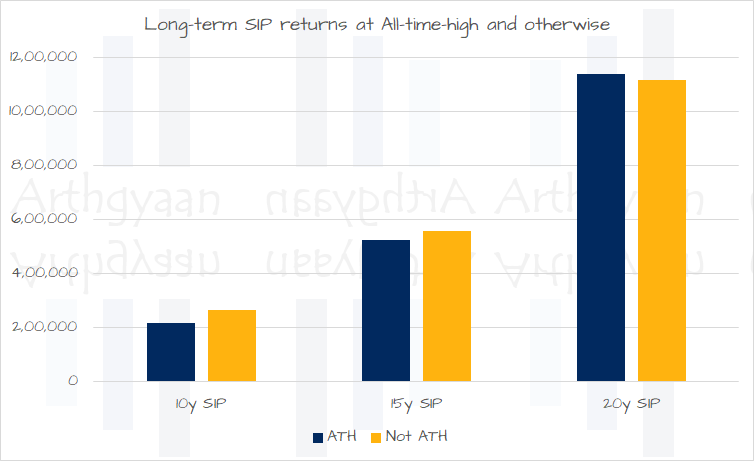

As expected intuitively, SIP returns for both short and long-term SIPs (₹1000/month in Nifty 50 price index) started at the time of all-time high is slightly lower than other periods as the charts below show:

Apart from the 20-year SIP case, all the others have slightly higher returns when the SIP series starts on an ATH dates vs. when it does not.

To answer this question, let us review the Nifty 50 price index since 1993. Over this period, there have been almost 500 days where the index has hit an all-time high.

There is unfortunately no shortcuts here in case you are expecting a simple go, halt or skip answer. Investment, like many other things in life, is simple once you understand it but not easy. Therefore, we will follow a systematic approach here via a series of questions:

Goal setting helps you understand the priorities of your life, set the future of you and your family, understand the various money-related challenges that come and be best prepared for the future financially. Goals give direction and momentum to your financial life:

You will hurt your chances of creating wealth via compounding if goals are not set.

You can follow the complete investment goal-setting framework as well as these worked out examples of S.M.A.R.T goals.

The basic premise of asset allocation is a balance of the investor’s goal priority (needs vs wants) and the time horizon of the goal like this:

Once that is determined, a split of risky and risk-free assets like equity, debt, gold, cash etc per goal can be determined.

You can read more on Asset allocation here: What should be the Asset Allocation for your goals?.

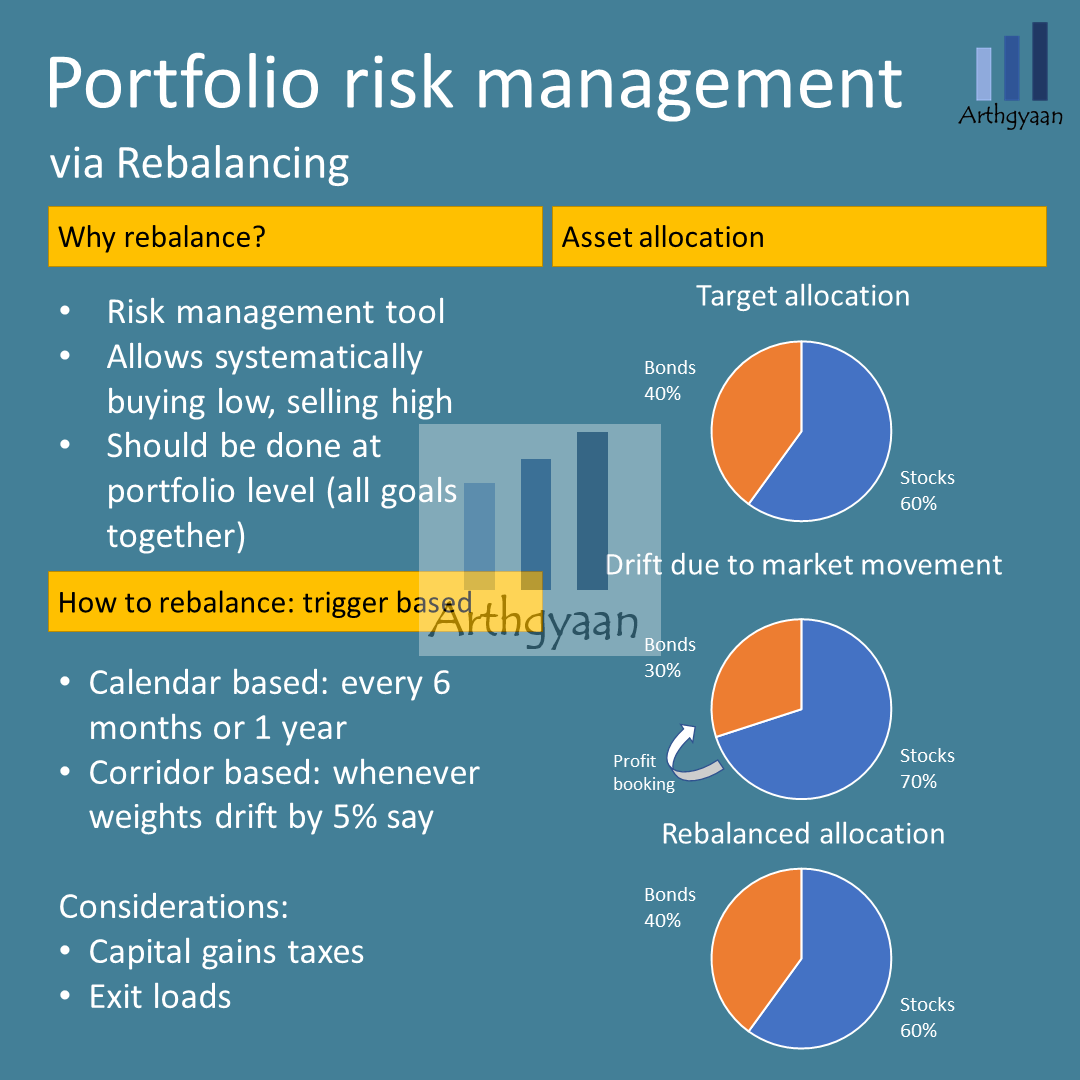

Rebalancing is a risk-management tool that allows you to systematically buy low and sell high.

We will use corridor-based rebalancing as the decision-making framework here. We will use 5% as a corridor and a target asset allocation between two asset classes equity and debt. We will rebalance if the market movement shows that the current allocation has deviated by 5% from the target. If you are unaware of the concept of rebalancing, then please review this article before proceeding: Portfolio rebalancing during goal-based investing: why, when and how?

Corridor-based rebalancing is explained in detail here: The stock market has reached an all-time high. Should you buy or sell?

Once you have completed this framework, the next steps regarding your equity SIP will be clear. To help you, we have a list of extensive case-studies that you may refer below.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Nifty above 21000: what should you do with your equity SIPs? Start, stop or continue? first appeared on 08 Dec 2023 at https://arthgyaan.com