How to buy SGB from the stock market?

This article shows you how to buy Sovereign Gold Bonds (SGB) from the stock market using your demat account.

This article shows you how to buy Sovereign Gold Bonds (SGB) from the stock market using your demat account.

This article is a part of our detailed article series on the concept of Sovereign Gold Bond (SGB). Ensure you have read the other parts here:

This article walks you through setting up and tracking your SGB portfolio for free using this user-friendly and free tool.

This article compares the currently active SGBs vs the latest SGB issue price to see what returns are implied for investors who are already invested.

This article explains which Sovereign Gold Bond (SGB) series should be bought from the stock market if you are planning to invest in SGB.

This article helps you choose the right type of gold for your long-term investments since all options do not give the best results.

This article provides a complete history of SGB issue price history since 2015 to help investors track the how the issue price has moved over time.

This article compiles an exhaustive list of FAQs for Sovereign Gold Bonds (SGB).

A Sovereign Gold Bond (SGB) is a piece of paper issued (in digital form) by the Government of India with the following features. For every unit of SGB purchased, the investor will:

Secondary market is the stock market where SGBs trade like any normal share like TCS and Reliance. There are a few reasons why buying SGB from the secondary market makes sense:

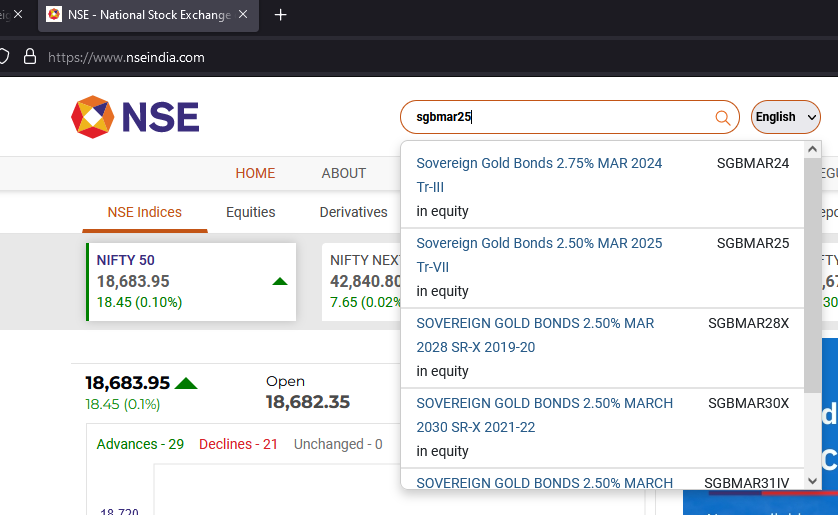

The NSE home page, and every interior page, offers an easy to use search box at the top to locate any SGB . You just need to type the letters SGB in the box. If you click the link in the search result, a page like this (see the next section) opens.

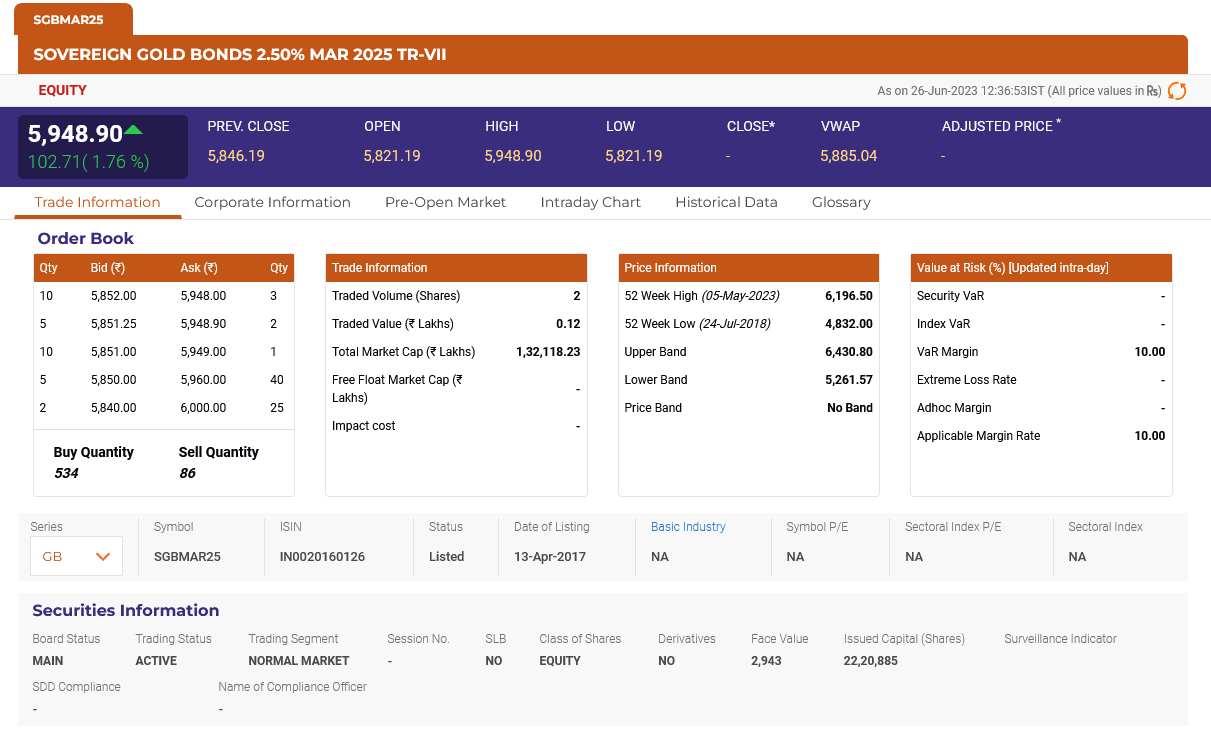

Here is the data that NSE shows at a glance just like any other stock. Using the image above we see:

For understanding the discount to gold price, you can refer to the current 999 gold price from the IBJA website.

