Markets are down but don't panic: what you should do instead

This article helps investors to choose the right course of action in falling markets.

This article helps investors to choose the right course of action in falling markets.

You will not make money unless stock markets fall

This article is a follow-up to our previous one on what do you do in case of market falls:

The concept here is simple:

This article will discuss how to implement corridor-based rebalancing and use it to profit from market falls.

Rebalancing allows you to systematically buy low and sell high

To implement rebalancing, you must first create a portfolio-level asset allocation plan using a tool like the Arthgyaan goal-based investing tool that covers your main goals like retirement / FIRE, children’s college education/marriage, house purchase etc.

We will consider a typical investor portfolio with some stocks, mutual funds, and a mix of EPF, PPF and NPS investments. Say you have assets of ₹50 lakhs and a SIP amount of ₹50,000/month. Your investing plan will have:

To interpret this, the portfolio has:

In this case, rebalancing is being triggered since the asset allocation is to be changed by 20% points from 40:60 to 60:40. We should, however, rebalance before the gap becomes so vast. For example, a typical value called the corridor can be taken as 5%, i.e. rebalance, when the asset allocation becomes either 55:45 or 65:35 with a target of 60:40.

We will explore below why a 5% corridor is a good recommendation.

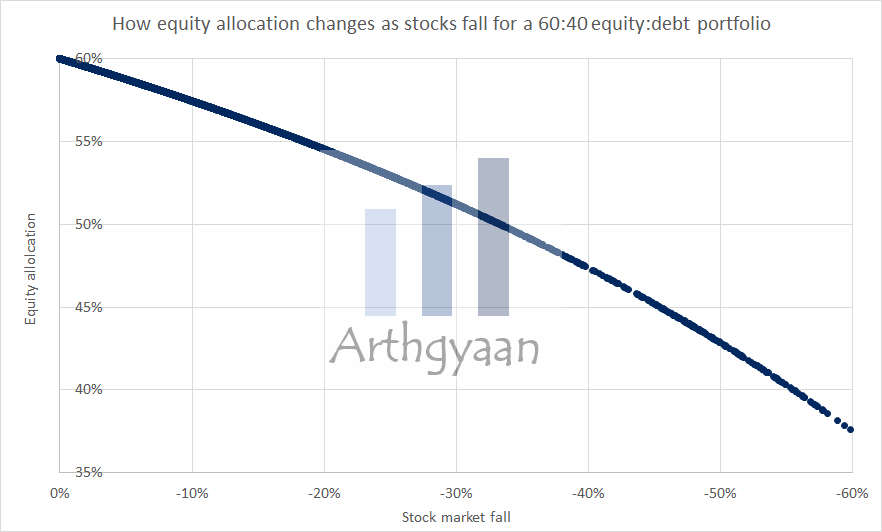

If you have ₹30L in equity and ₹20L in debt with a target allocation of 60:40 and the stock market falls 20%, your portfolio allocation becomes 30 * (1-20%):20 = 24:20 = 48:40. To bring it back to 60:40, you need to bring the equity value to ₹26.4L and the debt value to ₹17.6L by selling ₹2.4L of debt assets and buying the same amount of equity since 26.4:17.6 = 60:40. This activity should be done in one go.

The image above shows how the asset allocation of the 60:40 portfolio changes when the market falls. At each 5% fall (and rise), investors should rebalance back to the target 60:40 allocation.

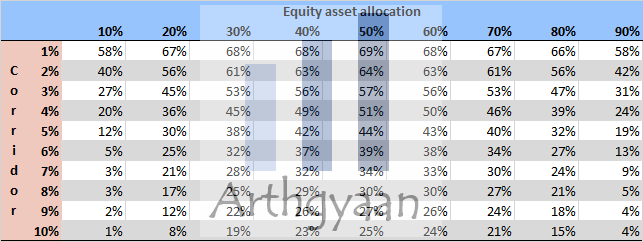

A natural question an investor should ask is where the 5% rule for a corridor comes from. The choice is to strike a balance between rebalancing too often, which is tax-inefficient vs rebalancing too less, which leads to a loss of opportunities for profit booking.

