What should NRIs do if your PAN has become inoperative?

This article shows the solution in case NRIs suddenly find their PAN number has become inoperative after 30th June 2023.

This article shows the solution in case NRIs suddenly find their PAN number has become inoperative after 30th June 2023.

This article is a part of our detailed article series on the issues tax-payers are facing due to not having PAN-Aadhaar linkage. Ensure you have read the other parts here:

This article tells you the common mistakes to avoid while giving your HRA exemption proof to your company.

This article considers one risk on TDS payment due to an inoperative seller PAN card where the buyers ends up with an income tax notice to pay the remaining tax.

After pushing back the deadline multiple times, the central government has started marking inoperative PAN numbers that are not linked to Aadhaar. This action was taken after the latest PAN-Aadhaar linkage deadline expired on 30th June 2023. As a result, many NRIs found out the hard way, while filing income tax return, that their PAN cards are now inoperative.

NRIs are not expected to be affected by the PAN-Aadhaar linkage deadline and, subsequently, PAN becoming inoperative since they are not expected to have Aadhaar numbers.

The NRIs PAN cards have become inoperative, i.e. cannot be used temporarily and not deactivated which could be permanent.

Once PAN becomes inoperative, the following issues will be seen:

Source: link

NRIs are affected due to non-linkage of PAN and Aadhaar since they have not told the income tax authorities that they are now NRIs and, therefore

NRIs who have been impacted here have either

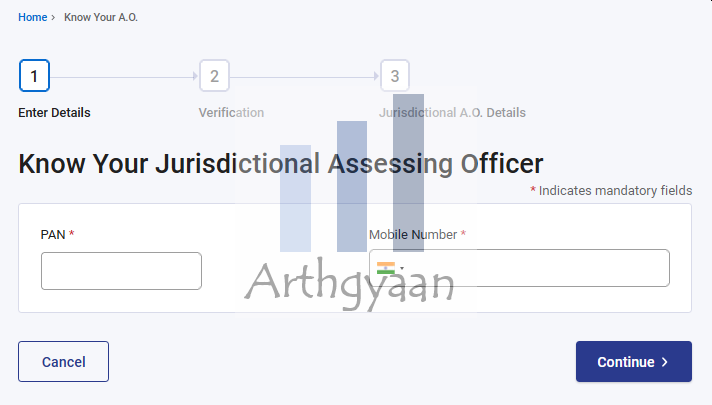

We will cover this process step-by-step:

Alternatively, on the next trip to India, NRIs can take an online Aadhaar application, physically submit their biometrics in India and then link their new Aadhaar number with PAN to make it operational again.

As per this tweet, taxpayers can

share their details via email at adg1.systems@incometax.gov.in & jd.systems1.1@incometax.gov.in along with a copy of the correspondence sent to JAO

The standard list comprises bank accounts (NRE/NRO), demat, mutual funds etc. The complete list is here: How should an NRI handle investments and accounts in India before shifting?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What should NRIs do if your PAN has become inoperative? first appeared on 21 Jul 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.