Lumpsum vs. SIP: Here's the Truth on the Winning Strategy for Mutual Fund Investors

This article helps you to decide for the last time which option is better for investing in mutual funds: SIP or lump sum.

This article helps you to decide for the last time which option is better for investing in mutual funds: SIP or lump sum.

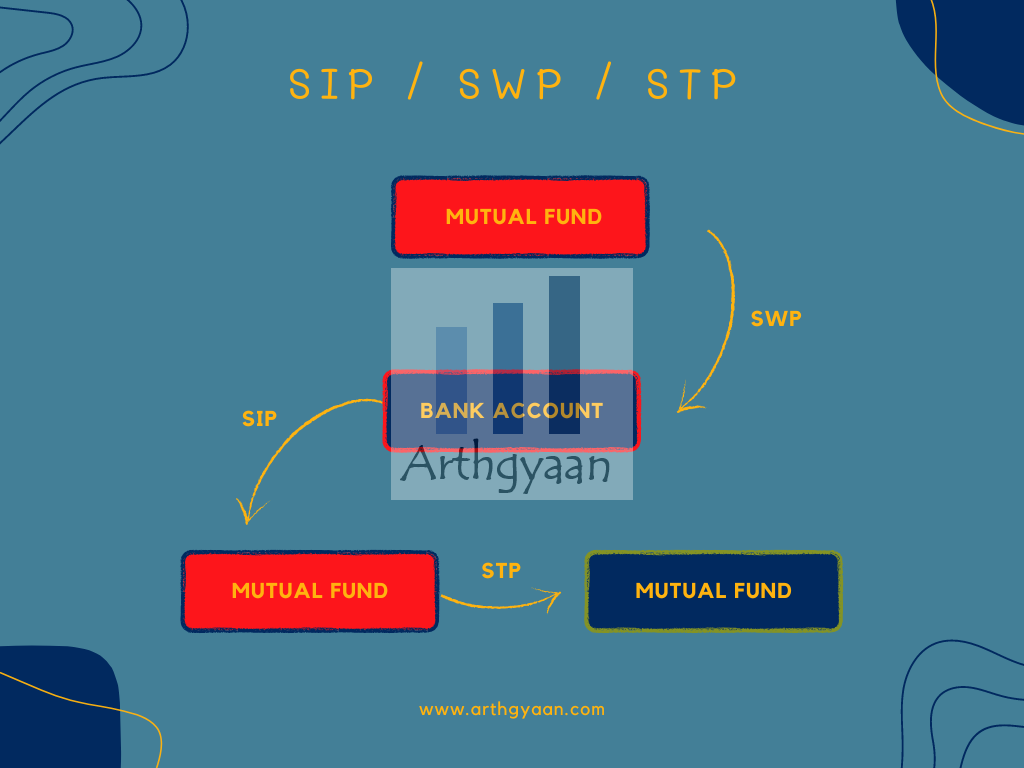

All of these are standing instructions that get executed as per a schedule you specify:

Note: You do not invest in a SIP; you invest via one since a SIP is a standing instruction. You invest in a mutual fund, or basket of stocks, via a SIP.

