How to invest a lump sum amount when the stock market is at an all-time high?

This article shows how an investor should invest a lump sum amount in the stock market when the market has reached an all time high.

This article shows how an investor should invest a lump sum amount in the stock market when the market has reached an all time high.

This article is a part of our detailed article series on what to do when stock markets reach a lifetime high. Ensure you have read the other parts here:

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

As the market keeps rising to new all-time high figures, how much returns should equity investors expect from their investments running in SIP form.

The article shows you what has happened in the past when the stock market hit an all-time high and what the investor should do next.

This article shows a way to decide what to do when stock markets reach all-time or lifetime highs. Should investors buy more or sell to book profits?

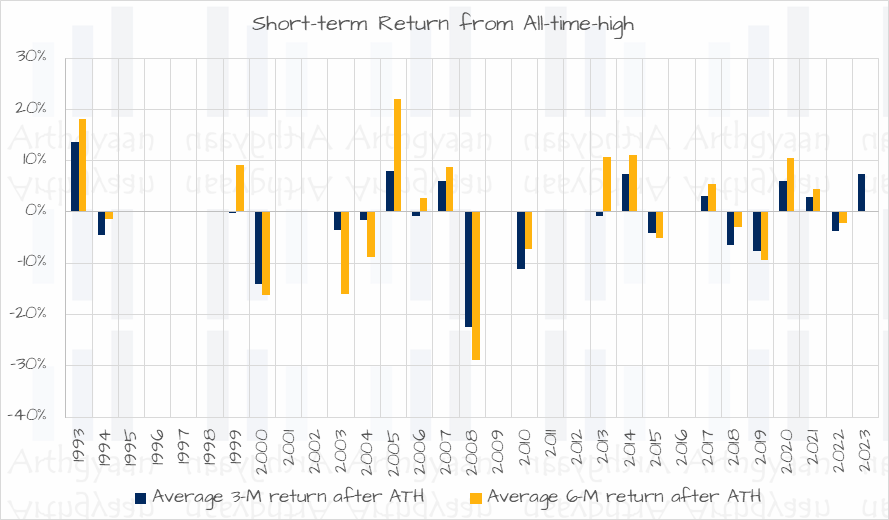

One of the biggest worries that investors have about the stock market reaching an all-time-high is the fear that the market will fall soon. We have looked at average short-term (3-month and 6-month) returns in the Nifty 50 just after the ATH. The results are shown below.

You can find more details here: Should you stop your SIPs now that the market has reached an all-time high?.

In this article, we will cover the case where the investor has a large sum of money, as a lump sum amount, that needs to be invested and the investor has two options:

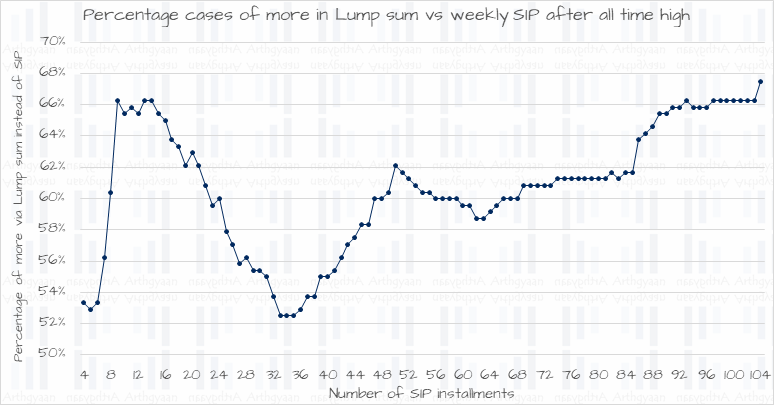

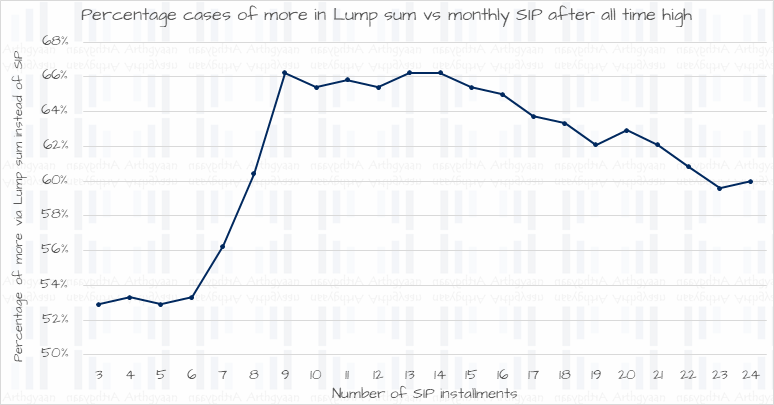

Here we are using the market data of the Nifty 50 price index from 1993 onwards. Every time the market has reached an all-time-high, we will either invest an amount of ₹10 lakhs as a lump sum or split that weekly or monthly over a period up to 2 years. The amount which is not yet invested is either held as an FD or in a money market or similar debt mutual fund and an SWP is run over this period. The systematic instruction takes out emotion from the equation.

We will examine the result of the investment after 10 years.

Here we are comparing a weekly SIP into a Nifty 50 index fund over a period or 4 to 104 weeks (2 years) vs. a single lump sum investment when the market is at an all-time-high. We examine which option gave higher returns after 10 years. The chart shows the percentage of cases where the lump sum gave higher returns. The amount not yet invested is held at 5%.

Here we are comparing a monthly SIP into a Nifty 50 index fund over a period or 3 to 24 months (2 years) vs. a single lump sum investment when the market is at an all-time-high. We examine which option gave higher returns after 10 years. The chart shows the percentage of cases where the lump sum gave higher returns. The amount not yet invested is held at 5%.

In finance, any trend above 50% probability generally indicates a result that can be reused. For example, in all of the cases examined, the average lump sum investment has beaten the one in SIP mode and that is the right choice to make. Intuitively we need to keep in mind that stock markets go up in general. Splitting the lump sum over a period of time means that later instalments are invested at progressively higher levels.

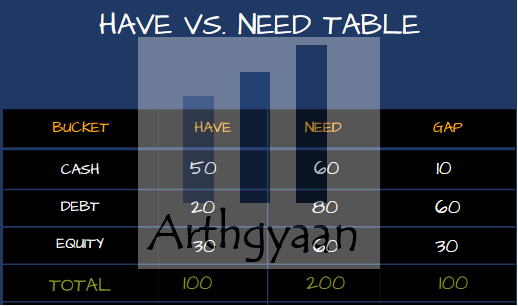

Also, the entire amount that you have may not be required to be invested in equity. Amounts due for spending in the next few years should not be in equity at all. We have discussed this point in detail here: How to invest a lump sum amount for your goals?.

The generic case, where the analysis is done over every time period, not just all-time-high, is here: Lumpsum vs. SIP: Here’s the Truth on the Winning Strategy For Mutual Fund Investors.

Even after all of this analysis, there are a few behavioural reasons where and SIP is preferable:

In such cases, a method of choosing of splitting the amount into a small number of weeks or months up to 2 years may be chosen. It is important to keep in mind that irrespective of the period over which the SIP will run, once the whole amount is invested, it will be fully exposed to the ups and downs of the stock market. If the market falls 40% the month after you finished your SIP, the fact to used a SIP to reach this point will not prevent your portfolio from losing value.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to invest a lump sum amount when the stock market is at an all-time high? first appeared on 10 Dec 2023 at https://arthgyaan.com