Markets are falling. Should you buy the dip?

This article talks about short-term changes to your investment strategy to take advantage of downward market movements. Does it work?

This article talks about short-term changes to your investment strategy to take advantage of downward market movements. Does it work?

Whenever the stock market corrects slightly, many investors start wondering one of two things: if only they could exit earlier before the fall. Another common question is if there is a way to know when the market will recover to enter at the bottom with extra cash.

A related question is, once the market stops correcting, what happens if instead of monthly investment in SIP form, we wait for the market to fall, say by 2-10%, and then invest. The idea seems workable intuitively, given that markets go up and down and corrections happen frequently. After all, we have shown, using data for the Nifty 50 since 1993 that:

Read more on this analysis here: Is there a correction in the stock markets?

So the natural question comes that we can use this to our advantage and invest opportunistically.

We will take a slight detour to show how the stock market offers corrections and hence opportunities at every scale, be it a day, a week, month, year, five years or even decades as shown below for the Nifty 50 for the day ending 24-Jan-2022. The three black line segments, superimposed on every chart, show the same fundamental repeating pattern of the market correction. However, we will examine what happens in the segment that leads up to the correction. That is where our tactical buying comes in.

This concept, called the fractal view of markets, is explained in more detail in this book: The Misbehavior of Markets.

We will explore a straightforward strategy: a normal, yearly 10% incrementing, SIP for five years vs opportunistic buying:

An opportunistic buying strategy is an example of tactical asset allocation since the strategic asset allocation will be reached only during rebalancing. Investors wishing to know more about asset allocation, before progressing, should refer to this post: What should be the Asset Allocation for your goals?.

We use Nifty 50 Price index data from NSE since 1992 to compare. We have 8 cases:

The simulation is run for 300 windows of 60 months each starting in 1993.