As the image shows, using historical data from 1993, for a 60:40 portfolio, there are 43% of cases where there is a sell equity signal with a 5% or more corridor, but that becomes a signal that is triggered only in 24% of cases if the corridor is chosen to be 10%. Also, as the chart in the previous section shows, for the asset allocation to fall to 50:50 from 60:40, the market has to fall by 33% every two years: Markets are falling. Should you buy the dip?

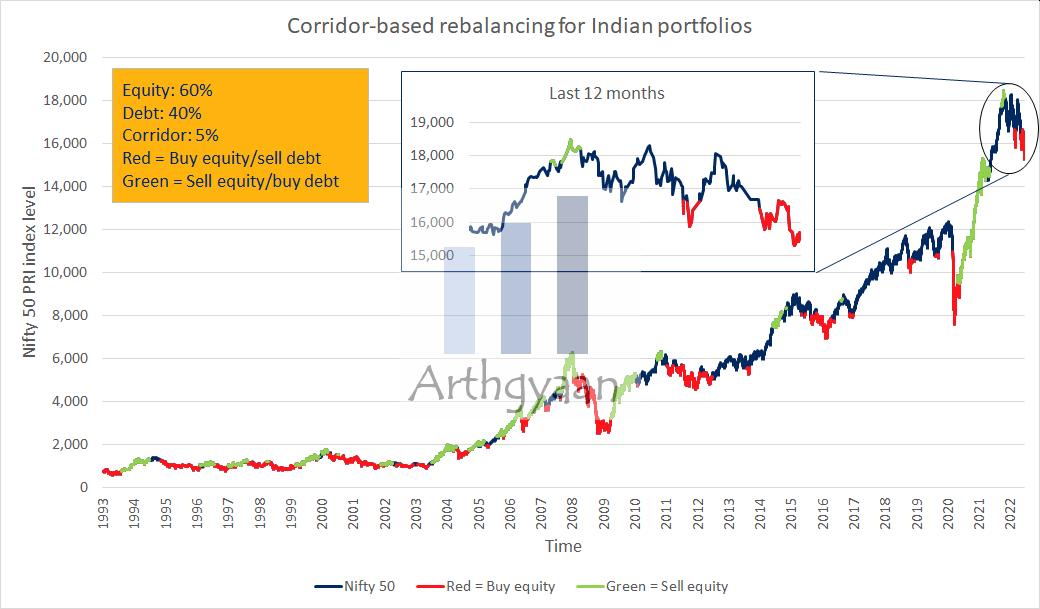

Here we see a chart of Nifty 50 price index data from 1993 with rebalancing triggers, for both buy and sell for equity vs debt, marked on it for a 5% corridor. In the zoomed version for the last 12 months, it is evident that investors should rebalance by selling debt and buying equity. Another thing that eagle-eyed readers should notice from the chart is that the Nifty 50 has made negative returns in the last 12 months. This observation further alludes to the opportunity rebalancing offers to buy more equity at lower levels.

Using a goal-based investing calculator, identify the amount of equity you need to buy. Then, sell that amount from your debt assets (unless they are locked like EPF and PPF) and invest that amount into equity in one go. If you are not comfortable investing in one shot, do it in a few parts over the next 3-4 weeks. If your debt assets are locked, like PPF and EPF, adjust your SIP amount to be equity-heavy over the next few months.

If you are retired, you should look at your bucket allocation strategy and use this opportunity to transfer some assets from your debt to your equity bucket. Of course, this assumes you have enough in your cash bucket for the next five years’ expenses.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Markets are down but don't panic: what you should do instead first appeared on 03 Jul 2022 at https://arthgyaan.com