Should you stop your SIPs now that the market has reached an all-time high?

The article shows you what has happened in the past when the stock market hit an all-time high and what the investor should do next.

The article shows you what has happened in the past when the stock market hit an all-time high and what the investor should do next.

This article is a part of our detailed article series on what to do when stock markets reach a lifetime high. Ensure you have read the other parts here:

This article shows how an investor should invest a lump sum amount in the stock market when the market has reached an all time high.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

This article shows a way to decide what to do when stock markets reach all-time or lifetime highs. Should investors buy more or sell to book profits?

We first wrote about the Nifty 50 reaching an all-time high (ATH) of 18,484.1 on 24-Nov-2022. Since then, the index has reached ATH levels 14 times, with the latest peak on 14-Jul-2023.

Hearing this news, many new investors are considering stopping their monthly SIPs, wondering what the stock market will do next.

Two things might be going on your mind when you see that the stock market has reached a new peak:

We will answer both these questions one by one.

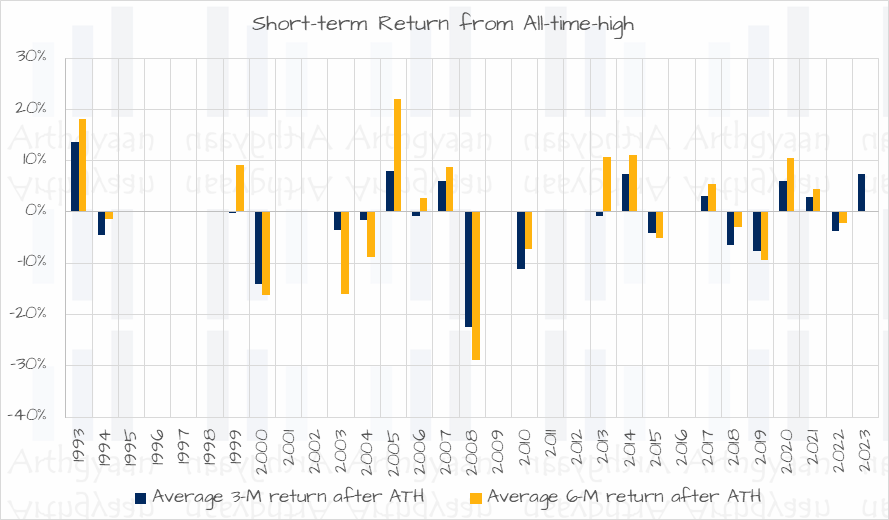

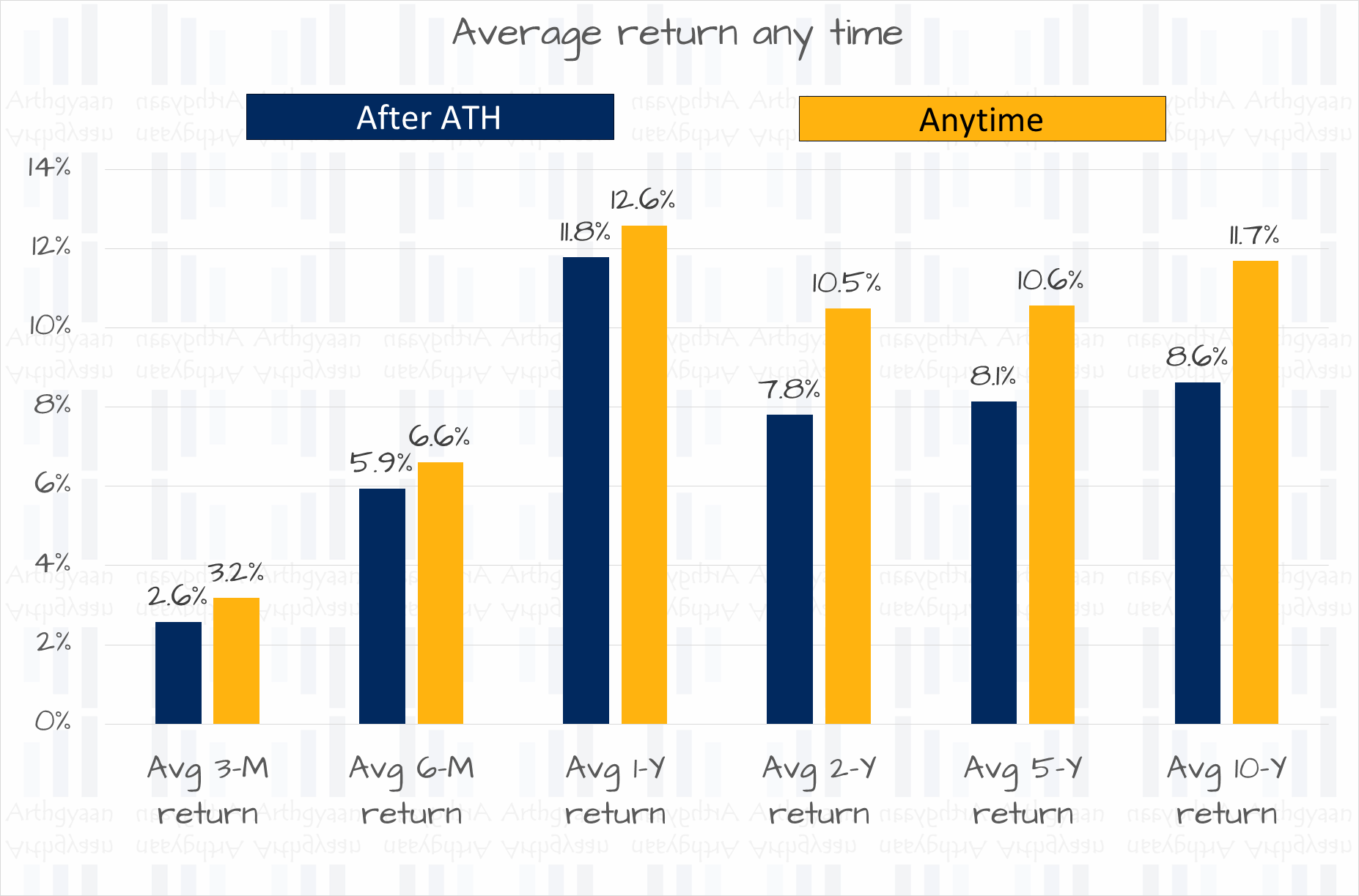

Here we have looked at average short-term (3-month and 6-month) returns in the Nifty 50 just after the ATH. The results are shown below.