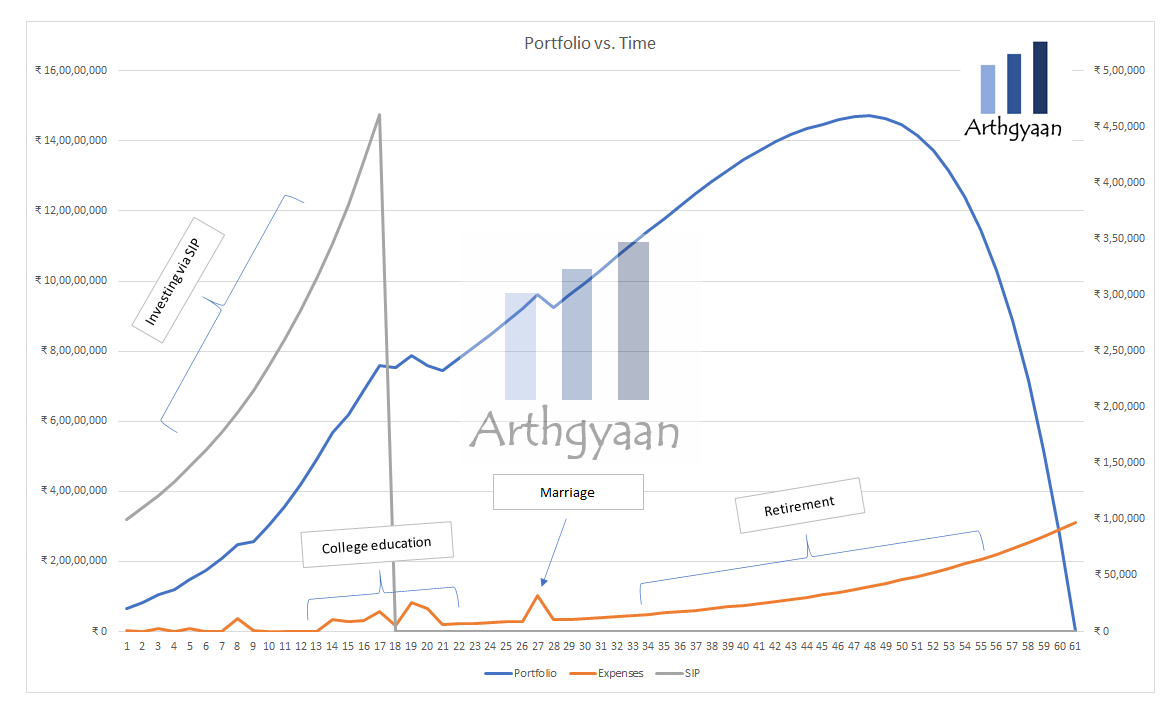

In the image above, SIP runs from years 1-17, and SWP takes over afterwards. However, STP may happen anytime in between for rebalancing purposes. We will explain the use cases below.

The asset management industry and every seller of mutual funds have one mantra that they want to drill into the head of the investor:

Start a SIP and never stop a SIP so that the SIP will create wealth

This concept of regular investing aligns nicely with all of us investors who are paid a salary every month:

Investing in Your 40s and 50s: Why Lump Sum Beats SIP for Mature Investors?

There are however cases where a much larger sum of money needs to be invested. For example:

This article provides a data-driven analysis of which approach is better for investing a large chunk of money into mutual funds:

The answer to the question of lump sum vs SIP is behavioural and has everything to do with this question:

What if the market falls immediately after you invest as a lump sum?

The obvious solution to this problem is splitting the lump sum over a few weeks or months by keeping the money either in the savings account or a debt mutual fund and run an STP to the risky equity fund of your choice. For the time being, let us leave aside the fact that once the whole sum is invested, whether at once or split over a few weeks/months, it will be fully exposed to the gyrations of the market.

We are therefore only concerned over the performance of the equity fund where the investment is being made over this brief period where the investment is being made. So, what we are going to do is that we are going to see if splitting this over this say 6 months or 6 weeks is better than investing at one go as a lump sum.

You have taken the data of some popular mutual funds, and we have seen using data since 2013 that which is better a lump sum which is at one go or a SIP over let’s say 6 months or 6 weeks. For the SIP case, we will run an STP from a debt mutual fund that gives 5% after tax annual return.

We have chosen the following popular mutual funds based on the assets under management using NAV data since Jan 2013 from AMFI website.

These fund names are NOT recommendations

| Fund | Category |

|---|---|

| UTI Nifty 50 Index Fund | Index (Large Cap) |

| Parag Parikh Flexi Cap | Flexi Cap |

| HDFC Midcap | Midcap |

| ICICI Prudential Blue Chip | Large Cap |

| Nippon Small Cap | Small Cap |

| HDFC Balanced Advantage | Balanced Advantage |

| SBI Equity Hybrid | Aggressive Hybrid |

| ICICI Prudential Multi Asset | Multi Asset Fund |

We have created a simple plan:

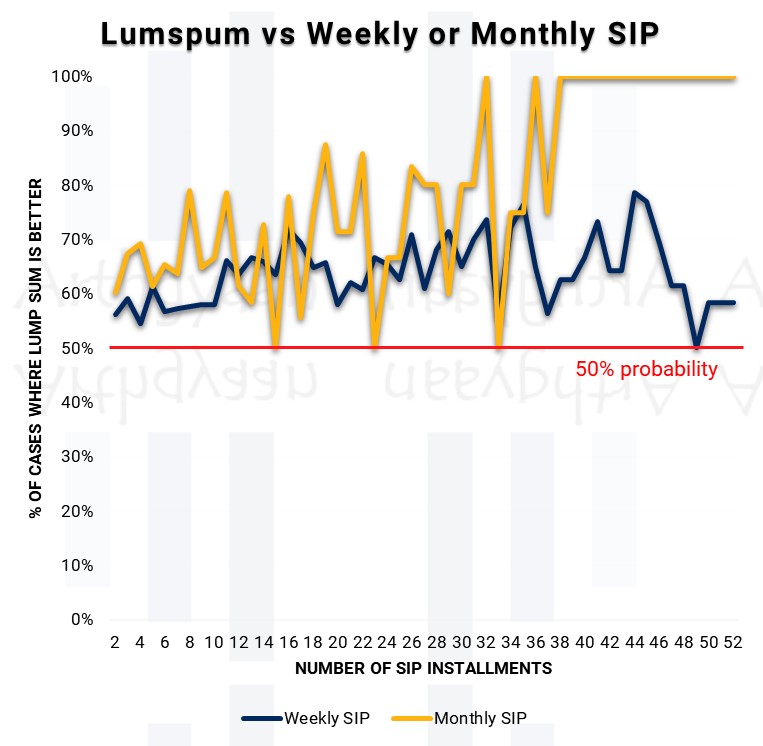

Here is a chart where we have shown the performance of a lump sum in the Nifty 50 index fund vs an SIP (either weekly or monthly) as an STP from a debt fund (either arbitrage or liquid) of the same AMC.