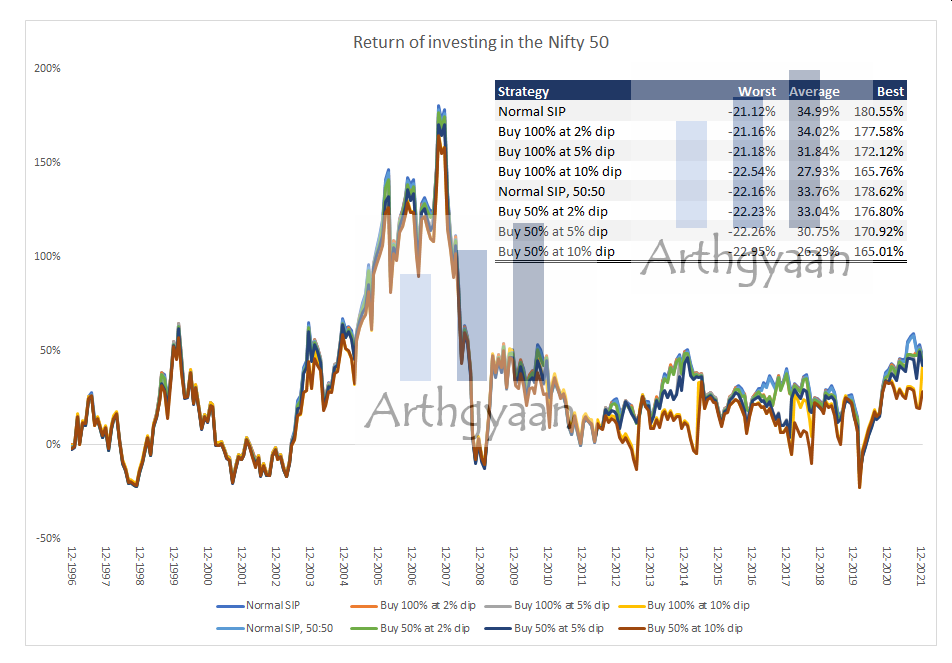

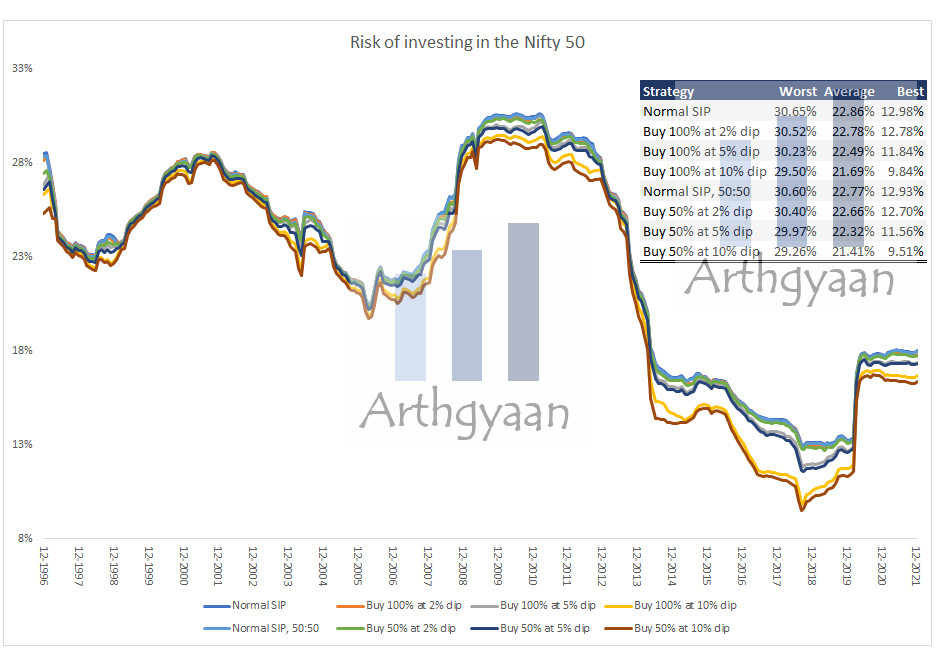

We show rolling risk and returns and averages, maximum and minimum return and risk for all 300 time periods.

As we see in the case of the returns, the standard SIP handily beats all variations of the opportunistic cases for average, best and worst returns. This result is expected in a market like India that has mostly gone up in the last 30 years. Of course, the conclusion will differ if the market goes sideways for the long term or is bearish for extended periods.

As mentioned before, the segment that leads up to the correction is the key bit here and that is the reason this intuitively fine strategy fails to beat a normal SIP. If the market is overall going up, as with Nifty 50 from 1993 till date, it makes sense to be invested as early as possible. Even if a correction comes, that correction will come after the market reaches higher and higher peaks repeating the same fractal pattern. We have assumed zero returns from the cash component, but a 3% annual return on cash, for example, will not materially alter this conclusion.

The risk charts show that the opportunistic buying strategy is marginally better risk-wise because they hold a fair bit of cash. This is the reason why the risk is lower as we are waiting for a more significant dip as the cash component of the portfolio increases.

However, the lower risk does not justify the lower return of the opportunistic buying strategy, given the extra effort in tracking the markets and then letting emotions affect the timing of the buy. It is incredibly human to freeze or think of exiting the market instead of going in when corrections happen. Simultaneously, if the model says to invest at 5%, it is tempting to wait for 10%. However, markets are unpredictable, and the bottom can come and go without taking any action. This is the implementation risk of the opportunistic buying strategy.

If we assume that overall, as an asset class, the equity markets will go up over time, the recommendation will be to invest as soon as cash is available. For most people, this will align with monthly salary income and hence they should invest in SIP mode.

It is essential to understand that is investing strategy involves only the equity part of the portfolio. Investments into debt and other asset classes and subsequent rebalancing will happen in the usual way. Therefore, our recommendation still stands at having a suitable asset allocation and implementing corridor-based rebalancing as per predefined rules created before investment starts.

These are the tools that help manage the risk of the portfolio irrespective of where the market is going:

Investors should understand that buying the dip is a losing strategy in a decades-long bull market and should not implement such opportunistic buying since that has implementation risks.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Markets are falling. Should you buy the dip? first appeared on 26 Jan 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.