Don't stop investing when the markets are down

A common piece of advice given by many people is to stop investing when the stocks markets are down. This article explores if this advice makes sense.

A common piece of advice given by many people is to stop investing when the stocks markets are down. This article explores if this advice makes sense.

Wait for a little while, while the markets consolidate.

Markets are falling. This is not the right time to invest.

We are in a bear market. Wait before investing.

Every time stock markets fall for some time, variations of the above advice make their way into mainstream / social media as well as conversations between investors. The general recommendation is that since markets are falling, investors should wait for some time before investing or should pause their existing SIPs.

This article will show via a simple back-testing exercise why this advice is something investors should avoid. The average 30 year old investor’s portfolio will last 50+ years and there is no point, as this article shows below, to worry about short-term fluctuations.

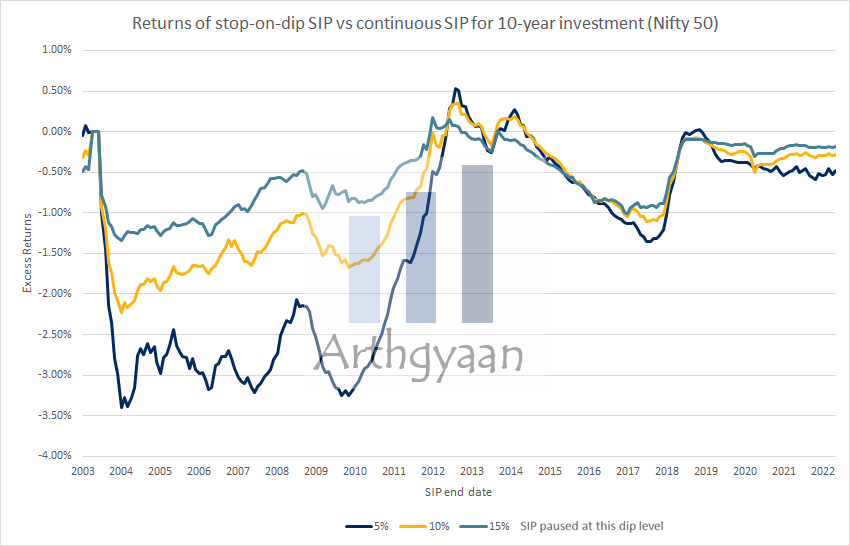

Using data from 1992 for the Nifty 50 price index, we show three graphs. The exercise we do is running a 10-year SIP from Jan-1993 to Dec-2002, Feb-1993 to Jan-2003 etc. until May-2012 to Apr-2022, and we check the relative performance of these two SIPs:

We calculate the returns of each SIP using the XIRR formula to compare the two returns. Unfortunately, we cannot compare the final values since there will be months when the stop-and-go SIP does not invest anything.

We plot the difference of returns of stop-on-dip over normal/continuous SIP overtime for three cases:

The Y-axis shows

XIRR (stop-on-dip) - XIRR (normal SIP)

We see that as the dip threshold increases, the stop-on-dip strategy performs worse and worse.

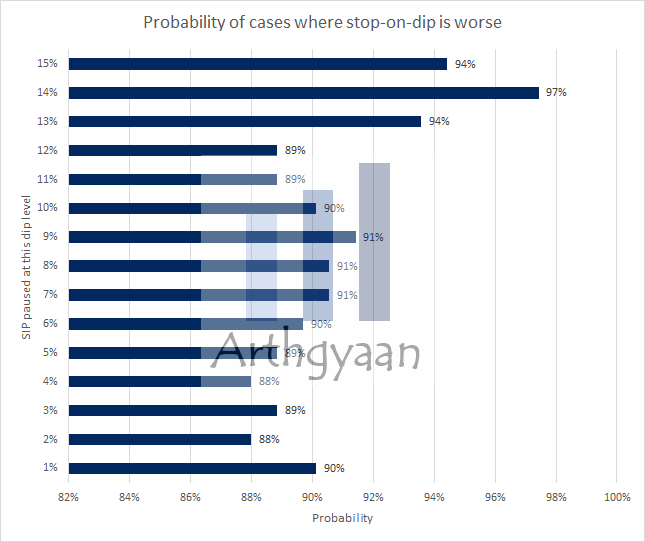

In this chart, we see that the stop-on-dip strategy is worse than the normal SIP in an overwhelming majority of cases. For example, if a SIP is paused when the market has fallen by 10%, the normal SIP has done better in 9 out of 10 chances.

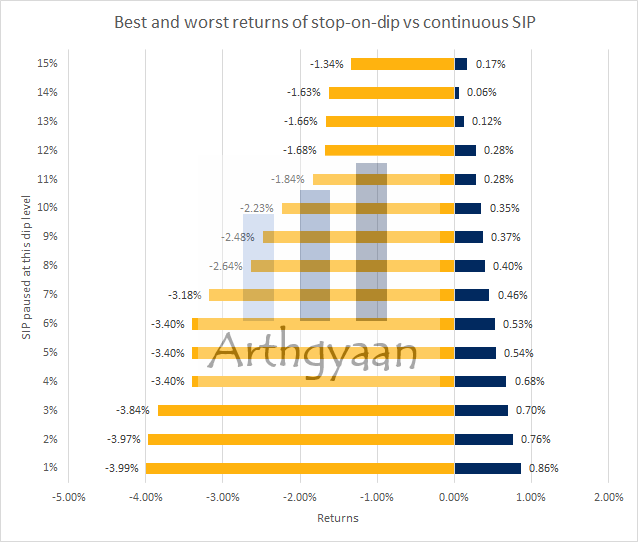

We now break down the returns for each of the stop-on-dip cases where the dip runs from 1% to 15% and see the best and worst values of

XIRR (stop-on-dip) - XIRR (normal SIP)

Again, if the stop-on-dip is better, the gain vs the normal SIP is minimal. For example, for a 10% dip, the best return vs the normal SIP is 0.35%, while the worst return is -2.23%, which is terrible.

If we combine the last two charts, the conclusion comes to:

It should be clear now that stop-on-dip is a strategy that has not worked historically in Indian markets.

Stop-on-dip does not work because when the markets are down, and there is an opportunity to gather units at low prices, the SIP is stopped. The normal SIP is automatically superior in most cases since it buys more units at lower prices on the way down.

There are some caveats to the analysis:

The markets might behave differently in the future. Still, given the historical data, we see that investors should not stop investing when markets are falling. Such short term considerations are not meaningful if your goals are decades away. Hence, the right next step is to rebalance from debt to equity as described in this follow-up article: Markets are down but don’t panic: what you should do instead

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Don't stop investing when the markets are down first appeared on 29 May 2022 at https://arthgyaan.com