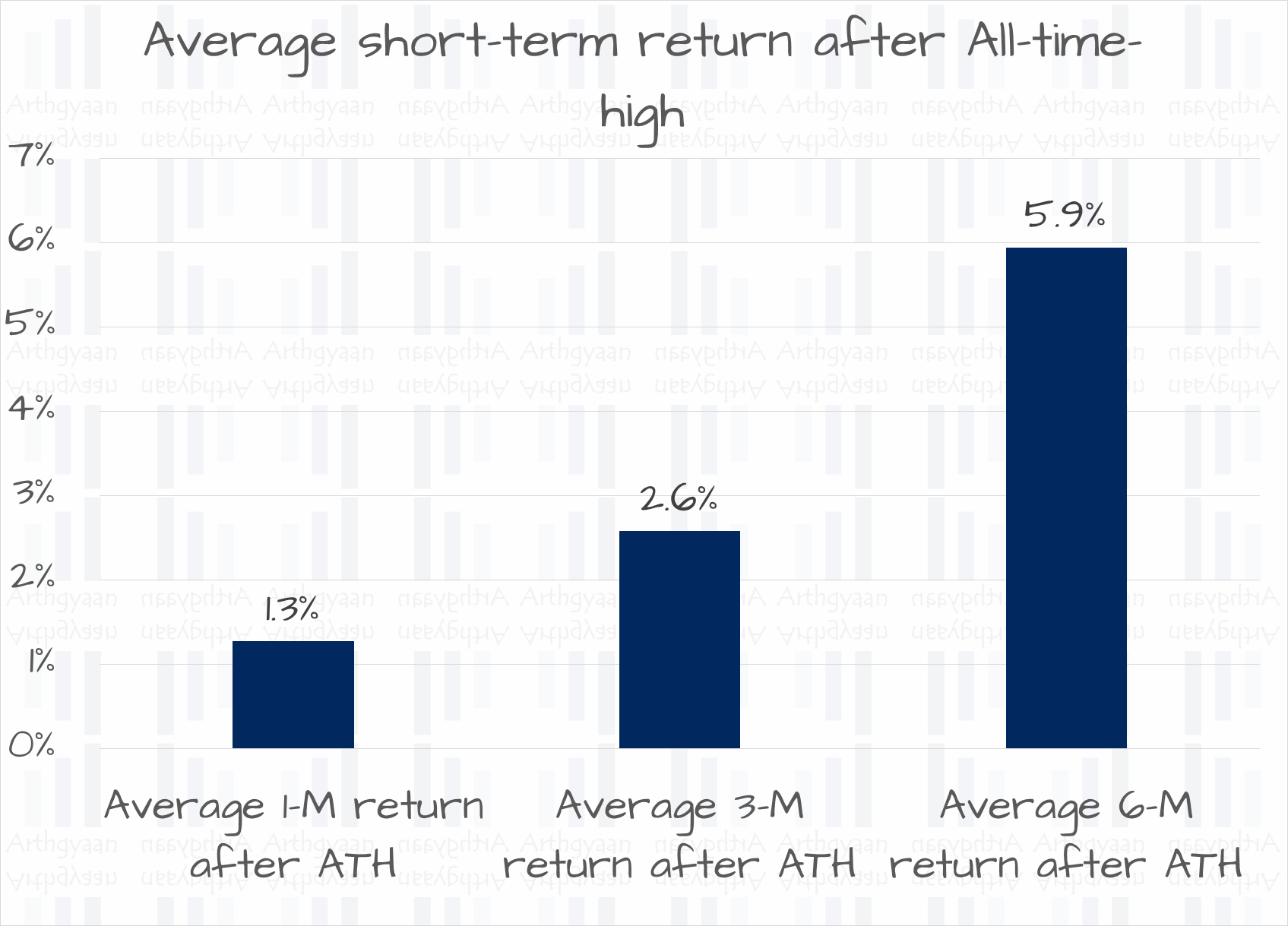

The short-term returns are decent if you look at the average over the entire period. As shown below, the situation significantly improves in the longer term.