SGB trades in the stock market since people

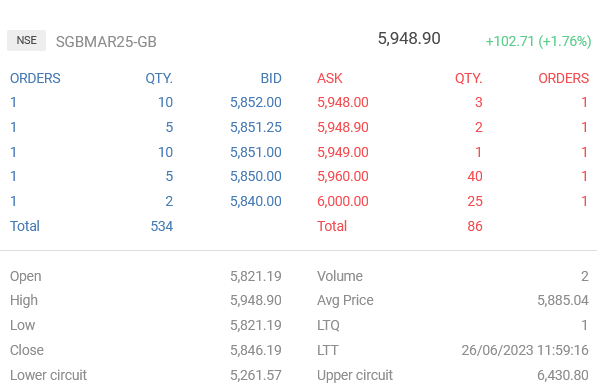

SGBs offer poor liquidity when they are trading. In the example here:

Interest amount = 1.25% of Face Value every 6 months

In the example above, the bond will give 1.25% of this ₹2,943 which is ₹36.79. Irrespective of how much you buy the bond for today, you will get ₹36.79 every 6 months. The interest is not calculated on the current trading price of the SGB.

Once you have chosen any SGB, you can login to your stock broker website to place and order for the bond. In the image above, this will be a delivery type limit order.

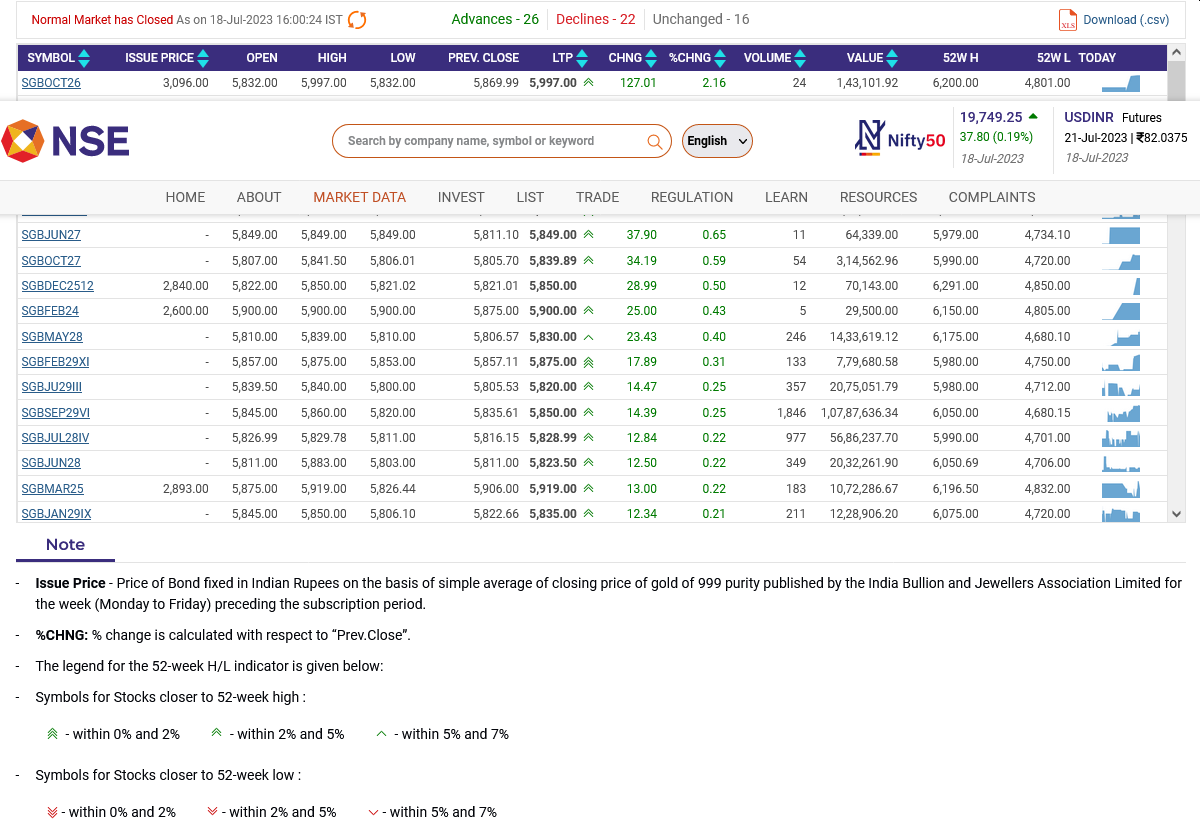

You need to calculate which SGB is trading at a discount to intrinsic value relative to the current gold price. We have a full article here: Sovereign Gold Bond (SGB): Which Series is Best for You?.

The NSE website has the complete list of currently trading SGBs here: Market Watch - Sovereign Gold Bonds (SGB)

While many brokers allow a stock SIP facility, you should not buy SGB using stock SIP simply because the most suitable SGB will vary from day to day. You need to choose SGB manually before purchase.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to buy SGB from the stock market? first appeared on 19 Jul 2023 at https://arthgyaan.com