What this chart shows is that whether it is weekly or monthly, lump sum has made more money in at least 50% or more cases. This result is significant since in Finance, a probability of 50% or more, since most decisions are anyway yes or no (buy or sell, lump sum or SIP, etc), is a strong indication of a result that can be significant for decision making. The intuitive reason for this result is:

Stock markets go up over time: invest early.

We have assumed 5% post-tax return in the debt fund that gives a better result for the SIP case since without it, the lump sum will be even higher in relative value.

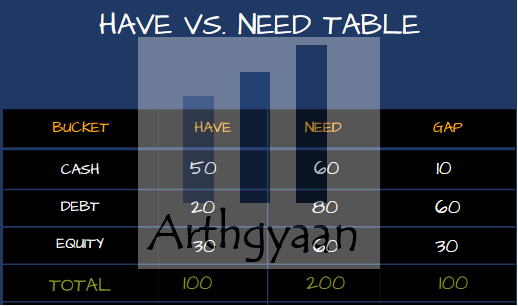

You need to consider also that the entire amount that you have may not be required to be invested in equity. Amounts due for spending in the next few years should not be in equity at all. We have discussed this point in detail here: How to invest a lump sum amount for your goals?.

Here we have chosen a lump sum vs either a 6-week or 6-month SIP (run as an STP from a 5% post-tax debt fund)

| Fund | Weekly SIP | Monthly SIP |

|---|---|---|

| UTI Nifty 50 Index Fund | 57% | 65% |

| Parag Parikh Flexi Cap | 71% | 85% |

| HDFC Midcap | 64% | 58% |

| ICICI Prudential Blue Chip | 62% | 65% |

| Nippon Small Cap | 63% | 69% |

| HDFC Balanced Advantage | 58% | 69% |

| SBI Equity Hybrid | 67% | 73% |

| ICICI Prudential Multi Asset | 65% | 81% |

Here as well, the result is clearly showing that if you invest as a lump sum, irrespective of the fund category, it is more probable that the return vs. the SIP option will be more. For example, in case of the Flexi cap, the lump sum has made more than the 6-month SIP in 85% case.

Warning: Before using these results for making investment decisions:

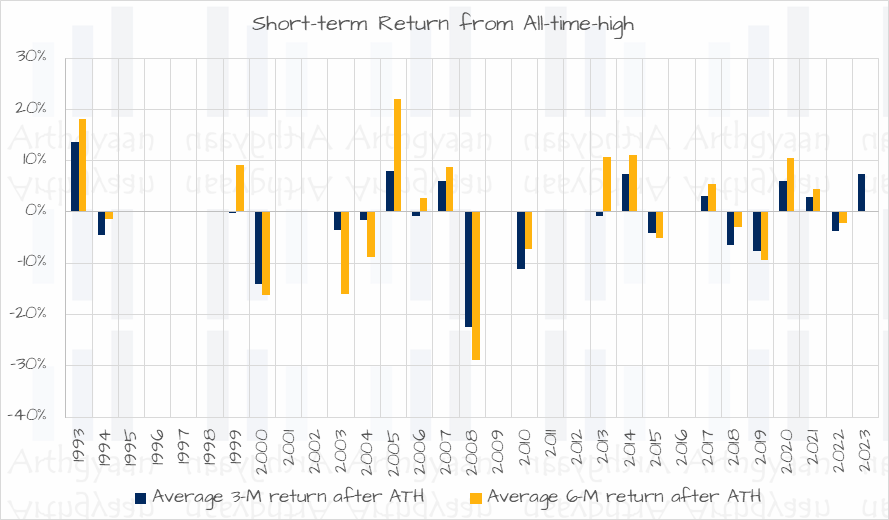

One of the biggest worries that investors have about the stock market reaching an all-time-high is the fear that the market will fall soon. We have looked at average short-term (3-month and 6-month) returns in the Nifty 50 just after the ATH. The results are shown below.

Based on this, have done this same analysis solely on the cases where the stock market is close to an all-time-high and the conclusion is explained here: How to invest a lump sum amount when the stock market is at an all-time high?

Even after all of this analysis, there are a few behavioural reasons where and SIP is preferable:

In such cases, a method of choosing of splitting the amount into a small number of weeks or months up to 2 years may be chosen. It is important to keep in mind that irrespective of the period over which the SIP will run, once the whole amount is invested, it will be fully exposed to the ups and downs of the stock market. If the market falls 40% the month after you finished your SIP, the fact to used a SIP to reach this point will not prevent your portfolio from losing value.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Lumpsum vs. SIP: Here's the Truth on the Winning Strategy for Mutual Fund Investors first appeared on 10 Nov 2024 at https://arthgyaan.com