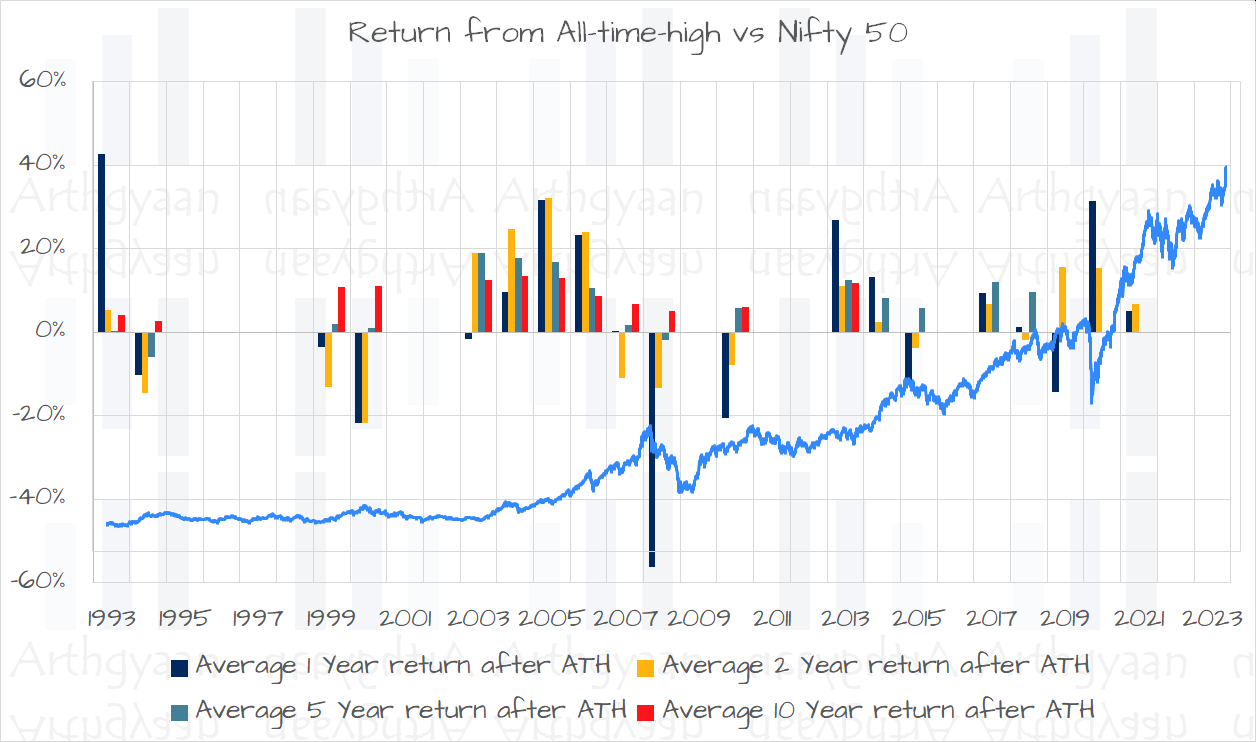

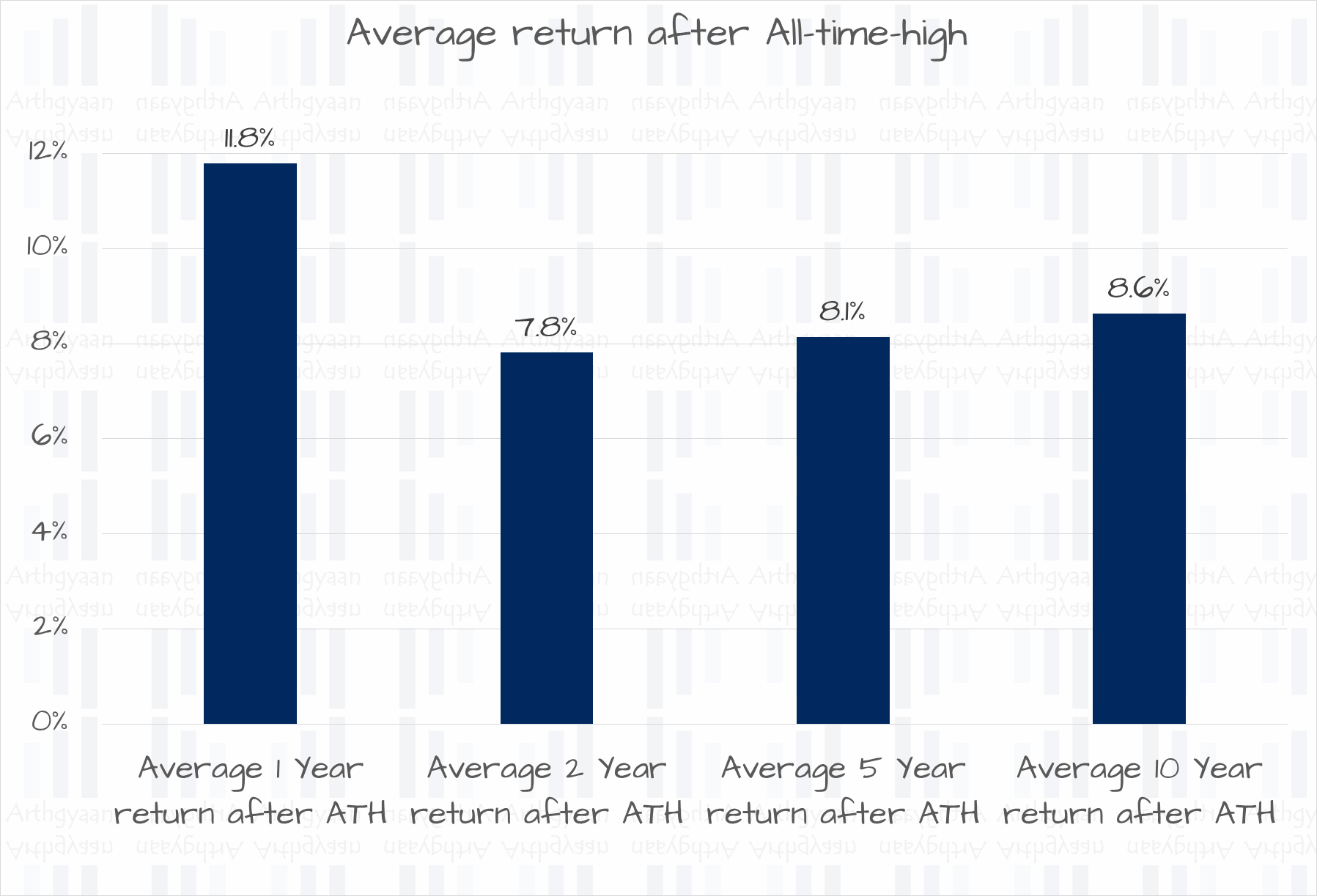

Here we have looked at average long-term (1-year, 2-year, 5-year and 10-year) returns in the Nifty 50 just after the ATH. The results are shown below.

The average returns are also quite reasonable in the longer term.

We now present the average returns for short and long-term holding periods. We see a substantial gap in the average returns for holding periods from 2 years onwards.

Here it is essential to consider how much is the current SIP amount relative to the corpus already accumulated since each of these returns is for a single investment immediately after the market reaches an all-time high.

If you have a ₹10L corpus and a ₹20,000/month SIP, then pausing the SIP for 1-2 periods may have some benefit. However, suppose your corpus is ₹1cr, and you have a ₹1L/month SIP. In that case, the impact of stopping the SIP and later restarting will be less on an overall portfolio basis. You might as well let the investments continue since you do not know when the markets will fall.

We have covered this topic in detail here: Nifty above 20000: what should you do with your equity SIPs? Start, stop or continue?

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you stop your SIPs now that the market has reached an all-time high? first appeared on 16 Jul 2023 at https://arthgyaan.com